|

市场调查报告书

商品编码

1797839

血液采集市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Blood Collection Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

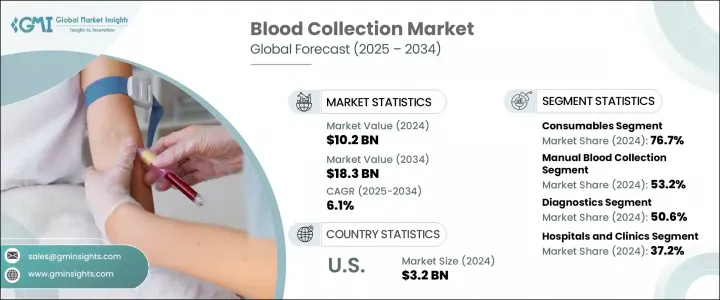

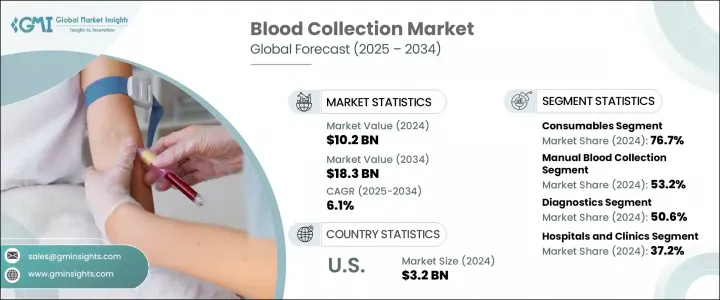

2024 年全球血液采集市场价值为 102 亿美元,预计到 2034 年将以 6.1% 的复合年增长率增长至 183 亿美元。市场扩张的动力来自慢性病和传染病负担的加重、技术的快速创新、外科手术数量的增加以及老龄人口的增加。随着医疗服务提供者优先考虑安全、准确和高效的血液样本采集以用于诊断、治疗和研究,对先进血液采集解决方案的需求正在增加。血液采集设备是临床工作流程中的关键工具,可确保在确保病人安全的前提下精确采集血液样本。这些设备广泛应用于医院、诊断实验室和血库,是各种医疗检测流程的支柱。市场也见证了对简化操作、降低污染风险和改善患者体验的系统的投资增加,这进一步巩固了其长期成长轨迹。

依产品类型划分,市场分为系统和耗材。耗材领域在2024年占据最大份额,达到76.7%,这得益于其在持续准确采集样本方面发挥的重要作用。预计到2034年,该领域的市场规模将超过139亿美元,预测期内的复合年增长率为6%。另一方面,系统领域预计在2025年至2034年间以略高的复合年增长率(6.3%)成长,这得益于越来越多地采用旨在提高营运效率和患者舒适度的整合解决方案。医疗保健提供者越来越青睐旨在提高诊断准确性和降低操作风险的系统,这进一步增强了该领域的发展势头。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 102亿美元 |

| 预测值 | 183亿美元 |

| 复合年增长率 | 6.1% |

根据采血方法,市场细分为手动采血和自动采血。 2024年,手动采血占总市场的53.2%,其成长得益于其成本效益、可用性以及在各种临床环境中的易用性。手动采血方法仍然是全球医疗保健实践的重要组成部分,依靠训练有素的专业人员进行精准的样本提取。该过程通常涉及使用针头或真空系统等定制设备,以满足特定患者和检测需求,确保在不同环境下的可靠性。

从应用角度来看,市场分为诊断、治疗和研究。 2024年,诊断仍占据主导地位,市占率达50.6%,这得益于依赖血液样本进行疾病检测、监测和预防的检测数量不断增加。对早期精准诊断健康状况的需求不断增长,刺激了对先进血液采集系统的需求,这反过来又加速了该领域的成长。

从区域来看,北美在2024年以35.4%的份额领先全球采血市场,这得益于其强大的医疗基础设施、日益增长的慢性病病例以及大量的诊断检测。该地区也受益于创新采血技术的快速普及以及对提高诊断速度和准确性的重视。在该地区,美国仍然是主要贡献者,市场规模从2023年的31亿美元成长到2024年的32亿美元。对高品质诊断服务的持续需求,加上采血方法的持续改进,预计将使美国在整个预测期内保持领先地位。

影响竞争格局的关键参与者包括赛默飞世尔科技、泰尔茂公司、麦克森公司、Haemonetics公司、雅培实验室、凯杰公司、费森尤斯公司、莎施泰特公司、格莱纳公司、FL MEDICAL公司、碧迪公司、康德乐公司、罗氏公司、Streck公司、西门子医疗公司和尼普罗公司。这些公司始终致力于推动产品创新,增强全球影响力,并提供满足全球医疗保健提供者不断变化的需求的解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性病和传染病发生率上升

- 血液采集技术的进步

- 外科手术数量不断增加

- 老年人口不断增加

- 产业陷阱与挑战

- 输血相关风险

- 缺乏熟练的医疗保健专业人员

- 市场机会

- 政府主导的提倡捐血和疾病筛检的活动日益增多

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 系统

- 自动化系统

- 手动系统

- 耗材

- 静脉

- 针头和注射器

- 双头针

- 带翼采血套装

- 标准皮下注射针

- 其他采血针

- 采血管

- 血清分离

- 乙二胺四乙酸

- 肝素

- 血浆分离

- 血袋

- 其他静脉产品

- 针头和注射器

- 毛细管

- 刺血针

- 微容器管

- 微量血球容积比管

- 加温装置

- 其他毛细管产品

- 静脉

第六章:市场估计与预测:依方法,2021 - 2034 年

- 主要趋势

- 手动采血

- 自动采血

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 诊断

- 治疗

- 研究

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院和诊所

- 诊断中心

- 血库

- 学术和研究机构

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Abbott Laboratories

- Becton, Dickinson, and Company

- Cardinal Health

- F. Hoffmann-La Roche

- FL MEDICAL

- Fresenius SE & Co

- Greiner

- Haemonetics Corporation

- McKesson Corporation

- Nipro Corporation

- QIAGEN

- Sarstedt AG & Co

- Siemens Healthineers

- Streck

- Terumo Corporation

- Thermo Fisher Scientific

The Global Blood Collection Market was valued at USD 10.2 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 18.3 billion by 2034. Market expansion is being driven by the growing burden of chronic and infectious diseases, rapid technological innovation, a higher volume of surgical procedures, and a rising elderly population. The demand for advanced blood collection solutions is increasing as healthcare providers prioritize safe, accurate, and efficient sample collection for diagnostics, treatment, and research. Blood collection devices are critical tools in clinical workflows, ensuring that blood samples are obtained with precision and patient safety in mind. These devices are widely used in hospitals, diagnostic laboratories, and blood banks, serving as the backbone of various medical testing processes. The market is also witnessing greater investment in systems that streamline operations, reduce contamination risk, and improve patient experience, further reinforcing its long-term growth trajectory.

By product type, the market is divided into systems and consumables. The consumables segment held the largest share at 76.7% in 2024, driven by its essential role in consistent and accurate sample collection. This segment is expected to reach over USD 13.9 billion by 2034, advancing at a CAGR of 6% during the forecast period. Systems, on the other hand, are forecast to grow at a slightly higher CAGR of 6.3% between 2025 and 2034, supported by the rising adoption of integrated solutions that improve operational efficiency and patient comfort. Healthcare providers are increasingly favoring systems designed to enhance diagnostic accuracy and reduce procedural risks, adding to the segment's momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.2 billion |

| Forecast Value | $18.3 billion |

| CAGR | 6.1% |

Based on method, the market is segmented into manual and automated blood collection. Manual blood collection accounted for 53.2% of the total market in 2024, with growth supported by its cost-effectiveness, availability, and ease of use in various clinical environments. This approach continues to be a key component of healthcare practices worldwide, relying on trained professionals to perform accurate sample extraction. The process typically involves using tailored devices such as needles or vacuum systems to meet specific patient and test requirements, ensuring reliability in diverse settings.

In terms of application, the market is categorized into diagnostics, treatment, and research. Diagnostics remained the dominant segment in 2024 with a 50.6% share, fueled by the growing number of tests that depend on blood samples for disease detection, monitoring, and prevention. Rising demand for early and precise identification of health conditions is spurring the need for advanced blood collection systems, which in turn is accelerating the segment's growth.

Regionally, North America led the global blood collection market with a 35.4% share in 2024, underpinned by a strong healthcare infrastructure, increasing cases of chronic illnesses, and a high volume of diagnostic testing. The region also benefits from the rapid adoption of innovative blood collection technologies and an emphasis on improving diagnostic speed and accuracy. Within the region, the United States remains the primary contributor, with the market size growing from USD 3.1 billion in 2023 to USD 3.2 billion in 2024. Consistent demand for high-quality diagnostic services, supported by continuous improvements in blood collection methodologies, is expected to sustain the country's leadership position throughout the forecast period.

Key players influencing the competitive landscape include Thermo Fisher Scientific, Terumo Corporation, McKesson Corporation, Haemonetics Corporation, Abbott Laboratories, QIAGEN, Fresenius SE & Co, Sarstedt AG & Co, Greiner, FL MEDICAL, Becton, Dickinson and Company, Cardinal Health, F. Hoffmann-La Roche, Streck, Siemens Healthineers, and Nipro Corporation. These companies are consistently focused on driving product innovation, strengthening their global reach, and delivering solutions that meet the changing requirements of healthcare providers across the world.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Method

- 2.2.4 Application

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of chronic and infectious diseases

- 3.2.1.2 Advancements in blood collection technologies

- 3.2.1.3 Increasing number of surgical procedures

- 3.2.1.4 Rising geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risks associated with blood transfusions

- 3.2.2.2 Lack of skilled healthcare professionals

- 3.2.3 Market opportunities

- 3.2.3.1 Rising government-led campaigns for promoting blood donation and disease screening

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 System

- 5.2.1 Automated systems

- 5.2.2 Manual systems

- 5.3 Consumables

- 5.3.1 Venous

- 5.3.1.1 Needles and syringes

- 5.3.1.1.1 Double-ended needles

- 5.3.1.1.2 Winged blood collection sets

- 5.3.1.1.3 Standard hypodermic needles

- 5.3.1.1.4 Other blood collection needles

- 5.3.1.2 Blood collection tubes

- 5.3.1.2.1 Serum-separating

- 5.3.1.2.2 EDTA

- 5.3.1.2.3 Heparin

- 5.3.1.2.4 Plasma-separating

- 5.3.1.3 Blood bags

- 5.3.1.4 Other venous products

- 5.3.1.1 Needles and syringes

- 5.3.2 Capillary

- 5.3.2.1 Lancets

- 5.3.2.2 Micro-container tubes

- 5.3.2.3 Micro-hematocrit tubes

- 5.3.2.4 Warming devices

- 5.3.2.5 Other capillary products

- 5.3.1 Venous

Chapter 6 Market Estimates and Forecast, By Method, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Manual blood collection

- 6.3 Automated blood collection

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Diagnostics

- 7.3 Treatment

- 7.4 Research

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 1.1 Key trends

- 1.2 Hospitals and clinics

- 1.3 Diagnostic centers

- 1.4 Blood banks

- 1.5 Academic and research institutes

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 1.5.1 U.S.

- 1.5.2 Canada

- 9.3 Europe

- 1.5.3 Germany

- 1.5.4 UK

- 1.5.5 France

- 1.5.6 Spain

- 1.5.7 Italy

- 1.5.8 Netherlands

- 9.4 Asia Pacific

- 1.5.9 China

- 1.5.10 Japan

- 1.5.11 India

- 1.5.12 Australia

- 1.5.13 South Korea

- 9.5 Latin America

- 1.5.14 Brazil

- 1.5.15 Mexico

- 1.5.16 Argentina

- 9.6 Middle East and Africa

- 1.5.17 South Africa

- 1.5.18 Saudi Arabia

- 1.5.19 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Becton, Dickinson, and Company

- 10.3 Cardinal Health

- 10.4 F. Hoffmann-La Roche

- 10.5 FL MEDICAL

- 10.6 Fresenius SE & Co

- 10.7 Greiner

- 10.8 Haemonetics Corporation

- 10.9 McKesson Corporation

- 10.10 Nipro Corporation

- 10.11 QIAGEN

- 10.12 Sarstedt AG & Co

- 10.13 Siemens Healthineers

- 10.14 Streck

- 10.15 Terumo Corporation

- 10.16 Thermo Fisher Scientific