|

市场调查报告书

商品编码

1801818

摩托车和踏板车市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Motorcycle and Scooter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

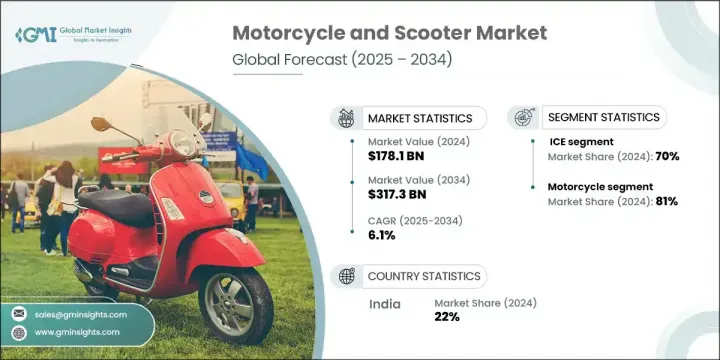

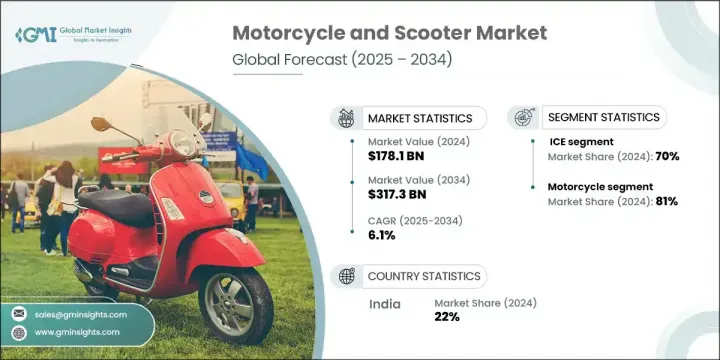

2024年,全球摩托车和踏板车市场规模达1,781亿美元,预计2034年将以6.1%的复合年增长率成长,达到3,173亿美元。由于城市交通需求的不断变化、可持续发展意识的不断提升以及年轻群体偏好的转变,该市场正在经历重大变化。随着消费者环保意识的增强以及政府支持绿色交通的激励措施的实施,电动车型正稳步发展。城市交通拥挤以及对经济高效、紧凑型出行方式的需求,正在推动两轮车的需求。

製造商正在透过融入GPS、行动互联和诊断功能等现代功能来提升摩托车和踏板车的吸引力。此外,轻量化结构、时尚外观和人体工学设计等趋势正在吸引更年轻的客户群。车辆订阅服务和共乘等新商业模式正在逐渐重塑人们在大都市地区的个人出行方式。售后市场也在不断发展,对骑乘者专属客製化、性能升级和增强型安全部件的需求日益增长,进一步推动了消费者对两轮车市场的参与度。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1781亿美元 |

| 预测值 | 3173亿美元 |

| 复合年增长率 | 6.1% |

2024年,内燃机 (ICE) 车型占据约 70% 的市场份额,预计 2025 年至 2034 年期间的复合年增长率将超过 5%。儘管电动两轮车的受欢迎程度稳步上升,但传统的汽油车仍然是众多骑乘者的首选。广泛的加油基础设施、成熟的机械可靠性以及出色的长途行驶续航里程是内燃机汽车继续占据全球销售主导地位的关键原因。传统引擎的强劲成长势头表明,目前,它们仍然能够满足全球众多消费者的期望。

2024年,摩托车仍是主要产品类别,占81%。预计到2034年,该细分市场的复合年增长率将达到6%。在全球许多地区,尤其是在新兴经济体,摩托车是最实用、最经济的日常交通工具。摩托车的标准排气量在100cc至250cc之间,是数百万通勤者必备的代步工具。全球摩托车产量很大一部分来自亚太地区,价格实惠和实用性是该地区消费者购买摩托车的主要因素。

印度摩托车和踏板车市场占22%的市场份额,2024年产值达296亿美元。作为全球最大的摩托车生产国,印度贡献了全球两轮车产量的约15-20%,2024财年产量约为2,800万辆。与成熟市场(摩托车通常用于休閒或豪华用途)不同,印度消费者的日常旅行依赖摩托车。在这里,关键的购买决策取决于成本效益、行驶里程、维护便利性和日常可靠性等因素。

塑造全球摩托车和踏板车市场的领导者包括 Classic Legends、Hero、TVS、Piaggio、Yamaha、Suzuki、Honda、Bajaj Motorcycles、OLA 和 ATHER。摩托车和踏板车行业的顶级製造商正透过专注于创新、在地化和产品多样化来巩固其市场地位。他们正在扩大电动车产品组合,以符合永续发展目标和消费者对清洁出行日益增长的兴趣。对智慧连接功能和安全技术的投资正在帮助品牌提升用户体验和品牌差异化。许多公司正在透过建立区域製造中心来降低物流成本并有效满足当地需求,从而加强其国内和出口足迹。与科技公司和行动平台的合作正在透过订阅模式和共享行动解决方案创造新的收入来源。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 都市化进程加快,交通拥挤加剧

- 电子商务和最后一哩配送的扩张

- 燃油价格上涨

- 电动两轮车的快速普及

- 亚洲中产阶级人口不断成长

- 产业陷阱与挑战

- 安全隐忧和事故率上升

- 充电基础设施不足

- 供应链中断

- 原料成本上涨

- 市场机会

- 电气化和电动车普及率

- 互联智慧行动解决方案

- 订阅和租赁模式

- 拓展非洲、东南亚市场

- 与配送平台建立策略伙伴关係

- 摩托车和踏板车市场的发展

- 历史市场发展与成熟度分析

- 从传统到现代行动解决方案的转变

- 两轮车领域的技术采用生命週期

- 市场整合与产业重组趋势

- 成长动力

- 成长潜力分析

- 监管格局

- 波特的分析

- PESTEL分析

- 技术创新与先进功能

- 摩托车ADAS及安全技术集成

- 联网摩托车解决方案和物联网集成

- 先进的动力总成技术

- 自主与半自主功能开发

- 摩托车和踏板车市场转型

- 电动两轮车技术演变

- 电池技术和续航里程优化

- 充电基础设施发展和可及性

- 政府激励和政策支持分析

- 消费者行为与市场偏好

- 人口统计资料和目标客户分析

- 购买决策因素与购买历程

- 使用模式和移动行为

- 品牌忠诚度和转换模式

- 价格敏感度与价值感知分析

- 专利格局

- 价格趋势

- 按国家

- 按产品

- 成本細項分析

- 生产统计

- 进出口

- 主要进口国家

- 主要出口国家

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 摩托车

- 巡洋舰摩托车

- 运动摩托车

- 旅行摩托车

- 标准/裸露摩托车

- 探险/双运动摩托车

- 越野摩托车

- 踏板车

- 传统汽油摩托车

- 电动滑板车

- 大型踏板车

- 轻型机车

第六章:市场估计与预测:以推进方式,2021 - 2034 年

- 主要趋势

- 内燃机(ICE)

- 电动车(EV)

第七章:市场估计与预测:依引擎排气量,2021 - 2034 年

- 主要趋势

- 250cc以下

- 250cc-500cc

- 500cc-1000cc

- 1000cc以上

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 离线

- 在线的

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 个人的

- 商业的

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Global Two-Wheeler OEMs

- Bajaj

- Hero

- Honda

- Piaggio

- Suzuki

- TVS

- Yamaha

- Premium Motorcycle Brands

- BMW Motorrad

- Ducati

- Harley-Davidson

- KTM

- Royal Enfield

- Kawasaki

- Electric Two-Wheeler Manufacturers

- Ather

- Ola Electric

- Revolt

- Ultraviolette

- Yadea

- Zero Motorcycles

- Niu Technologies

- Component and System Suppliers

- Bosch

- Brembo

- Continental

- Nissin

- ZF

- Connected Mobility and Software Providers

- MapmyIndia

- Ride Vision

- Sibros

- TomTom

- Vahan

The Global Motorcycle and Scooter Market was valued at USD 178.1 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 317.3 billion by 2034. This market is undergoing major changes due to evolving urban transportation needs, rising awareness around sustainability, and shifting preferences among younger demographics. Electric variants are gaining steady traction as consumers prioritize environmental consciousness and benefit from government incentives supporting green transportation. Urban congestion and the need for cost-efficient, compact mobility options are fueling demand for two-wheelers.

Manufacturers are enhancing the appeal of motorcycles and scooters by incorporating modern features such as GPS, mobile connectivity, and diagnostic capabilities. Additionally, trends in lightweight construction, sleek aesthetics, and ergonomic design are drawing in a younger customer base. New business models like vehicle subscription services and ridesharing options are slowly reshaping how people access personal mobility in metropolitan areas. The aftermarket is also evolving, with increasing demand for rider-specific customization, performance upgrades, and enhanced safety components, and further driving consumer engagement with the two-wheeler segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $178.1 Billion |

| Forecast Value | $317.3 Billion |

| CAGR | 6.1% |

In 2024, internal combustion engine (ICE) models held approximately 70% market share and are forecast to expand at a CAGR of over 5% from 2025 to 2034. While electric two-wheelers are steadily rising in popularity, traditional petrol-powered vehicles remain the preferred choice among many riders. The widespread availability of fueling infrastructure, well-established mechanical reliability, and superior range for longer rides are key reasons ICE vehicles continue to dominate global sales volumes. The momentum behind conventional engines demonstrates that, for now, they continue to meet the expectations of many consumers worldwide.

Motorcycles remained the leading product category in 2024, accounting for 81% share. This segment is expected to grow at a CAGR of 6% through 2034. In numerous global regions, particularly in emerging economies, motorcycles represent the most practical and economical means of daily transportation. With standard engine capacities ranging between 100cc and 250cc, these bikes serve as essential mobility tools for millions of commuters. A large share of global production originates from the Asia Pacific, where affordability and functional utility are major purchasing factors.

India Motorcycle and Scooter Market held 22% share and generated USD 29.6 billion in 2024. As the top global manufacturer of motorcycles, India contributes roughly 15-20% of worldwide two-wheeler production, with approximately 28 million units built in FY 2024. Unlike in mature markets, where motorcycles often serve recreational or luxury roles, Indian consumers rely on them for everyday use. Here, critical buying decisions are shaped by considerations like cost-efficiency, mileage, ease of maintenance, and day-to-day reliability.

Leading players shaping the Global Motorcycle and Scooter Market include Classic Legends, Hero, TVS, Piaggio, Yamaha, Suzuki, Honda, Bajaj Motorcycles, OLA, and ATHER. Top manufacturers in the motorcycle and scooter industry are reinforcing their market position by focusing on innovation, localization, and product diversification. They are expanding their electric vehicle portfolios to align with sustainability goals and growing consumer interest in cleaner mobility. Investment in smart connectivity features and safety technology is helping brands enhance user experience and brand differentiation. Many are strengthening their domestic and export footprints by establishing regional manufacturing hubs to reduce logistics costs and meet local demand efficiently. Partnerships with tech firms and mobility platforms are creating new revenue streams through subscription models and shared mobility solutions.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Propulsion

- 2.2.4 Engine Displacement

- 2.2.5 Distribution Channel

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising urbanization and traffic congestion

- 3.2.1.2 Expansion of e-commerce and last-mile delivery

- 3.2.1.3 Increasing fuel prices

- 3.2.1.4 Rapid adoption of electric two-wheelers

- 3.2.1.5 Growing middle-class population in Asia

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Safety concerns and rising accident rates

- 3.2.2.2 Inadequate charging infrastructure

- 3.2.2.3 Supply chain disruptions

- 3.2.2.4 Rising raw material costs

- 3.2.3 Market opportunities

- 3.2.3.1 Electrification and EV penetration

- 3.2.3.2 Connected and smart mobility solutions

- 3.2.3.3 Subscription and leasing models

- 3.2.3.4 Market expansion in Africa and Southeast Asia

- 3.2.3.5 Strategic partnerships with delivery platforms

- 3.2.4 Motorcycle and scooter market evolution

- 3.2.4.1 Historical market development and maturity analysis

- 3.2.4.2 Transition from traditional to modern mobility solutions

- 3.2.4.3 Technology adoption lifecycle in two-wheeler segment

- 3.2.4.4 Market consolidation and industry restructuring trends

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology innovation and advanced features

- 3.7.1 Motorcycle ADAS and safety technology integration

- 3.7.2 Connected motorcycle solutions and iot integration

- 3.7.3 Advanced powertrain technologies

- 3.7.4 Autonomous and semi-autonomous features development

- 3.8 Electric motorcycle and scooter market transformation

- 3.8.1 Electric two-wheeler technology evolution

- 3.8.2 Battery technology and range optimization

- 3.8.3 Charging infrastructure development and accessibility

- 3.8.4 Government incentives and policy support analysis

- 3.9 Consumer behavior and market preferences

- 3.9.1 Demographic profile and target customer analysis

- 3.9.2 Purchase decision factors and buying journey

- 3.9.3 Usage patterns and mobility behavior

- 3.9.4 Brand loyalty and switching patterns

- 3.9.5 Price sensitivity and value perception analysis

- 3.10 Patent landscape

- 3.11 Price trend

- 3.11.1 By country

- 3.11.2 By product

- 3.12 Cost breakdown analysis

- 3.13 Production statistics

- 3.13.1 Import and export

- 3.13.2 Major import countries

- 3.13.3 Major export countries

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly Initiatives

- 3.14.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Motorcycles

- 5.2.1 Cruiser motorcycles

- 5.2.2 Sport motorcycles

- 5.2.3 Touring motorcycles

- 5.2.4 Standard/naked motorcycles

- 5.2.5 Adventure/dual-sport motorcycles

- 5.2.6 Off-road/dirt motorcycles

- 5.3 Scooters

- 5.3.1 Traditional gasoline scooters

- 5.3.2 Electric scooters

- 5.3.3 Maxi scooters

- 5.3.4 Moped-style scooters

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Internal combustion engine (ICE)

- 6.3 Electric vehicles (EVs)

Chapter 7 Market Estimates & Forecast, By Engine Displacement, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Under 250cc

- 7.3 250cc-500cc

- 7.4 500cc-1000cc

- 7.5 Above 1000cc

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Offline

- 8.3 Online

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Personal

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Two-Wheeler OEMs

- 11.1.1 Bajaj

- 11.1.2 Hero

- 11.1.3 Honda

- 11.1.4 Piaggio

- 11.1.5 Suzuki

- 11.1.6 TVS

- 11.1.7 Yamaha

- 11.2 Premium Motorcycle Brands

- 11.2.1 BMW Motorrad

- 11.2.2 Ducati

- 11.2.3 Harley-Davidson

- 11.2.4 KTM

- 11.2.5 Royal Enfield

- 11.2.6 Kawasaki

- 11.3 Electric Two-Wheeler Manufacturers

- 11.3.1 Ather

- 11.3.2 Ola Electric

- 11.3.3 Revolt

- 11.3.4 Ultraviolette

- 11.3.5 Yadea

- 11.3.6 Zero Motorcycles

- 11.3.7 Niu Technologies

- 11.4 Component and System Suppliers

- 11.4.1 Bosch

- 11.4.2 Brembo

- 11.4.3 Continental

- 11.4.4 Nissin

- 11.4.5 ZF

- 11.5 Connected Mobility and Software Providers

- 11.5.1 MapmyIndia

- 11.5.2 Ride Vision

- 11.5.3 Sibros

- 11.5.4 TomTom

- 11.5.5 Vahan