|

市场调查报告书

商品编码

1801864

灌浆与锚固市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Grouts and Anchors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

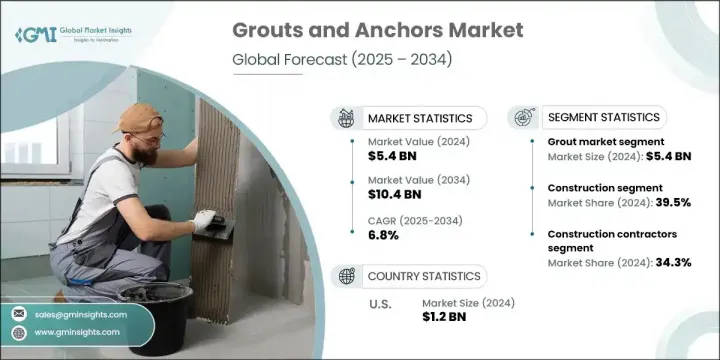

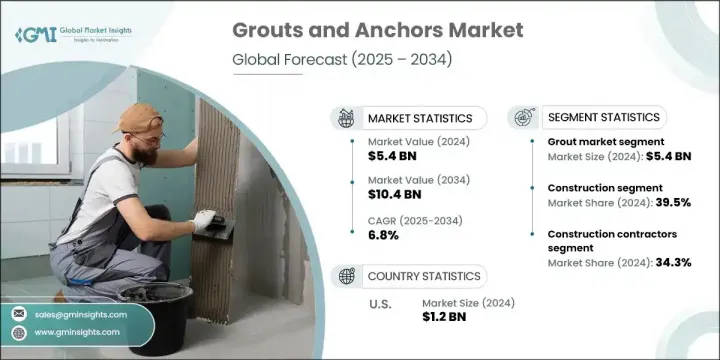

2024年,全球灌浆料和锚固材料市场价值为54亿美元,预计到2034年将以6.8%的复合年增长率成长,达到104亿美元。市场扩张与城镇化进程加快、建筑活动激增以及对基础设施韧性的日益重视密切相关。灌浆料和锚固材料是确保结构完整性的重要材料,它们能够稳定地基、固定装置并填补现代建筑和改造项目中的空隙。这些部件是商业建筑、桥樑、隧道等民用基础设施安全和使用寿命的基础。

随着全球对住宅、商业和公共基础设施的投资加速,对高性能耐用建筑材料的需求也日益增长。人们对技术先进且易于应用的锚固和灌浆解决方案的日益青睐也正在塑造该行业的发展。此外,无论是在已开发经济体还是新兴经济体,对不断演变的建筑规范和安全法规的合规要求也持续推动市场的发展动能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 54亿美元 |

| 预测值 | 104亿美元 |

| 复合年增长率 | 6.8% |

2024年,灌浆料占据了54.3%的市场份额,占据主导地位。这类材料被广泛用于稳定结构、填充空腔和改善荷载分布。灌浆料以其强度和适应性而闻名,对于结构修復、地基加固以及对耐久性和精度要求极高的施工任务至关重要。其长期可靠性使其成为小型维修和大型基础设施专案的首选解决方案。

由于全球对住宅、工业和商业开发项目的需求持续增长,建筑业在2024年的市占率为39.5%。由于建筑商追求更持久耐用、符合规范的建筑,他们正在转向高品质的灌浆和锚固产品,以满足性能和安全方面的期望。向永续建筑材料的转变也在加强先进灌浆和锚固产品在现代建筑实践中的应用。

美国灌浆和锚固市场占88.7%的市场份额,2024年产值达12亿美元。这一领先地位源于全国范围内对基础设施升级和新建项目的大规模投资。正在进行的联邦基础设施计划持续推动对可靠的灌浆和锚固材料的需求,这些材料具有强度高、使用寿命长和更强的韧性。随着基础设施老化和气候适应能力变得至关重要,建筑商持续寻求能够满足不断变化的结构需求的高性能产品。

影响全球灌浆和锚固市场的关键参与者包括喜利得股份公司 (Hilti AG)、马贝股份公司 (MAPEI SpA)、西卡股份公司 (Sika AG)、巴斯夫股份公司 (BASF SE) 和富斯乐国际 (Fosroc International)。为了巩固市场地位,灌浆和锚固领域的领先公司正专注于多项策略措施。这些措施包括扩大研发规模,开发固化时间更快、耐久性更高、永续性更强的创新材料。许多公司正在投资产品客製化和先进的化学配方,以满足特定建筑应用的需求。策略性合併、区域合作和收购也是扩大地域覆盖范围的常用方法。此外,各公司也强调对承包商的培训计划,以促进产品采用并确保其正确应用,同时整合数位工具,提供精准的配方建议和专案规划。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 转向永续建筑

- 采用混合和智慧技术

- 注射黏合剂锚引领成长

- 产业陷阱与挑战

- 原物料供应不稳定

- 监理合规压力

- 市场机会

- 模组化和预製建筑的兴起

- 客製化和特色产品

- 与建筑技术公司合作

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 粗粮市场

- 水泥基灌浆料

- 环氧灌浆料

- 化学灌浆

- 其他灌浆类型

- 聚氨酯灌浆料

- 丙烯酸灌浆

- 锚市场

- 机械锚

- 化学锚栓

- 黏接锚栓

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 建造

- 住宅

- 商业的

- 工业的

- 基础设施

- 运输

- 桥樑和高速公路

- 隧道和地下

- 铁路基础设施

- 机场建设

- 实用工具

- 水和废水

- 发电

- 电信

- 能源基础设施

- 运输

- 海洋和近海

- 港口和港湾建设

- 海上平台

- 海岸保护

- 船舶维修保养

- 采矿和地下应用

- 矿井支护系统

- 地下开挖

- 隧道稳定

- 地基改良

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 建筑承包商

- 总承包商

- 专业承包商

- 基础设施开发商

- 工业最终用途

- 分销商和零售商

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- MEA 其余地区

第九章:公司简介

- Arkema Group (via Bostik)

- BASF SE (Master Builders Solutions)

- Fosroc International Limited

- HB Fuller Company

- Henkel AG & Co. KGaA (Loctite brand)

- Hilti AG

- Laticrete International

- MAPEI SpA

- Saint-Gobain Weber

- Sika AG

- Stanley Black & Decker

- Wurth Group

The Global Grouts and Anchors Market was valued at USD 5.4 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 10.4 billion by 2034. Market expansion is strongly tied to increased urbanization, a surge in construction activity, and the growing emphasis on infrastructure resilience. Grouts and anchors are essential materials that ensure structural integrity by stabilizing foundations, securing fixtures, and filling gaps across both modern construction and retrofitting projects. These components are foundational to the safety and longevity of civil infrastructure, including commercial buildings, bridges, tunnels, and more.

As global investments in residential, commercial, and public infrastructure accelerate, so does the demand for high-performance and durable construction materials. The growing preference for technologically advanced and easy-to-apply anchoring and grouting solutions is also shaping the industry. Additionally, the push for compliance with evolving building codes and safety regulations continues to drive market momentum across both developed and emerging economies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.4 Billion |

| Forecast Value | $10.4 Billion |

| CAGR | 6.8% |

The grouts segment dominated with a 54.3% market share in 2024, as these materials are widely used to stabilize structures, fill cavities, and improve load distribution. Known for their strength and adaptability, grouts are essential for structural rehabilitation, foundation reinforcements, and demanding construction tasks requiring durability and precision. Their long-term reliability makes them the go-to solution in both small-scale repairs and large-scale infrastructure projects.

The construction segment held a 39.5% share in 2024, owing to constant global demand for residential, industrial, and commercial developments. As builders aim for longer-lasting, code-compliant buildings, they are turning to high-quality grouting and anchoring products to meet performance and safety expectations. The shift toward sustainable construction materials is also playing a role in reinforcing the use of advanced grouts and anchors in modern building practices.

U.S. Grouts and Anchors Market held an 88.7% share and generated USD 1.2 billion in 2024. This leadership position stems from large-scale investments in infrastructure upgrades and new construction across the country. Ongoing federal infrastructure initiatives are sustaining the demand for reliable grouting and anchoring materials that offer strength, longevity, and improved resilience. As infrastructure ages and climate resilience becomes critical, builders continue to seek high-performance products that align with evolving structural demands.

Key players shaping the Global Grouts and Anchors Market include Hilti AG, MAPEI S.p.A., Sika AG, BASF SE, and Fosroc International. To strengthen their market position, leading companies in the grouts and anchors space are focusing on several strategic initiatives. These include expanding R&D to develop innovative materials with faster curing times, higher durability, and sustainability features. Many are investing in product customization and advanced chemical formulations to meet the needs of specific construction applications. Strategic mergers, regional partnerships, and acquisitions are also common approaches to widen their geographical footprint. Furthermore, companies are emphasizing on training programs for contractors to boost product adoption and ensure proper application, while integrating digital tools for precise formulation recommendations and project planning.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Application

- 2.2.4 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Shift toward sustainable construction

- 3.2.1.2 Adoption of hybrid and smart technologies

- 3.2.1.3 Injectable adhesive anchors leading growth

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Raw material supply instability

- 3.2.2.2 Regulatory compliance pressure

- 3.2.3 Market opportunities

- 3.2.3.1 Rise in modular and prefabricated construction

- 3.2.3.2 Customization and specialty products

- 3.2.3.3 Collaboration with construction technology firms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Grouts market

- 5.2.1 Cementitious grouts

- 5.2.2 Epoxy grouts

- 5.2.3 Chemical grouts

- 5.2.4 Other grout types

- 5.2.4.1 Polyurethane grouts

- 5.2.4.2 Acrylic grouts

- 5.3 Anchors market

- 5.3.1 Mechanical anchors

- 5.3.2 Chemical anchors

- 5.3.3 Adhesive anchors

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Construction

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 Infrastructure

- 6.3.1 Transportation

- 6.3.1.1 Bridges and highways

- 6.3.1.2 Tunnels and underground

- 6.3.1.3 Railway infrastructure

- 6.3.1.4 Airport construction

- 6.3.2 Utilities

- 6.3.2.1 Water and wastewater

- 6.3.2.2 Power generation

- 6.3.2.3 Telecommunications

- 6.3.2.4 Energy infrastructure

- 6.3.1 Transportation

- 6.4 Marine and offshore

- 6.4.1 Port and harbor construction

- 6.4.2 Offshore platforms

- 6.4.3 Coastal protection

- 6.4.4 Marine repair and maintenance

- 6.5 Mining and underground applications

- 6.5.1 Mine support systems

- 6.5.2 Underground excavation

- 6.5.3 Tunnel stabilization

- 6.5.4 Ground improvement

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Construction Contractors

- 7.2.1 General Contractors

- 7.2.2 Specialty Contractors

- 7.3 Infrastructure Developers

- 7.4 Industrial End Use

- 7.5 Distributors and Retailers

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of MEA

Chapter 9 Company Profiles

- 9.1 Arkema Group (via Bostik)

- 9.2 BASF SE (Master Builders Solutions)

- 9.3 Fosroc International Limited

- 9.4 H.B. Fuller Company

- 9.5 Henkel AG & Co. KGaA (Loctite brand)

- 9.6 Hilti AG

- 9.7 Laticrete International

- 9.8 MAPEI S.p.A.

- 9.9 Saint-Gobain Weber

- 9.10 Sika AG

- 9.11 Stanley Black & Decker

- 9.12 Wurth Group