|

市场调查报告书

商品编码

1801825

宗教与精神产品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Religious and Spiritual Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

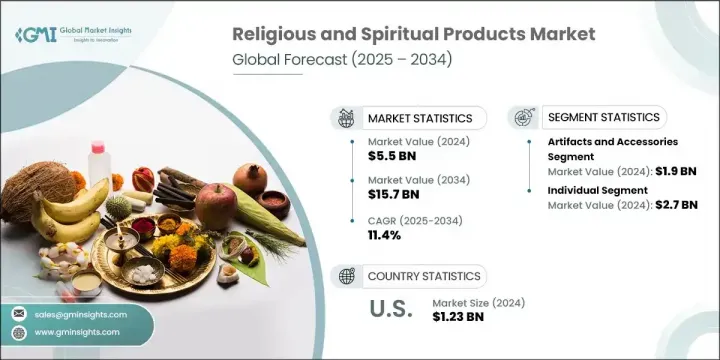

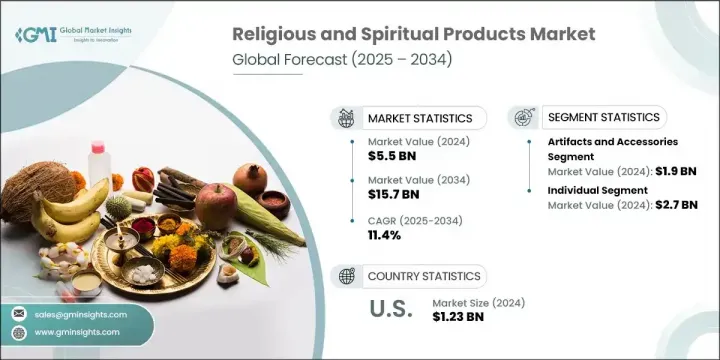

2024年,全球宗教和精神产品市场价值55亿美元,预计到2034年将以11.4%的复合年增长率成长,达到157亿美元。市场扩张的动力源于不断发展的精神实践和道德消费主义的兴起,消费者正在寻求与其价值观产生共鸣的产品。人们对不仅具有精神意义,而且可持续的商品的需求日益增长,例如无残忍仪式蜡烛或环保香。这种转变使品牌能够同时吸引传统用户和环保意识的消费者,从而释放出更高的价格潜力。精神产品与健康和保健实践的结合也增强了产品的相关性。

随着祈祷和冥想等精神工具因其对心理健康的益处而日益受到青睐,它们被定位为健康必需品,而不是纯粹的宗教物品。这种转变反映了信仰与商业的交融,将象征性物品转化为生活风格产品。市场正在超越宗教界限,服务更广泛关注个人成长、正念和自我关怀的人群。数位化的可及性和精神产品的个人化进一步扩大了其覆盖范围,吸引了新一代追求购物意义和便利性的消费者。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 55亿美元 |

| 预测值 | 157亿美元 |

| 复合年增长率 | 11.4% |

2024年,文物及配件市场产值达19亿美元,预计到2034年将以10.1%的复合年增长率成长。诸如圣物、念珠和神像等产品具有强大的文化价值,是不同传统宗教信仰中不可或缺的一部分。它们在个人崇拜和礼仪礼品中的频繁使用,使得城乡地区的需求保持稳定。这些物品还可以客製化、适应不同地区并进行创意设计,使製造商能够灵活地满足不同的精神偏好和美学品味。

2024年,个人消费市场规模达27亿美元,占49.1%。个人消费者持续购买精神类产品,用于个人仪式、冥想练习和正念修行。精神自我关怀的兴起拓展了产品的相关性,尤其是在寻求情绪健康和日常平衡的年轻消费者群体中。线上购物平台和行动应用程式的便利性提升了产品的可近性,用户无需依赖传统零售或机构中介,即可直接探索和购买。香、配件,甚至数位精神内容等产品都根据个人用途进行客製化,提供舒适感、个人化体验和情感共鸣。

2024年,美国宗教及精神产品市场价值达12.3亿美元,预计2025年至2034年期间的复合年增长率将达到10.4%。美国凭藉其浓厚的宗教氛围和高度的个人精神活动参与度,仍然是最具影响力的市场之一。这种环境支撑了对礼仪用品、精神文学和生活方式配件的需求。宗教自由和机构支持也使得美国市场在文化和政治层面上仍有利于基于信仰的商业活动。精神生活与身心健康的融合进一步刺激了消费。数位商务平台增强了可近性,为不同年龄层和信仰体系的消费者提供了更广泛的覆盖范围和更个人化的购物体验。

影响全球宗教和精神产品市场的关键参与者包括 Divine Hindu、Pujahome、Brown Living、Powerfulhand.com、Rudra India、Indo Divine Spiritual Solutions Pvt. Ltd.、Stuller, Inc.、Mysore Deep Perfumery House、Rgyan Shop、Namoh Indiya、Bolsius International BV、Delsbo Cant、Shuan True宗教和精神产品市场的领导品牌正在透过多样化的产品线扩大其影响力,这些产品线既满足传统信仰习俗,也满足现代健康习惯。许多公司专注于环保製造,提供可生物降解、无残忍且符合道德规范的产品,以吸引价值驱动的消费者。客製化选项和特定区域的设计正在实现更深层的消费者联繫。公司也正在利用数位管道,创造沉浸式电子商务体验和行动应用程序,以简化客户旅程。与精神影响者和健康平台的策略合作正在帮助品牌扩大知名度。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业影响力量

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区和产品类型

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 波特的分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034 年

- 主要趋势

- 文物及配件

- 礼仪用品

- 数位产品

- 教科书

- 其他的

第六章:市场估计与预测:依最终用途,2021-2034 年

- 主要趋势

- 个人

- 宗教机构

- 其他的

第七章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 公司网站

- 电子商务网站

- 离线

- 宗教书店

- 礼品店

- 专卖店

- 其他的

第八章:市场估计与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第九章:公司简介

- Bolsius International BV

- Brown Living

- Delsbo Candle AB

- Divine Hindu

- Indo Divine Spiritual Solutions Pvt. Ltd.

- Mysore Deep Perfumery House

- Namoh Indiya

- Powerfulhand.com

- Prajjwal International

- Pujahome

- Rgyan Shop

- Rudra India

- Shubhkart

- Sounds True Inc.

- Stuller, Inc.

The Global Religious and Spiritual Products Market was valued at USD 5.5 billion in 2024 and is estimated to grow at a CAGR of 11.4% to reach USD 15.7 billion by 2034. Market expansion is being fueled by a blend of evolving spiritual practices and the rise of ethical consumerism, where buyers are seeking products that resonate with their values. There's increasing demand for goods that are not only spiritually meaningful but also sustainable, such as cruelty-free ritual candles or environmentally conscious incense. This shift enables brands to appeal to both traditional users and conscious consumers, unlocking premium price potential. The alignment of spiritual products with health and wellness practices is also enhancing product relevance.

As spiritual tools like prayer and meditation gain traction for their mental health benefits, they're being positioned as wellness essentials rather than strictly religious items. This transition reflects how belief and commerce intersect, turning symbolic artifacts into lifestyle products. The market is moving beyond religious boundaries to serve a broader demographic interested in personal growth, mindfulness, and self-care. Digital accessibility and the personalization of spiritual products further increase their reach, attracting a new generation of consumers seeking both meaning and convenience in their purchases.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.5 billion |

| Forecast Value | $15.7 billion |

| CAGR | 11.4% |

In 2024, the artifacts and accessories segment generated USD 1.9 billion and is expected to grow at a CAGR of 10.1% through 2034. Products such as sacred symbols, prayer beads, and idols carry strong cultural value and are integral to spiritual routines across diverse traditions. Their frequent use in both personal worship and ceremonial gifting keeps demand steady across urban and rural regions alike. These items also allow for customization, regional adaptation, and creative design, giving manufacturers the flexibility to cater to various spiritual preferences and aesthetic tastes.

The individual segment generated USD 2.7 billion and accounted for 49.1% share in 2024. Individuals consistently purchase spiritual products for their personal rituals, meditation practices, and mindfulness routines. The growth of spiritual self-care has broadened product relevance, especially among younger consumers seeking emotional well-being and daily balance. The convenience of online shopping platforms and mobile applications has enhanced accessibility, allowing users to explore and buy directly without relying on traditional retail or institutional intermediaries. Items like incense, accessories, and even digital spiritual content are being tailored for personal use, offering comfort, personalization, and emotional resonance.

United States Religious and Spiritual Products Market was valued at USD 1.23 billion in 2024 and is projected to grow at a CAGR of 10.4% between 2025 and 2034. The U.S. remains one of the most influential markets due to its strong religious landscape and high level of individual engagement in spiritual activities. This environment supports demand for ceremonial goods, spiritual literature, and lifestyle-based accessories. Religious freedom and institutional support also contribute to a market that remains culturally and politically favorable for faith-based commerce. The integration of spirituality with wellness and mental health routines further fuels consumption. Digital commerce platforms have enhanced accessibility, enabling broader outreach and more personalized shopping experiences for consumers across age groups and belief systems.

Key players influencing the Global Religious and Spiritual Products Market include Divine Hindu, Pujahome, Brown Living, Powerfulhand.com, Rudra India, Indo Divine Spiritual Solutions Pvt. Ltd., Stuller, Inc., Mysore Deep Perfumery House, Rgyan Shop, Namoh Indiya, Bolsius International BV, Delsbo Candle AB, Shubhkart, Sounds True Inc., and Prajjwal International. Leading brands in the religious and spiritual products market are expanding their footprint through diversified product lines that cater to both traditional faith practices and modern wellness routines. Many companies are focusing on eco-conscious manufacturing, offering biodegradable, cruelty-free, and ethically sourced goods to attract value-driven consumers. Customization options and region-specific designs are enabling deeper consumer connection. Firms are also leveraging digital channels, creating immersive e-commerce experiences and mobile apps that streamline the customer journey. Strategic collaborations with spiritual influencers and wellness platforms are helping brands expand their visibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 End use

- 2.2.3 Distribution channel

- 2.2.4 Regional

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region and product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 -2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Artifacts and accessories

- 5.3 Ceremonial items

- 5.4 Digital products

- 5.5 Textbooks

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By End Use, 2021 -2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Individual

- 6.3 Religious institutions

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021 -2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Online

- 7.2.1 Company website

- 7.2.2 E-commerce website

- 7.3 Offline

- 7.3.1 Religious bookstores

- 7.3.2 Gift shops

- 7.3.3 Specialty stores

- 7.3.4 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 -2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 U.K.

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 Saudi Arabia

- 8.6.3 South Africa

Chapter 9 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 9.1 Bolsius International BV

- 9.2 Brown Living

- 9.3 Delsbo Candle AB

- 9.4 Divine Hindu

- 9.5 Indo Divine Spiritual Solutions Pvt. Ltd.

- 9.6 Mysore Deep Perfumery House

- 9.7 Namoh Indiya

- 9.8 Powerfulhand.com

- 9.9 Prajjwal International

- 9.10 Pujahome

- 9.11 Rgyan Shop

- 9.12 Rudra India

- 9.13 Shubhkart

- 9.14 Sounds True Inc.

- 9.15 Stuller, Inc.