|

市场调查报告书

商品编码

1822562

古董及收藏品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Antiques and Collectibles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

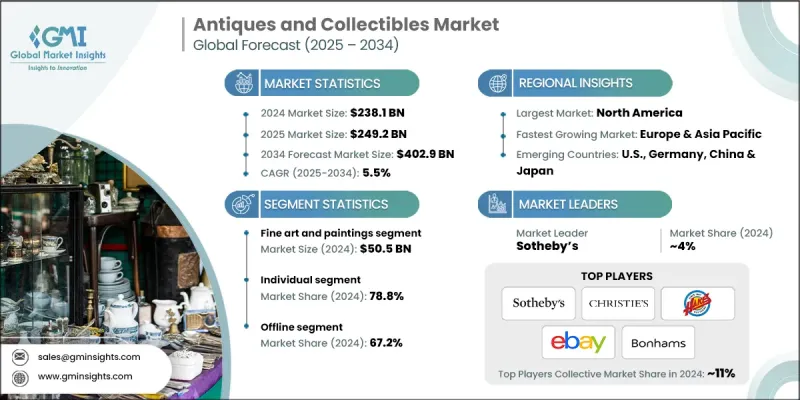

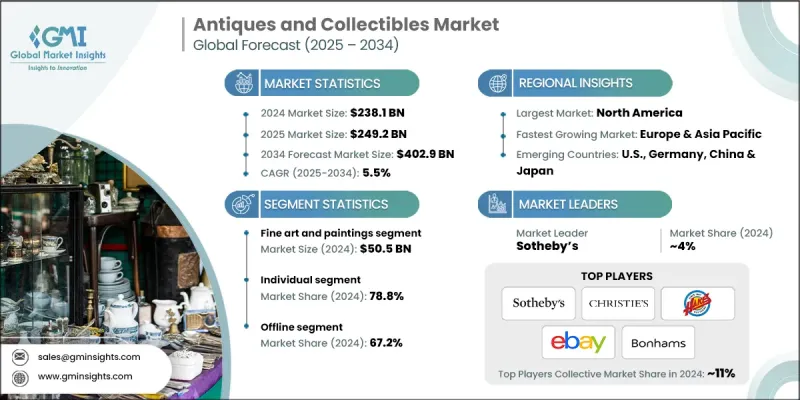

根据 Global Market Insights, Inc. 发布的最新报告,古董和收藏品市场在 2024 年的价值为 2,381 亿美元,预计将从 2025 年的 2,492 亿美元增长到 2034 年的 4029 亿美元,复合年增长率为 5.5%。

怀旧和復古产品的復苏、数位拍卖网站的扩张,以及人们对非传统投资(例如艺术品、稀有玩具、纪念品和古代文物)日益增长的兴趣,共同推动了市场的成长。成熟收藏家和新一代收藏家都在线上线下推动市场需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2381亿美元 |

| 预测值 | 4029亿美元 |

| 复合年增长率 | 5.5% |

关键驱动因素:

1.另类投资日益普及:在市场不稳定时期,收藏品、艺术品和古董产品越来越被视为一种价值储存手段。

2.拍卖数位化:行动应用程式和网路平台扩大了全球收藏品的取得管道。

3.名人和流行文化的吸引力日益增强:与标誌性人物、电影和品牌相关的收藏品仍然吸引着大批买家。

4.千禧世代和 Z 世代参与度上升:年轻一代正在收藏诸如 Pokemon 卡、黑胶唱片和 90 年代纪念品等收藏品。

关键参与者:

- 2024年古董和收藏品领域的主要参与者包括佳士得、苏富比、Heritage Auctions、eBay、邦瀚斯和Hakes Auctions。这六家公司合计占据约11%的市场。

主要挑战:

- 真实性和出处问题:假冒风险仍然是主要的威慑因素(尤其是对于高端和数位收藏品)。

- 价格不确定性:价值可能会根据趋势或经济变化而波动,这可能会阻碍消费者(尤其是那些规避风险的消费者)的购买。

1. 按产品类别 - 美术和绘画占据最大市场份额

2024年,纯艺术和绘画占据了市场的最大份额,知名艺术家创作的传统和当代艺术(包括原创作品)的拍卖价格均有所上涨。知名艺术家的原创作品吸引了「高净值」收藏家和机构买家的青睐。

2. 依最终用途划分-个人买家引领市场

个人买家是 2024 年最大的终端用户群体,他们根据个人兴趣、怀旧情绪或在房地产销售、古董展览或网路上购买。

3. 按配销通路-线下通路仍重要

线下管道,无论是透过传统拍卖行、古董展销会、画廊或房地产拍卖,在2024年仍将占据最大的市场份额,成为最大的市场。即使电子商务的使用日益普及,对物品进行实物检查、验证物品是否与描述相符以及进行现场竞价的能力仍然吸引了众多认真的收藏家和投资者。

4. 按地区划分-北美引领全球需求

2022 年,北美在古董和收藏品领域处于领先地位。古董被明确视为文化的一部分,并且拥有丰富的拍卖基础设施和全国成熟的二级市场。

2024年,北美引领古董和收藏品市场,其拍卖行业发展成熟,拥有众多高净值个人收藏家,而体育纪念品、漫画书和流行文化纪念品的收藏热潮也推动了这一市场的发展。美国尤其在实体房地产销售和线上拍卖方面表现强劲,人们对经过认证和评级的收藏品的兴趣也日益浓厚。

收藏品和古董产业的主要参与者有苏富比、佳士得国际、邦瀚斯、Heritage Auctions、RR Auction、Skinner、Invaluable、Julien's Auctions、Lelands、PWCC Marketplace、BiddingForGood、ComicLink、Hake's Americana & Collectibles、The Upperions、Funks、Goldens、Hake's American Upperons、The Upperions、Funks、Hersr、Golders、Mr.

目前,主要参与者正在大力投资NFT的普及、数位化和全球扩张,以利用不断变化的消费者偏好。苏富比和佳士得增加了线上拍卖的数量。此外,eBay和PWCC Marketplace正在为分级收藏品建立基于人工智慧的鑑定工具。孩之宝和Funko正在推动授权合作,以满足流行文化带来的市场需求。同样,其他拍卖行,例如RR Auction和邦瀚斯,也在开发精简的实体-数位混合竞价解决方案,为全球收藏家提供参与式、便捷的体验。这些策略与收藏品经济数位化和民主化的趋势一致。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 对艺术和历史的兴趣日益浓厚

- 文化和历史魅力

- 潜在古董和收藏品的投资

- 可支配所得增加

- 产业陷阱与挑战

- 身份验证和出处问题

- 监管和法律挑战

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品类别

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品类别,2021 - 2034 年

- 主要趋势

- 美术和绘画

- 古董家具和装饰艺术

- 金属製品及雕塑

- 珠宝和手錶

- 收藏玩具和游戏

- 书籍、手稿和纸张的短暂性

- 硬币、货币和钱币学

- 体育纪念品和交易卡

- 乐器及音讯装置

- 其他(汽车和交通收藏品)

第六章:市场估计与预测:依价格区间,2021 - 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第七章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 个人

- 商业的

- 博物馆

- 机构

- 其他的

第 8 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 在线的

- 专用古董平台

- 电子商务平台

- 离线

- 传统拍卖行

- 实体经销商

- 古董展览会

- 房地产销售和清算

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 印尼

- 马来西亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十章:公司简介

- BiddingForGood

- Bonhams

- Christie's International

- ComicLink

- eBay

- Funko

- Golden Auctions

- Hake's Americana & Collectibles

- Hasbro

- Heritage Auctions

- Invaluable

- Julien's Auctions

- Lelands

- PWCC Marketplace

- RR Auction

- Skinner

- Sotheby's

- Stanley Gibbons Group

- The Upper Deck Company

The antiques and collectibles market was valued at USD 238.1 billion in 2024 and is projected to grow from USD 249.2 billion in 2025 to USD 402.9 billion by 2034, at a CAGR of 5.5%, according to the latest report published by Global Market Insights, Inc.

The market growth is supported by a resurgence in nostalgic and vintage products, the expansion of digital auction sites, and increasing interest in non-traditional investments, such as fine art, rare toys, memorabilia, and ancient artifacts. Both mature collectors and the newer generations are fueling demand both online and offline.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $238.1 Billion |

| Forecast Value | $402.9 Billion |

| CAGR | 5.5% |

Key Drivers:

1. Increasing popularity of alternative investments: Collectibles, art, and vintage products are increasingly perceived as a store of value during market instability.

2. Auction digitalization: Mobile apps and internet platforms have expanded access to collectibles worldwide.

3. Growing Appeal of celebrity and pop culture: Collectibles with links to iconic figures, movies, and brands are still attracting big bids.

4. Rise in millennial and Gen Z engagement: Younger generations are adopting collectibles like Pokemon cards, vinyl records, and 90s memorabilia.

Key Players:

- The major players in the antiques and collectibles sector in 2024 are Christie's, Sotheby's, Heritage Auctions, eBay, Bonhams, and Hakes Auctions. In total, these six players have an estimated market share of ~11%.

Key Challenges:

- Authenticity and provenance concerns: Counterfeit risks remain a chief deterrent (especially for high-end and digital collectibles).

- Price uncertainty: Value can fluctuate based on trends or economic changes, which can discourage purchases for consumers (especially those who are risk-averse).

1. By Product Category - Fine Art & Paintings captures the Largest market share

Fine art and paintings took up the largest part of the market in 2024, with an increase in auction prices for both traditional and contemporary art (including original pieces) being made by known artists. Original pieces by recognised artists create demand by 'high net worth' collectors and institutional buyers alike.

2. By End Use - Individual Buyers Lead the Market

Individual buyers made up the largest group of end users in 2024 and bought based on personal interest, nostalgia, or investment value at estate sales, antique shows or on the internet.

3. By Distribution Channel - Offline Channels Remain Important

Offline channels, whether delivered through traditional auction houses, antique fairs, galleries, or estate sales, continued as the largest in 2024, by capturing the largest share of the market. The capacity to physically examine the item, or verify if the item is as described, and live bidding still brings serious collectors and investors to the table, even with the increasing use of e-commerce.

4. By Region - North America Leads Global Demand

North America was the leader in antiques and collectibles in 2022. Antiques are clearly recognized as a part of culture, and there is an abundant infrastructure for auctions and a nationwide established secondary market in place.

North America led the antiques and collectibles market in 2024, with an established auction industry and high-net-worth individual collectors, which was also driven by interest in sports memorabilia, comic books, and pop culture memorabilia. The U.S. specifically experiences strong activity in both in-person estate sales and online auctions, with increasing interest in certified and graded collectibles.

Major players in the collectibles and antiques industry are Sotheby's, Christie's International, Bonhams, Heritage Auctions, RR Auction, Skinner, Invaluable, Julien's Auctions, Lelands, PWCC Marketplace, BiddingForGood, ComicLink, Hake's Americana & Collectibles, The Upper Deck Company, Funko, Golden Auctions, Hasbro, Stanley Gibbons Group, and eBay.

Key players are now making significant investments in NFT adoption, digitalization, and global expansion to capitalize on evolving consumer preferences. Sotheby's and Christie's have boosted the number of online auctions. In addition, eBay and PWCC Marketplace are building AI-based authentication tools for graded collectibles. Hasbro and Funko are moving towards licensing collaborations to meet the market demand spun from pop culture. Likewise, other auction houses, such as RR Auction and Bonhams, are also developing streamlined physical-digital hybrid bidding solutions for participatory, accessible experiences for global collectors. These strategies are consistent with the observed increase in digitization and democratisation of the collectibles economy.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product category

- 2.2.3 Price range

- 2.2.4 End use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing interest in art and history

- 3.2.1.2 Cultural and historical appeal

- 3.2.1.3 Investment of potential antiques and collectibles

- 3.2.1.4 Rising disposable income

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Authentication and provenance issues

- 3.2.2.2 Regulatory and legal challenges

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Product category

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Category, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Fine art and paintings

- 5.3 Antique furniture and decorative arts

- 5.4 Metalwork and sculpture

- 5.5 Jewelry and watches

- 5.6 Collectible toys and games

- 5.7 Books, manuscripts, and paper ephemeral

- 5.8 Coins, currency, and numismatics

- 5.9 Sports memorabilia and trading cards

- 5.10 Musical instruments and audio equipment

- 5.11 Others (automotive and transportation collectibles)

Chapter 6 Market Estimates & Forecast, By Price range, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Individual

- 7.3 Commercial

- 7.3.1 Museum

- 7.3.2 Institutions

- 7.3.3 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 Dedicated antique platforms

- 8.2.2 E-commerce platforms

- 8.3 Offline

- 8.3.1 Traditional auction houses

- 8.3.2 Brick-and-mortar dealers

- 8.3.3 Antique fairs and shows

- 8.3.4 Estate sales and liquidations

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Indonesia

- 9.4.7 Malaysia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 BiddingForGood

- 10.2 Bonhams

- 10.3 Christie’s International

- 10.4 ComicLink

- 10.5 eBay

- 10.6 Funko

- 10.7 Golden Auctions

- 10.8 Hake’s Americana & Collectibles

- 10.9 Hasbro

- 10.10 Heritage Auctions

- 10.11 Invaluable

- 10.12 Julien's Auctions

- 10.13 Lelands

- 10.14 PWCC Marketplace

- 10.15 RR Auction

- 10.16 Skinner

- 10.17 Sotheby's

- 10.18 Stanley Gibbons Group

- 10.19 The Upper Deck Company