|

市场调查报告书

商品编码

1797701

硅基生物刺激素市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Silicon Based Biostimulants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

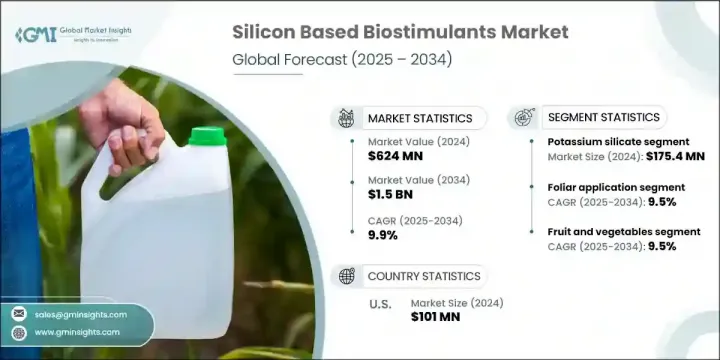

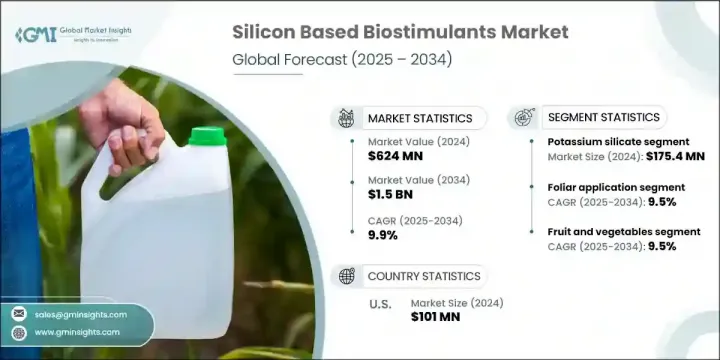

2024年,全球硅基生物刺激素市场规模达6.24亿美元,预计2034年将以9.9%的复合年增长率成长,达到15亿美元。随着农业持续优先发展可持续且富有韧性的耕作方式,该市场的发展势头强劲。农业生产正朝着注重生态和高效的种植方式转变,这推动了各种农业体系对硅基投入品的需求。随着农业越来越重视减轻生物和非生物胁迫的影响,这些生物刺激素因其能够促进植物健康、提高产量稳定性并抵抗环境压力而被广泛采用。

该行业的扩张得益于不断增长的研究、产品创新以及人们对智慧农业技术日益增长的兴趣。随着农场转向减少对化学物质的依赖并提高作物产量的种植方式,硅强化配方正受到全球种植者的青睐。强劲的产品性能进一步推动了市场的活力,尤其是在提高作物抗逆性和优化植物在逆境下代谢方面。世界各地先进的农业实践为此类专业产品的兴起创造了有利条件,体现了人们对再生农业和永续农业的更广泛投入。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.24亿美元 |

| 预测值 | 15亿美元 |

| 复合年增长率 | 9.9% |

市场上一个显着的发展是奈米硅生物刺激素的出现。这些先进的配方利用硅奈米颗粒来提高生物利用度,并带来针对性的益处,例如改善植物吸收和增强抗逆性。此类创新对高价值作物和精准农业的吸引力日益增强。随着研究的深入和商业化的加速,新的机会正在涌现,而越来越多的科学发现支持奈米硅在复杂农业系统中的优势。这一趋势预计将为技术先进的农业地区开闢新的成长途径。

在全球对气候变迁和土壤健康恶化的担忧中,农民和农业企业都在探索更聪明的解决方案。事实证明,硅基生物刺激素有助于增强农业抵御重金属暴露、干旱和土壤盐化等环境挑战的能力。这些解决方案与全球对永续农业投入的追求相契合,永续农业投入正成为气候意识型粮食生产体系的重要组成部分。随着种植者寻求在不损害生态平衡的情况下有效提升植物健康的途径,这些产品在农业领域的应用正在日益广泛。

就产品类型而言,硅酸钾细分市场在2024年创造了1.754亿美元的销售额,占28.1%的市场份额,这得益于其在增强多种作物强度和应对逆境方面的有效性。硅酸钾在各种农业环境中的稳定表现,使其成为寻求可靠生物刺激素的种植者的首选。

叶面肥在2024年占据34.1%的市场份额,预计到2034年将以9.5%的复合年增长率成长。这项技术之所以受欢迎,是因为它能够透过植物叶片快速吸收硅元素,并带来即时的效果。植物状况、抗逆性和产量品质的显着改善是其在追求快速、可衡量效益的种植者和园艺师中被广泛采用的关键原因。

2024年,美国硅基生物刺激素市产值达1.01亿美元,占80.1%的市占率。美国在该领域的领先地位得益于其强大的监管框架、农业技术的快速发展以及对环境管理的广泛重视。硅基生物刺激素已成为作物生产策略中不可或缺的一部分,尤其是在谷物和农产品种植中,提高产量和抗逆性是重中之重。随着农民应对日益难以预测的气候条件,这些产品与作物管理方案的整合正在稳步扩大。

塑造硅基生物刺激素市场的关键参与者包括先正达公司、UPL有限公司、科迪华公司、拜耳公司和巴斯夫。硅基生物刺激素领域的领先公司正透过创新、合作和全球扩张等方式巩固其市场地位。各公司正大力投资研发,以创造先进的配方,尤其是能够精准输送和提高药效的奈米硅技术。与农业研究机构和技术提供者的策略合作正在加速产品开发和商业化。许多参与者也透过收购和合资企业进入新兴市场,以扩大其地理覆盖范围。客製化产品以满足区域作物需求和监管标准已成为关键关注点。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 对永续农业的需求不断增长

- 增强作物抗逆性和产量

- 生物刺激素使用的监管支持

- 产品配方和奈米技术的进步

- 产业陷阱与挑战

- 农民意识和教育有限

- 与传统投入相比成本较高

- 市场机会

- 新兴市场的扩张

- 与精准农业和数位农业的融合

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 硅酸钾

- 硅酸钠

- 稳定化硅酸

- 硅奈米粒子

- 其他硅化合物

第六章:市场估计与预测:依应用方法,2021 - 2034 年

- 主要趋势

- 叶面施肥

- 土壤应用

- 种子处理

- 水肥一体化和水耕

第七章:市场估计与预测:依作物类型,2021 - 2034 年

- 主要趋势

- 谷物和谷类

- 水果和蔬菜

- 经济作物

- 草坪和观赏植物

- 其他特色作物

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- BASF SE

- Eutrema

- Haifa Group

- Intermag

- Nuvia Technologies

- Orion Future Technology Ltd

- Plant Food Company Inc

- PlantoSys Nederland BV

- Roam Technology

- Shield Lifesciences and Resins Pvt Ltd

- Sustainable Agro Solutions SA

- Syngenta AG

The Global Silicon Based Biostimulants Market was valued at USD 624 million in 2024 and is estimated to grow at a CAGR of 9.9% to reach USD 1.5 billion by 2034. This market is gaining traction as agriculture continues to prioritize sustainable and resilient farming methods. The ongoing shift toward eco-conscious and efficient cultivation practices is driving the demand for silicon-based inputs across various farming systems. With agriculture's increasing focus on mitigating the effects of biotic and abiotic stress, these biostimulants are being adopted for their ability to support plant health, yield stability, and resistance to environmental pressures.

The expansion of the industry is backed by rising research, product innovation, and growing interest in smart agriculture technologies. As farms transition to methods that reduce chemical reliance and improve crop outcomes, silicon-enhanced formulations are finding favor among producers globally. The dynamic nature of the market is further propelled by strong product performance, particularly in improving crop resilience and optimizing plant metabolism under stress. Sophisticated agricultural practices in several parts of the world are creating favorable conditions for the rise of specialized products in this category, reflecting a wider commitment to regenerative and sustainable farming.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $624 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 9.9% |

A notable development in the market is the emergence of nano-silicon biostimulants. These advanced formulations use silicon nanoparticles to enhance bioavailability and deliver targeted benefits, such as improved plant uptake and increased resistance to stress. Such innovations are becoming increasingly attractive for high-value crops and precision agriculture. As research deepens and commercialization gains speed, new opportunities are surfacing, driven by a rise in scientific findings that support the advantages of nano-silicon across complex farming systems. This trend is expected to open fresh pathways for growth in technologically advanced agricultural regions.

Amid global concerns about climate shifts and deteriorating soil health, both farmers and agribusinesses are exploring smarter solutions. Silicon-based biostimulants are proving instrumental in boosting agricultural resilience to environmental challenges, including heavy metal exposure, drought, and soil salinity. These solutions align with the global momentum toward sustainable agricultural inputs, which are becoming an essential part of climate-conscious food production systems. The adoption of these products is increasing across the farming spectrum as growers seek effective ways to enhance plant health without compromising ecological balance.

In terms of product type, the potassium silicate segment generated USD 175.4 million and held 28.1% share in 2024 due to its proven effectiveness in boosting plant strength and stress response across multiple crop types. Its consistent performance in diverse agricultural environments continues to make it a top choice among growers looking for reliable biostimulant options.

The foliar segment held a 34.1% share in 2024 and will grow at a 9.5% CAGR through 2034. This technique is popular because it enables rapid absorption of silicon through plant foliage and delivers immediate benefits. Visible improvements in plant condition, stress resistance, and yield quality are key reasons for its widespread adoption among growers and horticulturists aiming for fast, measurable outcomes.

United States Silicon Based Biostimulants Market generated USD 101 million in 2024 and held an 80.1% share. The country's leadership in the sector is supported by a strong regulatory framework, rapid advancements in agri-tech, and widespread emphasis on environmental stewardship. Silicon-based biostimulants have become integral in crop production strategies, particularly in grain and produce farming, where enhancing yield and stress tolerance are top priorities. The integration of these products into crop management programs is steadily expanding as farmers respond to increasingly unpredictable climate conditions.

Key players shaping the Silicon Based Biostimulants Market include Syngenta AG, UPL Limited, Corteva Inc., Bayer AG, and BASF SE. Leading firms in the silicon-based biostimulants sector are reinforcing their market positions through a combination of innovation, partnerships, and global expansion. Companies are heavily investing in R&D to create advanced formulations, particularly nano-silicon technologies that offer precision delivery and improved efficacy. Strategic collaborations with agricultural research institutions and tech providers are accelerating product development and commercialization. Many players are also entering emerging markets through acquisitions and joint ventures to expand their geographic footprint. Customization of product offerings to meet regional crop requirements and regulatory standards has become a critical focus.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application method

- 2.2.4 Crop type

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sustainable agriculture

- 3.2.1.2 Enhanced crop stress tolerance and yield

- 3.2.1.3 Regulatory support for biostimulants use

- 3.2.1.4 Advancements in product formulations and nanotechnology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited farmer awareness and education

- 3.2.2.2 Higher cost compared to conventional inputs

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 Integration with precision and digital agriculture

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Million, Tons)

- 5.1 Key trends

- 5.2 Potassium silicate

- 5.3 Sodium silicate

- 5.4 Stabilized silicic acid

- 5.5 Silicon nanoparticles

- 5.6 Other silicon compounds

Chapter 6 Market Estimates & Forecast, By Application Method, 2021 - 2034 (USD Million, Tons)

- 6.1 Key trends

- 6.2 Foliar application

- 6.3 Soil application

- 6.4 Seed treatment

- 6.5 Fertigation and hydroponic

Chapter 7 Market Estimates & Forecast, By Crop Type, 2021 - 2034 (USD Million, Tons)

- 7.1 Key trends

- 7.2 Cereals and grains

- 7.3 Fruits and vegetables

- 7.4 Industrial crops

- 7.5 Turf and ornamentals

- 7.6 Other specialty crops

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million, Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Italy

- 8.3.4 Spain

- 8.3.5 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 BASF SE

- 9.2 Eutrema

- 9.3 Haifa Group

- 9.4 Intermag

- 9.5 Nuvia Technologies

- 9.6 Orion Future Technology Ltd

- 9.7 Plant Food Company Inc

- 9.8 PlantoSys Nederland B.V.

- 9.9 Roam Technology

- 9.10 Shield Lifesciences and Resins Pvt Ltd

- 9.11 Sustainable Agro Solutions S.A

- 9.12 Syngenta AG