|

市场调查报告书

商品编码

1797751

RPA 平台培训市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测RPA Platform Training Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

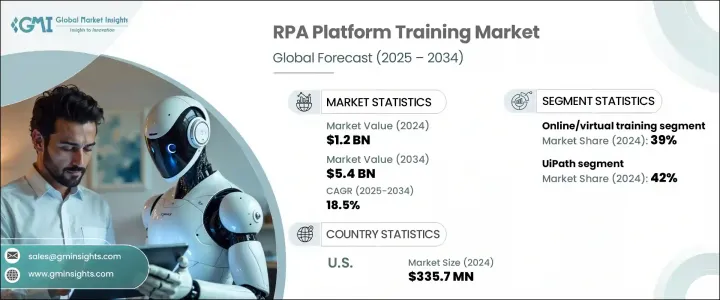

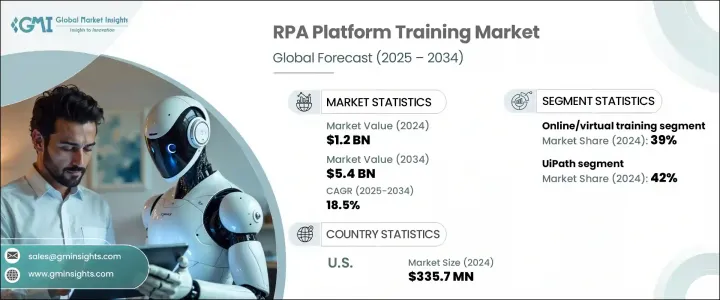

2024年,全球RPA平台培训市场规模达12亿美元,预计到2034年将以18.5%的复合年增长率成长,达到54亿美元。随着机器人流程自动化平台不断发展,并与人工智慧、自然语言处理(NLP)和光学字元辨识(OCR)等先进技术融合,培训已从一项基础技术技能转变为企业级核心需求。如今,企业将结构化、持续的技能提升视为实现大规模自动化成果的关键。这种转变加速了对开发人员、分析师和业务使用者的专业化、基于角色的培训路径的需求。

各行各业对自动化的依赖日益加深,推动了混合式和模组化学习计画的激增。政府和私营部门也正在进行协作技能培训,以缩小人才缺口。疫情期间,虚拟学习模式广受欢迎,并因其便利性和可扩展性而占据主导地位。企业客户非常青睐与特定平台相符的认证,这确保了自动化专案的标准化实施和治理。来自主流供应商的认证正成为标准的招募标准。随着培训如今已深深融入数位转型议程,学习平台正在不断扩展,以服务企业学习者和即将进入自动化领域的个人。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 12亿美元 |

| 预测值 | 54亿美元 |

| 复合年增长率 | 18.5% |

线上培训领域在2024年占据39%的市场份额,到2034年将以20%的复合年增长率成长。虚拟交付模式因其灵活性、按需性和支援分散式团队的能力,成为各业务职能部门的首选模式。这些数位课程包含关于机器人建构、编排和合规性的互动式模组,使其具有高度可扩展性,并与企业自动化目标保持一致。

UiPath 培训部门在 2024 年占据 42% 的市场份额,预计到 2034 年将以 20% 的复合年增长率成长。其生态系统已成为企业、大学和独立学习者建立自动化能力的关键。 UiPath 透过为技术和非技术用户设计的结构化课程,透过其强大的学习平台提供一致、可扩展的内容。这些资源支持各种职位的技能提升,同时增强企业对自动化应用的准备程度。

2024年,美国RPA平台培训市场占据82%的市场份额,市场规模达3.357亿美元。由于大型企业高度自动化的采用、成熟的数位学习基础设施以及充满活力的教育科技平台网络,美国继续保持领先地位。其在人工智慧创新和企业数位转型方面的领先地位,进一步推动了对RPA特定技能提升专案的强劲需求。

塑造 RPA 平台培训市场的主要参与者包括 Automation Anywhere、UiPath、SS&C Blue Prism、Coursera、Simplilearn、Udemy 和 Edureka。为了巩固市场地位,RPA 平台培训领域的公司正在开发结构化、针对特定角色的学习路径和全球认可的认证,以满足企业对标准化和人才准备的需求。与学术机构、企业客户和政府的策略联盟也使企业能够更广泛地获取精选内容和认证途径。领先的平台不断升级内容,以涵盖人工智慧和自动化领域的最新进展,同时投资于基于云端的交付方式,以实现无缝存取。该公司还推出了多语言培训模组和行动友善平台,以实现全球扩展。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 各行各业对 RPA 的采用日益增多

- 数位转型倡议

- RPA 认证需求不断成长

- AI与RPA的整合

- 产业陷阱与挑战

- 缺乏标准化课程

- 非技术专业人士的认知有限

- 市场机会

- 微认证和技能徽章

- 人工智慧融入学习平台

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 技能差距分析与劳动发展

- 当前RPA技能短缺评估

- 未来劳动力需求

- 技能再培训和技能提升计划

- 企业培训与个人认证

- 学术机构合作伙伴关係

- 政府培训项目

- RPA 的职业道路发展

- 定价分析与成本模型

- 培训成本结构分析

- 供应商定价策略

- 订阅模式与一次性付款模式

- 企业培训套餐定价

- 认证成本分析

- 培训投资的投资报酬率评估

- 跨平台成本比较

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 用例

- 最佳情况

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按培训,2021 - 2034 年

- 主要趋势

- 线上/虚拟培训

- 课堂培训

- 企业培训

- 认证项目

第六章:市场估计与预测:依平台,2021 - 2034 年

- 主要趋势

- UiPath

- 任何地方的自动化

- 蓝棱镜

- 其他的

第七章:市场估计与预测:依企业规模,2021 - 2034 年

- 主要趋势

- 中小企业

- 大型企业

第八章:市场估计与预测:依交付方式,2021 - 2034 年

- 主要趋势

- 自订进度学习

- 讲师指导培训 (ILT)

- 混合式学习

- 研讨会和训练营

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 学生

- IT专业人士

- 企业员工

- 自由工作者/顾问

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧人

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Automation Anywhere

- Besant Technologies

- Codecademy

- Cognixia

- Coursera

- Edureka

- Great Learning

- GreyCampus

- Intellipaat

- Kelly Technologies

- LinkedIn Learning

- MindMajix

- NobleProg

- Pluralsight

- RPA Academy

- Simplilearn

- Skillsoft

- SS&C Blue Prism

- Udemy

- UiPath

The Global RPA Platform Training Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 18.5% to reach USD 5.4 billion by 2034. As robotic process automation platforms continue to evolve and integrate with advanced technologies like AI, NLP, and OCR, training has shifted from a basic technical skill to a core enterprise-level requirement. Companies now view structured, ongoing upskilling as critical for achieving automation outcomes at scale. This transformation is accelerating the demand for specialized, role-based training paths tailored to developers, analysts, and business users alike.

The increasing reliance on automation across industries has driven a surge in hybrid and modular learning programs. Governments and the private sector are also launching collaborative skilling efforts to close talent gaps. Virtual learning formats gained traction during the pandemic and remain dominant due to their accessibility and scalability. Enterprise clients heavily favor certifications aligned with specific platforms, which ensures standardized implementation and governance across automation initiatives. Certifications from dominant vendors are becoming standard hiring criteria. With training now deeply embedded in digital transformation agendas, learning platforms are scaling up to serve both corporate learners and individuals entering the automation workforce.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $5.4 Billion |

| CAGR | 18.5% |

The online training segment held a 39% share in 2024 and will grow at a 20% CAGR through 2034. Virtual delivery is the preferred mode across business functions, given its flexible, on-demand nature and ability to support distributed teams. These digital programs include interactive modules on bot building, orchestration, and compliance, making them highly scalable and aligned with enterprise automation goals.

The UiPath training segment held a 42% share in 2024 and is anticipated to grow at a CAGR of 20% through 2034. Its ecosystem has become instrumental in building automation capability across businesses, universities, and independent learners. Through structured programs designed for both technical and non-technical users, UiPath delivers consistent, scalable content via its robust learning platform. These resources support upskilling across a wide range of roles while reinforcing enterprise readiness for automation adoption.

United States RPA Platform Training Market held an 82% share in 2024, generating USD 335.7 million. The country continues to lead due to high automation adoption among large enterprises, a mature digital learning infrastructure, and a vibrant network of EdTech platforms. Its leadership in AI innovation and corporate digital transformation further contributes to strong demand for RPA-specific upskilling programs.

The major players shaping the RPA Platform Training Market include Automation Anywhere, UiPath, SS&C Blue Prism, Coursera, Simplilearn, Udemy, and Edureka. To strengthen their market foothold, companies in the RPA platform training space are developing structured, role-specific learning paths and globally recognized certifications to meet enterprise demands for standardization and talent readiness. Strategic alliances with academic institutions, enterprise clients, and governments are also enabling broader access to curated content and certification tracks. Leading platforms are continuously upgrading content to include the latest advancements in AI and automation while investing in cloud-based delivery for seamless access. Companies are also launching multilingual training modules and mobile-friendly platforms to scale globally.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Training

- 2.2.3 Platform

- 2.2.4 Enterprise Size

- 2.2.5 Delivery Mode

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of RPA across industries

- 3.2.1.2 Digital transformation initiatives

- 3.2.1.3 Growing demand for RPA certifications

- 3.2.1.4 Integration of AI with RPA

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of standardized curriculum

- 3.2.2.2 Limited Awareness among non-tech professionals

- 3.2.3 Market opportunities

- 3.2.3.1 Micro-certifications and skill badging

- 3.2.3.2 AI integration into learning platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Skills gap analysis and workforce development

- 3.8.1 Current RPA skills shortage assessment

- 3.8.2 Future workforce requirements

- 3.8.3 Reskilling and upskilling initiatives

- 3.8.4 Corporate training vs individual certification

- 3.8.5 Academic institution partnerships

- 3.8.6 Government training programs

- 3.8.7 Career path development in RPA

- 3.9 Pricing analysis and cost models

- 3.9.1 Training cost structure analysis

- 3.9.2 Vendor pricing strategies

- 3.9.3 Subscription vs one-time payment models

- 3.9.4 Corporate training package pricing

- 3.9.5 Certification cost analysis

- 3.9.6 ROI assessment for training investments

- 3.9.7 Cost comparison across platforms

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use cases

- 3.13 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Training, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Online/Virtual training

- 5.3 Classroom training

- 5.4 Corporate/Enterprise training

- 5.5 Certification programs

Chapter 6 Market Estimates & Forecast, By Platform, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 UiPath

- 6.3 Automation anywhere

- 6.4 Blue prism

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 SME

- 7.3 Large enterprises

Chapter 8 Market Estimates & Forecast, By Delivery Mode, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Self-paced learning

- 8.3 Instructor-Led Training (ILT)

- 8.4 Blended learning

- 8.5 Workshops & bootcamps

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Students

- 9.3 IT Professionals

- 9.4 Enterprise employees

- 9.5 Freelancers/consultants

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Automation Anywhere

- 11.2 Besant Technologies

- 11.3 Codecademy

- 11.4 Cognixia

- 11.5 Coursera

- 11.6 Edureka

- 11.7 Great Learning

- 11.8 GreyCampus

- 11.9 Intellipaat

- 11.10 Kelly Technologies

- 11.11 LinkedIn Learning

- 11.12 MindMajix

- 11.13 NobleProg

- 11.14 Pluralsight

- 11.15 RPA Academy

- 11.16 Simplilearn

- 11.17 Skillsoft

- 11.18 SS&C Blue Prism

- 11.19 Udemy

- 11.20 UiPath