|

市场调查报告书

商品编码

1911463

频率控制与定时装置:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Frequency Control And Timing Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

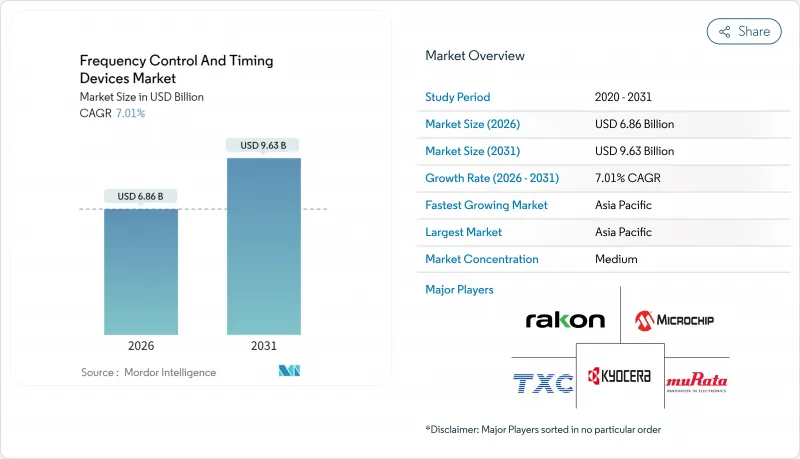

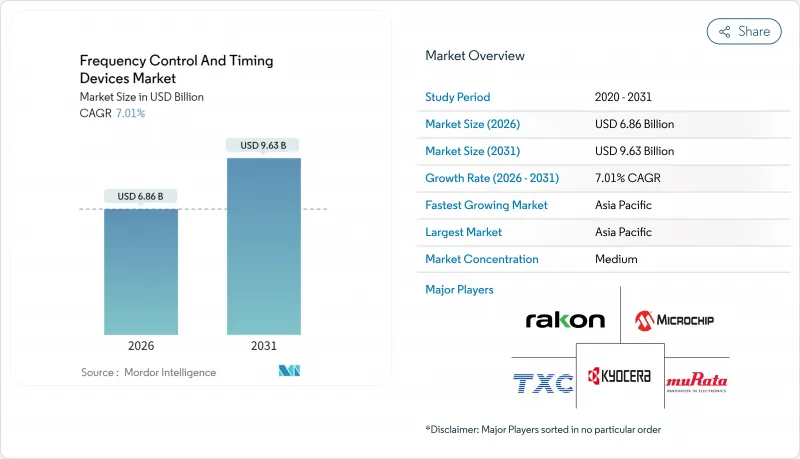

预计频率控制和定时设备市场将从 2025 年的 64.1 亿美元成长到 2026 年的 68.6 亿美元,到 2031 年将达到 96.3 亿美元,2026 年至 2031 年的复合年增长率为 7.01%。

这项市场演变反映了精准同步在5G无线接取网路、人工智慧增强型超大规模资料中心以及安全关键型汽车电子产品中扮演的关键角色。网路营运商、云端服务供应商和电动车製造商对亚微秒精度的需求日益增长,使得定时元件从低价值的通用产品转变为系统性能的战略推动因素。振盪器,尤其是温度补偿振盪器和恆温振盪器,因其能够提供独立5G时分双工(TDD)单元所需的超稳定参考频率,而成为市场需求的主要驱动力。儘管石英振盪器仍是主流技术,但快速成长的微机电振盪器正在不断扩大市场份额,因为设计人员在物联网节点和汽车控制单元中追求更小的尺寸、更宽的温度范围和低耗电量。亚太地区凭藉其一体化的电子元件供应链以及国内对5G终端、电动车和工业自动化设备日益增长的需求,占据了最大的区域市场份额。

全球频率控制与定时元件市场趋势及展望

5G基础建设发展进展

独立组网的5G架构需要1.5微秒以内的同步精度以防止小区间干扰,这使得TCXO和OCXO成为必不可少的无线电组件。小型基地台密集化使得延迟驱动的定时预算更加复杂,需要对每个节点进行单独的延迟补偿。供应商对频率稳定性提出了更高的要求,而普通石英晶体无法满足这些要求。随着供应商在屋顶安装中以基于MEMS的超级TCXO取代共振器以提高抗振性能,广域基地台也开始部署超级TCXO。计画中的5G-Advanced升级路径将引入时间敏感网路、网路切片和超可靠低延迟通讯(URLLC),到2030年,这些技术都将逐步提高精度要求。

汽车业的电气化和ADAS的普及

电动动力传动系统依赖精确的逆变器开关,而ADAS雷达、光达和摄影机融合技术则需要微秒同步时间戳来维持空间一致性。目前,集中式车载电脑将主时钟分配给数十个ECU,这使得能够承受引擎室振动和-40°C至+125°C温度波动的微机电振盪器变得尤为重要。汽车製造商正在强制要求AEC-Q200认证,该认证週期较长,但可确保15年的现场可靠性。随着L3和L4级自动驾驶技术在2026年后的普及,奈秒同步将成为感测器融合演算法的设计标准。

高精度晶体坯料晶圆厂产能限制

来自云杉松矿的高纯度二氧化硅是高品质振盪器的主要原料,但2024年飓风海伦造成的供应中断暴露了这种单一来源供应的脆弱性。全球只有少数晶圆厂能够以亚ppm级的频率公差进行蚀刻和研磨,这导致了配额分配政策,并将振盪器的前置作业时间延长至26週或更久。对合成石英生长和雷射退火技术的投资旨在释放新的产能,但商业化生产不太可能在2027年之前实现。 MEMS供应商正在推广硅基替代方案作为风险缓解措施,但石英在OCXO级稳定性方面仍具有卓越的性能。

细分市场分析

预计到2025年,振盪器将占据频率控制和定时装置市场56.12%的份额,并在2031年之前以8.44%的复合年增长率增长,巩固了其在通讯、汽车和工业平台中作为综合时钟解决方案的地位。在这一类别中,温度补偿晶体振盪器(TCXO)正迅速崛起,因为它们能够在-40°C至+85°C的温度范围内保持±0.1 ppm的稳定性,这对于小型蜂窝无线电至关重要。电压调节器晶体振盪器(VCXO)在5G大规模MIMO阵列中也越来越受欢迎,其中锁相环(PLL)微调可以抑制多普勒频移。

微机电振盪器是振盪器类别中成长最快的细分市场,与传统的石英晶体振盪器相比,其抗振性能提高了20倍,功耗降低了50%。数位可程式设计使得频率设定可以做到临时调整,从而缩短客户的供应链週期数週。虽然石英晶体振盪器仍然是低频应用的基本元件,但共振器在射频滤波器和双工器领域仍然占有一席之地,因为表面声波传播能够提供极高的选择性。

凭藉数十年的可靠性和成熟的全球晶圆厂,石英晶体元件预计到2025年将占据频率控制和定时元件市场71.25%的份额。然而,随着原始设备製造商(OEM)优先考虑小型化、耐高温和抗衝击性能,微机电系统(MEMS)解决方案的市场份额预计将以7.48%的复合年增长率成长。晶粒和晶圆层次电子构装的最新进展使得微机电振盪器的Z轴高度能够低于0.35毫米,使其能够应用于超薄5G设备。

表面声波元件在射频滤波领域发挥特殊作用,能够处理3 GHz以上的上变频器级。将石英振盪器与基于MEMS的温度控制电路相结合的混合结构提供了一种共存而非完全替代的方案。精密雷射微调技术的不断进步已将晶体老化降低到每年±1 ppm以下,确保了其在卫星有效载荷和仪器的OCXO级定时应用中的实际应用。

区域分析

亚太地区预计到2025年将占据频率控制和定时元件市场45.78%的份额,凸显了该地区作为製造地和大众消费市场的双重优势。随着5G宏基地台的扩建和电动车的加速普及,中国将增强上游需求;而拥有石英技术传统的日本将为全球超高稳定性石英坯料的供应提供支援;韩国将推动记忆体工厂和全国性5G中频段网路对定时装置的采购;台湾晶圆代工厂将提供后端组装服务。面对出口限制带来的不利影响,亚太地区的原始设备製造商(OEM)正在区域贸易区内推进MEMS模具和石英坯料加工的本地化生产。

北美维持第二的位置,这主要得益于超大规模资料中心总合新增超过1吉瓦的运算能力。 《晶片技术创新法案》(CHIPS Act)的激励措施正在重振美国本土的硅微机电系统(MEMS)和合成石英晶圆厂,从而降低对单一国家依赖的风险。国防现代化预算支持了用于受保护卫星通讯以及定位、导航和授时项目的OCXO(温度补偿晶体振盪器)和CSAC(晶体振盪器)的需求。

欧洲的前景取决于汽车和工业自动化产业。德国汽车製造商强制要求车载中央电脑使用符合AEC-Q200标准的装置,而法国和义大利的航太主要企业则要求使用抗辐射加固的OCXO。欧盟的「数位主权」倡议正在津贴MEMS研发丛集,而永续性指令则鼓励在大规模生产的消费性电子产品中使用低功耗硅时序装置,而非传统的石英晶体。在中东、非洲和南美等新兴地区,对4G到5G升级和智慧电网计划的投资正在推动对经济高效的SMD石英晶共振器的新兴但不断增长的需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 5G基础建设发展进展

- 汽车业的电气化和ADAS的普及

- 云端和人工智慧工作负载驱动超大规模资料中心

- 边缘运算物联网节点的普及

- 卫星卫星群需要精确计时。

- 晶片级手錶(CSAC)成本曲线取得突破

- 市场限制

- 高精度晶体坯料晶圆厂产能限制

- 消费性电子产品商品化导致价格下行压力

- 智慧财产权策略时机选择中的出口管制风险

- 安全关键型垂直产业的认证週期较长

- 产业价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 水晶

- 振盪器

- 温度补偿晶体振盪器(TCXO)

- 电压调节器晶体振盪器(VCXO)

- 恆温晶体振盪器(OCXO)

- 微机电振盪器

- 其他振盪器

- 共振器

- 透过技术

- 石英

- MEMS

- 表面声波(SAW)

- 其他的

- 透过包装

- 表面黏着型元件(SMD)

- 通孔/DIP

- 最终用户

- 电讯和资料中心

- 汽车/运输设备

- 家用电子电器

- 工业与物联网

- 航太/国防

- 医疗和医疗设备

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- Vendor Positioning Analysis

- 公司简介

- Murata Manufacturing Co., Ltd.

- Kyocera Corporation

- Seiko Epson Corporation

- TXC Corporation

- Nihon Dempa Kogyo Co., Ltd.

- Daishinku Corporation

- Microchip Technology Inc.

- SiTime Corporation

- Rakon Limited

- Siward Crystal Technology Co., Ltd.

- Hosonic Technology Co., Ltd.

- Texas Instruments Incorporated

- NXP Semiconductors NV

- Abracon LLC

- ECS Inc. International

- Vectron International, Inc.

- IQD Frequency Products Ltd.

- Pletronics, Inc.

- CTS Corporation

第七章 市场机会与未来展望

The frequency control and timing devices market is expected to grow from USD 6.41 billion in 2025 to USD 6.86 billion in 2026 and is forecast to reach USD 9.63 billion by 2031 at 7.01% CAGR over 2026-2031.

This market size trajectory reflects the pivotal role that precision synchronization now plays in 5G radio access networks, AI-enhanced hyperscale data centers, and safety-critical automotive electronics . Network operators, cloud providers, and electric-vehicle OEMs increasingly specify sub-microsecond accuracy, turning timing components from low-value commodities into strategic enablers of system performance. Oscillators, especially temperature-compensated and oven-controlled variants, lead demand because they deliver the ultra-stable references required in stand-alone 5G Time Division Duplex cells. Quartz remains the dominant technology, yet fast-rising MEMS oscillators gain ground as designers pursue smaller footprints, wider temperature tolerance, and lower power budgets in IoT nodes and automotive control units. Asia Pacific secures the largest regional footprint owing to its integrated electronics supply chain and accelerating domestic consumption of 5G handsets, EVs, and industrial automation equipment.

Global Frequency Control And Timing Devices Market Trends and Insights

5G Infrastructure Build-out Momentum

Standalone 5G architecture pushes synchronization accuracy to within 1.5 microseconds to prevent inter-cell interference, turning TCXOs and OCXOs into mandatory radio components . Small-cell densification compounds latency-driven timing budgets because each node requires individual delay compensation. Equipment vendors now issue tighter frequency-stability specifications that cannot be met with generic crystals. MEMS-based Super-TCXOs enter macro base stations as vendors trade quartz for higher vibration resilience at rooftop locations . The planned 5G-Advanced upgrade path introduces time-sensitive networking, network slicing, and URLLC, each escalating accuracy thresholds through 2030.

Electrification and ADAS Penetration in Automotive Industry

Electric powertrains depend on precise inverter switching, while ADAS radar, LiDAR, and camera fusion require microsecond-aligned time stamps to maintain spatial coherence. Centralized vehicle computers now distribute a master clock to dozens of ECUs, elevating MEMS oscillators because they endure under-hood vibration and -40 °C to +125 °C temperature swings. Automotive OEMs enforce AEC-Q200 certification, lengthening qualification cycles but ensuring 15-year field reliability. As Level-3 and Level-4 autonomy expand after 2026, nanosecond-grade synchronization will become a design baseline for sensor fusion algorithms.

Fab Capacity Constraints for High-Precision Quartz Blanks

Ultra-pure silica from the Spruce Pine mine feeds the highest-Q resonator supply chain; Hurricane Helene's 2024 disruption exposed single-source vulnerability . Only a handful of fabs worldwide can etch and lap blanks to sub-ppm frequency tolerance, generating allocation policies that lengthen oscillator lead times beyond 26 weeks. Investments in synthetic quartz growth and laser-annealing aim to unlock new capacity, yet commercial output is unlikely before 2027. MEMS vendors market silicon-based alternatives as risk-mitigation options, although quartz still outperforms in OCXO class stability.

Other drivers and restraints analyzed in the detailed report include:

- Cloud and AI Workloads Fuelling Hyperscale Data Centers

- Edge-Computing IoT Node Proliferation

- Price Erosion from Commoditization in Consumer Devices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Oscillators commanded 56.12% of the frequency control and timing devices market share in 2025 and are projected to expand at an 8.44% CAGR to 2031, underscoring their role as complete clock solutions across telecom, automotive, and industrial platforms. Within this cohort, temperature-compensated crystal oscillators gained momentum because they maintain +-0.1 ppm stability across -40 °C to +85 °C ranges essential for small-cell radios. Voltage-controlled crystal oscillators rose in popularity among 5G massive-MIMO arrays, where phase-locked-loop trimming curbs Doppler-induced offsets.

MEMS oscillators account for the fastest-growing slice inside the oscillator category due to their 20X better vibration immunity and 50% lower power draw compared with legacy quartz solutions. Their digital programmability enables last-minute frequency configuration, shortening customer supply-chain cycles by several weeks. Crystals remain the foundational building block at lower frequencies, while resonators retain niche adoption in RF filters and duplexers where surface-acoustic-wave propagation offers steep skirt selectivity.

Quartz devices represented 71.25% of the frequency control and timing devices market in 2025, safeguarded by decades-long reliability records and mature global fabs. However, MEMS solutions are forecast to capture incremental share through a 7.48% CAGR as OEMs prioritize smaller footprints and high temperature shock resistance. Recent silicon-die thinning and hermetic wafer-level packaging cut MEMS oscillator Z-height below 0.35 mm, unlocking adoption in ultra-slim 5G handsets.

Surface-acoustic-wave components keep a specialized role in RF filtering, where they can handle up-converter steps above 3 GHz. Hybrid topologies that marry a quartz resonator with MEMS-based temperature control circuits illustrate the path toward coexistence rather than outright substitution. Continuous improvements in precision laser-trimming push quartz aging below +-1 ppm per year, ensuring its viability in OCXO-class timing for satellite payloads and metrology instrumentation.

The Frequency Control and Timing Devices Market Report is Segmented by Product Type (Crystals, Oscillators, Resonators), Technology (Quartz, MEMS, Surface-Acoustic-Wave, Others), Packaging (Surface-Mount Device, Through-Hole/DIP), End-User (Telecommunications and Data Centres, Automotive and Transportation, Consumer Electronics, Industrial and IoT, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific's 45.78% share of the frequency control and timing devices market in 2025 underscores its dual identity as a manufacturing powerhouse and a high-volume consumer base. China intensifies upstream demand as it scales 5G macro sites and accelerates EV adoption, while Japan's quartz heritage anchors global supply of ultra-stable blanks. South Korea channels timing purchases into memory fabs and nationwide 5G mid-band coverage, and Taiwan's foundries supply back-end assembly services. Export-control headwinds prompt APAC OEMs to localize MEMS tooling and crystal-blank finishing within regional trade blocs.

North America holds the second-largest position, propelled by hyperscale data-center campuses that collectively add more than 1 GW of new compute power annually. The CHIPS Act's incentives catalyze domestic fabs for both silicon MEMS and synthetic quartz, cushioning the region from single-country disruption risk. Defense modernization budgets sustain OCXO and CSAC requirements for protected satcom and position-navigation-timing programs.

Europe's outlook is tethered to its automotive and industrial automation franchise; German OEMs mandate AEC-Q200 devices for centralized vehicle computers, and French and Italian aerospace primes stipulate radiation-tolerant OCXOs. The EU's digital sovereignty initiative channels grants into MEMS R&D clusters, while sustainability directives favor lower-power silicon timing over legacy quartz in high-volume consumer appliances. Emerging regions in the Middle East, Africa, and South America invest in 4G-to-5G upgrades and smart-grid projects, representing nascent yet rising demand for cost-effective SMD crystals.

- Murata Manufacturing Co., Ltd.

- Kyocera Corporation

- Seiko Epson Corporation

- TXC Corporation

- Nihon Dempa Kogyo Co., Ltd.

- Daishinku Corporation

- Microchip Technology Inc.

- SiTime Corporation

- Rakon Limited

- Siward Crystal Technology Co., Ltd.

- Hosonic Technology Co., Ltd.

- Texas Instruments Incorporated

- NXP Semiconductors N.V.

- Abracon LLC

- ECS Inc. International

- Vectron International, Inc.

- IQD Frequency Products Ltd.

- Pletronics, Inc.

- CTS Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 5G infrastructure build-out momentum

- 4.2.2 Electrification and ADAS penetration in the automotive industry

- 4.2.3 Cloud and AI workloads fuelling hyperscale data centres

- 4.2.4 Edge-computing IoT node proliferation

- 4.2.5 Satellite mega-constellations requiring precision timing

- 4.2.6 Chip-scale atomic clock (CSAC) cost curve breakthroughs

- 4.3 Market Restraints

- 4.3.1 Fab capacity constraints for high-precision quartz blanks

- 4.3.2 Price erosion from commoditisation in consumer devices

- 4.3.3 Export-control risks on the strategic timing of IP

- 4.3.4 Long qualification cycles in safety-critical verticals

- 4.4 Industry Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Crystals

- 5.1.2 Oscillators

- 5.1.2.1 Temperature-Compensated Crystal Oscillator (TCXO)

- 5.1.2.2 Voltage-Controlled Crystal Oscillator (VCXO)

- 5.1.2.3 Oven-Controlled Crystal Oscillator (OCXO)

- 5.1.2.4 MEMS Oscillator

- 5.1.2.5 Other Oscillators

- 5.1.3 Resonators

- 5.2 By Technology

- 5.2.1 Quartz

- 5.2.2 MEMS

- 5.2.3 Surface-Acoustic-Wave (SAW)

- 5.2.4 Others

- 5.3 By Packaging

- 5.3.1 Surface-Mount Device (SMD)

- 5.3.2 Through-Hole / DIP

- 5.4 By End-User

- 5.4.1 Telecommunications and Data Centres

- 5.4.2 Automotive and Transportation

- 5.4.3 Consumer Electronics

- 5.4.4 Industrial and IoT

- 5.4.5 Aerospace and Defence

- 5.4.6 Healthcare and Medical Devices

- 5.4.7 Other End-Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 Rest of Asia Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 Israel

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 UAE

- 5.5.5.4 Turkey

- 5.5.5.5 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Vendor Positioning Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.4.1 Murata Manufacturing Co., Ltd.

- 6.4.2 Kyocera Corporation

- 6.4.3 Seiko Epson Corporation

- 6.4.4 TXC Corporation

- 6.4.5 Nihon Dempa Kogyo Co., Ltd.

- 6.4.6 Daishinku Corporation

- 6.4.7 Microchip Technology Inc.

- 6.4.8 SiTime Corporation

- 6.4.9 Rakon Limited

- 6.4.10 Siward Crystal Technology Co., Ltd.

- 6.4.11 Hosonic Technology Co., Ltd.

- 6.4.12 Texas Instruments Incorporated

- 6.4.13 NXP Semiconductors N.V.

- 6.4.14 Abracon LLC

- 6.4.15 ECS Inc. International

- 6.4.16 Vectron International, Inc.

- 6.4.17 IQD Frequency Products Ltd.

- 6.4.18 Pletronics, Inc.

- 6.4.19 CTS Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment