|

市场调查报告书

商品编码

1801844

製药机器人市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Pharmaceutical Robots Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

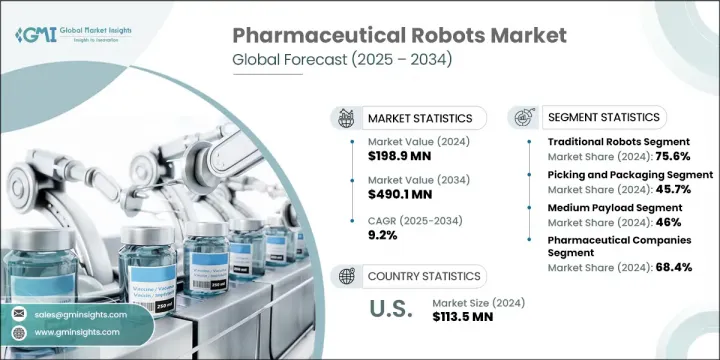

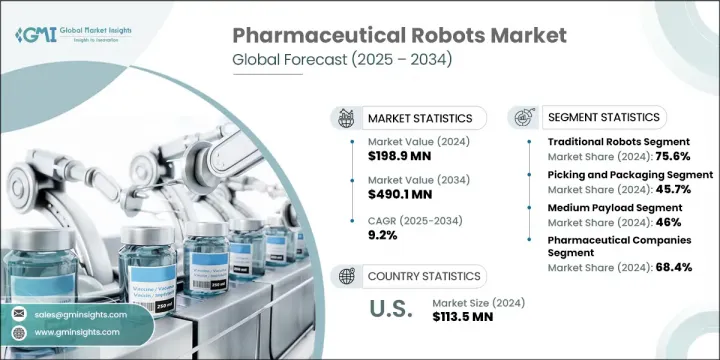

2024年,全球製药机器人市场规模达1.989亿美元,预计年复合成长率将达9.2%,到2034年将达到4.901亿美元。强劲成长的动力源自于製药生产流程自动化程度的提高、研发投入的增加以及协作机器人在药品生产设施中应用的不断扩展。製药机器人的应用范围十分广泛,包括药物检测、无尘室应用和生产工作流程。

协作机器人系统日益普及,主要原因在于增强工作场所安全性、解决劳动力短缺问题以及提高无菌配製和其他复杂製药流程效率的需求。同时,新一代疗法的显着进步和不断增加的研发投入,促使製药公司加速其营运自动化。这促进了对可扩展性、安全性和始终如一的精度的机器人系统的需求。行业创新与政府支持相结合,为製药机器人的广泛应用奠定了基础,进一步推动了该行业的自动化趋势。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.989亿美元 |

| 预测值 | 4.901亿美元 |

| 复合年增长率 | 9.2% |

2024年,传统机器人市场占据75.6%的份额,这得益于其在高端製造环境中无与伦比的精度、速度和效率。其中,关节型机器人系统因其在物料搬运和包装等操作中的多功能性而广泛应用。其灵活的有效载荷能力和高效率使其适用于各种製药应用。产业领导者正积极拓展这些机器人的应用范围,以满足製药製造的需求。

2024年,拣选和包装应用领域占了45.7%的份额。随着製药製造商寻求紧凑、节省空间、能够简化操作的解决方案,包装功能对机器人系统的需求持续成长。这些系统还能透过优化工作空间利用率来提高效率。各公司正在与自动化解决方案提供者合作,开发客製化系统,以满足不断变化的药品生产需求。重点仍然是加快包装工作流程并提高整个生产设施的营运产出。

2024年,美国製药机器人市场规模达1.135亿美元。辉瑞、艾伯维、强生和百时美施贵宝等大型製药公司的参与对推动这一成长发挥着至关重要的作用。美国企业也在投资,透过机器人技术和数位转型实现供应链现代化,以提高透明度和营运效率,同时最大限度地降低成本。这种对效率的关注正在推动全国製药生产线对机器人系统的需求。

製药机器人市场的主要参与者包括 FANUC、OMRON AUTOMATION、EPSON、UNIVERSAL ROBOTS、STAUBLI、ABB、MITSUBISHI ELECTRIC、DENSO WAVE、YASKAWA、KAWASAKI Robotics 和 KUKA。製药机器人市场的顶尖公司正在优先考虑自动化进步和智慧製造集成,以巩固其市场地位。他们正在投资研发具有增强安全性和精度的协作机器人,以满足製药业的特定要求。公司正在扩大其产品组合,以支持无尘室标准和无菌环境。与製药商建立策略合作伙伴关係可以共同开发用于包装、物料处理和药物配方的客製化解决方案。供应商还利用人工智慧和机器学习来创建能够适应复杂流程的智慧机器人系统。此外,正在加强全球扩张和售后服务网络,以确保客户支援和长期可靠性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 製药製造业对自动化的需求不断成长

- 增加医药研发投资和生产量

- 机器人系统的技术进步

- 製药生产设施中协作机器人的采用激增

- 产业陷阱与挑战

- 初期投资及维护成本高

- 缺乏在自动化部门工作的技术人员

- 市场机会

- 机器人技术中的人工智慧和机器学习的融合

- 新兴市场的扩张

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 技术进步

- 当前的技术趋势

- 新兴技术

- 价值链分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 2024年定价分析

- 市场演变与历史背景

- 波特的分析

- PESTEL分析

- 未来市场趋势

- 差距分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 传统机器人

- 关节型机器人

- SCARA机器人

- Delta/并联机器人

- 笛卡儿机器人

- 双臂机器人

- 协作机器人

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 挑选和包装

- 药品检验

- 实验室应用

- 其他应用

第七章:市场估计与预测:按有效载荷,2021 - 2034 年

- 主要趋势

- 低(最多 5 公斤)

- 中型(6-15公斤)

- 高(超过15公斤)

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 製药公司

- 研究实验室

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- ABB

- DENSO WAVE

- EPSON

- FANUC

- KAWASAKI Robotics

- KUKA

- MITSUBISHI ELECTRIC

- OMRON AUTOMATION

- STAUBLI

- UNIVERSAL ROBOTS

- YASKAWA

The Global Pharmaceutical Robots Market was valued at USD 198.9 million in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 490.1 million by 2034. This robust growth is being fueled by increasing automation across pharmaceutical manufacturing processes, heightened investments in R&D, and the expanding use of collaborative robotics within drug production facilities. Pharmaceutical robots are being utilized across a broad range of functions, including drug testing, cleanroom applications, and production workflows.

The rising adoption of collaborative robotic systems is primarily driven by the need for enhanced workplace safety, solutions to address labor shortages, and efficiency in sterile compounding and other complex pharmaceutical processes. At the same time, significant advancements in next-generation therapies and increasing R&D investments are prompting pharmaceutical companies to accelerate the automation of their operations. This is fostering demand for robotics systems that offer scalability, safety, and consistent precision. Industry innovation combined with government support is laying the foundation for widespread adoption of pharmaceutical robots, further advancing the automation trend within the sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $198.9 Million |

| Forecast Value | $490.1 Million |

| CAGR | 9.2% |

In 2024, the traditional robots segment held a 75.6% share, driven by their unmatched accuracy, speed, and effectiveness in high-end manufacturing environments. Among these, articulated robotic systems are widely deployed due to their versatility in operations such as material handling and packaging. Their flexible payload capacities and efficiency make them suitable for diverse pharmaceutical applications. Leading industry players are actively working to expand the application scope of these robots to serve pharmaceutical manufacturing needs.

The picking and packaging application segment held a 45.7% share in 2024. The demand for robotic systems in packaging functions continues to grow as pharma manufacturers seek compact, space-saving solutions that can streamline operations. These systems also improve efficiency by optimizing workspace utilization. Companies are partnering with automation solution providers to develop customized systems that align with evolving pharmaceutical production demands. The focus remains on speeding up packaging workflows and enhancing operational output across production facilities.

United States Pharmaceutical Robots Market was valued at USD 113.5 million in 2024. The presence of major pharmaceutical players such as Pfizer, AbbVie, Johnson & Johnson, and Bristol Myers Squibb plays a crucial role in fueling this growth. U.S.-based firms are also investing in modernizing their supply chains through robotics and digital transformation to improve transparency and operational efficiency while minimizing costs. This focus on efficiency is boosting the demand for robotic systems across pharmaceutical production lines nationwide.

Key market participants in the Pharmaceutical Robots Market include FANUC, OMRON AUTOMATION, EPSON, UNIVERSAL ROBOTS, STAUBLI, ABB, MITSUBISHI ELECTRIC, DENSO WAVE, YASKAWA, KAWASAKI Robotics, and KUKA. Top companies in the pharmaceutical robots market are prioritizing automation advancements and smart manufacturing integration to solidify their market foothold. They are investing in R&D to develop collaborative robots with enhanced safety features and precision, tailored to pharmaceutical-specific requirements. Companies are expanding their product portfolios to support cleanroom standards and sterile environments. Strategic partnerships with pharma manufacturers enable co-development of customized solutions for packaging, material handling, and drug formulation. Vendors are also leveraging AI and machine learning to create intelligent robotic systems capable of adapting to complex processes. In addition, global expansion and after-sales service networks are being strengthened to ensure customer support and long-term reliability.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Application trends

- 2.2.4 Payload trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for automation in pharmaceutical manufacturing

- 3.2.1.2 Increasing pharmaceutical research and development investments and production volumes

- 3.2.1.3 Technological advancements in robotic systems

- 3.2.1.4 Surging adoption of collaborative robots in pharma manufacturing facilities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment and maintenance

- 3.2.2.2 Lack of skilled personnel to work in automated units

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and machine learning in robotics

- 3.2.3.2 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Value chain analysis

- 3.7 Pharmaceutical robots market in terms of Volume (Units), 2021 -2034

- 3.7.1 Global

- 3.7.2 North America

- 3.7.3 Europe

- 3.7.4 Asia Pacific

- 3.7.5 Latin America

- 3.7.6 MEA

- 3.8 Pricing analysis, 2024

- 3.9 Market evolution and historical context

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Future market trends

- 3.13 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 MEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Traditional robots

- 5.2.1 Articulated robots

- 5.2.2 SCARA robots

- 5.2.3 Delta/Parallel robots

- 5.2.4 Cartesian robots

- 5.2.5 Dual-arm robots

- 5.3 Collaborative robots

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Picking and packaging

- 6.3 Pharmaceutical drugs inspection

- 6.4 Laboratory applications

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By Payload, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Low (Upto 5 kg)

- 7.3 Medium (6-15 kg)

- 7.4 High (more than 15 kg)

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical companies

- 8.3 Research laboratories

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 DENSO WAVE

- 10.3 EPSON

- 10.4 FANUC

- 10.5 KAWASAKI Robotics

- 10.6 KUKA

- 10.7 MITSUBISHI ELECTRIC

- 10.8 OMRON AUTOMATION

- 10.9 STAUBLI

- 10.10 UNIVERSAL ROBOTS

- 10.11 YASKAWA