|

市场调查报告书

商品编码

1801811

生物刺激素配方材料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Biostimulants Formulation Material Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

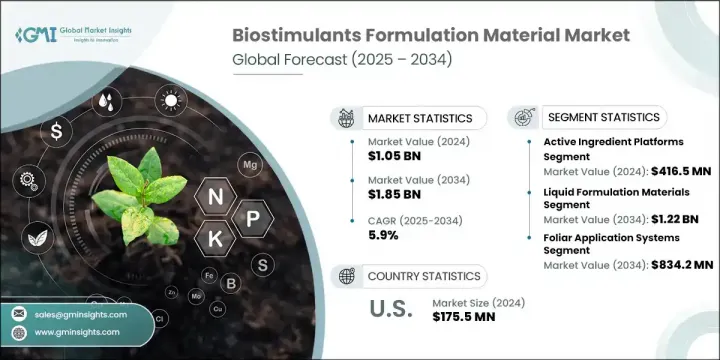

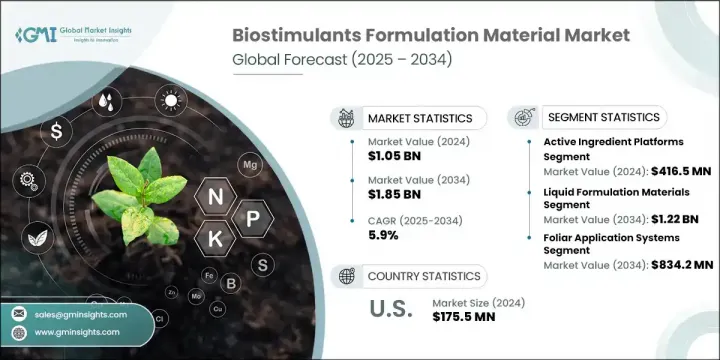

2024年,全球生物刺激素製剂材料市场规模达10.5亿美元,预计2034年将以5.9%的复合年增长率成长至18.5亿美元。由于全球对永续农业实践的重视,以及对既能提高生产力又能兼顾环保的投入品的需求日益增长,生物刺激素製剂市场正获得显着发展。市场普遍转向以自然和生物为基础的作物改良解决方案,加上有利的政策环境,正在推动市场扩张。叶面施肥仍是主要的施用方式,占所有施用方式的近一半。然而,人们对种子处理和土壤施用製剂日益增长的兴趣正在重塑行业格局,尤其是在标靶施用方法的创新日益先进且应用日益广泛的背景下。

向天然配方材料(例如微生物溶液、海藻萃取物和天然多醣)的转变正在加速。减少化学投入的监管压力,加上消费者对无残留食品的偏好,正加速向永续生物刺激素的转变。生产商正投入资源进行研发,专注于可生物降解、高效且永续的解决方案,以支持现代农业。针对特定作物类型、土壤条件和当地气候设计的高度定製配方正日益成为一种趋势。各公司正在利用先进的资料分析和农业见解,提供客製化的生物刺激素,以提高产量、实现溢价,并与寻求精准、高价值作物解决方案的种植者建立长期合作关係。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 10.5亿美元 |

| 预测值 | 18.5亿美元 |

| 复合年增长率 | 5.9% |

到2034年,稳定剂和助剂细分市场将以7.4%的复合年增长率增长,这得益于它们能够有效保存活性成分、延长保质期,并增强生物刺激素在各种应用中的功能性传递。这些成分,包括乳化剂和表面活性剂,在维持配方均匀性、确保吸收以及支持与其他农产品的兼容性方面发挥关键作用。它们的日益增长的使用凸显了当今作物投入配方日益复杂且精确的要求。

至2034年,干製剂材料市场将以4.6%的复合年增长率成长。虽然液体製剂因其易用性和创新性而日益受到青睐,但在需要长保质期和稳定性的领域,干製剂仍然至关重要。随着市场的发展,预计干製剂的份额将略有下降,但在某些应用情境下,需求将保持稳定。

美国生物刺激素製剂材料市场占80.1%的市场份额,2024年市场规模达1.755亿美元。该地区受益于完善的监管环境、持续的农业研发投入以及对环境友善农业实践的大力推动。多醣体因其环保性和有效性在美国广受青睐。在这个高度工业化和技术导向的市场中,稳定剂和助剂对于维持产品稳定性以及确保与其他农业化学品系统的一致性至关重要。微生物接种剂、胺基酸和海藻基材料等活性成分的广泛使用,凸显了现代农业对生物製剂和精准投入的日益青睐。

塑造全球生物刺激素製剂材料市场的关键参与者包括诺维信公司 (Novozymes A/S)、巴斯夫 (BASF SE)、瓦拉格罗公司 (Valagro SpA)、联合磷化有限公司 (UPL Limited) 和先正达公司 (Syngenta AG)。为了在生物刺激素製剂材料市场站稳脚跟,各公司正大力投资研发可持续的作物专用产品,以提高产量并符合环境标准。创新是公司发展的重点,尤其是创造可生物降解的定製配方,以适应不同的气候和土壤条件。与农业科技公司、研究机构和种植者的策略合作,有助于公司共同开发针对特定区域的解决方案。各公司也正在拓展全球分销网络,并进军新兴市场,以挖掘新的成长领域。对数位平台和精准农业工具的重视,支援产品供应的即时客製化。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 对永续和有机农业投入品的需求不断增长

- 对环保作物保护产品的监管支持

- 更加重视提高作物产量和品质

- 配方和输送系统的技术进步

- 产业陷阱与挑战

- 农民意识和技术知识有限

- 由于环境因素导致产品功效发生变化

- 市场机会

- 开发针对特定作物的定製配方

- 与数位农业和精准农业的融合

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依材料类型

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按材料类型,2021 - 2034 年

- 主要趋势

- 天然多醣

- 稳定剂和佐剂

- 活性成分平台

- 海藻萃取物製剂原料

- 腐植酸和黄腐酸衍生物

- 胺基酸和蛋白质水解物碱

- 微生物包封材料

第六章:市场估计与预测:依形式,2021 - 2034 年

- 主要趋势

- 液体配方材料

- 乳化剂和增溶剂

- 悬浮剂和增稠剂

- 防腐剂和抗菌剂

- 冻融稳定剂

- 干燥配方材料

- 造粒及製粒助剂

- 抗结块剂和流动促进剂

- 粉尘控制和处理改进剂

- 防潮涂层

第七章:市场估计与预测:按应用方法,2021 - 2034 年

- 主要趋势

- 种子处理製剂材料

- 涂料和黏合剂

- 附着力促进剂和成膜剂

- 着色剂和识别系统

- 保护性封装材料

- 叶面施肥系统

- 喷雾佐剂和渗透促进剂

- 防漂移及沉积助剂

- 紫外线防护剂和稳定性增强剂

- 用于罐混的相容剂

- 土壤施用材料

- 造粒助剂和黏合剂

- 缓释涂层系统

- 土壤渗透促进剂

- 湿度管理材料

- 其他的

第八章:市场估计与预测:依作物类型,2021 - 2034 年

- 主要趋势

- 谷物和谷类

- 水果和蔬菜

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 法国

- 义大利

- 西班牙

- 德国

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 埃及

- MEA 其余地区

第十章:公司简介

- Ashland Global Holdings Inc.

- BASF SE

- Biotechnica (UK)

- Citymax Group (China)

- Croda International Plc

- Elemental Enzymes

- Evonik Industries AG

- Fertinagro Biotech

- Genvor

- Natural Growth Biostimulants LLC

- Novozymes A/S

- SIPCAM Inagra(欧洲)

- Syngenta AG

- UPL Limited

- Valagro SpA

The Global Biostimulants Formulation Material Market was valued at USD 1.05 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 1.85 billion by 2034. The market is gaining significant traction due to the worldwide emphasis on sustainable agricultural practices and the increasing demand for productivity-boosting yet environmentally conscious inputs. The broader shift toward nature-based and biological crop enhancement solutions, combined with favorable policy environments, is propelling market expansion. Foliar application remains the dominant method of usage, accounting for nearly half of all applications. However, growing interest in seed treatments and soil-applied formulations is reshaping industry dynamics, especially as innovation in targeted delivery methods becomes more advanced and widely available.

The transition to natural formulation materials-such as microbial solutions, seaweed extracts, and natural polysaccharides-is intensifying. Regulatory pressure to reduce chemical inputs, coupled with consumer preference for residue-free food, is accelerating this move toward sustainable biostimulants. Producers are dedicating resources to research and development focused on biodegradable, effective, and sustainable solutions that support modern agriculture. There's a growing trend toward highly tailored formulations designed for specific crop types, soil conditions, and local climates. Companies are leveraging advanced data analytics and agronomic insights to offer customized biostimulants that boost yields, command premium pricing, and foster long-term relationships with growers seeking precise, high-value crop solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.05 Billion |

| Forecast Value | $1.85 Billion |

| CAGR | 5.9% |

The stabilizers and adjuvants segment will grow at a CAGR of 7.4% through 2034, supported by their ability to preserve active ingredients, improve shelf-life, and enhance the functional delivery of biostimulants across a wide range of applications. These ingredients, including emulsifiers and surfactants, play a key role in maintaining formulation uniformity, ensuring absorption, and supporting compatibility with other agricultural products. Their rising use highlights the growing complexity and precision required in today's crop input formulations.

The dry formulation materials segment will grow at a CAGR of 4.6% through 2034. While liquid formulations are becoming more prominent due to ease of use and innovation, dry forms remain critical in scenarios requiring long shelf-life and stability. As the market evolves, a slight decline in dry formulation share is anticipated, although demand will remain steady in certain use cases.

U.S. Biostimulants Formulation Material Market held 80.1% share, generating USD 175.5 million in 2024. The region benefits from a well-developed regulatory landscape, ongoing investment in agricultural R&D, and a strong push for environmentally responsible farming practices. Polysaccharides are widely favored in the U.S. due to their environmental compatibility and effectiveness. In this highly industrialized and tech-focused market, stabilizers and adjuvants are essential to maintaining product stability and ensuring alignment with other agrochemical systems. The dominant use of active ingredients such as microbial inoculants, amino acids, and seaweed-based materials underscores a growing preference for biologicals and precision inputs in modern agriculture.

Key players shaping the Global Biostimulants Formulation Material Market include Novozymes A/S, BASF SE, Valagro S.p.A., UPL Limited, and Syngenta AG. To establish a strong foothold in the Biostimulants Formulation Material Market, companies are investing heavily in research to develop sustainable, crop-specific products that enhance yield while aligning with environmental standards. A major focus lies in innovation-particularly in creating biodegradable, tailored formulations suited for varied climatic and soil conditions. Strategic collaborations with agricultural tech firms, research institutes, and growers are helping companies co-develop region-specific solutions. Firms are also expanding global distribution networks and entering emerging markets to tap into new growth areas. Emphasis on digital platforms and precision agriculture tools supports real-time customization of product offerings.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Material type

- 2.2.2 Form

- 2.2.3 Application method

- 2.2.4 Crop type

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sustainable and organic agricultural inputs

- 3.2.1.2 Regulatory support for eco-friendly crop protection products

- 3.2.1.3 Increasing focus on crop yield and quality enhancement

- 3.2.1.4 Technological advancements in formulation and delivery systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited farmer awareness and technical knowledge

- 3.2.2.2 Variability in product efficacy due to environmental factors

- 3.2.3 Market opportunities

- 3.2.3.1 Development of crop-specific and customized formulations

- 3.2.3.2 Integration with digital agriculture and precision farming

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By material type

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, by Material Type, 2021 - 2034 (USD Bn, Tons)

- 5.1 Key trends

- 5.2 Natural polysaccharides

- 5.3 Stabilizers and adjuvants

- 5.4 Active ingredient platforms

- 5.4.1 Seaweed extract formulation materials

- 5.4.2 Humic and fulvic acid derivatives

- 5.4.3 Amino acid and protein hydrolysate bases

- 5.4.4 Microbial encapsulation materials

Chapter 6 Market Estimates & Forecast, by Form, 2021 - 2034 (USD Bn, Tons)

- 6.1 Key trends

- 6.2 Liquid formulation materials

- 6.2.1 Emulsifiers and solubilizers

- 6.2.2 Suspension agents and thickeners

- 6.2.3 Preservatives and antimicrobial agents

- 6.2.4 Freeze-thaw stabilizers

- 6.3 Dry formulation materials

- 6.3.1 Granulation and pelletization aids

- 6.3.2 Anti-caking and flow enhancement agents

- 6.3.3 Dust control and handling improvers

- 6.3.4 Moisture barrier coatings

Chapter 7 Market Estimates & Forecast, by Application Method, 2021 - 2034 (USD Bn, Tons)

- 7.1 Key trends

- 7.2 Seed treatment formulation materials

- 7.2.1 Coating materials and binders

- 7.2.2 Adhesion promoters and film formers

- 7.2.3 Colorants and identification systems

- 7.2.4 Protective encapsulation materials

- 7.3 Foliar application systems

- 7.3.1 Spray adjuvants and penetration enhancers

- 7.3.2 Anti-drift and deposition aids

- 7.3.3 UV protectants and stability enhancers

- 7.3.4 Compatibility agents for tank mixing

- 7.4 Soil application materials

- 7.4.1 Granulation aids and binding agents

- 7.4.2 Slow-release coating systems

- 7.4.3 Soil penetration enhancers

- 7.4.4 Moisture management materials

- 7.5 Others

Chapter 8 Market Estimates & Forecast, by Crop Type, 2021 - 2034 (USD Mn, Tons)

- 8.1 Key trends

- 8.2 Cereals and grains

- 8.3 Fruits and vegetables

- 8.4 Others

Chapter 9 Market Estimates & Forecast, by Region, 2021 - 2034 (USD Mn, Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Italy

- 9.3.4 Spain

- 9.3.5 Germany

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Egypt

- 9.6.5 Rest of MEA

Chapter 10 Company Profiles

- 10.1 Ashland Global Holdings Inc.

- 10.2 BASF SE

- 10.3 Biotechnica (UK)

- 10.4 Citymax Group (China)

- 10.5 Croda International Plc

- 10.6 Elemental Enzymes

- 10.7 Evonik Industries AG

- 10.8 Fertinagro Biotech

- 10.9 Genvor

- 10.10 Natural Growth Biostimulants LLC

- 10.11 Novozymes A/S

- 10.12 SIPCAM Inagra (Europe)

- 10.13 Syngenta AG

- 10.14 UPL Limited

- 10.15 Valagro S.p.A