|

市场调查报告书

商品编码

1851741

机器人流程自动化(RPA):市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Robotic Process Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

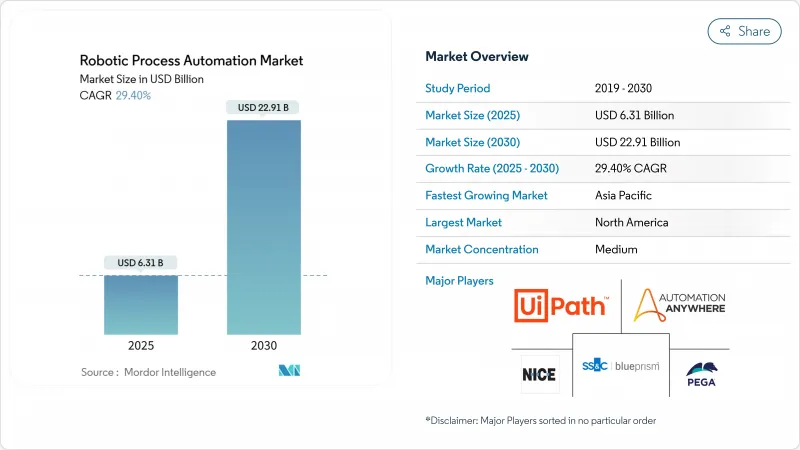

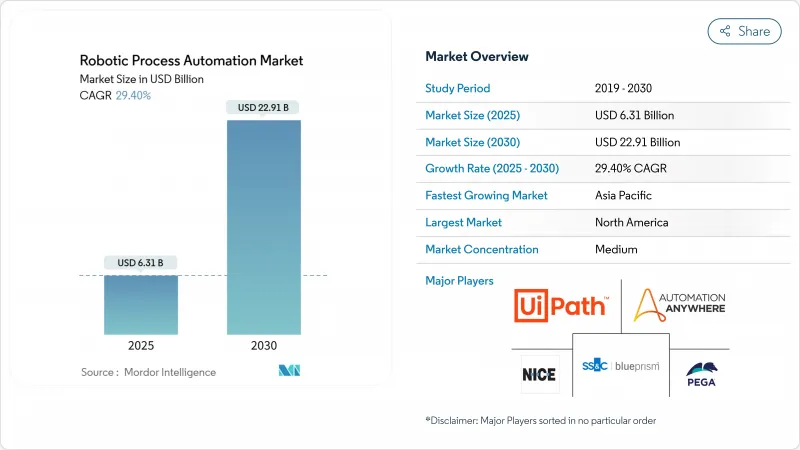

预计到 2025 年,机器人流程自动化 (RPA) 市场规模将达到 63.1 亿美元,到 2030 年将达到 229.1 亿美元,预测期(2025-2030 年)的复合年增长率为 29.40%。

生成式人工智慧与现有RPA平台的日益融合,正在拓展可自动化任务的范围,从而解决以往需要人工干预的非结构化流程。云端原生部署也透过缩短引进週期和将支出重新分配到营运预算中,推动了市场成长。北美地区凭藉严格的合规性和成熟的技术生态系统,预计到2024年将占据最大的机器人流程自动化(RPA)市场份额,达到39.6%;而亚太地区预计将以34.5%的复合年增长率(CAGR)实现最快增长,这主要得益于政府支持的自动化项目以及中小企业采用付费使用制机器人。供应商之间的竞争日益激烈,他们透过专注于人工智慧的收购和合作,将智慧文件处理、低程式码设计和自主代理功能整合到各自的平台蓝图中。

全球机器人流程自动化 (RPA) 市场趋势与洞察

全通路零售订单履行自动化

为了满足消费者对即时购物的期望,零售商正在推动库存核对、出货编配和退货管理的自动化。 Grupo Exito实施了一项企业级RPA(机器人流程自动化)项目,将其电商前端与原有ERP数据连接起来,订单处理时间缩短了高达75%。透过整合电脑视觉模组,该公司在高峰期保持了98%以上的准确率,而人工智慧驱动的需求预测则帮助零售商在供应链不确定性的情况下应对利润压力。因此,无论是在成熟市场或新兴电商市场,零售商都将自动化视为应对物流中断和劳动力短缺的必要保障。

中小企业采用云端原生RPA平台

基于消费的SaaS模式降低了中小企业的进入门槛。 Jana Small Finance Bank在迁移到UiPath云端服务后,无需部署本地基础设施,关键流程的周转时间缩短了约70%。随着超大规模服务供应商将RPA整合到其市场中,中小企业可以在几天内部署安全的机器人,并仅根据交易量的成长扩展许可证。分析师预测,随着公民开发者工具的成熟和特定产业模板的普及,到2027年,中小企业将占新机器人部署量的40%以上。

由于使用者介面变更导致机器人持续故障

企业和SaaS应用频繁的介面更新会让选择器感到困惑,并导致机器人无法正常运作。 Tarsus Distribution在供应商格式变更后不得不重新设计其发票工作流程,这凸显了其旧版萤幕抓取机器人的脆弱性。虽然新平台增加了物件式的选择器和自癒功能,但变更管理方面的不足仍然拖慢了扩展计划的步伐,并削弱了人们对这个新兴专案的信心。

细分市场分析

到2024年,本地部署将占机器人流程自动化 (RPA) 市场54.3%的份额。儘管如此,云端采用率仍将以38.2%的复合年增长率 (CAGR) 保持最高水平,但随着安全认证的普及,这一差距将会缩小。 UiPath表示,超过80%的新订单来自云端订阅,客户的部署速度比本地部署快50%。欧洲银行正在采用混合模式,在内部管理敏感的支付工作流程,同时利用云端租户进行设计、测试和分析。这种灵活性使企业能够在满足居住要求的同时,保持弹性容量。

随着边缘运算技术的成熟,供应商正在打包轻量级运行时环境,这些环境可在本地运行,但可从云端接收编配。此类架构可降低工厂车间机器人的延迟,同时最大限度地减少伺服器管理开销。因此,许多製造商计划在未来三年内将其非生产机器人迁移到 SaaS 平台,理由是 SaaS 可以简化修补程式管理并即时取得 AI 升级。因此,订阅收入很可能超过永久授权收入,并继续推动机器人流程自动化 (RPA) 市场的发展。

到2024年,软体平台将占总营收的51.3%,而随着企业意识到以人为本的变革管理是成功的关键,服务业正以35.1%的复合年增长率快速成长。越来越多的企业将需求探索、流程再造和开发人员辅导等服务打包在一起,这些服务约占整体转型预算的60%。 SS&C Technologies将Blue Prism软体与咨询服务结合,使其机器人数量增加了两倍,并节省了1亿美元的成本。

由于智慧自动化需要不断调整人工智慧模型,因此对持续改善服务的需求也日益增长。供应商现在提供的託管服务以服务等级协定 (SLA) 为基础,而非以单一计划里程碑为导向,从而保证最终成果。这种转变进一步扩大了机器人流程自动化 (RPA) 服务市场的份额,凸显了该产业正从工具实施向重塑整个企业营运模式的转变。

机器人流程自动化 (RPA) 市场配置(本地部署、云端/SaaS)、解决方案元件(软体、服务)、公司规模(中小企业、大型企业)、技术类型(有人值守 RPA、无人值守 RPA、智慧/认知 RPA)、最终用户产业(银行、金融服务和保险 (BFSI)、IT 和电信、医疗保健、其他地区)以及电信、医疗保健地区进行细分、其他地区进行区域医疗保健市场预测以美元计价。

区域分析

北美地区将在2024年继续保持领先地位,市占率将达到39.6%,这主要得益于该地区早期采用率较高,以及政府和金融服务领域严格的合规要求。例如,美国住房与城市发展部等机构正在采用RPA(机器人流程自动化)和机器学习相结合的方法来改善福利处理流程。加州机动车辆管理局等州级机构则利用机器人来加速数位化驾照服务,并确保在疫情期间服务不会中断。供应商格局受益于丰富的系统整合能力和熟练的自动化专业人员,从而确保了业务的持续成长。

亚太地区是成长最快的地区,复合年增长率高达34.5%。日本的RPA系统Robopat DX在中小企业中的安装量已超过1700套,显示在劳动市场紧张的情况下,RPA系统拥有强大的市场基础。印度马尼帕尔医院已实现财务工作流程自动化,以符合日益完善的数位化医疗法规。政府补贴和本地语言介面支援预计将进一步扩大製造商和外包中心对RPA系统的应用,从而推动该地区机器人流程自动化(RPA)市场的发展。

在欧洲,《数位营运韧性法案》要求银行记录并对其自动化工作流程进行压力测试。金融机构已累计多年预算,每家银行的预算高达1500万欧元,以确保在2025年之前达到合规要求。德国製造商正在推动后勤部门自动化,而北欧医疗保健系统则在全部区域部署共用的机器人库。采用本地数据和透过云端主机编配的混合部署结构正逐渐成为主流,稳步提升了机器人流程自动化(RPA)市场在欧盟成员国的影响力。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 零售全通路履约自动化

- 中小企业采用云端原生RPA平台

- 基于 GEN-AI 的机器人设计助手

- 超大规模市场的计量收费机器人

- DORA 和 HIPAA 之后的合规主导自动化

- 全球共享服务中心人才短缺

- 市场限制

- UI 变更导致机器人持续故障

- 无人机器人的管治与伦理审查

- 从传统RPA套件转换过来成本高昂

- 新兴市场流程标准化程度低

- 产业价值链分析

- 监管环境

- 技术展望

- 产业吸引力:波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

第五章 市场规模与成长预测

- 透过部署

- 本地部署

- 云/SaaS

- 按解决方案组件

- 软体(平台和许可)

- 服务(实施、卓越中心、支援)

- 按公司规模

- 中小企业

- 大公司

- 依技术类型

- 参加了RPA

- 无人值守的RPA

- 智慧型/认知型RPA

- 按最终用户行业划分

- BFSI

- 资讯科技和电讯

- 卫生保健

- 零售及消费品

- 製造业

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 新加坡

- 马来西亚

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- UiPath Inc.

- Automation Anywhere Inc.

- SS&C Blue Prism Ltd.

- NICE Ltd.(Robotic Automation)

- Pegasystems Inc.

- Kofax Inc.

- WorkFusion Inc.

- Kryon Systems Ltd.

- EdgeVerve Systems Ltd.

- AntWorks Pte Ltd.

- Laiye Technology Ltd.

- Cyclone Robotics Co. Ltd.

- AutomationEdge Technologies Inc.

- Datamatics Global Services Ltd.

- Nividous Software Solutions

- Soroco

- Redwood Software Inc.

- Microsoft Corp.(Power Automate)

- Servicetrace GmbH

- Jidoka(Novayre Solutions)

- Fortra LLC(ex-HelpSystems)

- ElectroNeek Robotics Inc.

- Robocorp Technologies Inc.

- Robiquity Ltd.

- Rocketbot SpA

- OpenConnect Systems Inc.

第七章 投资分析

第八章 市场机会与未来趋势

- 閒置频段与未满足需求评估

The Robotic Process Automation Market size is estimated at USD 6.31 billion in 2025, and is expected to reach USD 22.91 billion by 2030, at a CAGR of 29.40% during the forecast period (2025-2030).

Increasing integration of generative AI with established RPA platforms widens the range of automatable tasks and lets enterprises address unstructured processes that once required human intervention. Expansion is also fueled by cloud-native deployments that shorten implementation cycles and shift spending to operating budgets. North America held the largest Robotic Process Automation market share at 39.6% in 2024, supported by stringent compliance mandates and mature technology ecosystems, while Asia-Pacific is registering the fastest regional CAGR of 34.5% as governments sponsor automation programs and SMEs adopt pay-as-you-go bots. Vendor competition is intensifying through AI-focused acquisitions and partnerships that bundle intelligent document processing, low-code design, and autonomous agent capabilities into platform roadmaps.

Global Robotic Process Automation Market Trends and Insights

Retail Omni-Channel Order-Fulfilment Automation

Retailers are automating inventory reconciliation, shipment orchestration, and return management to keep pace with real-time consumer expectations. Grupo Exito cut order-processing times by up to 75% after deploying an enterprise-wide RPA program that links e-commerce front ends with legacy ERP data. Integration of computer-vision modules maintains accuracy above 98% during peak seasons, while AI-assisted demand forecasting helps retailers manage margin pressure amid supply-chain volatility. Retailers in both mature and emerging e-commerce markets, therefore, view automation as an essential hedge against logistics disruptions and labor shortages.

SME Adoption of Cloud-Native RPA Platforms

Consumption-based SaaS models are lowering entry barriers for small firms. Jana Small Finance Bank shortened critical process turnaround times by nearly 70% after migrating to UiPath's cloud service, with no on-premise infrastructure required. As hyperscale providers embed RPA into their marketplaces, SMEs can deploy secure bots within days and scale licenses only when transaction volumes rise. Analysts expect SMEs to drive more than 40% of net-new bot deployments by 2027 as citizen-developer tools mature and industry-specific templates proliferate.

Persistent Bot Breakage from UI Changes

Frequent interface updates in enterprise and SaaS apps disrupt selectors and render bots inoperable, consuming up to 40% of annual automation budgets for reactive maintenance. Tarsus Distribution had to redesign invoice workflows when supplier formats shifted, highlighting the fragility of legacy, screen-scraping bots. Newer platforms add object-based selectors and self-healing functions, yet change-management shortcomings continue to delay scaling plans and erode confidence in early-stage programs.

Other drivers and restraints analyzed in the detailed report include:

- Gen-AI-Powered Bot-Design Assistants

- Pay-as-You-Go Bots on Hyperscale Marketplaces

- Governance and Ethical Scrutiny of Unattended Bots

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-premise installations remained dominant at 54.3% of the Robotic Process Automation market in 2024 because heavily regulated sectors required local control. Cloud deployments nevertheless posted the highest 38.2% CAGR and will narrow the gap as security certifications expand. UiPath stated that more than 80% of new bookings stem from cloud subscriptions, and customers achieve rollouts 50% faster than on-premise equivalents. The hybrid pattern is gaining ground as European banks keep sensitive payment workflows in-house while using cloud tenants for design, test, and analytics. This flexibility lets firms satisfy residency mandates without forfeiting elastic capacity.

As edge computing matures, vendors package lightweight run-times that execute locally yet receive orchestration from the cloud. Such architectures reduce latency for factory-floor bots while minimizing server administration overhead. Consequently, many manufacturers plan to migrate their non-production robots to SaaS within three years, citing simplified patching and immediate access to AI upgrades. The resulting shift will continue to boost the Robotic Process Automation market as subscription revenue overtakes perpetual licenses.

Software platforms controlled 51.3% of revenue in 2024, but services are expanding at a 35.1% CAGR as organizations recognize that people-centric change management dictates success. Implementers increasingly bundle discovery, re-engineering, and citizen-developer coaching, representing roughly 60% of total transformation budgets. SS&C Technologies realized USD 100 million in cost savings by pairing Blue Prism software with advisory services that tripled its bot count.

Demand for continuous-improvement retainers is also rising because intelligent automation requires ongoing AI model tuning. Vendors now position managed service offers that guarantee SLA-based outcomes rather than discrete project milestones. This pivot further inflates the Robotic Process Automation market size allocated to services and underscores the sector's progression from tool adoption toward enterprise-wide operating model redesign.

Robotic Process Automation Market is Segmented by Deployment (On-Premise and Cloud/SaaS), Solution Component (Software and Services), Enterprise Size (Small and Medium Enterprises and Large Enterprises), Technology Type (Attended RPA, Unattended RPA, and Intelligent/Cognitive RPA), End-User Industry (BFSI, IT and Telecom, Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained leadership with a 39.6% share in 2024, propelled by early adoption curves and rigorous compliance mandates across government and financial services. Agencies such as the U.S. Department of Housing and Urban Development employ combined RPA and machine-learning approaches to modernize benefit processing. State entities like the California DMV leveraged bots to accelerate digital licensing services, allowing continuity during pandemic disruptions. The vendor landscape benefits from abundant system-integrator capacity and skilled automation professionals, ensuring continuous pipeline growth.

Asia-Pacific is the fastest-growing geography at 34.5% CAGR. Japan's RPA Robopat DX passed 1,700 SME implementations, signaling grassroots demand in a tight labor market. India's Manipal Hospitals automated finance workflows to comply with expanding digital health regulations. Government subsidy schemes and local-language interface support will further widen adoption among manufacturers and outsourcing hubs, magnifying the Robotic Process Automation market in the region.

Europe's trajectory is shaped by the Digital Operational Resilience Act, which compels banks to document and stress-test automated workflows. Institutions have earmarked multi-year budgets reaching EUR 15 million per entity to meet the 2025 compliance deadline. German manufacturers showcase deep back-office automation, while Nordic healthcare systems deploy region-wide shared-bot libraries. Hybrid deployment structures that retain data on-premise yet orchestrate via cloud consoles are becoming the norm, steadily increasing the Robotic Process Automation market presence across European Union member states.

- UiPath Inc.

- Automation Anywhere Inc.

- SS&C Blue Prism Ltd.

- NICE Ltd. (Robotic Automation)

- Pegasystems Inc.

- Kofax Inc.

- WorkFusion Inc.

- Kryon Systems Ltd.

- EdgeVerve Systems Ltd.

- AntWorks Pte Ltd.

- Laiye Technology Ltd.

- Cyclone Robotics Co. Ltd.

- AutomationEdge Technologies Inc.

- Datamatics Global Services Ltd.

- Nividous Software Solutions

- Soroco

- Redwood Software Inc.

- Microsoft Corp. (Power Automate)

- Servicetrace GmbH

- Jidoka (Novayre Solutions)

- Fortra LLC (ex-HelpSystems)

- ElectroNeek Robotics Inc.

- Robocorp Technologies Inc.

- Robiquity Ltd.

- Rocketbot SpA

- OpenConnect Systems Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Retail omni-channel order-fulfilment automation

- 4.2.2 SME adoption of cloud-native RPA platforms

- 4.2.3 Gen-AI powered bot-design assistants

- 4.2.4 Pay-as-you-go bots on hyperscale marketplaces

- 4.2.5 Compliance-driven automation post-DORA and HIPAA

- 4.2.6 Global talent shortages in shared-service centres

- 4.3 Market Restraints

- 4.3.1 Persistent bot breakage from UI changes

- 4.3.2 Governance and ethical scrutiny of unattended bots

- 4.3.3 High switching cost from legacy RPA suites

- 4.3.4 Low process standardisation in emerging markets

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud/SaaS

- 5.2 By Solution Component

- 5.2.1 Software (Platforms and Licences)

- 5.2.2 Services (Implementation, CoE, Support)

- 5.3 By Enterprise Size

- 5.3.1 Small and Medium Enterprises (SMEs)

- 5.3.2 Large Enterprises

- 5.4 By Technology Type

- 5.4.1 Attended RPA

- 5.4.2 Unattended RPA

- 5.4.3 Intelligent/Cognitive RPA

- 5.5 By End-user Industry

- 5.5.1 BFSI

- 5.5.2 IT and Telecom

- 5.5.3 Healthcare

- 5.5.4 Retail and CPG

- 5.5.5 Manufacturing

- 5.5.6 Other End-user Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Singapore

- 5.6.4.6 Malaysia

- 5.6.4.7 Australia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 UiPath Inc.

- 6.4.2 Automation Anywhere Inc.

- 6.4.3 SS&C Blue Prism Ltd.

- 6.4.4 NICE Ltd. (Robotic Automation)

- 6.4.5 Pegasystems Inc.

- 6.4.6 Kofax Inc.

- 6.4.7 WorkFusion Inc.

- 6.4.8 Kryon Systems Ltd.

- 6.4.9 EdgeVerve Systems Ltd.

- 6.4.10 AntWorks Pte Ltd.

- 6.4.11 Laiye Technology Ltd.

- 6.4.12 Cyclone Robotics Co. Ltd.

- 6.4.13 AutomationEdge Technologies Inc.

- 6.4.14 Datamatics Global Services Ltd.

- 6.4.15 Nividous Software Solutions

- 6.4.16 Soroco

- 6.4.17 Redwood Software Inc.

- 6.4.18 Microsoft Corp. (Power Automate)

- 6.4.19 Servicetrace GmbH

- 6.4.20 Jidoka (Novayre Solutions)

- 6.4.21 Fortra LLC (ex-HelpSystems)

- 6.4.22 ElectroNeek Robotics Inc.

- 6.4.23 Robocorp Technologies Inc.

- 6.4.24 Robiquity Ltd.

- 6.4.25 Rocketbot SpA

- 6.4.26 OpenConnect Systems Inc.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 8.1 White-Space and Unmet-Need Assessment