|

市场调查报告书

商品编码

1801905

混凝土铺路设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Concrete Paving Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

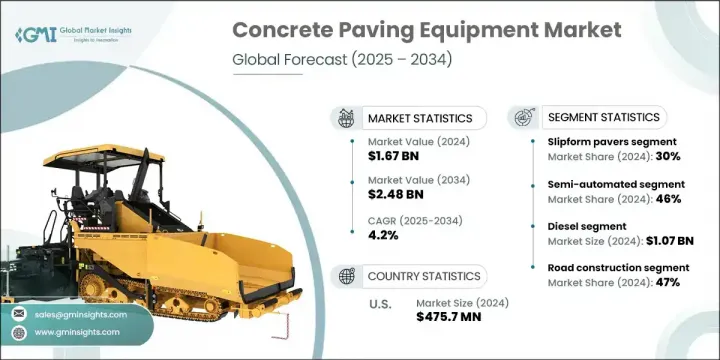

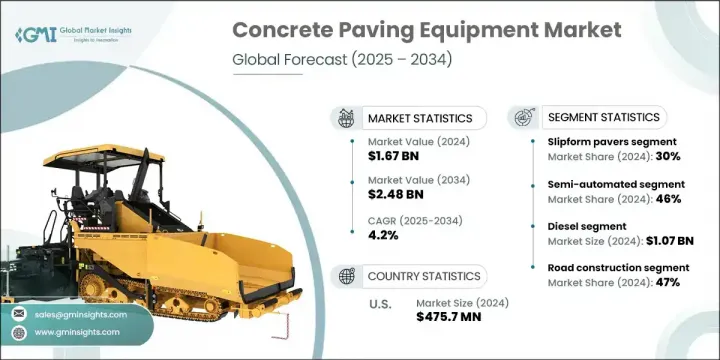

2024 年全球混凝土铺路设备市场价值为 16.7 亿美元,预计到 2034 年将以 4.2% 的复合年增长率增长至 24.8 亿美元。这一稳步增长归因于全球基础设施建设的持续势头,尤其是道路、高速公路、桥樑和机场建设。城市化进程的激增推动了基础设施投资,尤其是在新兴经济体,这些国家的政府正在优先考虑交通升级,以缓解交通拥堵并支持经济扩张。对高精度道路工程和长期耐用性的日益重视,使得人们更加依赖现代铺路设备。混凝土铺路系统也正在快速向自动化转变,製造商将人工智慧、GPS 和远端资讯处理整合到机器中,以提高铺路精度和营运效率。由机器学习支援的预测性维护系统可透过最大限度地减少停机时间和优化现场性能,正在获得广泛应用。

滑模摊舖机市场在2024年占据了30%的市场份额,预计到2034年将以5%的复合年增长率成长。这些机器无需预装侧模即可连续浇筑混凝土,是大规模应用的理想选择。随着企业寻求提高大型基础设施施工的速度和路面质量,市场对此类高性能机械的需求正在不断增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 16.7亿美元 |

| 预测值 | 24.8亿美元 |

| 复合年增长率 | 4.2% |

2024年,半自动铺路机市场占据了46%的市场份额,预计到2034年将成长4%。这些机器融合了手动控制和自动导航系统,确保更精准地分配和完成物料。感测器辅助液压系统和GPS导航转向等先进技术使这些设备更加高效、经济,并在性能和操作灵活性之间取得平衡。

美国混凝土摊舖设备市场占85%的市场份额,2024年市场规模达4.757亿美元。联邦政府大力支持基础设施振兴,这持续加速了现代摊舖系统的普及。政府的主要政策强调整合诸如自动机械导航 (AMG) 等技术,该技术利用卫星定位技术实现更佳的坡度控制、摊舖均匀性和材料利用率。美国对自动化的重视以及持续的联邦政府资金投入,使其始终处于行业领先地位。

全球混凝土摊舖设备市场的领导者包括高马科公司 (Gomaco Corporation)、Bid-well、卡特彼勒 (Caterpillar)、贝塞尔 (BESSER)、维特根集团 (Wirtgen Group)、安曼集团 (Ammann Group) 和三一集团 (SANY Group)。为了巩固市场地位,主要公司正在实施一系列策略,重点是创新、技术整合和全球扩张。製造商正在积极开发模组化和适应性强的设备,以支援大型和小型摊舖专案。与基础设施开发商的策略合作帮助他们获得了长期合约。他们还投资于智慧感测器和远端资讯处理等先进的自动化功能,以提高效率并减少对劳动力的依赖。机器控制系统和人工智慧驱动的维护工具的持续改进,正在提高正常运作时间。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 组件提供者

- 一级原始设备製造商

- 经销商/分销商

- 售后服务

- 最终用途

- 成本结构

- 利润率

- 每个阶段的增值

- 影响供应链的因素

- 破坏者

- 供应商格局

- 对部队的影响

- 成长动力

- 都市化和基础建设不断推进

- 提高现代铺路机械的进步

- 更重视道路安全与耐久性

- 新兴市场的经济扩张

- 产业陷阱与挑战

- 熟练劳动力短缺

- 原物料价格波动

- 市场机会

- 租赁服务

- 智慧自主铺路技术

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 生产统计

- 生产消费中心

- 进出口分析

- 贸易流动模式

- 技术与创新格局

- 现有技术

- 无线铺路技术占据主导地位

- 智慧控制系统的演变

- 新兴技术

- 人工智慧 (AI) 与机器学习 (ML) 集成

- 物联网 (IoT) 与连结革命

- 智慧材料与混凝土创新

- 电气化和替代动力系统

- 数位孪生与建筑资讯模型

- 创新生态系和伙伴关係

- 技术合作策略

- 创新加速机制

- 现有技术

- 专利分析

- 监管格局

- 北美洲

- 监理框架架构

- 合规成本影响

- 欧洲

- 欧盟监管协调

- 技术整合要求

- 亚太地区

- 中国的监管演变

- 区域协调努力

- 拉丁美洲

- 中东和非洲

- 北美洲

- 价格趋势

- 历史价格走势

- 主要地区价格动态

- 北美定价模式

- 亚太成本优势

- 欧洲高端定位

- 价格弹性和敏感度分析

- 价格驱动因素分析

- 未来价格预测

- 成本細項分析

- 成本明细分析

- 关键要点

- 未来市场演变

- 永续发展驱动的市场转型

- 智慧建筑生态系的演变

- 基于性能的规范革命

- 加速交付势在必行

- 情境规划与策略性应对

- 贸易流量分析

- HS编码分类框架

- 一次设备分类

- 产品和材料分类

- 全球贸易流动模式。

- 建筑业贸易概况

- 混凝土铺路设备贸易流

- 港口和物流分析

- 关税和贸易政策分析。

- 美国贸易政策框架。

- 国际贸易法规

- HS编码分类框架

- 可持续性分析

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 滑模摊舖机

- 滚筒摊舖机

- 混凝土布料机

- 批量铺路砖

第六章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 手动的

- 半自动化

- 全自动

第七章:市场估计与预测:依电源分类,2021 - 2034 年

- 主要趋势

- 柴油引擎

- 电的

- 杂交种

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 住宅建筑

- 道路建设

- 商业建筑

- 其他的

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 政府机构

- 建筑公司

- 租赁公司

第十章:市场估计与预测:按地区,2021 - 2034 年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 荷兰

- 瑞典

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 全球参与者

- Caterpillar

- CMI Roadbuilding

- 戴纳派克

- Fayat Group

- Gomaco Corporation

- JCB

- Komatsu

- Liebherr

- SANY Group

- Terex Corporation (Bid-Well)

- Volvo CE

- Wirtgen Group

- XCMG Group

- 区域参与者

- BESSER

- Guntert & Zimmerman

- HEM Paving Equipment

- Power Curbers Companies

- SCHWING Stetter

- 新兴玩家

- Aimix Group

- Curb Fox

The Global Concrete Paving Equipment Market was valued at USD 1.67 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 2.48 billion by 2034. This steady rise is attributed to ongoing momentum in global infrastructure development, particularly across the construction of roads, highways, bridges, and airports. A surge in urbanization is fueling infrastructure investments, especially in emerging economies, where governments are prioritizing transportation upgrades to reduce congestion and support economic expansion. The increased focus on high-precision roadwork and long-term durability has created greater reliance on modern paving equipment. Concrete paving systems are also seeing a rapid shift toward automation, with manufacturers integrating AI, GPS, and telematics into machines to enhance paving precision and operational efficiency. Predictive maintenance systems, supported by machine learning, are gaining ground by minimizing downtime and optimizing field performance.

The slipform pavers segment held a 30% share in 2024 and is projected to grow at a CAGR of 5% through 2034. These machines deliver continuous concrete placement without requiring pre-installed side forms, making them ideal for large-scale applications. The market is experiencing rising demand for such high-performance machinery as companies look to enhance speed and surface quality across major infrastructure jobs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.67 Billion |

| Forecast Value | $2.48 Billion |

| CAGR | 4.2% |

In 2024, the semi-automated paving machines segment captured a 46% share and is expected to grow at 4% through 2034. These machines offer a blend of manual control with automated guidance systems that ensure material is distributed and finished more accurately. Advanced technologies like sensor-assisted hydraulics and GPS-guided steering make these units more efficient and cost-effective, balancing performance with operational flexibility.

United States Concrete Paving Equipment Market held an 85% share and generated USD 475.7 million in 2024. The strong presence of federal programs supporting infrastructure revitalization continues to accelerate the adoption of modern paving systems. Key government policies are emphasizing the integration of technologies like Automatic Machine Guidance (AMG), which leverages satellite-based positioning for better grade control, paving uniformity, and material utilization. The country's preference for automation and consistent federal funding has kept it at the forefront of industry.

The leading players in the Global Concrete Paving Equipment Market include Gomaco Corporation, Bid-well, Caterpillar, BESSER, Wirtgen Group, Ammann Group, and SANY Group. To strengthen their market position, key companies are leveraging a combination of strategies that focus on innovation, technology integration, and global expansion. Manufacturers are actively developing modular and adaptable equipment that supports both large- and small-scale paving projects. Strategic collaborations with infrastructure developers are helping them secure long-term contracts. They are also investing in advanced automation features like smart sensors and telematics to increase efficiency and reduce labor dependency. Continuous improvements in machine control systems and AI-driven maintenance tools are enabling better uptime.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Data mining sources

- 1.2.1 Global

- 1.2.2 Regional/Country

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Type

- 2.2.4 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Tier 1 OEMs

- 3.1.1.4 Dealers/distributors

- 3.1.1.5 Aftermarket services

- 3.1.1.6 End use

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing urbanization and infrastructure development

- 3.2.1.2 Raising advancements in modern paving machines

- 3.2.1.3 Increasing focus on road safety and durability

- 3.2.1.4 Economic expansion in emerging markets

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Skilled Labor Shortage

- 3.2.2.2 Volatility in Raw Material Prices

- 3.2.3 Market opportunities

- 3.2.3.1 Rental & leasing services

- 3.2.3.2 Smart & autonomous paving technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Porter’s analysis

- 3.5 PESTEL analysis

- 3.6 Production statistics

- 3.6.1 Production and consumption hubs

- 3.6.2 Export and import analysis

- 3.6.3 Trade flow patterns

- 3.7 Technology & innovation landscape

- 3.7.1 Current technologies

- 3.7.1.1 Stringless paving technology dominance

- 3.7.1.2 Intelligent control systems evolution

- 3.7.2 Emerging technologies

- 3.7.2.1 Artificial intelligence (AI) and machine learning (ML) integration

- 3.7.2.2 Internet of Things (IoT) and connectivity revolution

- 3.7.2.3 Smart materials and concrete innovation

- 3.7.2.4 Electrification and alternative powertrains

- 3.7.2.5 Digital twin and building information modeling

- 3.7.3 Innovation ecosystem and partnerships

- 3.7.3.1 Technology partnership strategy

- 3.7.3.2 Innovation acceleration mechanisms

- 3.7.1 Current technologies

- 3.8 Patent analysis

- 3.9 Regulatory landscape

- 3.9.1 North America

- 3.9.1.1 Regulatory framework architecture

- 3.9.1.2 Compliance cost implications

- 3.9.2 Europe

- 3.9.2.1 EU Regulatory Harmonization

- 3.9.2.2 Technology integration requirements

- 3.9.3 Asia Pacific

- 3.9.3.1 China's regulatory evolution

- 3.9.3.2 Regional harmonization efforts

- 3.9.4 Latin America

- 3.9.5 Middle East & Africa

- 3.9.1 North America

- 3.10 Price trends

- 3.10.1 Historical price trajectory

- 3.10.2 Major regions price dynamics

- 3.10.2.1 North American pricing patterns

- 3.10.2.2 Asia-Pacific cost advantages

- 3.10.2.3 European premium positioning

- 3.10.3 Price elasticity and sensitivity analysis

- 3.10.4 Price driver analysis

- 3.10.5 Future price projection

- 3.11 Cost breakdown analysis

- 3.11.1 Analysis of the cost breakdown

- 3.11.2 Key takeaways

- 3.12 Future market evolution

- 3.12.1 Sustainability-driven market transformation

- 3.12.2 Smart construction ecosystem evolution

- 3.12.3 Performance-based specification revolution

- 3.12.4 Accelerated delivery imperatives

- 3.12.5 Scenario planning and strategic responses

- 3.13 Trade flow analysis

- 3.13.1 HS code classification framework

- 3.13.1.1 Primary equipment classifications

- 3.13.1.2 Product and material classifications

- 3.13.2 Global trade flow patterns.

- 3.13.2.1 Construction industry trade overview

- 3.13.2.2 Concrete paving equipment trade flows

- 3.13.2.3 Port and logistics analysis

- 3.13.3 Tariff and trade policy analysis.

- 3.13.3.1 U.S. trade policy framework.

- 3.13.3.2 International trade regulations

- 3.13.1 HS code classification framework

- 3.14 Sustainability analysis

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly initiatives

- 3.14.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New Product Launches

- 4.5.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Slipform pavers

- 5.3 Roller pavers

- 5.4 Concrete spreaders

- 5.5 Batch pavers

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automated

- 6.4 Fully automated

Chapter 7 Market Estimates & Forecast, By Power Source, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Diesel

- 7.3 Electric

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Residential construction

- 8.3 Road construction

- 8.4 Commercial construction

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Government agencies

- 9.3 Construction companies

- 9.4 Rental companies

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 North America

- 10.1.1 U.S.

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Belgium

- 10.2.7 Netherlands

- 10.2.8 Sweden

- 10.2.9 Russia

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 Singapore

- 10.3.6 South Korea

- 10.3.7 Vietnam

- 10.3.8 Indonesia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Caterpillar

- 11.1.2 CMI Roadbuilding

- 11.1.3 Dynapac

- 11.1.4 Fayat Group

- 11.1.5 Gomaco Corporation

- 11.1.6 JCB

- 11.1.7 Komatsu

- 11.1.8 Liebherr

- 11.1.9 SANY Group

- 11.1.10 Terex Corporation (Bid-Well)

- 11.1.11 Volvo CE

- 11.1.12 Wirtgen Group

- 11.1.13 XCMG Group

- 11.2 Regional Players

- 11.2.1 BESSER

- 11.2.2 Guntert & Zimmerman

- 11.2.3 HEM Paving Equipment

- 11.2.4 Power Curbers Companies

- 11.2.5 SCHWING Stetter

- 11.3 Emerging Players

- 11.3.1 Aimix Group

- 11.3.2 Curb Fox