|

市场调查报告书

商品编码

1782128

加工工业物料搬运设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Processing Industry Material Handling Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

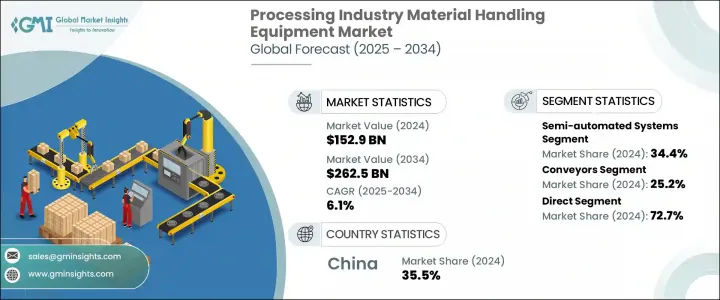

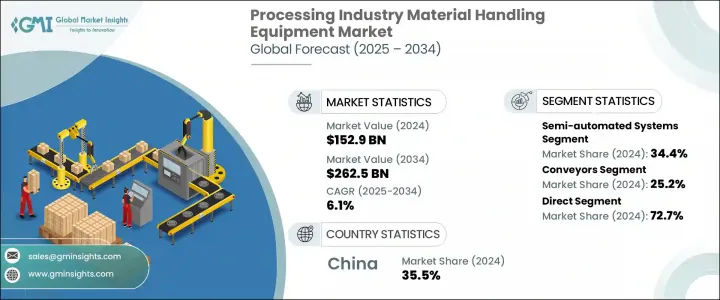

2024年,全球加工工业物料搬运设备市场规模达1,529亿美元,预计2034年将以6.1%的复合年增长率成长,达到2,625亿美元。这一稳定成长主要得益于加工产业对先进自动化解决方案日益增长的需求。在智慧技术的融合推动下,该产业正日益拥抱数位转型,这些技术正在重塑物料的运输、储存和管理方式。自动化不再是未来的趋势,而是成为提高营运效率、降低成本和保障员工安全的重要因素。

各行各业的企业正在利用机器人、人工智慧和物联网等创新技术来简化工作流程,增强即时视觉性,并透过更优化的流程控制来获得竞争优势。这些数位化系统不仅能够提高产量,还能透过减少对人工的依赖、最大限度地减少操作错误并延长正常运作时间,支援精实製造。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1529亿美元 |

| 预测值 | 2625亿美元 |

| 复合年增长率 | 6.1% |

随着企业在快速发展的市场中面临提升生产力和保持敏捷性的日益增长的压力,向现代物料搬运设备的转变也在不断加速。智慧搬运解决方案的采用使企业能够更快地响应动态生产需求,同时透过节能营运和最大程度减少材料浪费来支援永续发展目标。此外,这些自动化系统可以根据各种行业需求进行客製化,使其成为对精度、一致性和适应性至关重要的加工应用的理想选择。

从食品饮料加工到化学品和电子产品,企业都在投资能够提升流程、减少瓶颈并确保设施内无缝衔接的设备。这种现代化的动力不仅正在改变大型製造业务,也对那些希望在不投入大量资金打造全自动系统的情况下保持竞争力的中型工厂大有裨益。这些转变的累积效应,使得专门针对加工环境的物料搬运设备需求呈现强劲成长态势。

就操作模式而言,市场分为手动系统、半自动化系统、全自动系统和支援物联网的智慧搬运系统。其中,半自动化系统在2024年成为市场领导者,约占总收入的34.4%。预计在预测期内,该领域的复合年增长率将超过4.4%。半自动化设备将自动化优势与操作员控製完美结合,这对于需要灵活性和精确度的企业尤其具有吸引力。这些系统尤其适用于工作流程各异的设施,使操作员能够有效率地管理客製化任务,同时实现重复性活动的机械化。半自动化系统价格实惠、易于整合且维护要求较低,使其成为许多希望扩大规模但又不想完全转向自主营运的加工企业的实用选择。

根据应用,市场细分为输送机、起重机和提昇机、堆高机和工业卡车、自动导引车 (AGV)、储存和检索系统、机器人物料搬运系统、散装物料搬运设备等。输送机细分市场在 2024 年占据市场主导地位,收入份额为 25.2%,预计 2025 年至 2034 年的复合年增长率将超过 5.5%。输送机系统的广泛部署是由于它们能够在加工厂内的不同地点之间无缝运输物料。它们的多功能设计支援从轻型物品到散装货物的各种货物的运输,从而提高吞吐量并最大限度地缩短搬运时间。这些系统透过确保不间断的物料流为流程优化做出了重要贡献,这对于连续生产週期运作的产业至关重要。

根据配销通路,市场分为直接通路和间接通路。 2024年,直销通路占据主导地位,营收份额达72.7%,预计整个预测期内的复合年增长率将超过4.7%。直接管道为买家提供更便利的客製化解决方案和技术支持,从而创造强大的价值主张。然而,间接通路在市场扩张中仍扮演关键角色。它能够扩大客户覆盖范围,并提供客製化、售后支援和灵活融资方案等额外服务,这些服务对中小企业尤其具有吸引力。这种双通道模式有助于製造商在个人化服务和大规模覆盖之间取得平衡。

从区域来看,中国在2024年成为亚太地区加工产业物料搬运设备市场的领跑者,占了约35.5%的区域份额。预计到2034年,中国市场规模将超过20亿美元。这一主导地位得益于快速的工业发展、强大的製造业基础设施以及旨在推动自动化和智慧製造的强大政府倡议。持续的城镇化和区域工业化过程进一步推动了对先进搬运系统的需求,使中国成为亚太地区该产业成长的关键贡献者。

塑造全球加工产业物料搬运设备市场格局的知名企业包括大福、皇冠设备公司、德马泰克集团、基伊埃、法孚集团、海斯特-耶鲁物料搬运公司、JBT公司、Intelligrated、永恆力、林德物料搬运公司、凯傲田、三菱Logisnext、利乐、胜斐丰田集团。这些公司正在大力投资研发、合作和全球扩张,以增强其竞争地位,并满足日益增长的智慧整合物料搬运解决方案需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 技术进步和自动化

- 电子商务和物流的成长

- 工业和製造业的扩张

- 产业陷阱与挑战

- 维护费用和复杂性

- 熟练劳动力短缺

- 初期投资高

- 机会

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按运作方式

- 监理框架

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特五力分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依营运模式,2021-2034 年

- 主要趋势

- 手动搬运设备

- 半自动化系统

- 全自动系统

- 支援物联网的智慧处理系统

第六章:市场估计与预测:依设备类型,2021-2034 年

- 主要趋势

- 传送带

- 起重机和升降机

- 堆高机和工业用卡车

- 自动导引车(AGV)

- 储存和检索系统

- 机器人物料搬运系统

- 散装物料处理设备

- 其他

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 高效率的物料运输

- 储存和组织

- 提高安全性

- 提高生产力

- 其他

第八章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 食品和饮料加工

- 化学和製药加工

- 采矿和金属加工

- 製药製造业

- 石油和天然气

- 后勤

- 汽车和电子製造业

- 其他

第九章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- 直接的

- 间接

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Crown Equipment Corporation

- Daifuku

- Dematic Group

- Fives Group

- GEA

- Hyster-Yale Materials Handling

- Intelligrated (a Honeywell company)

- JBT Corporation

- Jungheinrich

- KION Group

- Linde Material Handling

- Mitsubishi Logisnext

- SSI Schaefer Group

- Tetra Pak

- Toyota Industries Corporation

The Global Processing Industry Material Handling Equipment Market was valued at USD 152.9 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 262.5 billion by 2034. This steady rise is primarily attributed to the growing demand for advanced, automated solutions across processing sectors. The industry is increasingly embracing digital transformation, driven by the integration of intelligent technologies that are reshaping how materials are moved, stored, and managed. Automation is no longer a future trend-it has become an essential element of operational efficiency, cost reduction, and workforce safety.

Companies across processing industries are leveraging innovations such as robotics, AI, and IoT to streamline workflows, enhance real-time visibility, and gain a competitive edge through better process control. These digital systems not only improve production output but also support lean manufacturing by reducing reliance on manual labor, minimizing operational errors, and increasing uptime.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $152.9 Billion |

| Forecast Value | $262.5 Billion |

| CAGR | 6.1% |

As businesses face heightened pressure to boost productivity and maintain agility in rapidly evolving markets, the shift toward modern material handling equipment continues to accelerate. The adoption of smart handling solutions has enabled companies to respond faster to dynamic production needs, while also supporting sustainability goals through energy-efficient operations and minimizing material waste. Furthermore, these automated systems can be tailored for various industrial requirements, making them ideal for processing applications where precision, consistency, and adaptability are critical.

From food and beverage processing to chemicals and electronics, enterprises are investing in equipment that enhances flow, reduces bottlenecks, and ensures seamless intra-facility movement. This push toward modernization is not only transforming large manufacturing operations but is also proving beneficial for mid-sized facilities aiming to stay competitive without investing heavily in fully autonomous systems. The cumulative effect of these shifts is a robust demand trajectory for material handling equipment tailored specifically to processing environments.

In terms of operation mode, the market is categorized into manual systems, semi-automated systems, fully automated systems, and IoT-enabled smart handling systems. Among these, the semi-automated segment emerged as the market leader in 2024, capturing around 34.4% of the overall revenue. This segment is forecasted to grow at a CAGR of over 4.4% through the forecast period. Semi-automated equipment offers an optimal blend of automation benefits and operator control, which is particularly appealing to businesses that require both flexibility and precision. These systems are especially suitable for facilities with varying workflows, enabling operators to manage customized tasks efficiently while mechanizing repetitive activities. Their affordability, ease of integration, and lower maintenance requirements make them a practical choice for many processing firms aiming to scale without transitioning fully to autonomous operations.

On the basis of application, the market is segmented into conveyors, cranes and hoists, forklifts and industrial trucks, automated guided vehicles (AGVs), storage and retrieval systems, robotic material handling systems, bulk material handling equipment, and others. The conveyors segment led the market in 2024 with a revenue share of 25.2%, and it is anticipated to register a CAGR of over 5.5% from 2025 to 2034. The widespread deployment of conveyor systems is due to their ability to transport materials seamlessly across different points within processing plants. Their design versatility supports the movement of a wide range of goods, from lightweight items to bulk loads, thereby improving throughput and minimizing handling times. These systems contribute significantly to process optimization by ensuring uninterrupted material flow, which is essential for industries that operate on continuous production cycles.

The market, based on distribution channel, is divided into direct and indirect channels. In 2024, the direct sales segment held the dominant position with a revenue share of 72.7% and is projected to grow at a CAGR of over 4.7% throughout the forecast period. Direct channels offer buyers better access to tailored solutions and technical support, creating strong value propositions. However, the indirect segment continues to play a critical role in market expansion. It enables broader customer reach and provides additional services such as customization, post-sale assistance, and flexible financing options, which are especially appealing to small and mid-sized enterprises. This dual-channel approach helps manufacturers maintain a balance between personalized service and wide-scale accessibility.

Regionally, China emerged as the front-runner in the Asia-Pacific processing industry material handling equipment market in 2024, securing approximately 35.5% of the regional share. The country's market is projected to exceed USD 2 billion by 2034. This dominance is fueled by rapid industrial development, a robust manufacturing infrastructure, and strong governmental initiatives aimed at boosting automation and smart manufacturing. Continued urbanization and regional industrialization efforts further drive the demand for advanced handling systems, making China a key contributor to the sector's growth across APAC.

Prominent players shaping the global landscape of the processing industry material handling equipment market include Daifuku, Crown Equipment Corporation, Dematic Group, GEA, Fives Group, Hyster-Yale Materials Handling, JBT Corporation, Intelligrated, Jungheinrich, Linde Material Handling, KION Group, Mitsubishi Logisnext, Tetra Pak, SSI Schaefer Group, and Toyota Industries Corporation. These companies are investing heavily in R&D, partnerships, and global expansions to strengthen their competitive positions and cater to the increasing need for intelligent and integrated material handling solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Mode of operation

- 2.2.2 Equipment type

- 2.2.3 Application

- 2.2.4 End use industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements and automation

- 3.2.1.2 Growth of e-commerce and logistics

- 3.2.1.3 Expansion of industrial and manufacturing sectors

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Maintenance expenses and complexity

- 3.2.2.2 Shortage of skilled workforce

- 3.2.2.3 High initial investment

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By mode of operation

- 3.7 Regulatory framework

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Mode of Operation, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Manual handling equipment

- 5.3 Semi-automated systems

- 5.4 Fully automated systems

- 5.5 IoT-enabled smart handling systems

Chapter 6 Market Estimates & Forecast, By Equipment Type, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Conveyors

- 6.3 Cranes & Hoists

- 6.4 Forklifts & Industrial Trucks

- 6.5 Automated Guided Vehicles (AGVs)

- 6.6 Storage & Retrieval Systems

- 6.7 Robotic Material Handling Systems

- 6.8 Bulk Material Handling Equipment

- 6.9 Other

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Efficient movement of materials

- 7.3 Storage and organization

- 7.4 Improving safety

- 7.5 Increasing productivity

- 7.6 Other

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage processing

- 8.3 Chemical and pharmaceutical processing

- 8.4 Mining & metals processing

- 8.5 Pharmaceutical manufacturing

- 8.6 Oil & gas

- 8.7 Logistics

- 8.8 Automotive and electronics manufacturing

- 8.9 Other

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Crown Equipment Corporation

- 11.2 Daifuku

- 11.3 Dematic Group

- 11.4 Fives Group

- 11.5 GEA

- 11.6 Hyster-Yale Materials Handling

- 11.7 Intelligrated (a Honeywell company)

- 11.8 JBT Corporation

- 11.9 Jungheinrich

- 11.10 KION Group

- 11.11 Linde Material Handling

- 11.12 Mitsubishi Logisnext

- 11.13 SSI Schaefer Group

- 11.14 Tetra Pak

- 11.15 Toyota Industries Corporation