|

市场调查报告书

商品编码

1797886

分子诊断市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Molecular Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

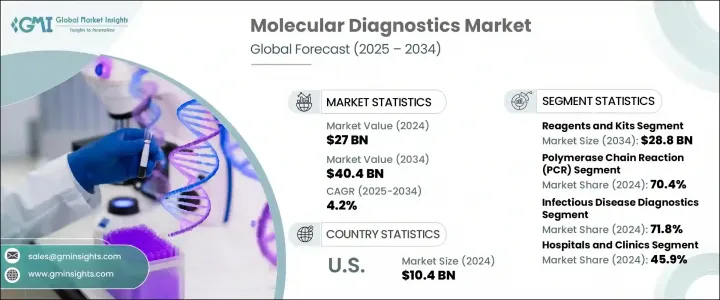

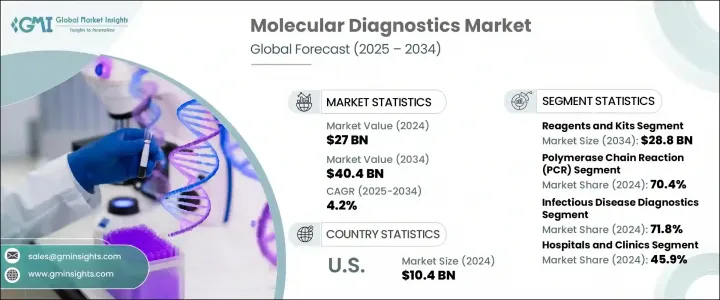

2024 年全球分子诊断市场价值为 270 亿美元,预计到 2034 年将以 4.2% 的复合年增长率成长,达到 404 亿美元。这一稳定增长受到多种因素的推动,例如传染病病例的增加、分子诊断技术的不断创新、早期疾病检测意识的增强、对即时诊断 (POC) 的需求激增以及全球老年人口的快速增长。

分子诊断透过分析基因组和蛋白质组(包括DNA、RNA和蛋白质)中的生物标记物,成为识别和监测疾病的重要技术。随着医疗保健系统面临提供更快、更准确的诊断解决方案的压力,该技术在现代临床实践中发挥日益重要的作用。赛默飞世尔科技、豪洛捷、希森美康、丹纳赫和凯杰等市场主要参与者正在不断扩展其产品线,以满足不断变化的全球医疗需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 270亿美元 |

| 预测值 | 404亿美元 |

| 复合年增长率 | 4.2% |

分子诊断涉及高度灵敏和准确的检测,对于识别包括遗传性疾病、癌症和传染病在内的多种疾病至关重要。这种精准度正推动其在已开发市场和新兴市场的广泛应用。在众多技术中,聚合酶炼式反应 (PCR) 在 2024 年占据 70.4% 的市场份额,领先市场。 PCR 能够精确扩增 RNA 和 DNA,并且能够检测出即使是微量的遗传物质,使其成为早期检测的重要工具,尤其适用于传染病筛检和基因检测。

2024年,肿瘤检测市场规模达21亿美元,预计2034年将达32亿美元。全球癌症发生率的上升,以及对早期诊断的需求不断增长,推动先进分子检测工具在肿瘤学领域的应用。医疗保健系统正在投资基于分子的仪器、试剂盒和试剂,以实现高灵敏度和特异性,从而改善患者预后并推进癌症管理方案。

2024年,美国分子诊断市场规模达104亿美元。由于传染病发病率持续上升,以及政府大力支持下一代诊断技术的开发和商业化,美国和加拿大市场正呈现强劲成长动能。即使监管标准严格,创新诊断仪器和试剂盒的推出也受到显着鼓励。技术进步和先进分子检测平台的广泛应用,正在进一步推动北美市场的发展。

全球分子诊断市场的领先公司包括罗氏公司、Qiagen、安捷伦科技、Biocartis、赛默飞世尔科技、西门子医疗、雅培实验室、QuidelOrtho Corporation、Bio-Rad Laboratories、Illumina、Becton、Dickinson and Company、Sysmex Corporation、Huwel Lifesciences、Biomerie Houxic、丹纳赫集团和丹纳赫集团和丹纳赫集团和丹纳赫集团和丹纳赫集团和丹纳赫集团。为了巩固其在竞争激烈的分子诊断领域的地位,各公司正在积极寻求策略联盟、合併和收购。他们也专注于投资研发,以创新高通量、自动化和多重测试平台。扩大产品组合、获得监管部门批准和进入新的区域市场正在帮助参与者扩大其全球影响力。此外,人工智慧和数位平台的整合正在提高诊断的准确性和速度,从而提供技术优势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 全球技术进步和对早期疾病诊断认识的提高

- POC诊断需求不断成长

- 老年人口基数不断增加

- 研发计划数量不断增加

- 传染病发生率上升

- 产业陷阱与挑战

- 分子诊断测试成本高昂

- 缺乏熟练的人员

- 市场机会

- 新兴市场的扩张

- 与人工智慧(AI)的融合

- 成长动力

- 成长潜力分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 监管格局

- 未来市场趋势

- 定价分析

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 仪器

- 试剂和试剂盒

第六章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 聚合酶炼式反应(PCR)

- 杂交

- 定序

- 等温核酸扩增技术(INAAT)

- 微阵列

- 其他技术

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 传染病诊断

- 新冠肺炎

- 流感

- 呼吸道合胞病毒(RSV)

- 结核

- CT/NG

- 爱滋病

- C型肝炎

- B型肝炎

- 其他传染病诊断

- 遗传疾病检测

- 肿瘤学检测

- 其他应用

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院和诊所

- 诊断实验室

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Abbott Laboratories

- Agilent Technologies

- Becton, Dickinson, and Company

- Biocartis

- Biomerieux

- Bio-Rad Laboratories

- Danaher Corporation

- F. Hoffmann-La Roche

- Hologic

- Huwel Lifesciences

- Illumina

- Qiagen

- QuidelOrtho Corporation

- Siemens Healthineers

- Sysmex Corporation

- Thermo Fisher Scientific

The Global Molecular Diagnostics Market was valued at USD 27 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 40.4 billion by 2034. This steady growth is being fueled by multiple converging factors such as rising cases of infectious diseases, continuous innovation in molecular diagnostic technologies, growing awareness of early disease detection, the surging need for point-of-care (POC) diagnostics, and the rapid expansion of the global elderly population.

Molecular diagnostics serves as a vital technique in identifying and monitoring diseases by analyzing biological markers in the genome and proteome, including DNA, RNA, and proteins. With healthcare systems under pressure to deliver faster and more accurate diagnostic solutions, this technique is playing an increasingly central role in modern clinical practice. Major players in the market-such as Thermo Fisher Scientific, Hologic, Sysmex Corporation, Danaher Corporation, and Qiagen-continue to expand their offerings to meet evolving global health needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $27 Billion |

| Forecast Value | $40.4 Billion |

| CAGR | 4.2% |

Molecular diagnostics involves highly sensitive and accurate tests that are critical for identifying a wide array of conditions, including genetic disorders, cancers, and infectious diseases. This accuracy is driving its adoption across both developed and emerging markets. Among the technologies used, polymerase chain reaction (PCR) led the market in 2024 with a 70.4% share. Its precise amplification of RNA and DNA and ability to detect even the smallest quantities of genetic material make PCR an essential tool for early detection, especially for infectious disease screening and genetic testing.

The oncology testing segment was valued at USD 2.1 billion in 2024 and is projected to reach USD 3.2 billion by 2034. Increasing cancer incidence across the globe, along with a rising demand for early diagnosis, is driving the uptake of advanced molecular testing tools in oncology. Healthcare systems are investing in molecular-based instruments, kits, and reagents that enable high sensitivity and specificity, improving patient outcomes and advancing cancer management protocols.

United States Molecular Diagnostics Market generated 10.4 billion in 2024. The U.S. and Canadian markets are witnessing significant momentum due to the continued rise of infectious diseases and strong support for the development and commercialization of next-generation diagnostic technologies. Even with strict regulatory standards in place, there is notable encouragement for the rollout of innovative diagnostic instruments and kits. Technological advancement and widespread adoption of sophisticated molecular testing platforms are helping to drive the market further in North America.

Leading companies operating in the Global Molecular Diagnostics Market include F. Hoffmann-La Roche, Qiagen, Agilent Technologies, Biocartis, Thermo Fisher Scientific, Siemens Healthineers, Abbott Laboratories, QuidelOrtho Corporation, Bio-Rad Laboratories, Illumina, Becton, Dickinson and Company, Sysmex Corporation, Huwel Lifesciences, Biomerieux, Danaher Corporation, and Hologic. To solidify their positions in the competitive molecular diagnostics space, companies are actively pursuing strategic alliances, mergers, and acquisitions. They are also focused on investing in R&D to innovate high-throughput, automated, and multiplex testing platforms. Expanding product portfolios, obtaining regulatory approvals, and entering new regional markets are helping players scale their global footprint. Additionally, integration of AI and digital platforms is enhancing diagnostic accuracy and speed, providing a technological edge.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Technology

- 2.2.3 Application

- 2.2.4 End use

- 2.2.5 Regional

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advances and increasing awareness towards early disease diagnosis globally

- 3.2.1.2 Escalating demand for POC diagnostics

- 3.2.1.3 Increasing geriatric population base

- 3.2.1.4 Increasing number of R&D initiatives

- 3.2.1.5 Rising incidences of infectious diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of molecular diagnostic tests

- 3.2.2.2 Lack of skilled personnel

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 Integration with artificial intelligence (AI)

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology and innovation landscape

- 3.4.1 Current technological trends

- 3.4.2 Emerging technologies

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East and Africa

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.3 Reagents and kits

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Polymerase chain reaction (PCR)

- 6.3 Hybridization

- 6.4 Sequencing

- 6.5 Isothermal nucleic acid amplification technology (INAAT)

- 6.6 Microarrays

- 6.7 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Infectious disease diagnostics

- 7.2.1 COVID-19

- 7.2.2 Flu

- 7.2.3 Respiratory syncytial virus (RSV)

- 7.2.4 Tuberculosis

- 7.2.5 CT/NG

- 7.2.6 HIV

- 7.2.7 Hepatitis C

- 7.2.8 Hepatitis B

- 7.2.9 Other infectious disease diagnostics

- 7.3 Genetic disease testing

- 7.4 Oncology testing

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Diagnostic laboratories

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Agilent Technologies

- 10.3 Becton, Dickinson, and Company

- 10.4 Biocartis

- 10.5 Biomerieux

- 10.6 Bio-Rad Laboratories

- 10.7 Danaher Corporation

- 10.8 F. Hoffmann-La Roche

- 10.9 Hologic

- 10.10 Huwel Lifesciences

- 10.11 Illumina

- 10.12 Qiagen

- 10.13 QuidelOrtho Corporation

- 10.14 Siemens Healthineers

- 10.15 Sysmex Corporation

- 10.16 Thermo Fisher Scientific