|

市场调查报告书

商品编码

1773461

碳市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Spin on Carbon Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

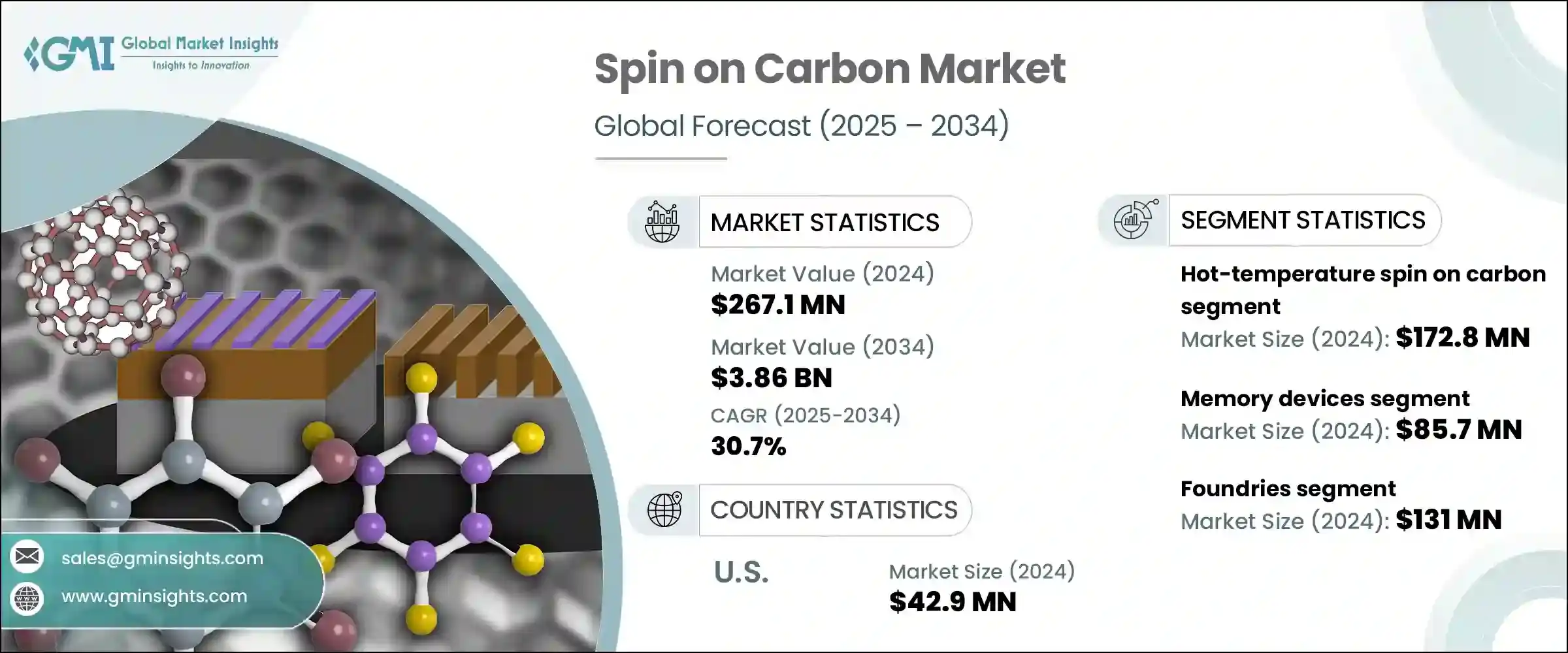

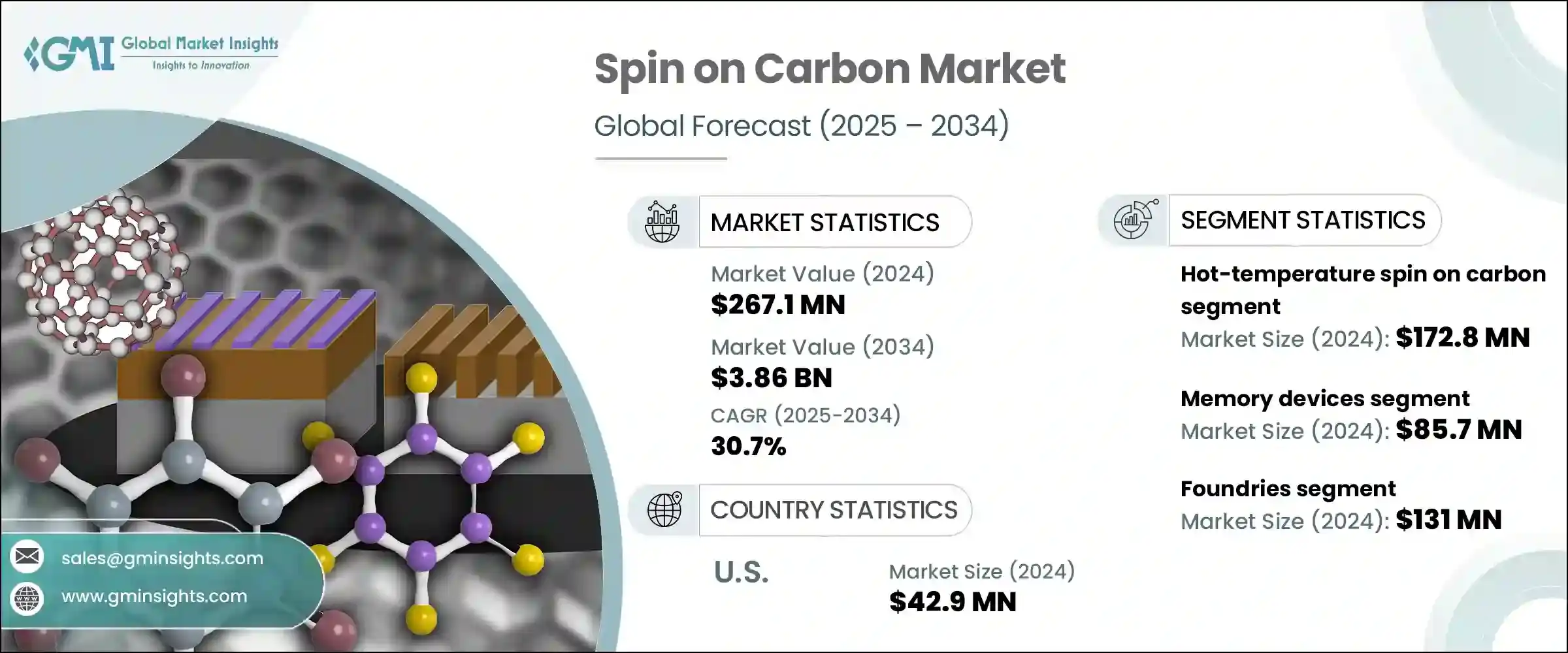

2024年,全球旋涂碳市场规模达2.671亿美元,预计2034年将以30.7%的复合年增长率成长,达到38.6亿美元。这项快速扩张主要得益于代工厂投资的不断成长以及极紫外线(EUV)微影技术的日益普及。随着人工智慧、高效能运算和5G等行业的持续发展,领先的代工厂正在扩大其製造能力,这增加了对旋涂碳等材料的需求。

系统单晶片 (SoC) 是半导体生产的关键组件,尤其是在先进的晶片设计中,它能够提供抗蚀刻性能并实现均匀的薄膜涂覆。晶片设计的演变,加上半导体製造流程的不断发展,推动了市场对旋涂碳材料的需求。此外,半导体製造向 EUV 光刻技术的转变,以其能够创建超精细特征的能力而闻名,进一步推动了市场的成长。 EUV 的采用对于开发更小、更强大的半导体装置至关重要,而 SoC 材料对于实现精确的图案转移和提高 7 奈米以下节点的蚀刻精度至关重要,因此对市场的成长做出了重大贡献。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.671亿美元 |

| 预测值 | 38.6亿美元 |

| 复合年增长率 | 30.7% |

2024年,高温旋涂碳材料占最大市场份额,价值1.728亿美元。随着半导体应用(尤其是高速处理器和记忆体晶片)对更高的热稳定性和更低的介电常数的需求,高温SoC材料的发展势头强劲。这些材料是先进封装技术和3D积体电路的理想选择,这些技术和积体电路需要能够承受高温而不发生性能劣化的材料。半导体装置的日益小型化也推动了对高温SoC材料的需求,尤其是在铜互连技术领域。

2024年,储存装置市场价值达8,570万美元,这得益于其在低k电介质和互连製造中的重要作用。这些材料对于支援云端运算、人工智慧和5G等尖端应用中的高速资料传输至关重要,而效能和效率在这些应用中至关重要。随着记忆体架构的不断缩小和堆迭记忆体技术的不断发展,材料满足日益严格的需求的压力也越来越大。随着装置朝向更小节点和更高密度配置发展,对SoC材质的需求变得更加关键。

2024年,美国旋涂碳产业产值达4,290万美元。美国在航太创新领域的领先地位推动了对旋涂碳等先进材料的需求,这些材料可用于製造国防和飞机应用中的轻质高强度零件。此外,向风能和太阳能等再生能源的转变,也推动了储能係统对耐用轻质碳基材料的需求。汽车电气化趋势的日益增长,进一步刺激了轻质电池零件和热管理系统对旋涂碳的需求,确保美国在市场上保持主导地位。

旋涂碳产业的主要参与者包括 Brewer Science, Inc.、杜邦、DONGJIN SEMICHEM CO LTD、Applied Materials, Inc.、Merck KGaA、JSR Micro, Inc.、Irresistible Materials、Shin-Etsu Chemical Co., Ltd.、Nano-C、KOYJ Co.M Ltd. Ltd., Ltd.、Nano-C、KOYJ Co.M Ltd., Ltd. 和 SDI Ltd., Ltd. 和 SDI.为了巩固市场地位,旋涂碳产业的公司正专注于技术进步和材料创新。

他们正在大力投入研发,以提高旋涂碳在半导体製造过程中的性能,尤其是在 7 奈米以下等超先进节点。与代工厂和半导体製造商建立策略合作伙伴关係也至关重要,以确保与最新製造技术的兼容性。此外,各公司正在扩展其产品线,以满足再生能源和航太等各行各业日益增长的需求。在维持高品质标准的同时,精简生产流程、降低成本,对于在这个快速发展的市场中提升竞争力至关重要。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 半导体产业节点尺寸不断缩小

- EUV微影技术的采用率不断提高

- 不断成长的代工投资

- 增强抗蚀刻性和薄膜均匀性

- 先进封装的应用日益广泛

- 产业陷阱与挑战

- 材料和加工成本高

- 环境和废弃物管理问题

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 新兴商业模式

- 合规性要求

- 永续性措施

- 消费者情绪分析

- 专利和智慧财产权分析

- 地缘政治与贸易动态

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 市场集中度分析

- 按地区

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各区域市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係和合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:依材料类型,2021 年至 2034 年

- 主要趋势

- 高温碳旋

- 常温自旋碳

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 逻辑元件

- 储存装置

- 功率元件

- 微机电系统

- 光子学

- 先进封装

- 其他的

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 铸造厂

- 整合设备製造商

- 外包半导体组装和测试

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Applied Materials, Inc.

- Brewer Science, Inc.

- DONGJIN SEMICHEM CO LTD

- DuPont

- Irresistible Materials

- JSR Micro, Inc.

- KOYJ Co., Ltd.

- Merck KGaA

- Nano-C

- Samsung SDI Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- YCCHEM CO.,Ltd.

The Global Spin on Carbon Market was valued at USD 267.1 million in 2024 and is estimated to grow at a CAGR of 30.7% to reach USD 3.86 billion by 2034. This rapid expansion is primarily driven by the growing investments in foundries and the increasing adoption of extreme ultraviolet (EUV) lithography. As industries such as artificial intelligence, high-performance computing, and 5G continue to rise, leading foundries are scaling up their manufacturing capabilities, which increases the demand for materials like spin-on carbon.

SoC serves as a crucial component in semiconductor production, especially in advanced chip designs, providing etch resistance and enabling uniform film coating. This evolution in chip design, paired with rising semiconductor manufacturing, propels the demand for spin-on carbon in the market. Additionally, the shift toward EUV lithography in semiconductor fabrication, known for its ability to create ultra-fine features, further fuels the market growth. The adoption of EUV is critical to developing smaller, more powerful semiconductor devices, and SoC materials are essential in enabling accurate pattern transfer and enhancing etching precision in sub-7nm nodes, thus contributing significantly to the market's growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $267.1 Million |

| Forecast Value | $3.86 Billion |

| CAGR | 30.7% |

In 2024, the hot-temperature spin-on carbon segment accounted for the largest market share, valued at USD 172.8 million. As semiconductor applications, particularly high-speed processors and memory chips, demand better thermal stability and low dielectric constant, hot-temperature SoCs have gained momentum. These materials are ideal for advanced packaging technologies and 3D integrated circuits, which require materials capable of enduring high process temperatures without degradation. The increasing miniaturization of semiconductor devices also drives the demand for hot-temperature SoCs, especially in copper interconnect technologies.

The memory device segment was valued at USD 85.7 million in 2024, driven by their essential role in the fabrication of low-k dielectrics and interconnects. These materials are crucial for supporting high-speed data transfer in cutting-edge applications such as cloud computing, AI, and 5G, where performance and efficiency are paramount. As memory architecture continues to shrink and stacked memory technologies evolve, the pressure on materials to meet increasingly stringent demands has grown. The need for SoC materials becomes even more critical as devices move towards smaller nodes and higher-density configurations.

U.S. Spin on Carbon Industry generated USD 42.9 million in 2024. The country's leadership in aerospace innovation drives the demand for advanced materials like spin-on carbon, used in lightweight, high-strength components for defense and aircraft applications. Additionally, the shift toward renewable energy sources, such as wind and solar, is boosting the need for durable and lightweight carbon-based materials in energy storage systems. The growing trend toward vehicle electrification is further fueling demand for spin-on carbon in lightweight battery components and thermal management systems, ensuring the U.S. remains a dominant force in the market.

Key players in the Spin on Carbon Industry include Brewer Science, Inc., DuPont, DONGJIN SEMICHEM CO LTD, Applied Materials, Inc., Merck KGaA, JSR Micro, Inc., Irresistible Materials, Shin-Etsu Chemical Co., Ltd., Nano-C, KOYJ Co., Ltd., YCCHEM CO., Ltd., Samsung SDI Co., Ltd. To strengthen their market position, companies in the spin-on carbon industry are focusing on technological advancements and material innovations.

They are investing heavily in research and development to improve the performance of spin-on carbon in semiconductor manufacturing processes, particularly in ultra-advanced nodes like sub-7nm. Strategic partnerships with foundries and semiconductor manufacturers are also critical to ensure compatibility with the latest fabrication technologies. Additionally, companies are expanding their product offerings to meet the growing demand across diverse industries, including renewable energy and aerospace. Efforts to streamline production processes and reduce costs while maintaining high-quality standards are central to enhancing competitiveness in this rapidly expanding market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Material type trends

- 2.2.2 Application trends

- 2.2.3 End use trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Shrinking node sizes in semiconductor industry

- 3.2.1.2 Increased adoption of EUV lithography

- 3.2.1.3 Growing foundry investments

- 3.2.1.4 Enhanced etch resistance and film uniformity

- 3.2.1.5 Rising use in advanced packaging

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High material and processing costs

- 3.2.2.2 Environmental and waste management concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Sustainability measures

- 3.11 Consumer sentiment analysis

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ Startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Hot-temperature spin on carbon

- 5.3 Normal-temperature spin on carbon

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Logic devices

- 6.3 Memory devices

- 6.4 Power devices

- 6.5 Micro-electromechanical systems

- 6.6 Photonics

- 6.7 Advanced packaging

- 6.8 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Foundries

- 7.3 Integrated device manufacturers

- 7.4 Outsourced semiconductor assembly & test

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Applied Materials, Inc.

- 9.2 Brewer Science, Inc.

- 9.3 DONGJIN SEMICHEM CO LTD

- 9.4 DuPont

- 9.5 Irresistible Materials

- 9.6 JSR Micro, Inc.

- 9.7 KOYJ Co., Ltd.

- 9.8 Merck KGaA

- 9.9 Nano-C

- 9.10 Samsung SDI Co., Ltd.

- 9.11 Shin-Etsu Chemical Co., Ltd.

- 9.12 YCCHEM CO.,Ltd.