|

市场调查报告书

商品编码

1797814

自动样品储存系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automated Sample Storage Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

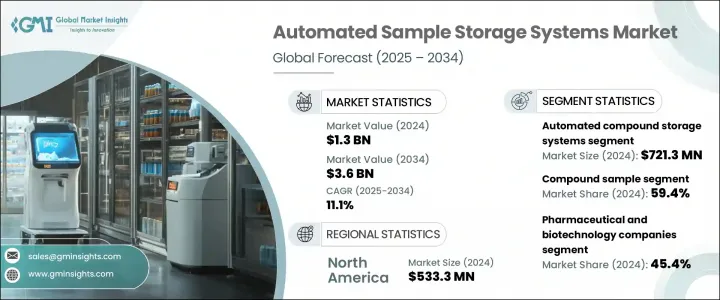

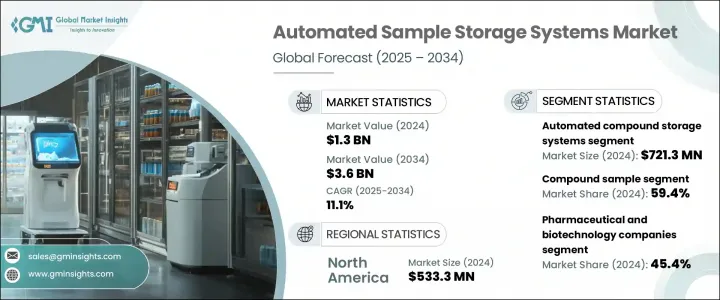

2024年,全球自动化样本储存系统市场规模达13亿美元,预计2034年将以11.1%的复合年增长率成长,达到36亿美元。强劲的成长势头源于生物样本库需求的不断增长、对样本完整性保护的日益重视以及生命科学和临床实验室的数位转型。随着药物开发和基因组研究的不断推进,全球各地的实验室纷纷转向自动化,以实现更准确、更安全、更可扩展的样本管理。自动化储存系统与实验室数位化工具(例如实验室资讯管理系统 (LIMS))的集成,可增强样本追踪、库存控制和资料准确性。

大型研究计画和公共卫生生物库的投资不断增长,推动了对可扩展、技术驱动的储存解决方案的需求。自动化系统有助于实验室减少人为错误、维持合规性并支援高通量工作流程,尤其是在製药、生物技术和临床领域。随着样本量和资料复杂性的上升,自动化正成为高效实验室运作的基石,塑造现代实验室基础设施和临床研究环境的未来。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 36亿美元 |

| 复合年增长率 | 11.1% |

2024年,自动化化合物储存系统细分市场收入达7.213亿美元。这些系统能够在最大程度上减少人工干预的情况下实现大规模化合物库存储,在药物研发中发挥关键作用。它们能够简化化合物检索并确保一致性,对药物筛选工作流程和药物研发运作至关重要。随着化合物库规模的不断扩大以及对高通量环境下可重复结果的需求,对可靠化合物管理的需求持续成长。

2024年,化合物样品市场占据59.4%的份额,这得益于快节奏筛选环境中应用的不断增长。随着製药公司寻求更快的周转时间,提供精确追踪、温度控制和机器人处理的自动化解决方案有助于增强化合物筛选工作流程,最终缩短时间并提高药物研发效率。

2024年,美国自动化样本储存系统市场规模达4.725亿美元,巩固了其作为区域主要贡献者的地位。北美的领先地位源自于许多製药和生物科技公司积极应用自动化技术进行样本储存。该地区还拥有服务研究计画的大型生物样本库,进一步刺激了对可扩展且安全的样本管理系统的需求。药物研发管线的持续扩张以及精准医疗的推动也推动了该地区对先进储存解决方案的采用。

引领全球自动化样本储存系统市场的领导者包括赛默飞世尔科技、布鲁克斯自动化、MEGAROBO、ASKION、松下医疗、TTP LabTech、Biotron Healthcare、SPT Labtech、贝克曼库尔特、海尔生物医疗、Angelantoni Life Science、LiCONiC、Azenta、Hamilton Company 和 MICRONIC。自动化样本储存系统市场的主要公司正致力于加强技术整合、拓展全球分销管道,并开发满足不断变化的客户需求的客製化系统。许多公司正在投资下一代机器人技术、基于人工智慧的样本追踪以及基于云端的软体,以实现与实验室资讯学平台的无缝连接。各公司也透过策略合作伙伴关係和收购来加强其区域影响力,尤其是在新兴的生物製药中心。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 对生物样本库和维护生物库的需求日益增长

- 临床和研究实验室的数位转型

- 药物发现和开发的成长

- 越来越关注样本的完整性和合规性

- 产业陷阱与挑战

- 需要大量的初始资本投资

- 与资料安全和备份相关的担忧

- 市场机会

- 人工智慧和物联网的技术进步

- 对捆绑一站式解决方案的需求不断增长

- 成长动力

- 成长潜力分析

- 监管格局

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 未来市场趋势

- 专利分析

- 定价分析

- 按产品

- 按地区

- 差距分析

- 波特的分析

- PESTLE 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 自动化复合储存系统

- 自动化液体处理系统

- 其他产品

第六章:市场估计与预测:按样本,2021 - 2034 年

- 主要趋势

- 化合物样品

- 生物样本

- 其他样品

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 製药和生物技术公司

- 学术和研究机构

- 生物样本库

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Angelantoni Life Science

- ASKION

- Azenta US

- Beckman Coulter

- Biotron Healthcare

- Brooks Automation

- Haier Biomedical

- Hamilton Company

- LiCONiC

- MEGAROBO

- MICRONIC

- Panasonic Healthcare

- SPT Labtech

- Thermo Fisher Scientific

- TTP LabTech

The Global Automated Sample Storage Systems Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 11.1% to reach USD 3.6 billion by 2034. This strong growth trajectory is driven by the rising demand for biorepositories, increased focus on preserving sample integrity, and digital transformation within life science and clinical laboratories. As drug development and genomic research advance, laboratories across the globe are turning to automation for more accurate, secure, and scalable sample management. The integration of automated storage systems with lab digitization tools, such as laboratory information management systems (LIMS), enhances sample tracking, inventory control, and data accuracy.

The growing investment in large-scale research programs and public health biobanks is fueling the need for scalable, tech-driven storage solutions. Automated systems help labs reduce human error, maintain compliance, and support high-throughput workflows, especially in pharmaceutical, biotech, and clinical settings. As sample volumes and data complexity rise, automation is becoming a cornerstone of efficient lab operations, shaping the future of modern laboratory infrastructure and clinical research environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $3.6 Billion |

| CAGR | 11.1% |

In 2024, the automated compound storage systems segment generated USD 721.3 million. These systems play a critical role in pharmaceutical discovery by enabling large-scale chemical library storage with minimal manual intervention. Their ability to streamline compound retrieval and ensure consistency makes them vital to drug screening workflows and pharmaceutical R&D operations. The need for reliable compound management continues to grow due to increasing chemical library sizes and demand for reproducible results in high-throughput environments.

The compound sample segment held a 59.4% share in 2024, driven by rising applications in fast-paced screening environments. As pharmaceutical companies seek faster turnaround times, automated solutions offering precise tracking, temperature control, and robotic handling help enhance compound screening workflows, ultimately reducing timelines and improving efficiency in drug discovery.

U.S. Automated Sample Storage Systems Market generated USD 472.5 million in 2024, solidifying its position as a key regional contributor. North America's leadership stems from a strong presence of pharmaceutical and biotech companies actively using automation in sample storage. The region also hosts major biobank facilities that serve research programs, further boosting demand for scalable and secure sample management systems. The ongoing expansion of drug discovery pipelines and the push for precision medicine are also driving regional adoption of advanced storage solutions.

Leading players shaping the Global Automated Sample Storage Systems Market include Thermo Fisher Scientific, Brooks Automation, MEGAROBO, ASKION, Panasonic Healthcare, TTP LabTech, Biotron Healthcare, SPT Labtech, Beckman Coulter, Haier Biomedical, Angelantoni Life Science, LiCONiC, Azenta, Hamilton Company, and MICRONIC. Key companies in the automated sample storage systems market are focusing heavily on enhancing technology integration, expanding global distribution channels, and developing systems tailored to evolving customer needs. Many are investing in next-gen robotics, AI-based sample tracking, and cloud-based software for seamless connectivity with lab informatics platforms. Companies are also strengthening their regional presence through strategic partnerships and acquisitions, particularly in emerging biopharma hubs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Sample

- 2.2.4 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing need for biobanking and maintaining biorepositories

- 3.2.1.2 Digital transformation across clinical and research laboratories

- 3.2.1.3 Growth in drug discovery and development

- 3.2.1.4 Growing focus on sample integrity and compliance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Requirement of substantial initial capital investments

- 3.2.2.2 Concerns related to data security and backup

- 3.2.3 Market opportunities

- 3.2.3.1 Technological advancements in AI and IoT

- 3.2.3.2 Growing demand for bundled one-stop solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Pricing analysis

- 3.8.1 By product

- 3.8.2 By region

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTLE analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Automated compound storage systems

- 5.3 Automated liquid handling systems

- 5.4 Other products

Chapter 6 Market Estimates and Forecast, By Sample, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Compound sample

- 6.3 Biological sample

- 6.4 Other samples

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pharmaceutical and biotechnology companies

- 7.3 Academic and research institutes

- 7.4 Biobanks

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profile

- 9.1 Angelantoni Life Science

- 9.2 ASKION

- 9.3 Azenta US

- 9.4 Beckman Coulter

- 9.5 Biotron Healthcare

- 9.6 Brooks Automation

- 9.7 Haier Biomedical

- 9.8 Hamilton Company

- 9.9 LiCONiC

- 9.10 MEGAROBO

- 9.11 MICRONIC

- 9.12 Panasonic Healthcare

- 9.13 SPT Labtech

- 9.14 Thermo Fisher Scientific

- 9.15 TTP LabTech