|

市场调查报告书

商品编码

1801840

燕麦片市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Oat Flakes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

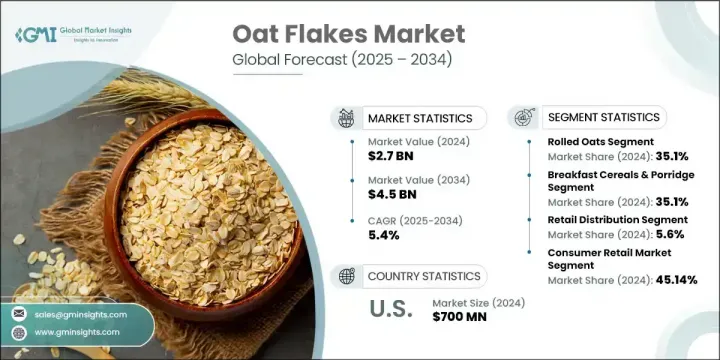

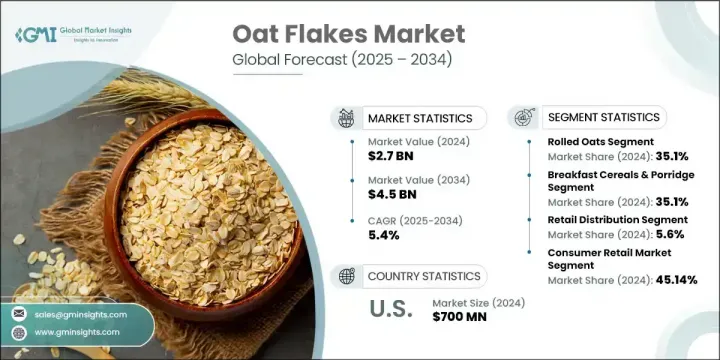

2024年,全球燕麦片市场规模达27亿美元,预计复合年增长率为5.4%,到2034年将达45亿美元。燕麦片是透过蒸、碾压和压扁整粒燕麦粒製成的。这些燕麦片已成为广受欢迎的早餐主食,也是各种包装和烘焙食品中的功能性配料。消费者对健康的日益重视是推动该市场成长的重要因素。燕麦片富含膳食纤维、必需矿物质和维生素,深受注重健康的人士的青睐,他们正在寻找健康便捷的正餐或零食替代品。

产品创新在塑造产业发展中发挥关键作用。许多顶级品牌正在丰富其产品线,包括即溶燕麦片、风味燕麦片以及营养丰富的配方,以满足忙碌的生活方式和多样化的饮食需求。无论是用于热早餐、冰沙碗还是烘焙食谱,燕麦片的便捷使用帮助其成为全球家庭的首选产品。北美在全球市场占据主导地位,这得益于其强大的消费者认知度、根深蒂固的早餐文化以及广泛普及的优质燕麦产品。该地区先进的零售网路和强劲的国内燕麦产量也促进了持续的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 27亿美元 |

| 预测值 | 45亿美元 |

| 复合年增长率 | 5.4% |

2024年,燕麦片市场占有35.1%的份额,预计到2034年复合年增长率将达到5.5%。燕麦片的广泛吸引力源于适度的烹饪时间和丰富的营养价值之间的平衡。消费者青睐燕麦片,是因为它们拥有熟悉的口感,并且用途广泛,从早餐碗到烘焙食品,应有尽有。燕麦片相对较低的加工程度确保了其关键营养成分的保留,从而巩固了其在註重健康的消费者群体中的地位。

从应用角度来看,早餐谷物和粥类产品在2024年占据了35.1%的市场份额,预计到2034年将以5.5%的复合年增长率成长。人们越来越倾向于早餐时食用高纤维、有益心臟健康的膳食,这增加了燕麦的消费量。燕麦在控制胆固醇和提供持久能量方面的作用已得到认可,使其成为注重营养开启一天的消费者的首选。此外,烘焙和包装食品行业的需求也在增长,燕麦片越来越多地用于改善鬆饼、饼干和麵包等食品的口感和营养成分。

2024年,美国燕麦片市场产值达7亿美元。美国市场的成长轨迹得益于人们健康意识的提升、人们对植物性和无麸质饮食的兴趣日益浓厚,以及强劲的国内供应。当地燕麦种植的改善和高效的生产运作也是关键因素。美国消费者对具有功能性健康益处(例如改善消化和心臟健康)的产品的需求持续增长,这与燕麦片的营养成分非常契合。

塑造全球燕麦片市场的公司包括 Richardson International Limited、Great River Organic Milling、McCann's Irish Oatmeal、Blue Lake Milling、Kellogg Company、Grain Millers Inc.、Nature's Path Foods、Jordans Dorset Ryvita、Flahavan's、百事公司(桂格燕麦)、Mornflake、Honing Foods) Products、Avena Foods Limited、Cream Hill Estates、General Mills Inc.、Country Choice Organic、Gluten Free Oats LLC、Bob's Red Mill Natural Foods 和 Hamlyns of Scotland。燕麦片行业的公司正优先考虑创新、永续性和市场细分,以扩大其影响力。其主要策略之一是推出多样化的产品线——从有机和无麸质燕麦片到调味和即食燕麦片——以满足不断变化的消费者偏好。许多企业正在投资先进的加工技术,以保留营养成分,同时改善口感和质地。品牌和包装也发挥着至关重要的作用,企业努力突出清洁标籤和健康声明。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 燕麦片(老式燕麦)

- 普通燕麦片

- 有机燕麦片

- 调味燕麦片

- 快熟燕麦(速食燕麦)

- 标准速食燕麦

- 有机速食燕麦

- 强化速食燕麦

- 即溶燕麦

- 原味即溶燕麦

- 调味即溶燕麦

- 优质即溶燕麦

- 钢切燕麦(爱尔兰燕麦)

- 传统钢切割

- 速煮钢切

- 有机钢切燕麦

- 特色优质燕麦片

- 古代谷物混合物

- 经认证的无麸质燕麦

- 遗产和传家宝品种

第六章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 早餐麦片和粥

- 热早餐麦片

- 冷早餐应用

- 隔夜燕麦和准备好的燕麦

- 烘焙和食品製造

- 居家烘焙应用

- 商业食品製造

- 工业食品加工

- 饮料和冰沙

- 冰沙和奶昔应用

- 植物奶替代品

- 功能性饮料

- 零食和能量棒

- 格兰诺拉麦片和能量棒

- 零食混合料和干果混合料

- 饼干和薯片

- 婴儿食品和婴儿营养

- 婴儿谷类产品

- 幼儿和儿童营养

第七章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 零售分销

- 超市和大卖场

- 健康食品和专卖店

- 便利商店

- 线上和电子商务

- 各大电商平台

- 直接面向消费者的管道

- 行动商务

- 食品服务分销

- 餐厅和咖啡馆销售

- 机构餐饮服务

- 饭店和旅游业

- 批发和 B2B 分销

- 食品分销商

- 工商销售

第八章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 消费性零售市场

- 家庭消费

- 注重健康的消费者

- 家庭和儿童市场

- 老年人和老年消费者

- 食品製造业

- 早餐麦片製造商

- 烘焙食品生产商

- 休閒食品公司

- 婴儿食品製造商

- 食品服务业

- 餐厅及咖啡馆经营者

- 机构餐饮服务

- 餐饮和活动服务

- 保健食品服务

- 工业应用

- 原料供应业

- 营养补充品製造

- 动物饲料业

- 出口和国际贸易

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- PepsiCo Inc. (Quaker Oats)

- Kellogg Company

- General Mills Inc.

- Bob's Red Mill Natural Foods

- Nature's Path Foods

- Arrowhead Mills (Hain Celestial Group)

- Country Choice Organic

- Grain Millers Inc.

- Richardson International Limited

- Avena Foods Limited

- Blue Lake Milling

- Gluten Free Oats LLC

- Morning Foods Limited

- Mornflake

- Hamlyns of Scotland

- Jordans Dorset Ryvita

- Flahavan's

- Honeyville Food Products

- Great River Organic Milling

- Hodgson Mill

- McCann's Irish Oatmeal

- Cream Hill Estates

The Global Oat Flakes Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 4.5 billion by 2034. Oat flakes are produced by steaming, rolling, and flattening whole oat groats. These flakes have become a popular breakfast staple and functional ingredient in various packaged and baked food products. The rising emphasis on health and wellness among consumers is a significant factor fueling the growth of this market. Known for being rich in fiber, essential minerals, and vitamins, oat flakes appeal to health-conscious individuals seeking wholesome and convenient meal or snack alternatives.

Product innovation is playing a key role in shaping industry. Many top brands are diversifying their offerings to include instant oats, flavored options, and nutrient-enriched formulations designed for busy lifestyles and varied dietary needs. Their ease of use-whether in a hot breakfast, smoothie bowl, or a baking recipe-has helped establish oat flakes as a go-to product across global households. North America holds the dominant share in the global market, supported by strong consumer awareness, a well-established breakfast culture, and widespread access to high-quality oat-based products. The region's advanced retail networks and robust domestic oat production also contribute to consistent demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $4.5 Billion |

| CAGR | 5.4% |

The rolled oats segment held 35.1% share in 2024 and is forecasted to grow at a CAGR of 5.5% by 2034. Their widespread appeal stems from a balance between moderate cook times and strong nutritional value. Consumers gravitate toward these oats for their familiar texture and versatility across recipes ranging from breakfast bowls to baked goods. Their relatively lower processing level ensures they retain key nutrients, which strengthens their position among health-minded buyers.

In terms of application, the breakfast cereals and porridge segment held 35.1% share in 2024, and is expected to grow at a CAGR of 5.5% through 2034. The growing preference for high-fiber, heart-healthy meals in the morning has increased the consumption of oats in this category. Their recognized role in managing cholesterol and providing long-lasting energy makes them a top choice for consumers prioritizing nutritious starts to the day. Additionally, demand is growing within the baking and packaged food industry, where oat flakes are increasingly used to improve texture and nutritional content in items such as muffins, cookies, and breads.

United States Oat Flakes Market generated USD 700 million in 2024. The market's growth trajectory in the US is supported by a mix of rising health awareness, growing interest in plant-based and gluten-free diets, and strong domestic supply. Improvements in local oat cultivation and efficient manufacturing operations are also key contributors. Consumers in the US are showing consistent demand for products that offer functional health benefits like improved digestion and heart health, which aligns well with oat flakes' nutritional profile.

Companies shaping the Global Oat Flakes Market include Richardson International Limited, Great River Organic Milling, McCann's Irish Oatmeal, Blue Lake Milling, Kellogg Company, Grain Millers Inc., Nature's Path Foods, Jordans Dorset Ryvita, Flahavan's, PepsiCo Inc. (Quaker Oats), Mornflake, Morning Foods Limited, Arrowhead Mills (Hain Celestial Group), Hodgson Mill, Honeyville Food Products, Avena Foods Limited, Cream Hill Estates, General Mills Inc., Country Choice Organic, Gluten Free Oats LLC, Bob's Red Mill Natural Foods, and Hamlyns of Scotland. Companies operating in the oat flakes sector are prioritizing innovation, sustainability, and market segmentation to expand their presence. One of the primary strategies is the launch of diverse product lines-ranging from organic and gluten-free variants to flavored and ready-to-cook oat flakes-to cater to evolving consumer preferences. Many players are investing in advanced processing techniques that retain nutritional content while improving taste and texture. Branding and packaging also play a critical role, with efforts aimed at highlighting clean labels and health claims.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Application

- 2.2.3 Distribution channel

- 2.2.4 End use industry

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Million & Tons)

- 5.1 Key trends

- 5.2 Rolled oats (old-fashioned oats)

- 5.2.1 Regular rolled oats

- 5.2.2 Organic rolled oats

- 5.2.3 Flavored rolled oats

- 5.3 Quick oats (quick-cooking oats)

- 5.3.1 Standard quick oats

- 5.3.2 Organic quick oats

- 5.3.3 Fortified quick oats

- 5.4 Instant oats

- 5.4.1 Plain instant oats

- 5.4.2 Flavored instant oats

- 5.4.3 Premium instant oats

- 5.5 Steel-cut oats (irish oats)

- 5.5.1 Traditional steel-cut

- 5.5.2 Quick-cooking steel-cut

- 5.5.3 Organic steel-cut oats

- 5.6 Specialty and premium oat flakes

- 5.6.1 Ancient grain blends

- 5.6.2 Gluten-free certified oats

- 5.6.3 Heritage and heirloom varieties

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Tons)

- 6.1 Key trends

- 6.2 Breakfast cereals & porridge

- 6.2.1 Hot breakfast cereals

- 6.2.2 Cold breakfast applications

- 6.2.3 Overnight and prepared oats

- 6.3 Baking and food manufacturing

- 6.3.1 Home baking applications

- 6.3.2 Commercial food manufacturing

- 6.3.3 Industrial food processing

- 6.4 Beverages and smoothies

- 6.4.1 Smoothie and shake applications

- 6.4.2 Plant-based milk alternatives

- 6.4.3 Functional beverages

- 6.5 Snack foods and bars

- 6.5.1 Granola and energy bars

- 6.5.2 Snack mixes and trail mixes

- 6.5.3 Crackers and chips

- 6.6 Baby food and infant nutrition

- 6.6.1 Infant cereal products

- 6.6.2 Toddler and child nutrition

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Million & Tons)

- 7.1 Key trends

- 7.2 Retail distribution

- 7.2.1 Supermarkets and hypermarkets

- 7.2.2 Health food and specialty stores

- 7.2.3 Convenience stores

- 7.3 Online and e-commerce

- 7.3.1 Major e-commerce platforms

- 7.3.2 Direct-to-consumer channels

- 7.3.3 Mobile commerce

- 7.4 Food service distribution

- 7.4.1 Restaurant and cafe sales

- 7.4.2 Institutional food service

- 7.4.3 Hospitality and tourism

- 7.5 Wholesale and b2b distribution

- 7.5.1 Food distributors

- 7.5.2 Industrial and commercial sales

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Million & Tons)

- 8.1 Key trends

- 8.2 Consumer retail market

- 8.2.1 Household consumption

- 8.2.2 Health-conscious consumers

- 8.2.3 Family and children's market

- 8.2.4 Senior and elderly consumers

- 8.3 Food manufacturing industry

- 8.3.1 Breakfast cereal manufacturers

- 8.3.2 Baked goods producers

- 8.3.3 Snack food companies

- 8.3.4 Baby food manufacturers

- 8.4 Food service industry

- 8.4.1 Restaurant and cafe operators

- 8.4.2 Institutional food service

- 8.4.3 Catering and event services

- 8.4.4 Healthcare food service

- 8.5 Industrial applications

- 8.5.1 Ingredient supply industry

- 8.5.2 Nutritional supplement manufacturing

- 8.5.3 Animal feed industry

- 8.5.4 Export and international trade

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 PepsiCo Inc. (Quaker Oats)

- 10.2 Kellogg Company

- 10.3 General Mills Inc.

- 10.4 Bob's Red Mill Natural Foods

- 10.5 Nature's Path Foods

- 10.6 Arrowhead Mills (Hain Celestial Group)

- 10.7 Country Choice Organic

- 10.8 Grain Millers Inc.

- 10.9 Richardson International Limited

- 10.10 Avena Foods Limited

- 10.11 Blue Lake Milling

- 10.12 Gluten Free Oats LLC

- 10.13 Morning Foods Limited

- 10.14 Mornflake

- 10.15 Hamlyns of Scotland

- 10.16 Jordans Dorset Ryvita

- 10.17 Flahavan's

- 10.18 Honeyville Food Products

- 10.19 Great River Organic Milling

- 10.20 Hodgson Mill

- 10.21 McCann's Irish Oatmeal

- 10.22 Cream Hill Estates