|

市场调查报告书

商品编码

1782099

磁致伸缩材料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Magnetostrictive Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

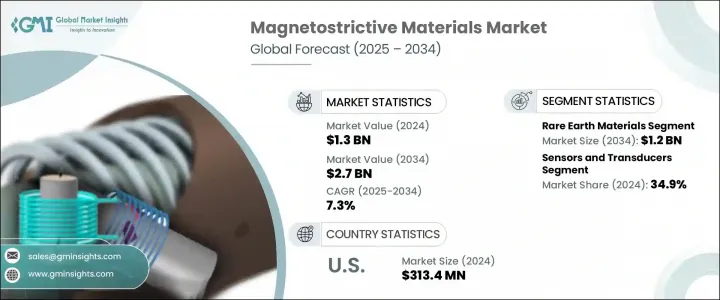

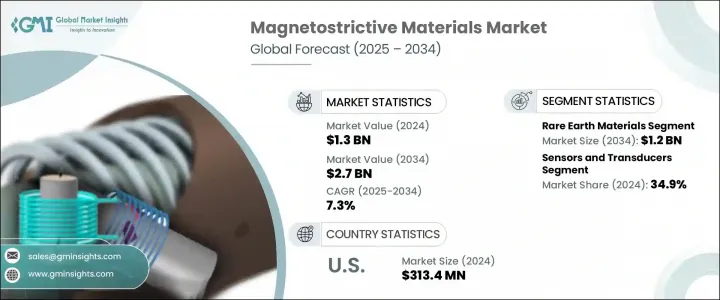

2024年,全球磁致伸缩材料市场规模达13亿美元,预计到2034年将以7.3%的复合年增长率成长,达到27亿美元。磁致伸缩材料因其独特的磁场改变形状或尺寸的能力而日益增长,使其成为先进技术应用中不可或缺的材料。磁致伸缩材料的应用领域涵盖汽车、医疗保健、航太和消费性电子等多个领域。在汽车领域,这些材料作为感测器和执行器(尤其是在动力转向系统中)的组成部分,可以提高车辆的性能、效率和安全性。

电动和混合动力汽车的成长进一步推动了这个市场的发展。医疗保健应用受益于其卓越的精确度,从而实现更精准的诊断和针对性治疗,改善患者预后。同时,航太公司依靠这些材料进行有效的振动控制和持续的结构健康监测,确保关键零件的安全性和性能。这种跨产业的双重效用不仅拓宽了它们的应用范围,也显着扩大了市场需求,因为各行各业都在寻求可靠、高效能的解决方案来应对不断变化的技术挑战。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 27亿美元 |

| 复合年增长率 | 7.3% |

稀土材料领域在2024年创造了5.895亿美元的市场规模,预计到2034年将达到12亿美元。该领域占据主导地位,因为铽等稀土元素具有优异的磁性和高磁係数。这些特性使其成为对精度和效率要求高的应用的理想选择,例如感测器、执行器和变压器。汽车、航空和消费性电子领域对先进技术的日益普及,推动了稀土基磁致伸缩材料的发展。

感测器和换能器在2024年占据34.9%的市场份额,成为最大的应用领域。磁致伸缩材料因其能够将磁能转换为机械能以及将机械能转换为磁能的能力而备受推崇,非常适合感测器和换能器製造。其高灵敏度、高耐用性和高精确度使其成为汽车和消费性电子设备中不可或缺的组件。

2024年,美国磁致伸缩材料市场规模达3.134亿美元。这一增长主要源于这些材料在感测器、执行器和变压器等各种工业应用中的广泛应用。製造业、汽车业和航太等产业都依赖磁致伸缩材料来提高操作精度和效率。在工业自动化领域,磁致伸缩感测器广泛用于精确的位置和位移测量。持续的自动化关注和对先进感测技术的需求预计将在整个预测期内推动市场成长。

磁致伸缩材料市场的领先公司包括 Cedrat Technologies、TdVib LLC、Grirem Advanced Materials Co., Ltd.、Metglas Inc. 和 Aperam SA。为了巩固市场地位并获得竞争优势,这些製造商采取了推出创新产品、扩大生产能力和进行併购等策略。

为了巩固市场地位并扩大市场份额,磁致伸缩材料领域的公司专注于几个关键策略方针。这些方针包括大力投资研发,推出满足不断变化的产业需求的创新高性能材料。他们还优先考虑扩大产能,以满足日益增长的需求,尤其是来自汽车和航太等快速发展的行业的需求。併购有助于公司拓宽产品组合和地理覆盖范围,而策略合作伙伴关係则有助于公司获得新技术和新市场。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按类型

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场规模及预测:依材料类型,2021-2034

- 主要趋势

- 稀土材料

- Terfenol-D(铽-镝-铁)

- 钐铁化合物

- 其他稀土材料

- 铁基合金

- 盖尔芬诺(Fe-Ga)

- 阿尔芬诺尔(Fe-Al)

- 其他铁基合金

- 镍基合金

- 镍铁合金

- 其他镍基合金

- 钴基合金

- 其他材料

第六章:市场规模及预测:依形式,2021-2034

- 主要趋势

- 散装材料

- 桿

- 盘子

- 区块

- 其他散装形式

- 薄膜

- 复合材料

- 颗粒复合材料

- 层压复合材料

- 其他复合形式

- 粉末

- 其他形式

第七章:市场规模及预测:依应用,2021-2034

- 主要趋势

- 感应器和换能器

- 力和扭矩感测器

- 位置和位移感测器

- 应力和应变感测器

- 磁场感测器

- 声学和超音波换能器

- 其他感测器和换能器

- 执行器和运动控制

- 线性执行器

- 旋转执行器

- 精密定位系统

- 振动控制系统

- 其他执行器应用

- 能量收集系统

- 振动能量收集器

- 声能收集器

- 其他能量收集应用

- 声纳和水下声学

- 结构健康监测

- 其他应用

第 8 章:市场规模与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 汽车

- 引擎和动力系统应用

- 悬吊和底盘应用

- 感测器应用

- 其他汽车应用

- 航太和国防

- 飞机系统

- 国防应用

- 空间应用

- 其他航太和国防应用

- 能源和电力

- 能量收集

- 发电

- 其他能源和电力应用

- 工业的

- 生产设备

- 过程控制

- 其他工业应用

- 消费性电子产品

- 医疗保健和医疗

- 海洋

- 其他的

第九章:市场规模及预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- TdVib

- Grirem Advanced Materials

- Metglas

- Cedrat Technologies

- Aperam

- Arnold Magnetic Technologies

- Sensor Technology

- AK Steel Holding Corporation

- Xinetics

The Global Magnetostrictive Materials Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 2.7 billion by 2034. Demand for magnetostrictive materials is rising due to their unique ability to change shape or size when subjected to magnetic fields, making them indispensable in advanced technological applications. Their usage spans a variety of sectors such as automotive, healthcare, aerospace, and consumer electronics. In the automotive field, these materials enhance vehicle performance, efficiency, and safety by being integral in sensors and actuators, particularly in power steering systems.

The growth of electric and hybrid vehicles is further propelling this market. Healthcare applications benefit greatly from their exceptional precision, enabling more accurate diagnostics and targeted treatments that improve patient outcomes. Meanwhile, aerospace companies rely on these materials for effective vibration control and continuous structural health monitoring, ensuring safety and performance in critical components. This dual utility across sectors not only broadens their application scope but also significantly amplifies market demand as industries seek reliable, high-performance solutions to meet evolving technological challenges.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.7 Billion |

| CAGR | 7.3% |

The rare earth materials segment generated USD 589.5 million in 2024 and is expected to reach USD 1.2 billion by 2034. This segment dominates because rare earth elements like terbium provide superior magnetic properties and high magnetic coefficients. These qualities make them ideal for applications requiring precision and efficiency, including sensors, actuators, and transformers. The increasing adoption of advanced technology in the automotive, aviation, and consumer electronics sectors fuels the growth of rare earth-based magnetostrictive materials.

The sensors and transducers accounted for a 34.9% share in 2024, making this the largest application segment. Magnetostrictive materials are prized for their ability to convert magnetic energy into mechanical energy and vice versa, lending themselves perfectly to sensor and transducer manufacturing. Their high sensitivity, durability, and accuracy make them essential components in automotive and consumer electronics devices.

United States Magnetostrictive Materials Market generated USD 313.4 million in 2024. This growth is driven by the increased use of these materials in various industrial applications, including sensors, actuators, and transformers. Industries such as manufacturing, automotive, and aerospace rely on magnetostrictive materials to improve operational accuracy and efficiency. In industrial automation, magnetostrictive sensors are widely used for precise position and displacement measurements. The ongoing focus on automation and the demand for advanced sensing technologies are expected to boost market growth throughout the forecast period.

Leading companies in the Magnetostrictive Materials Market include Cedrat Technologies, TdVib LLC, Grirem Advanced Materials Co., Ltd., Metglas Inc., and Aperam S.A. To strengthen their market positions and gain competitive advantages, these manufacturers pursue strategies such as launching innovative products, expanding production capacity, and engaging in mergers and acquisitions.

To solidify their foothold and expand market presence, companies in the magnetostrictive materials sector focus on several key strategic approaches. These include investing heavily in research and development to introduce innovative, higher-performance materials that meet evolving industry needs. They also prioritize capacity expansion to handle growing demand, especially from rapidly developing sectors like automotive and aerospace. Mergers and acquisitions help companies broaden their product portfolios and geographic reach, while strategic partnerships enable access to new technologies and markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material type

- 2.2.3 Form

- 2.2.4 Application

- 2.2.5 End use industry

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Material Type, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Rare earth materials

- 5.2.1 Terfenol-D (Tb-Dy-Fe)

- 5.2.2 Samarium-iron compounds

- 5.2.3 Other rare earth materials

- 5.3 Iron-based alloys

- 5.3.1 Galfenol (Fe-Ga)

- 5.3.2 Alfenol (Fe-Al)

- 5.3.3 Other iron-based alloys

- 5.4 Nickel-based alloys

- 5.4.1 Nickel-iron alloys

- 5.4.2 Other nickel-based alloys

- 5.5 Cobalt-based alloys

- 5.6 Other materials

Chapter 6 Market Size and Forecast, By Form, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Bulk materials

- 6.2.1 Rods

- 6.2.2 Plates

- 6.2.3 Blocks

- 6.2.4 Other bulk forms

- 6.3 Thin films

- 6.4 Composites

- 6.4.1 Particulate composites

- 6.4.2 Laminated composites

- 6.4.3 Other composite forms

- 6.5 Powders

- 6.6 Other forms

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Sensors and transducers

- 7.2.1 Force and torque sensors

- 7.2.2 Position and displacement sensors

- 7.2.3 Stress and strain sensors

- 7.2.4 Magnetic field sensors

- 7.2.5 Acoustic and ultrasonic transducers

- 7.2.6 Other sensors and transducers

- 7.3 Actuators and motion control

- 7.3.1 Linear actuators

- 7.3.2 Rotary actuators

- 7.3.3 Precision positioning systems

- 7.3.4 Vibration control systems

- 7.3.5 Other actuator applications

- 7.4 Energy harvesting systems

- 7.4.1 Vibration energy harvesters

- 7.4.2 Acoustic energy harvesters

- 7.4.3 Other energy harvesting applications

- 7.5 Sonar and underwater acoustics

- 7.6 Structural health monitoring

- 7.7 Other applications

Chapter 8 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 Automotive

- 8.2.1 Engine and powertrain applications

- 8.2.2 Suspension and chassis applications

- 8.2.3 Sensor applications

- 8.2.4 Other automotive applications

- 8.3 Aerospace and defense

- 8.3.1 Aircraft systems

- 8.3.2 Defense applications

- 8.3.3 Space applications

- 8.3.4 Other aerospace and defense applications

- 8.4 Energy and power

- 8.4.1 Energy harvesting

- 8.4.2 Power generation

- 8.4.3 Other energy and power applications

- 8.5 Industrial

- 8.5.1 Manufacturing equipment

- 8.5.2 Process control

- 8.5.3 Other industrial applications

- 8.6 Consumer electronics

- 8.7 Healthcare and medical

- 8.8 Marine

- 8.9 Others

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 TdVib

- 10.2 Grirem Advanced Materials

- 10.3 Metglas

- 10.4 Cedrat Technologies

- 10.5 Aperam

- 10.6 Arnold Magnetic Technologies

- 10.7 Sensor Technology

- 10.8 AK Steel Holding Corporation

- 10.9 Xinetics