|

市场调查报告书

商品编码

1801797

乳製品及大豆食品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Dairy and Soy Food Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

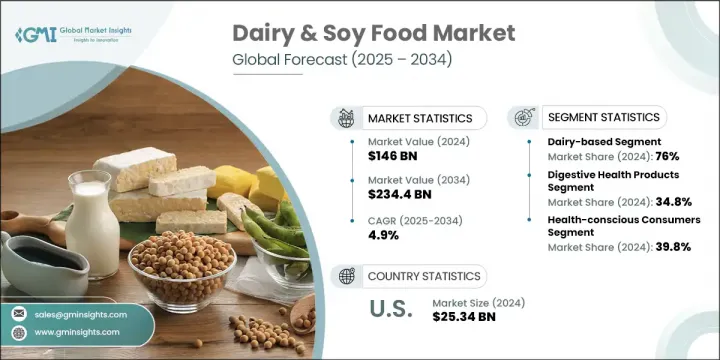

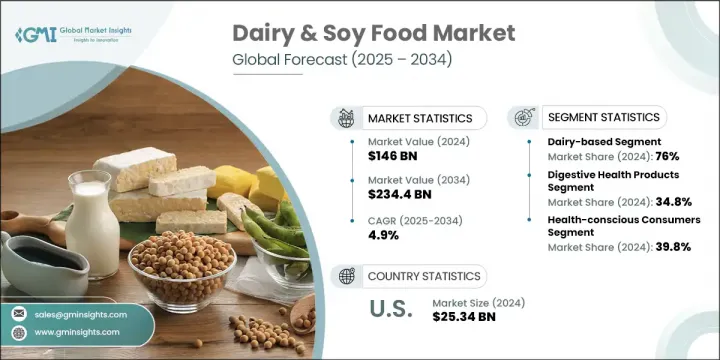

2024 年全球乳製品和大豆食品市场价值为 1,460 亿美元,预计到 2034 年将以 4.9% 的复合年增长率增长至 2,344 亿美元。市场涵盖的产品种类繁多,包括牛奶、优格和起司等乳製品,以及植物性饮料和大豆替代品。这一成长背后的一个关键驱动力是消费者对健康和保健的日益关注。人们对添加剂最少、功能性较强的营养产品的需求日益增长。随着乳糖不耐症变得越来越普遍,许多消费者开始转向具有与传统乳製品相同口味、质地和营养价值的植物性食品。

植物性饮食和纯素饮食的兴起引发了该领域的重大创新,各大公司纷纷拓展产品组合,推出新型优格、植物性饮料和强化食品,瞄准纯素食者、弹性素食者和注重环保的消费者。已开发国家人口老化也刺激了对强化乳製品和大豆食品的需求,尤其是那些富含蛋白质、维生素和益生菌的食品,这些食品有助于骨骼健康、消化功能和整体活力。同时,电子商务的快速发展也提高了产品的可及性,使品牌能够触及更多消费者,并提供更丰富的产品种类。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1460亿美元 |

| 预测值 | 2344亿美元 |

| 复合年增长率 | 4.9% |

2024 年,乳製品类健康食品占最大份额,达到 76%,预计到 2034 年将维持 5.3% 的成长率。这些产品吸引了注重肠道健康、免疫力和骨骼强度的健康消费者,其开发创新旨在降低脂肪和糖的含量,同时增加饮食限制人群的可及性。

2024年,消化健康产品领域占了34.8%的市场份额,预计到2034年成长率将达到5.5%。这一迅猛增长主要源于消费者对肠道健康和增强免疫系统的日益关注,越来越多的人寻求兼具营养和功能的产品。随着消化健康问题在全球日益普遍,从腹胀、消化不良到肠躁症(IBS)等更为复杂的疾病,消费者开始转向能够促进消化和整体肠道菌丛平衡的食品和补充剂。

2024年,美国乳製品和大豆食品市场产值达253.4亿美元。预计到2034年,美国市场的复合年增长率将达到6.4%,这得益于消费者对注重安全、营养成分透明和便利产品形式的品牌的信任。有机、无麸质和植物性产品的日益普及,进一步推动了美国市场的发展。

全球乳製品和大豆食品市场的领先公司包括达能公司、联合利华、拉克塔利斯集团、恆天然合作集团、Hain Celestial 集团、菲仕兰坎皮纳、通用磨坊、迪安食品公司、Arla Foods amba、Silk(达能)、雀巢公司、卡夫亨氏公司、养乐多本社、WhiteWave Foods(达能)和家乐氏公司。为了巩固其在竞争激烈的乳製品和大豆食品领域的地位,各公司实施了各种策略。这些措施包括不断改进产品配方以满足消费者不断变化的偏好,例如提供低糖、高蛋白和无乳糖的选择。许多公司已经扩大了他们的产品线,包括植物性替代品,以满足对纯素食和弹性素食日益增长的需求。合作、收购和生产流程创新也是多元化产品组合和提高产品可及性的关键策略。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 增强健康意识

- 乳糖不耐症盛行率上升

- 植物性饮食的采用和素食主义的增长

- 蛋白质强化与营养强化需求

- 产业陷阱与挑战

- 传统乳业竞争

- 特色保健产品价格溢价

- 市场机会

- 新兴市场健康意识增强

- 功能性食品与营养保健品的整合

- 个人化营养和客製化

- 电子商务和直接面向消费者的成长

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品类别

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品类别,2021-2034 年

- 主要趋势

- 乳製品健康食品

- 益生菌乳製品

- 富含蛋白质的乳製品

- 功能性乳製品

- 大豆食品

- 传统大豆食品

- 豆奶及饮料

- 大豆蛋白製品

- 组合和混合产品

- 乳製品和大豆混合产品

- 多蛋白配方

- 功能性食品组合

- 特殊营养产品

第六章:市场估计与预测:依健康效益,2021-2034 年

- 主要趋势

- 消化健康产品

- 益生菌和益生元食品

- 增强消化酶

- 肠道健康支持产品

- 骨骼和关节健康

- 富钙产品

- 维生素D强化食品

- 骨骼健康支持配方

- 心臟保健产品

- 胆固醇管理食品

- Omega-3 增强产品

- 有益心臟健康的配方

- 蛋白质和肌肉健康

- 高蛋白产品

- 肌肉恢復配方

- 运动营养整合

- 体重管理

- 低热量、低脂肪

- 增强饱足感的产品

- 代谢支持配方

第七章:市场估计与预测:依消费者细分,2021-2034

- 主要趋势

- 注重健康的消费者

- 饮食限制部分

- 基于年龄的细分

- 儿童及青少年营养

- 成人健康与保健

- 老年营养与护理

- 基于生活方式的细分

- 忙碌的专业人士

- 有机和天然偏好

- 高端和手工消费者

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Arla Foods amba

- Danone SA

- Dean Foods Company

- Fonterra Co-operative Group

- FrieslandCampina

- General Mills, Inc.

- Hain Celestial Group, Inc.

- Kellogg Company

- Lactalis Group

- Nestle SA

- Silk (Danone)

- The Kraft Heinz Company

- Unilever PLC

- WhiteWave Foods (Danone)

- Yakult Honsha Co., Ltd.

The Global Dairy & Soy Food Market was valued at USD 146 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 234.4 billion by 2034. This market spans a broad range of products, including dairy items like milk, yogurt, and cheese, as well as plant-based beverages and soy alternatives. A key driver behind this growth is the increasing focus on health and wellness among consumers. There is a growing demand for nutritious products with minimal additives and more functional benefits. As lactose intolerance becomes more common, many consumers are turning to plant-based options that offer the same taste, texture, and nutritional value as traditional dairy products.

The rise of plant-based and vegan diets has sparked significant innovation in this space, with companies diversifying their portfolios to include new types of yogurt, plant-based beverages, and fortified goods aimed at vegans, flexitarians, and environmentally conscious shoppers. The aging population in developed countries is also fueling demand for fortified dairy and soy foods, particularly those enriched with proteins, vitamins, and probiotics to support bone health, digestion, and overall vitality. Meanwhile, the rapid growth of e-commerce is improving product accessibility, allowing brands to reach more consumers and offer a wider variety of products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $146 Billion |

| Forecast Value | $234.4 Billion |

| CAGR | 4.9% |

In 2024, dairy-based health foods segment held the largest share at 76% and is expected to maintain a growth rate of 5.3% through 2034. These products, which appeal to health-conscious consumers focused on gut health, immunity, and bone strength, are being developed with innovations aimed at reducing fat and sugar content while increasing accessibility for individuals with dietary restrictions.

The digestive health products segment captured a significant 34.8% share of the market in 2024, with an anticipated growth rate of 5.5% through to 2034. This impressive expansion is largely driven by an increasing consumer focus on gut health and immune system enhancement, as more individuals seek products that offer both nutritional and functional benefits. As digestive health issues become more prevalent globally, from bloating and indigestion to more complex conditions like IBS, consumers are turning to foods and supplements that promote better digestion and overall gut flora balance.

United States Dairy and Soy Food Market generated USD 25.34 billion in 2024. The country's market is expected to grow at a CAGR of 6.4% by 2034, driven by consumer trust in brands that prioritize safety, transparency in nutritional labeling, and convenient product formats. The increasing popularity of organic, gluten-free, and plant-based products has further propelled the U.S. market forward.

Leading companies in the Global Dairy and Soy Food Market include Danone S.A., Unilever PLC, Lactalis Group, Fonterra Co-operative Group, Hain Celestial Group, Inc., FrieslandCampina, General Mills, Inc., Dean Foods Company, Arla Foods amba, Silk (Danone), Nestle S.A., The Kraft Heinz Company, Yakult Honsha Co., Ltd., WhiteWave Foods (Danone), and Kellogg Company. To solidify their position in the competitive dairy and soy food sector, companies have implemented various strategies. These include continuous product reformulations to meet evolving consumer preferences, such as offering lower sugar, high-protein, and lactose-free options. Many companies have expanded their product lines to include plant-based alternatives, tapping into the growing demand for vegan and flexitarian choices. Partnerships, acquisitions, and innovation in production processes have also been key strategies to diversify portfolios and improve product accessibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product category

- 2.2.3 Health benefit

- 2.2.4 Consumer segment

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing health and wellness consciousness

- 3.2.1.2 Rising prevalence of lactose intolerance

- 3.2.1.3 Plant-based diet adoption and veganism growth

- 3.2.1.4 Protein enrichment and nutritional enhancement demands

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Traditional dairy industry competition

- 3.2.2.2 Price premium for specialty health products

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging market health awareness growth

- 3.2.3.2 Functional food and nutraceutical integration

- 3.2.3.3 Personalized nutrition and customization

- 3.2.3.4 E-commerce and direct-to-consumer growth

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product category

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Category, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Dairy-based health foods

- 5.2.1 Probiotic dairy products

- 5.2.2 Protein-enriched dairy

- 5.2.3 Functional dairy products

- 5.3 Soy-based food products

- 5.3.1 Traditional soy foods

- 5.3.2 Soy milk and beverages

- 5.3.3 Soy protein products

- 5.4 Combination and hybrid products

- 5.4.1 Dairy-soy blend products

- 5.4.2 Multi-protein formulations

- 5.4.3 Functional food combinations

- 5.4.4 Specialty nutritional products

Chapter 6 Market Estimates and Forecast, By Health Benefit, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Digestive health products

- 6.2.1 Probiotic and prebiotic foods

- 6.2.2 Digestive enzyme enhanced

- 6.2.3 Gut health support products

- 6.3 Bone and joint health

- 6.3.1 Calcium-enriched products

- 6.3.2 Vitamin D fortified foods

- 6.3.3 Bone health support formulations

- 6.4 Heart health products

- 6.4.1 Cholesterol management foods

- 6.4.2 Omega-3 enhanced products

- 6.4.3 Heart-healthy formulations

- 6.5 Protein and muscle health

- 6.5.1 High-protein products

- 6.5.2 Muscle recovery formulations

- 6.5.3 Sports nutrition integration

- 6.6 Weight management

- 6.6.1 Low-calorie and reduced-fat

- 6.6.2 Satiety-enhancing products

- 6.6.3 Metabolic support formulations

Chapter 7 Market Estimates and Forecast, By Consumer Segment, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Health-conscious consumers

- 7.3 Dietary restriction segments

- 7.4 Age-based segments

- 7.4.1 Children and adolescent nutrition

- 7.4.2 Adult health and wellness

- 7.4.3 Senior nutrition and care

- 7.5 Lifestyle-based segments

- 7.5.1 Busy professional

- 7.5.2 Organic and natural preference

- 7.5.3 Premium and artisanal consumers

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Arla Foods amba

- 9.2 Danone S.A.

- 9.3 Dean Foods Company

- 9.4 Fonterra Co-operative Group

- 9.5 FrieslandCampina

- 9.6 General Mills, Inc.

- 9.7 Hain Celestial Group, Inc.

- 9.8 Kellogg Company

- 9.9 Lactalis Group

- 9.10 Nestle S.A.

- 9.11 Silk (Danone)

- 9.12 The Kraft Heinz Company

- 9.13 Unilever PLC

- 9.14 WhiteWave Foods (Danone)

- 9.15 Yakult Honsha Co., Ltd.