|

市场调查报告书

商品编码

1782109

输尿管镜市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Ureteroscope Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

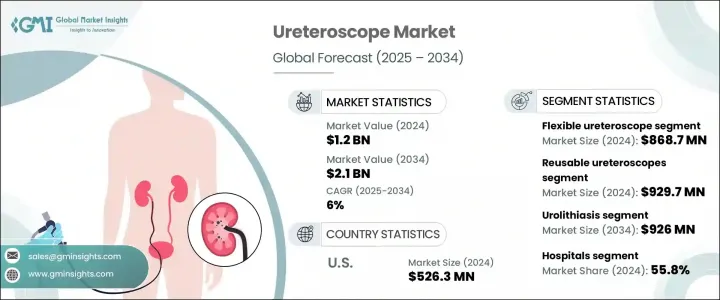

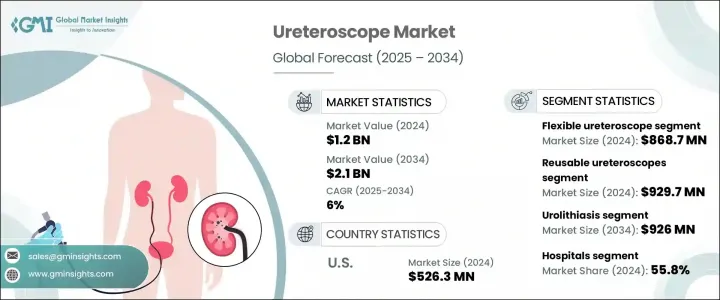

2024 年全球输尿管镜市场规模达 12 亿美元,预计到 2034 年将以 6% 的复合年增长率成长至 21 亿美元。这一增长轨迹主要受全球肾结石和其他泌尿道相关疾病发生率上升的驱动。此外,由于临床疗效改善、术后併发症减少以及住院时间缩短,采用微创技术的医疗保健趋势持续增强。这些优点促使医护人员和患者更倾向于选择内视镜介入而非传统手术。输尿管镜——用于诊断和治疗输尿管及肾臟疾病的设备——随着其设计不断改进,灵活性和影像技术不断提升,其重要性日益凸显。这些创新技术能够实现更精准的治疗,提高患者的舒适度和安全性,从而支持其在全球医疗保健系统中的广泛应用。

泌尿道感染和肾结石的增多,可归因于现代生活习惯、肥胖率上升、遗传因素以及某些人群的体液摄取不足等多种因素。随着这些健康问题日益普遍,医学界正将输尿管镜视为一种有效且微创的解决方案。输尿管镜旨在解决各种泌尿系统问题,例如狭窄、肿瘤和结石。它们配备先进的可视化和可操作性,可对整个泌尿道进行全面诊断和微创治疗。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 12亿美元 |

| 预测值 | 21亿美元 |

| 复合年增长率 | 6% |

2024年,柔性输尿管镜市场价值达8.687亿美元。其适应性强,易于在复杂的泌尿道中导航,使其成为诊断和处理复杂泌尿外科病例的理想选择。材料和视觉化技术的进步进一步提升了这些设备的性能,使其在临床上广泛应用。随着泌尿科医师寻求能够进行更安全、更有效率手术的精密器械,对柔性输尿管镜的需求日益增长。

在临床应用方面,泌尿系统结石领域在2024年占据了最高的市场份额,预计到2034年将达到9.26亿美元。泌尿系统结石影响着广泛的人群,如果不及时治疗,可能会导致严重的併发症。输尿管镜的精准性和高效性使其成为治疗此类疾病的重要工具,尤其是在需要透过微创手术取出或碎石的情况下。

由于强大的医疗基础设施和对泌尿系统疾病的高度认知,美国输尿管镜市场在2024年的价值达到5.263亿美元。先进的医疗技术,加上庞大的肾结石和泌尿道疾病患者群体,推动了持续的需求。此外,顶级医疗器材製造商的涌现以及新型成像工具的快速普及,巩固了美国在该领域的领先地位。

输尿管镜市场竞争格局中的关键参与者包括波士顿科学 (Boston Scientific)、史托斯 (STORZ)、安布 (Ambu)、普森 (PUSEN)、康乐保 (Coloplast)、BD、史赛克 (Stryker)、多尼尔医疗科技 (Dornier MedTech)、Neoscope、奥运、欧普夫医疗 (Dornier MedTech) 和理查康欧普夫 (EULF)。为了巩固市场地位,输尿管镜产业的公司正在大力投资创新,专注于提高设备的灵活性、小型化和光学清晰度。他们正积极透过策略合作伙伴关係和量身定制的产品发布来扩展产品组合,以满足已开发和新兴医疗市场的需求。一次性和电子输尿管镜技术的持续改进也是一个重点关注领域。此外,各公司正在加强其全球分销网络,并参与培训项目以支持临床应用,从而确保长期竞争力和持续的市场成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 肾结石和泌尿道疾病的盛行率不断上升

- 输尿管镜技术的进步

- 微创设备的采用日益增多

- 产业陷阱与挑战

- 先进电子输尿管镜成本高昂

- 机会

- 向新兴市场扩张

- 输尿管镜与机器人手术系统的整合

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 按产品分類的价格趋势

- 未来市场趋势

- 报销场景

- 消费者行为分析

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 柔性输尿管镜

- 硬性输尿管镜

第六章:市场估计与预测:按可用性,2021 - 2034 年

- 主要趋势

- 可重复使用的输尿管镜

- 抛弃式输尿管镜

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 泌尿系统结石

- 尿道狭窄

- 泌尿道感染

- 其他应用

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Ambu

- BD

- Boston Scientific

- Coloplast

- Dornier MedTech

- neoscope

- OLYMPUS

- OPCOM Medical

- PUSEN

- RICHARD WOLF

- STORZ

- Stryker

The Global Ureteroscope Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 2.1 billion by 2034. This growth trajectory is primarily being driven by the rising global incidence of kidney stones and other urinary tract-related conditions. Alongside this, the broader healthcare trend of adopting minimally invasive technologies continues to gain pace, fueled by better clinical outcomes, reduced post-operative complications, and shorter hospital stays. These advantages are pushing both healthcare providers and patients to prefer endoscopic interventions over traditional surgery. Ureteroscopes-devices designed to diagnose and treat ureteral and renal conditions-have become increasingly important as their designs evolve to offer improved flexibility and advanced imaging. These innovations allow for more precise treatments with greater patient comfort and enhanced safety, supporting their growing adoption across healthcare systems worldwide.

The increase in urinary tract infections and renal calculi can be attributed to a mix of modern lifestyle habits, rising obesity rates, genetic influences, and poor hydration in certain populations. As these health issues become more common, the medical community is turning to ureteroscopy as an effective and less invasive solution. These scopes are engineered to address a wide range of urological concerns such as strictures, tumors, and calculi. Equipped with cutting-edge visualization and maneuverability, they enable thorough diagnosis and minimally invasive treatment across the urinary tract.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.1 Billion |

| CAGR | 6% |

The flexible ureteroscopes segment was valued at USD 868.7 million in 2024. Their adaptability and ease of navigation through the intricate urinary pathways make them ideal for diagnosing and managing complex urological cases. Technological advancements in materials and visualization further enhance the performance of these devices, leading to widespread clinical acceptance. The demand for flexible ureteroscopes is increasing as urologists seek precision instruments that allow for safer and more efficient procedures.

In terms of clinical application, the urolithiasis segment commanded the highest market share in 2024 and is expected to reach USD 926 million by 2034. Urolithiasis affects a broad demographic and can result in serious complications if untreated. The precision and efficiency of ureteroscopes make them essential tools in treating this condition, particularly when stone removal or fragmentation is required through less invasive surgical means.

U.S. Ureteroscope Market was valued at USD 526.3 million in 2024 due to its strong healthcare infrastructure and high awareness of urological disorders. Advanced medical technology, combined with a significant patient population dealing with kidney stones and urinary tract issues, drives consistent demand. Additionally, the presence of top-tier medical device manufacturers and the rapid adoption of newer imaging tools solidify the country's leadership in this space.

Key players contributing to the competitive landscape of the Ureteroscope Market include Boston Scientific, STORZ, Ambu, PUSEN, Coloplast, BD, Stryker, Dornier MedTech, Neoscope, OLYMPUS, OPCOM Medical, and RICHARD WOLF. To strengthen their market position, companies in the ureteroscope industry are investing heavily in innovation, focusing on enhancing device flexibility, miniaturization, and optical clarity. They are actively expanding their product portfolios through strategic partnerships and product launches tailored to meet the demands of both developed and emerging healthcare markets. Continuous improvement in disposable and digital ureteroscope technology is also a key focus area. Additionally, players are ramping up their global distribution networks and engaging in training programs to support clinical adoption, thereby ensuring long-term competitiveness and sustained market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Usability

- 2.2.4 Application

- 2.2.5 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of kidney stones and urinary tract diseases

- 3.2.1.2 Technological advancements in ureteroscopy

- 3.2.1.3 Growing adoption of minimally invasive devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced and digital ureteroscopes

- 3.2.3 Opportunities

- 3.2.3.1 Expansion into emerging markets

- 3.2.3.2 Integration of ureteroscopes with robotic surgical systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends, by product

- 3.7 Future market trends

- 3.8 Reimbursement scenario

- 3.9 Consumer behaviour analysis

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 MEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Flexible ureteroscope

- 5.3 Rigid ureteroscope

Chapter 6 Market Estimates and Forecast, By Usability, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Reusable ureteroscopes

- 6.3 Disposable ureteroscopes

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Urolithiasis

- 7.3 Urethral stricture

- 7.4 Urinary tract infections

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Ambu

- 10.2 BD

- 10.3 Boston Scientific

- 10.4 Coloplast

- 10.5 Dornier MedTech

- 10.6 neoscope

- 10.7 OLYMPUS

- 10.8 OPCOM Medical

- 10.9 PUSEN

- 10.10 RICHARD WOLF

- 10.11 STORZ

- 10.12 Stryker