|

市场调查报告书

商品编码

1694047

美国频率控制与定时设备:市场占有率分析、产业趋势与成长预测(2025-2030 年)United States Frequency Control And Timing Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

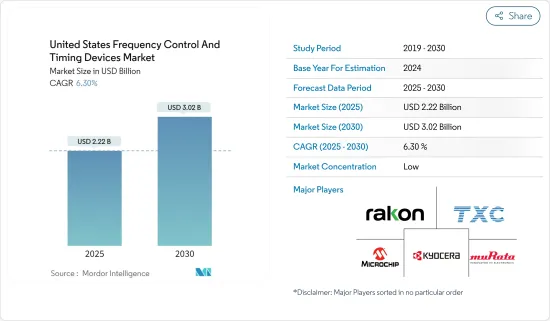

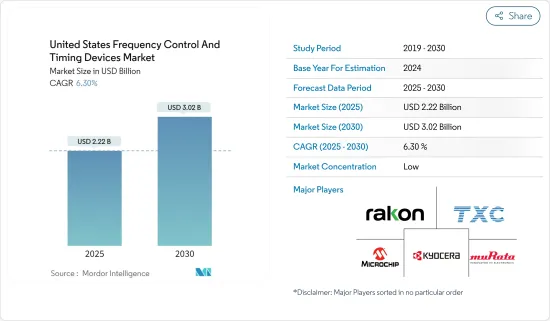

美国频率控制和计时设备市场规模预计在 2025 年为 22.2 亿美元,预计到 2030 年将达到 30.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.3%。

频率控制设备在电子系统中起着至关重要的作用,提供资讯准确传输所需的讯号和时间控制。利用石英晶共振器、MEMS 和陶瓷共振器的原理,这些设备能够产生稳定的振盪,以确保数位系统中的时钟和时序稳定性。

关键亮点

- 5G 智慧型手机的广泛普及以及 5G 网路在全球的扩张推动了市场的发展。根据CTA报告,预计2024年美国消费科技零售额将成长2.8%,达到5,120亿美元。

- 此外,人工智慧功能的融入预计将在今年推动个人电脑、智慧型手机等各类设备的升级。展望未来,晶片製造商将专注于在其设备中融入更多人工智慧功能,以促进销售并鼓励升级。

- 此外,产业领袖强调,扩增实境和虚拟实境耳机将成为未来几年的关键驱动力。在 2024 年 CES 上,我们将看到各种扩增实境设备,从 Meta Platforms (META) 的VR头戴装置到 Xreal 的智慧眼镜。

- 频率控制和定时设备市场是电子产业的一个重要领域,为各种各样的应用提供必要的组件。然而,这些设备的高开发和製造成本对市场成长构成了挑战。

- 俄乌战争、美国关係紧张等疫情后的地缘政治紧张局势为市场成长蒙上阴影。特别是,由于欧洲和美国政府的严格监管,迎合俄乌衝突的主要供应商已经停止了该地区的销售。

- 例如,德州仪器已于2022年2月起暂停向俄罗斯、伊朗和白俄罗斯销售产品。俄乌衝突将对电子产业产生重大影响。俄罗斯与乌克兰的衝突加剧了现有的半导体供应链挑战和持续的晶片短缺。这种中断可能导致价格波动,并可能导致镍、钯、铜、钛和铝等关键原材料短缺,从而直接影响产品生产。

美国频率控制与定时设备市场趋势

微机电振盪器成长强劲

- 电子机械系统 (MEMS) 振盪器可用作精确的计时装置,产生各种应用所需的稳定参考频率。这些频率对于电子系统排序、管理资料传输、定义无线电频率和测量时间至关重要。 微机电振盪器设计紧凑,耐衝击和振动,并提供精确的计时。它的耐用性使其适用于工业、商业和消费领域的广泛应用。

- 近年来,可携式和穿戴式电子产品的普及,凸显了对降低振盪器等电子元件的能耗和尺寸的追求。基于 MEMS 的振盪器由于其精确频率产生和能源效率的双重优势,在时脉电路中越来越受到青睐。

- 随着智慧型手机和其他行动装置在美国越来越受欢迎, 微机电振盪器市场预计在未来几年将大幅成长。 微机电振盪器以其可靠性、低功耗和高性能而闻名,非常适合智慧型手机。与标准半导体技术的兼容性进一步简化了製造和整合流程。因此,随着智慧型手机使用量的持续飙升,对微机电振盪器的需求只会成长。

- 在美国,物联网应用的激增正在推动对微机电振盪器的需求。 微机电振盪器以其紧凑的设计、节能和精确度而闻名,是物联网应用的理想选择。 微机电振盪器确保精确的定时和同步,提高数据准确性并满足物联网设备的尺寸和功耗限制。这使其成为製造商和开发商的首选。 微机电振盪器提高了物联网设备的可靠性和效能,实现了智慧家庭、工业自动化和医疗保健的无缝运作。 微机电振盪器满足严格时序要求的能力反映了美国不断扩大的物联网格局,推动了对微机电振盪器的需求。

汽车产业是一个快速成长的终端用户

- 振盪器在现代汽车中发挥着至关重要的作用。如今的汽车本质上就是车轮上的高速网络,如果没有计时晶片,汽车就会停下来。互联网本身依赖这个重要组件。汽车领域半导体的未来发展轨迹受到两大主导力量的影响:电气化和自动驾驶。

- 预计电气化将在未来十年取得长足进步,主要受混合动力汽车汽车和电动车(EV)普及的推动。国际能源总署预计,2023年美国电动车新註册量将达140万辆,较2022年大幅成长40%。儘管2023年的成长速度将较前一年略有放缓,但电动车的整体需求仍保持韧性。

- 这一势头正值产业致力于降低电池成本、加强充电基础设施和延长电动车行驶里程之际。同时,汽车也变得越来越「智慧」——配备了感测器和智慧系统。这为第二大趋势——自动驾驶——奠定了基础。从防撞系统到自动停车和变换车道感测器,这些曾经的「奢侈」功能如今已变得司空见惯,并为 ADAS(高级驾驶辅助系统)、自动驾驶和高级远端资讯处理奠定了基础。

- 根据媒体报道,美国国家公路交通安全管理局(NHTSA)已强制要求,从2029年开始,所有新车必须配备自动紧急煞车(AEB)。新规意味着,所有在美国销售的重量低于10,000磅的新乘用车都将被要求配备这项安全技术。美国政府估计,这项措施每年可挽救400人的生命并防止数千人受伤。汽车製造商必须在 2029 年 9 月 1 日之前遵守该法规,但对于小批量製造商有一个宽限期。这些法规大大加强了频率控制和计时设备市场。

美国频率控制与定时设备产业概况

美国频率控制和计时设备市场较为分散,透过创新获得持续竞争优势的机会庞大。由于预计终端用户产业新客户(包括村田製作所、京瓷、Rakon Limited、Microchip Technology Inc. 和 TXC Corporation)的需求将激增,竞争只会更加激烈。

- 2024年4月—先进电子元件製造商京瓷艾贝克斯(Kyocera Avex)宣布,将以「Kyocera Avex Components Inc. (Erie)」的名义建立一个新的高品质、低噪音共振器频率控制产品製造和设计中心。新製造工厂预计将生产超过 120 万个该公司专利的、无与伦比的低功耗 OCXO(恆温控制晶体振盪器)、各种 TCXO(温控晶体振盪器)和 VCXO(电压控制晶体振盪器)。

- 2024 年 2 月 - Lacon 将在 2024 年巴塞隆纳 MWC 上展示其最新的无线网路和针对 IT 和通讯资料中心的初始扩展保留解决方案。 Error Exchange OCXO(MercuryXE2)是 Lacon 最近发布的微型 IC-OCXO Mercury 的一个版本。频率误差交换处理和老化补偿的结合提高了网路同步器评估板上系统的当前同步能力,从而提高了保持效能。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 新冠疫情和宏观经济趋势对该产业的影响

第五章市场动态

- 市场驱动因素

- 5G 普及率不断提高,对频率控制和计时设备的需求也随之增加

- 对先进汽车应用的需求不断增长

- 市场问题

- 开发成本高

第六章市场区隔

- 按类型

- 石英晶共振器

- 振盪器

- 温度补偿晶体振盪器(TCXO)

- 电压调节器晶体振盪器(VCXO)

- 恆温晶体振盪器(OCXO)

- 微机电振盪器

- 其他振盪器

- 共振器

- 锯齿滤波器

- 即时时钟

- 按最终用户产业

- 车

- 电脑及週边设备

- 通讯/伺服器/数据存储

- 消费性电子产品

- 产业

- 国防与航太

- 物联网(穿戴式装置、健身追踪器、智慧家庭设备、智慧城市、智慧照明系统等)

- 其他终端用户产业(医疗保健、石油和天然气、农业、零售、测试和测量等)

第七章竞争格局

- 公司简介

- Murata Manufacturing Co. Ltd

- Kyocera Corporation

- Rakon Limited

- Microchip Technology Inc.

- TXC Corporation

- Seiko Epson Corporation

- Daishinku Corporation

- Hosonic Technology(Group)Co. Ltd

- Nihon Dempa Kogyo Co. Ltd

- SiTime Corporation

- SIWARD Crystal Technology Co. Ltd

- Texas Instruments Inc.

- NXP Semiconductors

- Abracon LLC

- CTS Corporation

第八章投资分析

第九章 市场机会与未来趋势

The United States Frequency Control And Timing Devices Market size is estimated at USD 2.22 billion in 2025, and is expected to reach USD 3.02 billion by 2030, at a CAGR of 6.3% during the forecast period (2025-2030).

Frequency control devices play a pivotal role in electronic systems, providing the necessary signals and timing controls for the precise transmission of information. By leveraging principles applied to quartz crystals, MEMS, and ceramic resonators, these devices can generate stable oscillations, ensuring clocking and timing stability in digital systems.

Key Highlights

- The market is being propelled by the rising adoption of 5G smartphones and the expanding 5G network coverage globally. In the United States, consumer tech retail sales are projected to climb by 2.8% to reach a substantial USD 512 billion in 2024, as reported by CTA.

- Furthermore, the integration of artificial intelligence features is expected to drive upgrades across various devices, including PCs and smartphones, this year. Looking ahead, chip manufacturers are homing in on infusing more AI capabilities into devices to bolster sales and encourage upgrades.

- Additionally, industry leaders highlight that augmented reality and virtual reality headsets will be key growth drivers in the coming years. At CES 2024, one can expect diverse extended reality devices, ranging from VR headsets by Meta Platforms (META) to smart glasses by Xreal.

- The frequency control and timing devices market is a critical segment within the electronics industry, providing essential components for various applications. However, the high costs of developing and producing these devices challenge the market's growth.

- Post-pandemic geopolitical tensions, including the Russia-Ukraine War and US-China tensions, have cast a shadow on market growth. Notably, major vendors responding to the Russia-Ukraine conflict halted sales in the region due to stringent government restrictions from Europe and the United States.

- For example, Texas Instruments ceased sales to Russia, Iran, and Belarus starting in February 2022. The Russia-Ukraine conflict is poised to significantly impact the electronics industry. It has further exacerbated existing semiconductor supply chain challenges and the persistent chip shortage. This disruption could lead to price volatility and potential shortages in key raw materials like nickel, palladium, copper, titanium, and aluminum, directly affecting the production of products.

US Frequency Control and Timing Devices Market Trends

MEMS Oscillator to Witness Significant Growth

- Microelectromechanical system (MEMS) oscillators serve as precise timing devices, producing stable reference frequencies crucial for various applications. These frequencies are pivotal in electronic system sequencing, data transfer management, defining radio frequencies, and time measurement. MEMS oscillators offer a compact design, delivering precise timekeeping that's resilient against shocks and vibrations. Their durability makes them well-suited for a wide range of applications spanning industrial, commercial, and consumer sectors.

- The recent surge in portable and wearable electronics underscores the push to minimize energy usage and size across electronic components, notably oscillators. Clock circuits are increasingly favoring MEMS-based oscillators for their dual benefits: precise frequency generation and energy efficiency.

- The rising adoption of smartphones and mobile devices across the United States is poised to fuel substantial growth in the MEMS oscillator market in the coming years. MEMS oscillators, known for their reliability, low power consumption, and high performance, find a natural fit in smartphones. Their compatibility with standard semiconductor techniques further streamlines their manufacturing and integration processes. Consequently, as smartphone usage continues to surge, the demand for MEMS oscillators is set to escalate.

- The surge in IoT adoption is driving the demand for MEMS oscillators in the United States. Known for their compact design, energy efficiency, and precision, MEMS oscillators are ideal for IoT applications. They ensure accurate timing and synchronization, enhancing data accuracy and fitting IoT devices' size and power constraints. This makes them the preferred choice for manufacturers and developers. MEMS oscillators boost the reliability and performance of IoT devices, enabling seamless operations in smart homes, industrial automation, and healthcare. Their ability to meet stringent timing requirements is fueling the demand for MEMS oscillators, reflecting the expanding IoT landscape in the United States.

Automotive Industry to be the Fastest Growing End User

- Oscillators have ascended to a pivotal role in modern vehicles. Today's cars are essentially high-speed networks on wheels; without timing chips, they'd grind to a halt. Even the internet itself hinges on these crucial components. The future trajectory of semiconductors in the automotive sector is being shaped by two dominant forces: electrification and autonomous driving.

- Electrification, primarily driven by the rising adoption of hybrid and electric vehicles (EVs), is poised for a significant surge in the coming decade. According to the IEA, new electric car registrations in the United States hit 1.4 million in 2023, marking a robust 40% increase from 2022. While the growth rate in 2023 was slightly slower than the previous years, the overall demand for electric vehicles remained resilient.

- This momentum is fueled by the industry's focus on slashing battery costs, enhancing charging infrastructure, and extending the driving range of EVs. Concurrently, vehicles are getting 'smarter,' brimming with sensors and intelligent systems. This sets the stage for the second major trend: autonomous driving. These once ' luxury ' features are commonplace, from collision-avoidance systems to automatic parking and lane-change sensors, laying the groundwork for advanced driver-assistance systems (ADAS), autonomous driving, and sophisticated telematics.

- Media reports reveal that the National Highway Traffic Safety Administration (NHTSA) mandated Automatic Emergency Braking (AEB) on all new vehicles, effective 2029. Under this new regulation, all new passenger vehicles sold in the USA weighing under 10,000 lbs(4,500 kg) must be equipped with this safety technology. The US government estimates that this move could potentially save up to 400 lives annually and prevent thousands of injuries. Automakers are required to comply by September 1, 2029, with a grace period extending to low-volume manufacturers. These regulations are notably bolstering the frequency control and timing device market.

US Frequency Control and Timing Devices Industry Overview

The United States frequency control and timing devices market is fragmented, where the sustainable competitive advantage through innovation is considerable. The competition will only increase, considering the anticipated surge in demand from new customers from the end-user industries, and some of the players include Murata Manufacturing Co. Ltd, Kyocera Corporation, Rakon Limited, Microchip Technology Inc., TXC Corporation

- April 2024 - Kyocera Avx, a manufacturer of advanced electronic components, unveiled a new manufacturing and design center for high-quality, low-noise quartz crystal frequency control products under the name Kyocera Avx Components Corporation (Erie). The newly established production facility is expected to manufacture over 1.2 million patented and unparalleled low-power OCXO (oven-controlled crystal oscillators) and a range of TCXO (temperature-computed crystal oscillators) and VCXO (voltage-computed crystal oscillators).

- February 2024 - Rakon displays its initial extended holdover solution for modern radio networks and telecommunications data centers at MWC Barcelona 2024. The Error Exchange OCXO (MercuryXE2) is a version of Rakon's recently launched Mercury compact IC-OCXO. It improves the system's current synchronization abilities on a network synchronizer evaluation board by incorporating frequency error exchange processing and aging compensation, thereby increasing the holdover performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Macro Economic Trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of 5G Augmenting the Demand for Frequency Control and Timing Devices

- 5.1.2 Rising Demand for Advanced Automotive Applications

- 5.2 Market Challenges

- 5.2.1 High Cost of Development

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Crystals

- 6.1.2 Oscillator

- 6.1.2.1 Temperature Compensated Crystal Oscillator (TCXO)

- 6.1.2.2 Voltage-controlled Crystal Oscillator (VCXO)

- 6.1.2.3 Oven-controlled Crystal Oscillator (OCXO)

- 6.1.2.4 MEMS Oscillator

- 6.1.2.5 Other Types of Oscillators

- 6.1.3 Resonators

- 6.1.4 Saw Filters

- 6.1.5 Real Time Clocks

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Computer and Peripherals

- 6.2.3 Communications/Server/Data Storage

- 6.2.4 Consumer Electronics

- 6.2.5 Industrial

- 6.2.6 Defense and Aerospace

- 6.2.7 IoT (Wearables, Fitness Tracker, Smart Home Devices, Smart Cities, Smart Lighting System, and Others)

- 6.2.8 Other End-user Industries (Healthcare, Oil and Gas, Agriculture, Retail, Test and Measurement, and Others)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Murata Manufacturing Co. Ltd

- 7.1.2 Kyocera Corporation

- 7.1.3 Rakon Limited

- 7.1.4 Microchip Technology Inc.

- 7.1.5 TXC Corporation

- 7.1.6 Seiko Epson Corporation

- 7.1.7 Daishinku Corporation

- 7.1.8 Hosonic Technology (Group) Co. Ltd

- 7.1.9 Nihon Dempa Kogyo Co. Ltd

- 7.1.10 SiTime Corporation

- 7.1.11 SIWARD Crystal Technology Co. Ltd

- 7.1.12 Texas Instruments Inc.

- 7.1.13 NXP Semiconductors

- 7.1.14 Abracon LLC

- 7.1.15 CTS Corporation