|

市场调查报告书

商品编码

1797803

家居材料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Home Furnishing Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

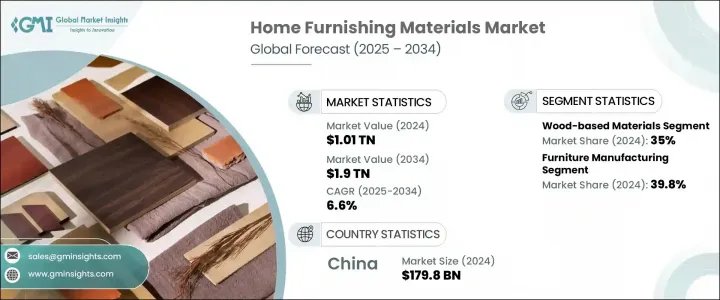

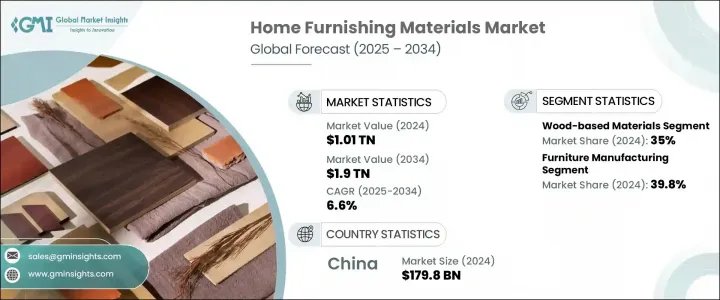

2024年,全球家居材料市场规模达1.01兆美元,预计2034年将以6.6%的复合年增长率成长,达到1.9兆美元。这一成长主要得益于消费者在家居装修和升级方面的支出持续成长,尤其是在新冠疫情之后。一些更广泛的趋势也推动了这个市场扩张,包括城市化进程加快、新兴经济体中产阶级的壮大,以及消费者对提升家居美观度和舒适度的日益关注。

此外,电商平台的快速发展重塑了家具产业,让消费者能够方便地在线上购买家具和家居材料。预计到2024年,电商将占全球销售额的24%左右,这得益于消费者对个人化家居解决方案需求的激增。各大企业正在增强其数位平台,包括使用扩增实境(AR)工具,以提升购物体验并提供更多客製化服务。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.01兆美元 |

| 预测值 | 1.9兆美元 |

| 复合年增长率 | 6.6% |

同时,全球环境标准和法规对甲醛排放和碳足迹的压力日益加大,正推动各行各业迈向永续发展。企业越来越意识到采用更环保替代品的必要性,这促使低VOC(挥发性有机化合物)材料的创新,这些材料既符合更严格的环保准则,又能保持高性能和美观性。随着永续性成为製造商和消费者的首要考虑因素,各公司正在投资环保材料,例如无毒木质饰面、再生零件和节能製造流程。

家具製造业持续引领市场,2024 年将占 39.8% 的市场。预计该领域在 2025 年至 2034 年期间的复合年增长率将达到 6.4%。住宅和商业家具的需求量庞大,涵盖各种类型的家具,例如客厅家具、卧室家具、办公家具和餐厅家具。值得注意的是,城市中产阶级的壮大以及居家办公模式的转变等趋势,导致消费者对模组化、符合人体工学和多功能家具的需求增加。木质材料因其美观、耐用性以及在家具、地板、橱柜和装饰墙体组件中的广泛应用,在市场中占据主导地位。

中国家居材料市场占 41.2% 的份额,2024 年市场规模达 1,798 亿美元。这一增长得益于快速的城市化、电子商务的普及以及千禧世代和 Z 世代等年轻一代日益增长的需求。家居装饰和自适应家具的线上销售都在急剧增长,这反映出消费者偏好的变化,他们更重视家居装饰的便利性和灵活性。

全球家居材料市场的领导者包括莫霍克工业公司 (Mohawk Industries Inc.)、惠好公司 (Weyerhaeuser Company)、圣戈班集团 (Saint-Gobain)、宜家集团 (IKEA Group) 和 Ashley Furniture Industries LLC。为了巩固市场地位,家居材料产业的企业正专注于数位转型和以客户为中心的创新。领先企业正在增加对电商平台和扩增实境 (AR) 等数位工具的投资,使客户能够个人化购物体验并在购买前直观地看到产品。此外,企业正在适应监管变化,优先考虑永续性,并在产品线中融入低挥发性有机化合物 (VOC) 和环保材料。企业也在透过进入新兴市场来扩大其全球影响力,因为这些市场的城市化和不断增长的可支配收入正在推动对家居材料的需求。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 依材料类型

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计数据

- 主要进口国

- 主要出口国

(註:仅提供重点国家的贸易统计)

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按材料类型,2021 - 2034 年

- 主要趋势

- 木质材料

- 实木

- 硬木部分

- 软木部分

- 工程木製品

- 木质复合材料

- 胶合板和单板

- 刨花板和定向刨花板

- 中密度纤维板 (MDF) 和高密度纤维板 (HDF)

- 木塑复合材料(WPC)

- 实木

- 纺织材料

- 天然纤维

- 棉及棉混纺

- 亚麻和大麻

- 羊毛和丝绸

- 合成纤维

- 聚酯和尼龙

- 丙烯酸和聚丙烯

- 技术纺织品

- 家纺应用

- 装饰织物

- 窗帘和帷幔

- 地毯和地垫

- 寝具和床单

- 天然纤维

- 金属材料

- 钢铁部件

- 铝及合金

- 黄铜和青铜

- 特殊金属

- 聚合物和塑胶材料

- 热塑性塑料

- 热固性塑料

- 生物基塑料

- 再生塑胶材料

- 陶瓷和玻璃材料

- 传统陶瓷

- 先进陶瓷

- 强化玻璃和安全玻璃

- 装饰玻璃

- 复合材料及先进材料

- 纤维增强复合材料

- 智慧材料

- 奈米材料

- 生物基复合材料

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 家具製造

- 座椅家具

- 桌子和存储

- 卧室家具

- 厨房和餐厅家具

- 办公家具

- 户外家具

- 地板应用

- 硬木地板

- 强化地板和乙烯基地板

- 地毯和纺织地板

- 陶瓷和石材地板

- 窗帘

- 窗帘和帷幔

- 百叶窗和遮阳帘

- 百叶窗和屏风

- 墙面装饰和装饰

- 壁纸和墙面纺织品

- 装饰面板

- 墙壁艺术和配件

- 软体装饰

- 靠垫和枕头

- 盖毯和毛毯

- 装饰配件

- 照明应用

- 灯罩和灯具

- 装饰照明组件

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 独栋住宅

- 多户住宅

- 豪华和高端市场

- 中端市场

- 经济舱

- 商业领域

- 办公大楼和企业空间

- 饭店业

- 饭店和度假村

- 餐厅和咖啡馆

- 医疗保健设施

- 教育机构

- 零售和购物中心

- 工业和机构

- 政府大楼

- 工业设施

- 宗教和社区中心

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Ashley Furniture Industries LLC

- BASF SE

- Blum Inc.

- Dow Inc.

- Guardian Glass

- Herman Miller Inc.

- Hettich Group

- IKEA Group

- Interface Inc.

- International Paper Company

- Lectra SA

- Mohawk Industries Inc.

- Oppein Home Group Inc.

- Saint-Gobain

- Shaw Industries Group Inc.

- Steelcase Inc.

- Stora Enso Oyj

- Suzano SA

- UPM-Kymmene Corporation

- Weyerhaeuser Company

The Global Home Furnishing Materials Market was valued at USD 1.01 trillion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 1.9 trillion by 2034. This growth is primarily driven by the continued rise in consumer spending on home improvements and upgrades, particularly in the wake of the COVID-19 pandemic. Several broader trends are contributing to this market expansion, including increased urbanization, a growing middle class in emerging economies, and an increasing consumer focus on enhancing home aesthetics and comfort.

Additionally, the significant growth of e-commerce platforms has reshaped the industry, providing consumers with easy access to furniture and home materials online. By 2024, e-commerce is expected to account for about 24% of global sales, driven by a surge in consumer demand for personalized home furnishing solutions. Companies are enhancing their digital platforms, including the use of augmented reality (AR) tools, to improve the shopping experience and offer more customization.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.01 Trillion |

| Forecast Value | $1.9 Trillion |

| CAGR | 6.6% |

Simultaneously, the rising pressure from global environmental standards and regulations surrounding formaldehyde emissions and carbon footprints is driving a significant shift toward sustainability within industries. Businesses are increasingly recognizing the need to adopt greener alternatives, prompting innovations in low-VOC (volatile organic compounds) materials that meet stricter environmental guidelines while maintaining high performance and aesthetic appeal. As sustainability becomes a priority for both manufacturers and consumers, companies are investing in eco-friendly materials like non-toxic wood finishes, recycled components, and energy-efficient manufacturing processes.

The furniture manufacturing sector continues to lead the market, accounting for a 39.8% share in 2024. This segment is expected to grow at a CAGR of 6.4% from 2025 to 2034. The demand for both residential and commercial furniture is substantial, encompassing various types of furniture, such as living room sets, bedroom furnishings, office systems, and dining room pieces. Notably, trends like the expansion of the middle class in urban areas and shifts in work-from-home dynamics have led to increased consumer demand for modular, ergonomic, and versatile furniture. Wood-based materials dominate the market due to their aesthetic appeal, durability, and wide range of applications in furniture, flooring, cabinets, and decorative wall components.

China Home Furnishing Materials Market held a 41.2% share, generating USD 179.8 billion in 2024. This growth is fueled by rapid urbanization, high e-commerce adoption, and growing demand from younger generations such as millennials and Gen Z. Both online sales of home decor and adaptive furniture are rising sharply, reflecting the changing preferences of consumers who value convenience and flexibility in their home furnishings.

Leading players in the global home furnishing materials market include Mohawk Industries Inc., Weyerhaeuser Company, Saint-Gobain, IKEA Group, and Ashley Furniture Industries LLC. To strengthen their market position, companies in the home furnishing materials industry are focusing on digital transformation and customer-centric innovations. Leading players are increasingly investing in their e-commerce platforms and digital tools like augmented reality to enable customers to personalize their shopping experience and visualize products before purchasing. Additionally, businesses are adapting to regulatory changes by prioritizing sustainability and integrating low-VOC and eco-friendly materials into their product lines. Companies are also expanding their global reach by tapping into emerging markets where urbanization and rising disposable incomes are driving demand for home furnishing materials.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Application

- 2.2.4 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By material type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

( Note: the trade statistics will be provided for key countries only)

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Material Type, 2021 - 2034 (USD Bn, Units)

- 5.1 Key trends

- 5.2 Wood-based materials

- 5.2.1 Solid wood

- 5.2.1.1 Hardwood segments

- 5.2.1.2 Softwood segments

- 5.2.1.3 Engineered wood products

- 5.2.2 Wood composites

- 5.2.2.1 Plywood and veneers

- 5.2.2.2 Particleboard and OSB

- 5.2.2.3 MDF and HDF

- 5.2.2.4 Wood-plastic composites (WPC)

- 5.2.1 Solid wood

- 5.3 Textile materials

- 5.3.1 Natural fibers

- 5.3.1.1 Cotton and cotton blends

- 5.3.1.2 Linen and hemp

- 5.3.1.3 Wool and silk

- 5.3.2 Synthetic fibers

- 5.3.2.1 Polyester and nylon

- 5.3.2.2 Acrylic and polypropylene

- 5.3.2.3 Technical textiles

- 5.3.3 Home textile applications

- 5.3.3.1 Upholstery fabrics

- 5.3.3.2 Curtains and draperies

- 5.3.3.3 Carpets and rugs

- 5.3.3.4 Bedding and linens

- 5.3.1 Natural fibers

- 5.4 Metal materials

- 5.4.1 Steel and iron components

- 5.4.2 Aluminum and alloys

- 5.4.3 Brass and bronze

- 5.4.4 Specialty metals

- 5.5 Polymer and plastic materials

- 5.5.1 Thermoplastics

- 5.5.2 Thermosets

- 5.5.3 Bio-based plastics

- 5.5.4 Recycled plastic materials

- 5.6 Ceramic and glass materials

- 5.6.1 Traditional ceramics

- 5.6.2 Advanced ceramics

- 5.6.3 Tempered and safety glass

- 5.6.4 Decorative glass

- 5.7 Composite and advanced materials

- 5.7.1 Fiber-reinforced composites

- 5.7.2 Smart materials

- 5.7.3 Nanomaterials

- 5.7.4 Bio-based composites

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Bn)

- 6.1 Key trends

- 6.2 Furniture manufacturing

- 6.2.1 Seating furniture

- 6.2.2 Tables and storage

- 6.2.3 Bedroom furniture

- 6.2.4 Kitchen and dining furniture

- 6.2.5 Office furniture

- 6.2.6 Outdoor furniture

- 6.3 Flooring applications

- 6.3.1 Hardwood flooring

- 6.3.2 Laminate and vinyl flooring

- 6.3.3 Carpet and textile flooring

- 6.3.4 Ceramic and stone flooring

- 6.4 Window treatments

- 6.4.1 Curtains and drapes

- 6.4.2 Blinds and shades

- 6.4.3 Shutters and screens

- 6.5 Wall coverings and decor

- 6.5.1 Wallpapers and wall textiles

- 6.5.2 Decorative panels

- 6.5.3 Wall art and accessories

- 6.6 Soft furnishings

- 6.6.1 Cushions and pillows

- 6.6.2 Throws and blankets

- 6.6.3 Decorative accessories

- 6.7 Lighting applications

- 6.7.1 Lamp shades and fixtures

- 6.7.2 Decorative lighting components

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Bn, Units)

- 7.1 Key trends

- 7.2 Single family homes

- 7.3 Multi-family housing

- 7.4 Luxury and premium segment

- 7.5 Mid-market segment

- 7.6 Economy segment

- 7.7 Commercial sector

- 7.7.1 Office buildings and corporate spaces

- 7.7.2 Hospitality industry

- 7.7.2.1 Hotels and resorts

- 7.7.2.2 Restaurants and cafes

- 7.7.3 Healthcare facilities

- 7.7.4 Educational institutions

- 7.7.5 Retail and shopping centers

- 7.8 Industrial and institutional

- 7.8.1 Government buildings

- 7.8.2 Industrial facilities

- 7.8.3 Religious and community centers

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Bn, units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Ashley Furniture Industries LLC

- 9.2 BASF SE

- 9.3 Blum Inc.

- 9.4 Dow Inc.

- 9.5 Guardian Glass

- 9.6 Herman Miller Inc.

- 9.7 Hettich Group

- 9.8 IKEA Group

- 9.9 Interface Inc.

- 9.10 International Paper Company

- 9.11 Lectra SA

- 9.12 Mohawk Industries Inc.

- 9.13 Oppein Home Group Inc.

- 9.14 Saint-Gobain

- 9.15 Shaw Industries Group Inc.

- 9.16 Steelcase Inc.

- 9.17 Stora Enso Oyj

- 9.18 Suzano S.A.

- 9.19 UPM-Kymmene Corporation

- 9.20 Weyerhaeuser Company