|

市场调查报告书

商品编码

1773466

硬体安全模组市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Hardware Security Modules Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球硬体安全模组市场价值为 14 亿美元,预计到 2034 年将以 14.8% 的复合年增长率成长,达到 58 亿美元。市场成长的动力源自于更严格的资料隐私监管规定、云端运算的使用增加以及物联网设备的广泛部署。世界各国政府都在执行立法,强制组织保护敏感资料,并对不合规行为处以重罚。这种压力促使企业采用 HSM 进行加密金钥保护和资料加密。随着企业越来越多地转向可扩展且灵活的基于云端的基础设施,它们也面临着多租户环境中更高的违规风险。

硬体安全模组 (HSM) 在实现加密金钥管理和保障这些架构安全方面发挥关键作用。随着互联网连接设备的全球兴起,安全通讯和身份验证变得至关重要。硬体安全模组透过支援加密操作并安全地储存敏感金钥,确保在这些装置之间传输的资料的机密性和真实性。预计到 2024 年,将有超过 170 亿台物联网设备投入使用,对安全 HSM 基础设施的依赖正在激增,使其成为各行各业数位信任框架的核心。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 14亿美元 |

| 预测值 | 58亿美元 |

| 复合年增长率 | 14.8% |

2024年,USB或便携式设备市场规模达到4.94亿美元,预计到2034年将以15.1%的复合年增长率成长。这些紧凑型设备具有移动性和灵活性,使企业能够在任何地点安全地执行加密操作。随着网路威胁日益复杂,企业需要能够轻鬆整合到其营运工作流程中的敏捷安全解决方案。便携式HSM透过提供即插即用的加密金钥管理和安全储存来满足此需求,同时又不影响效能或合规性。其易于部署和经济高效的特点,使其对拥有分散式员工和远端营运环境的组织尤其具有吸引力。

2024年,SSL/TLS金钥保护市场规模达2.44亿美元,预估复合年增长率为16.7%。随着针对数位凭证的网路攻击日益增多,安全的网路通讯变得越来越重要,各组织也更加重视SSL和TLS加密金钥的保护。 HSM(硬体安全模组)正被越来越多地采用,以确保强加密、可靠的凭证处理以及私钥的安全生命週期管理。这些模组提供防篡改保护,并透过将加密操作与软体漏洞隔离,帮助减少攻击面。随着数位信任成为企业IT系统的基础要素,HSM在SSL/TLS环境中的角色也日益增强。

2024年,德国硬体安全模组市场规模达7,100万美元,预计2034年将维持15.7%的强劲复合年增长率。资料隐私法的强力执行,加上《联邦资料保护法》和欧盟《一般资料保护规范》(GDPR)等国家法规的强化,正推动德国企业采用高度安全的加密解决方案。德国各行各业的机构正在投资硬体加密技术,以履行合规性要求并保护个人识别资讯(PII)。德国的资料安全文化,加上日益增强的技术意识和数位转型,持续推动HSM的需求,并支持欧洲HSM产业的更广泛发展。

推动全球硬体安全模组市场发展的关键公司包括 Utimaco GmbH、Entrust Corporation、IBM Corporation 和 Thales Group。这些公司正在透过提供满足现代企业需求的高级加密解决方案,重塑安全格局。硬体安全模组领域的领先公司正在利用策略倡议巩固其市场地位。

一项关键策略是投资开发云端原生 HSM,使其能够与混合云和多云平台无缝集成,从而顺应企业云端应用的日益增长。企业也致力于透过合作和收购扩大其全球影响力,以进军新兴市场。使用防篡改、经 FIPS 认证的 HSM 来增强产品组合,既有助于满足法规要求,又能提升客户信任度。一些公司正在透过 API 支援和 SDK 整合来增强互通性,使开发人员和安全团队更容易使用 HSM。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 与物联网设备集成

- 网路安全威胁不断升级

- 严格遵守法规

- 数位支付的激增

- 扩展量子云端运算服务

- 陷阱与挑战

- 实施成本高

- 复杂的整合过程

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- Pestel 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 基于区域网路/网路附加的 HSM

- 基于USB/便携式HSM

- 基于 Pcie/内部 HSM

- 基于云端的 HSM

第六章:市场估计与预测:依部署模式,2021 年至 2034 年

- 主要趋势

- 本地

- 基于云端(即服务)

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 付款处理

- 验证

- 程式码和文檔签名

- 资料库加密

- SSL/TLS 金钥保护

- 公钥基础设施(PKI)

- 数位版权管理 (DRM)

- 其他的

第八章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 银行、金融服务和保险(BFSI)

- 政府和国防

- 卫生保健

- 零售与电子商务

- 电信和IT

- 能源和公用事业

- 製造业

- 媒体与娱乐

- 其他的

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Adweb Technologies

- Amazon Web Services (AWS)

- DINAMO Networks

- ellipticSecure

- Entrust Corporation

- ETAS GmbH

- Fortanix

- Futurex

- IBM Corporation

- Infineon Technologies AG

- JISA Softech Pvt. Ltd.

- Kryptoagile Solutions Pvt. Ltd.

- Kryptus

- Lattice Semiconductor

- Microchip Technology Inc.

- Microsoft Corporation

- Nitrokey

- Securosys SA

- Spyrus

- STMicroelectronics

- Thales Group

- Utimaco GmbH

- Yubico

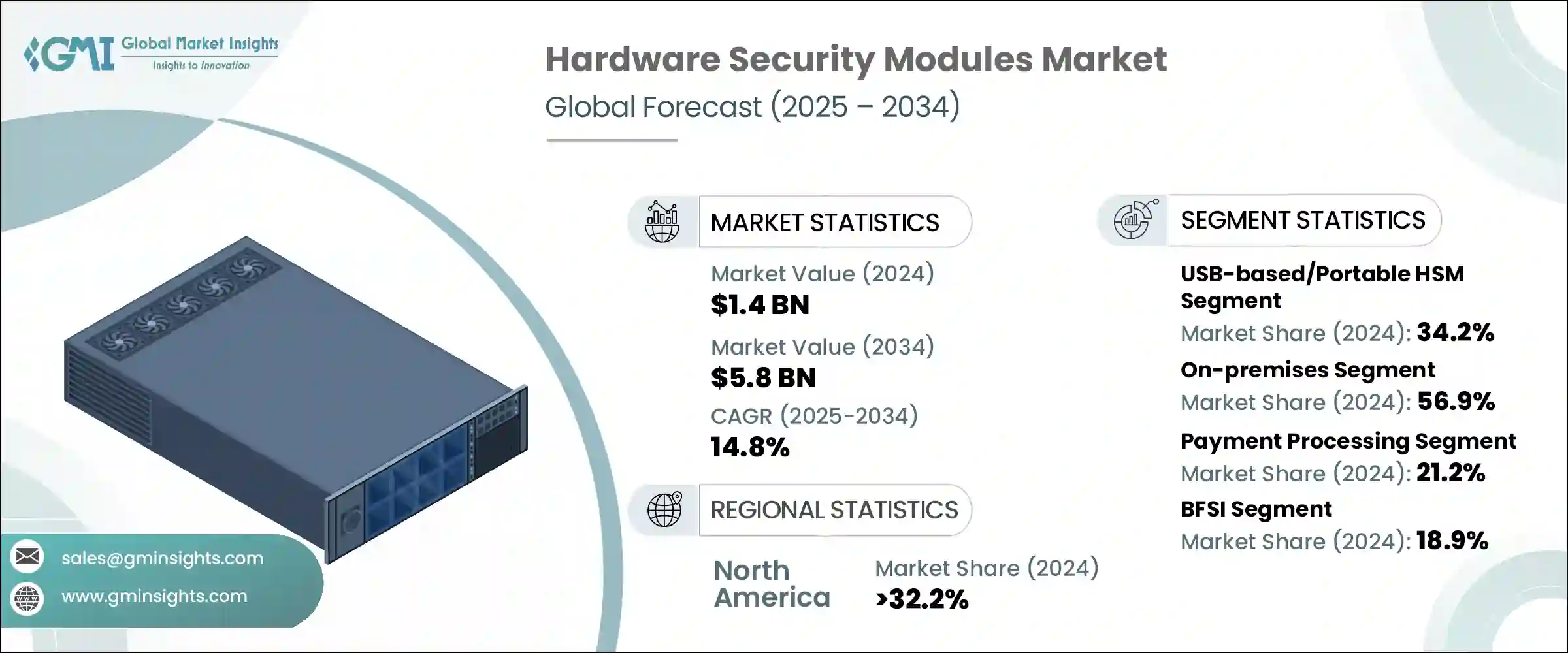

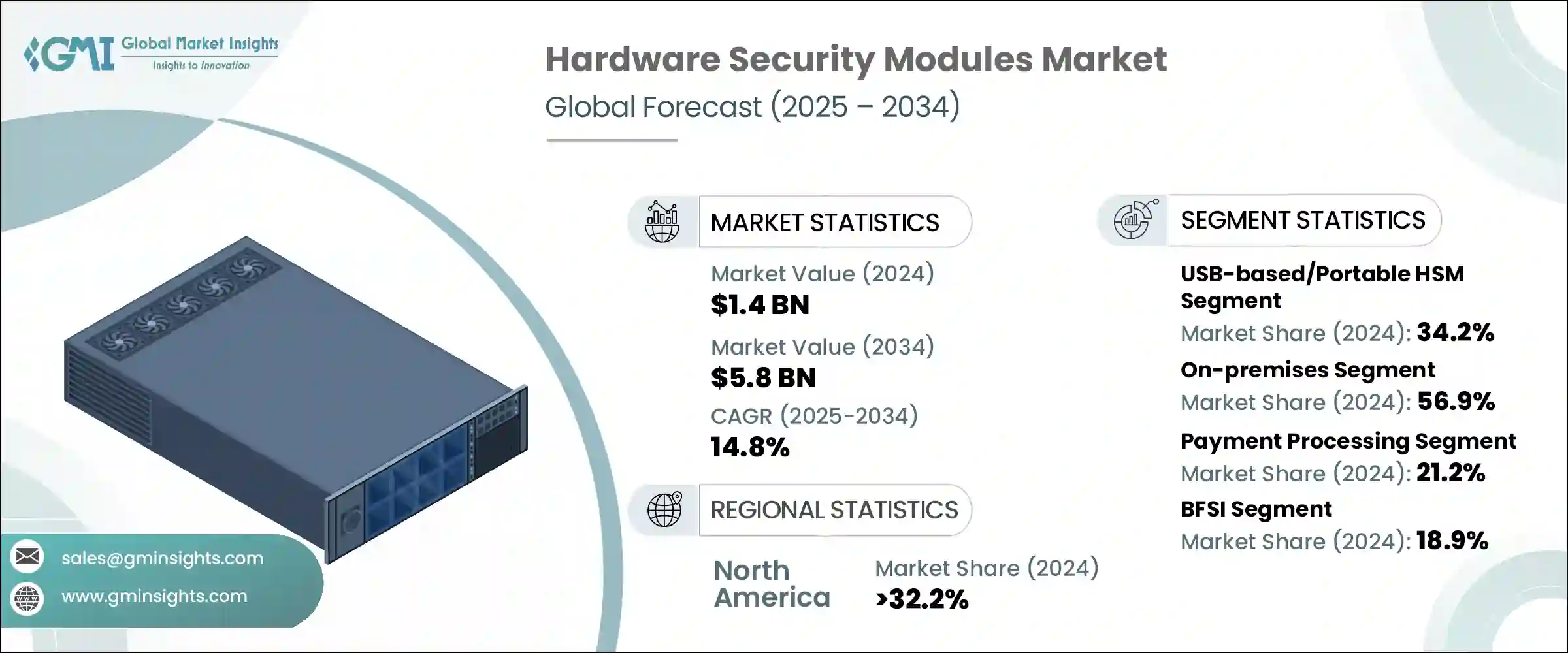

The Global Hardware Security Modules Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 14.8% to reach USD 5.8 billion by 2034. Market growth is being fueled by stricter regulatory mandates for data privacy, increased use of cloud computing, and widespread deployment of IoT devices. Governments across the globe are enforcing legislation that compels organizations to secure sensitive data, with significant penalties for non-compliance. This pressure is driving businesses to adopt HSMs for cryptographic key protection and data encryption. As enterprises increasingly shift to scalable and flexible cloud-based infrastructures, they are also exposing themselves to higher risks of breaches in multi-tenant environments.

HSMs are playing a pivotal role in enabling encryption key management and securing these architectures. With the global rise of Internet-connected devices, secure communication and identity verification are becoming essential. Hardware security modules ensure the confidentiality and authenticity of data transferred across these devices by enabling cryptographic operations and safely storing sensitive keys. With over 17 billion IoT devices expected to be in use by 2024, the reliance on secure HSM infrastructures is surging, placing them at the core of digital trust frameworks across industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $5.8 Billion |

| CAGR | 14.8% |

The USB-based or portable segment generated USD 494 million in 2024 and is forecasted to grow at a CAGR of 15.1% through 2034. These compact devices offer mobility and flexibility, enabling enterprises to perform cryptographic operations securely from any location. As cyber threats increase in complexity, companies require agile security solutions that can be easily integrated into their operational workflows. Portable HSMs address this need by offering plug-and-play encryption key management and secure storage without compromising performance or compliance. Their ease of deployment and cost-effectiveness make them particularly appealing to organizations with distributed workforces and remote operational environments.

In 2024, the SSL/TLS key protection segment generated USD 244 million with a projected CAGR of 16.7%. With secure internet communications becoming more critical amid rising cyberattacks targeting digital certificates, organizations are placing greater emphasis on safeguarding SSL and TLS cryptographic keys. HSMs are being increasingly adopted to ensure strong encryption, reliable certificate handling, and secure lifecycle management of private keys. These modules offer tamper-resistant protection and help reduce the attack surface by isolating cryptographic operations from software vulnerabilities. As digital trust becomes a foundational element of enterprise IT systems, the role of HSMs in SSL/TLS environments continues to grow.

Germany Hardware Security Modules Market generated USD 71 million in 2024, with a robust CAGR of 15.7% through 2034. Strong enforcement of data privacy laws, reinforced by national regulations such as the Federal Data Protection Act alongside the EU's GDPR, is pushing enterprises in the country to adopt highly secure cryptographic solutions. German institutions across sectors are investing in hardware-based encryption to fulfill compliance mandates and to safeguard personally identifiable information (PII). The culture of data security in Germany, combined with growing technological awareness and digital transformation, continues to drive HSM demand and supports the broader growth of the European HSM industry.

Key companies driving the Global Hardware Security Modules Market include Utimaco GmbH, Entrust Corporation, IBM Corporation, and Thales Group. These players are reshaping the security landscape by offering advanced encryption solutions tailored to modern enterprise needs. Leading companies in the hardware security modules space are leveraging strategic initiatives to solidify their market presence.

A key strategy involves investing in the development of cloud-native HSMs that integrate seamlessly with hybrid and multi-cloud platforms, aligning with growing enterprise cloud adoption. Companies are also focusing on expanding their global footprint through partnerships and acquisitions to tap into emerging markets. Strengthening product portfolios with tamper-resistant, FIPS-certified HSMs supports both regulatory compliance and customer trust. Several firms are enhancing interoperability through API support and SDK integration, making HSMs more accessible to developers and security teams.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and Definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Integration with IoT devices

- 3.2.1.2 Escalating cybersecurity threats

- 3.2.1.3 Stringent regulatory compliance

- 3.2.1.4 Proliferation of digital payments

- 3.2.1.5 Expansion of quantum cloud computing services

- 3.2.2 Pitfalls and challenges

- 3.2.2.1 High implementation costs

- 3.2.2.2 Complex integration processes

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 Pestel analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Lan-based/network-attached HSM

- 5.3 USB-based/portable HSM

- 5.4 Pcie-based/internal HSM

- 5.5 Cloud-based HSM

Chapter 6 Market Estimates and Forecast, By Deployment Mode, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud-based (as-a-Service)

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Payment processing

- 7.3 Authentication

- 7.4 Code and document signing

- 7.5 Database encryption

- 7.6 SSL/TLS key protection

- 7.7 Public key infrastructure (PKI)

- 7.8 Digital rights management (DRM)

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Billion)

- 8.1 Key trends

- 8.2 Banking, financial services, and insurance (BFSI)

- 8.3 Government and defense

- 8.4 Healthcare

- 8.5 Retail and e-commerce

- 8.6 Telecom and it

- 8.7 Energy and utilities

- 8.8 Manufacturing

- 8.9 Media and entertainment

- 8.10 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 Uk

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company profiles

- 10.1 Adweb Technologies

- 10.2 Amazon Web Services (AWS)

- 10.3 DINAMO Networks

- 10.4 ellipticSecure

- 10.5 Entrust Corporation

- 10.6 ETAS GmbH

- 10.7 Fortanix

- 10.8 Futurex

- 10.9 IBM Corporation

- 10.10 Infineon Technologies AG

- 10.11 JISA Softech Pvt. Ltd.

- 10.12 Kryptoagile Solutions Pvt. Ltd.

- 10.13 Kryptus

- 10.14 Lattice Semiconductor

- 10.15 Microchip Technology Inc.

- 10.16 Microsoft Corporation

- 10.17 Nitrokey

- 10.18 Securosys SA

- 10.19 Spyrus

- 10.20 STMicroelectronics

- 10.21 Thales Group

- 10.22 Utimaco GmbH

- 10.23 Yubico