|

市场调查报告书

商品编码

1801841

水泥基灌浆料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cementitious Grouts Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

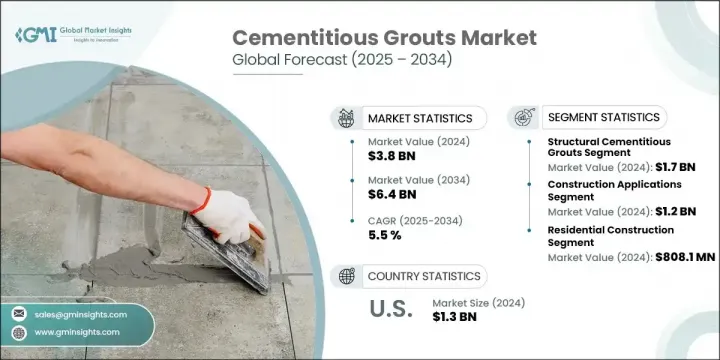

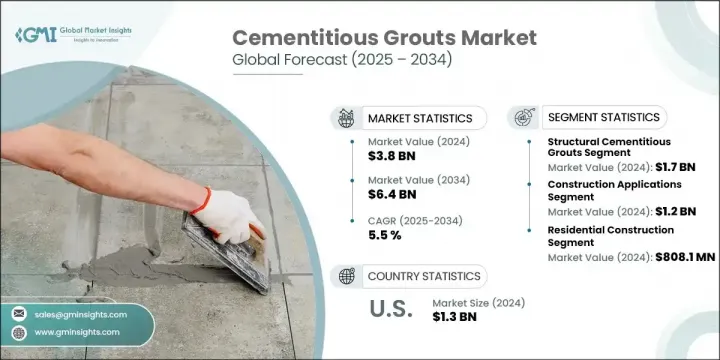

2024年,全球水泥基灌浆料市场规模达38亿美元,预估年复合成长率为5.5%,2034年将达64亿美元。由于其在基础设施加固、隧道施工、岩土稳定和先进建筑应用领域的应用日益广泛,该市场正在经历稳健成长。东欧、亚太和中东等发展中地区的投资正在加剧对工程水泥基材料的需求。

结构级灌浆料因其抗压强度和尺寸稳定性,尤其是在大型基础设施中,仍然是最常用的材料。然而,随着性能化建筑在全球范围内成为优先事项,市场上对耐化学腐蚀材料以及速凝或收缩补偿水泥基灌浆料的需求日益增长,尤其是在抗震加固和隧道应用中。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 38亿美元 |

| 预测值 | 64亿美元 |

| 复合年增长率 | 5.5% |

地质复杂性也促使传统水泥浆转向微细水泥浆,后者占据了10%的市场。这些高性能产品在土壤固结和细裂缝修復方面的需求日益增长,尤其是在需要精确渗透和基材黏结的岩土工程应用中。聚合物改质和混合水泥浆进一步吸引了市场的兴趣,这些产品对长期耐久性、流动性和极端环境条件下的耐受性至关重要,这支持了向先进且适应性强的建筑材料发展的趋势。

2024年,结构水泥基灌浆料市场规模达17亿美元,由于其在土木工程和基础建设领域的强劲应用,继续保持主导地位。这些材料尤其适用于桥樑轴承、底板和预製组件等荷载关键型应用。其高抗压强度、抗重载能力和尺寸稳定性使其成为公共基础设施和交通项目的首选材料。亚太地区基础建设发展迅速,中国和印度等国家做出了巨大贡献,这推动了对水泥基灌浆料的需求,尤其是在地铁系统和高速公路项目方面。

2024 年,水泥基灌浆料市场占有 38% 的份额。它们广泛应用于钢筋锚定、高层结构和预製系统,这是因为需要能够承受高负荷并在各种气候条件下发挥作用的材料,这反映了结构灌浆料在现代建筑技术和高性能混凝土设计中的重要作用。

美国水泥基灌浆料市场占82%的市场份额,2024年产值达13亿美元。这一主导地位得益于持续的基础设施更新计划、透过联邦项目扩大的公共资金投入以及日益转向可持续建筑材料的趋势。美国市场尤其受到桥樑、隧道、预製件黏结和土壤稳定领域对高性能灌浆料需求的驱动。这些应用需要高强度、低渗透性和强耐化学性的灌浆料解决方案,尤其是在要求严苛的土木工程环境中。

全球水泥基灌浆料市场的领导者包括豪瑞集团(拉法基豪瑞)、马贝集团、西卡集团、富斯罗克国际有限公司和巴斯夫集团。为了扩大在水泥基灌浆料领域的影响力,主要企业正采取投资研发等策略,开发先进的灌浆料配方,以提高机械性能和耐久性。企业正专注于低收缩、速凝和环保的灌浆料,以适应不断发展的建筑标准。扩大高成长地区的产能并与区域经销商建立策略伙伴关係,也有助于企业挖掘在地化需求。此外,企业优先考虑绿色建筑认证和合规性,以满足永续发展项目资助的基础设施项目的需求,确保其在公共和私营建筑领域得到更广泛的应用。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 基础设施发展与现代化

- 建筑业需求不断增长

- 隧道和采矿扩建

- 永续性和环境法规

- 产业陷阱与挑战

- 初期投资成本高

- 技术专长要求

- 原物料价格波动

- 市场机会

- 新兴市场渗透

- 绿建筑与永续建筑

- 先进材料创新

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 结构水泥基灌浆料

- 高性能结构灌浆料

- 标准结构灌浆

- 速凝结构灌浆料

- 非结构性水泥基灌浆料

- 通用灌浆料

- 空隙填充灌浆料

- 密封和防水灌浆

- 特种水泥基灌浆料

- 超高性能灌浆料

- 海洋和近海灌浆

- 耐高温灌浆料

- 耐化学腐蚀灌浆料

- 微细水泥灌浆料

- 混合和改性灌浆

- 聚合物改质灌浆料

- 纤维增强灌浆料

- 矿物掺合料增强灌浆料

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 建筑应用

- 地基和底板灌浆

- 锚栓安装

- 预製构件连接

- 结构修復和修復

- 采矿和隧道施工

- 地基加固稳定

- 进水控制

- 岩体加固

- 竖井和隧道衬砌

- 基础设施项目

- 桥樑建设与维修

- 水坝和水库应用

- 公路和交通基础设施

- 公用设施和管道项目

- 船舶和近海应用

- 港口和港湾建设

- 离岸风力涡轮机安装

- 水下结构修復

- 工业应用

- 设备基础灌浆

- 地板和路面应用

- 化工厂和设施建设

- 岩土工程应用

- 土壤稳定

- 地基改良

- 边坡稳定

第七章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 住宅建筑

- 单户住宅

- 多户住宅

- 翻新和改造

- 商业建筑

- 办公大楼

- 零售和购物中心

- 饭店和娱乐

- 工业建筑

- 生产设施

- 仓库和配送中心

- 发电设施

- 基础设施和土木工程

- 交通基础设施

- 水和废水处理

- 能源基础设施

- 采矿和采矿业

- 采煤

- 金属和矿物开采

- 石油和天然气业务

- 海洋和近海工业

- 船舶建造和修理

- 海上能源项目

- 港口和码头开发

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Sika AG

- MAPEI SpA

- BASF SE (Master Builders Solutions)

- Fosroc International Limited

- Euclid Chemical Company

- LafargeHolcim (Holcim Group)

- CEMEX SAB de CV

- CRH plc

- HeidelbergCement AG

- Arkema Group

- UltraTech Cement Limited

- Perma Construction Aids Pvt. Ltd.

- Saint-Gobain Weber

- Ambuja Cements Limited

The Global Cementitious Grouts Market was valued at USD 3.8 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 6.4 billion by 2034. The market is experiencing solid growth due to increased use in infrastructure reinforcement, tunneling operations, geotechnical stabilization, and advanced construction applications. Investments across developing regions such as Eastern Europe, Asia-Pacific, and the Middle East are intensifying the demand for engineered cementitious materials.

Structural-grade grouts remain the most used due to their compressive strength and dimensional stability, particularly in large-scale infrastructure. However, the market is witnessing growing traction for chemical-resistant variants and rapid-set or shrinkage-compensated cementitious grouts, particularly in seismic retrofitting and tunnel applications, as performance-based construction becomes a priority globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 5.5% |

Geological complexities are also contributing to the shift from conventional cement grouts to microfine cement grouts, which hold a 10% share. These high-performance products are gaining demand in soil consolidation and fine crack remediation, especially in geotechnical applications that require precise penetration and substrate bonding. Polymer-modified and blended grouts are further capturing market interest where long-term durability, flowability, and resistance in extreme environmental conditions are essential, supporting the trend toward advanced and adaptable construction materials.

The structural cementitious grouts segment was worth USD 1.7 billion in 2024, maintaining dominance due to its strong uptake in civil and infrastructure construction. These materials are particularly used in load-critical applications like bridge bearings, base plates, and precast assemblies. Their high compressive strength, resistance to heavy dynamic loads, and dimensional stability make them the preferred choice in public infrastructure and transport projects. The fast-paced infrastructure development across Asia-Pacific, with countries like China and India contributing significantly, is driving up the demand, particularly for metro systems and expressway projects.

The cementitious grouts segment held 38% share in 2024. Their widespread use in reinforcement anchoring, high-rise structures, and precast systems is due to the demand for materials that can endure high loads and perform in varied climatic conditions, reflecting the critical role of structural grouts in modern construction techniques and high-performance concrete design.

US Cementitious Grouts Market held 82% share and generated USD 1.3 billion in 2024. This dominant position is supported by continual infrastructure renewal initiatives, expanded public funding through federal programs, and a growing shift toward sustainable construction materials. The market in the US is particularly driven by demand for high-performance grouts used in bridges, tunneling, precast bonding, and soil stabilization. These applications require solutions offering high strength, minimal permeability, and strong chemical resistance, particularly in demanding civil engineering environments.

The leading players in the Global Cementitious Grouts Market include Holcim Group (LafargeHolcim), MAPEI S.p.A, Sika AG, Fosroc International Limited, and BASF SE. To expand their presence in the cementitious grouts sector, key players are leveraging strategies such as investing in R&D to develop advanced grouting formulations that deliver improved mechanical performance and durability. Companies are focusing on low-shrinkage, rapid-setting, and eco-friendly grouts to align with evolving construction standards. Expanding manufacturing capacity in high-growth regions and forming strategic partnerships with regional distributors are also helping players tap into localized demand. Additionally, businesses are prioritizing certifications and compliance with green building codes to cater to infrastructure projects funded through sustainability-driven programs, ensuring broader adoption across public and private construction sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Raw Material

- 2.2.4 Application

- 2.2.5 End use industry

- 2.2.6 Production process

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Infrastructure development and modernization

- 3.2.1.2 Growing construction industry demand

- 3.2.1.3 Tunneling and mining expansion

- 3.2.1.4 Sustainability and environmental regulations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Technical expertise requirements

- 3.2.2.3 Raw material price volatility

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging market penetration

- 3.2.3.2 Green building and sustainable construction

- 3.2.3.3 Advanced material innovations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Structural Cementitious Grouts

- 5.2.1 High-Performance Structural Grouts

- 5.2.2 Standard Structural Grouts

- 5.2.3 Rapid-Setting Structural Grouts

- 5.3 Non-Structural Cementitious Grouts

- 5.3.1 General Purpose Grouts

- 5.3.2 Void Filling Grouts

- 5.3.3 Sealing and Waterproofing Grouts

- 5.4 Specialty Cementitious Grouts

- 5.4.1 Ultra-High Performance Grouts

- 5.4.2 Marine and Offshore Grouts

- 5.4.3 High-Temperature Resistant Grouts

- 5.4.4 Chemical Resistant Grouts

- 5.5 Microfine Cement Grouts

- 5.6 Blended and Modified Grouts

- 5.6.1 Polymer-Modified Grouts

- 5.6.2 Fiber-Reinforced Grouts

- 5.6.3 Mineral Admixture Enhanced Grouts

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Construction applications

- 6.2.1 Foundation and base plate grouting

- 6.2.2 Anchor bolt installation

- 6.2.3 Precast element connections

- 6.2.4 Structural repairs and rehabilitation

- 6.3 Mining and tunneling

- 6.3.1 Ground consolidation and stabilization

- 6.3.2 Water ingress control

- 6.3.3 Rock mass reinforcement

- 6.3.4 Shaft and tunnel lining

- 6.4 Infrastructure projects

- 6.4.1 Bridge construction and repair

- 6.4.2 Dam and reservoir applications

- 6.4.3 Highway and transportation infrastructure

- 6.4.4 Utility and pipeline projects

- 6.5 Marine and offshore applications

- 6.5.1 Port and harbor construction

- 6.5.2 Offshore wind turbine installations

- 6.5.3 Underwater structural repairs

- 6.6 Industrial applications

- 6.6.1 Equipment foundation grouting

- 6.6.2 Floor and pavement applications

- 6.6.3 Chemical plant and facility construction

- 6.7 Geotechnical applications

- 6.7.1 Soil stabilization

- 6.7.2 Ground improvement

- 6.7.3 Slope stabilization

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Residential construction

- 7.2.1 Single-family housing

- 7.2.2 Multi-family housing

- 7.2.3 Renovation and remodeling

- 7.3 Commercial construction

- 7.3.1 Office buildings

- 7.3.2 Retail and shopping centers

- 7.3.3 Hospitality and entertainment

- 7.4 Industrial construction

- 7.4.1 Manufacturing facilities

- 7.4.2 Warehouses and distribution centers

- 7.4.3 Power generation facilities

- 7.5 Infrastructure and civil engineering

- 7.5.1 Transportation infrastructure

- 7.5.2 Water and wastewater treatment

- 7.5.3 Energy infrastructure

- 7.6 Mining and extractive industries

- 7.6.1 Coal mining

- 7.6.2 Metal and mineral extraction

- 7.6.3 Oil and gas operations

- 7.7 Marine and offshore industries

- 7.7.1 Shipbuilding and repair

- 7.7.2 Offshore energy projects

- 7.7.3 Port and terminal development

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Sika AG

- 9.2 MAPEI S.p.A

- 9.3 BASF SE (Master Builders Solutions)

- 9.4 Fosroc International Limited

- 9.5 Euclid Chemical Company

- 9.6 LafargeHolcim (Holcim Group)

- 9.7 CEMEX S.A.B. de C.V.

- 9.8 CRH plc

- 9.9 HeidelbergCement AG

- 9.10 Arkema Group

- 9.11 UltraTech Cement Limited

- 9.12 Perma Construction Aids Pvt. Ltd.

- 9.13 Saint-Gobain Weber

- 9.14 Ambuja Cements Limited