|

市场调查报告书

商品编码

1801908

糖尿病护理设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Diabetes Care Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

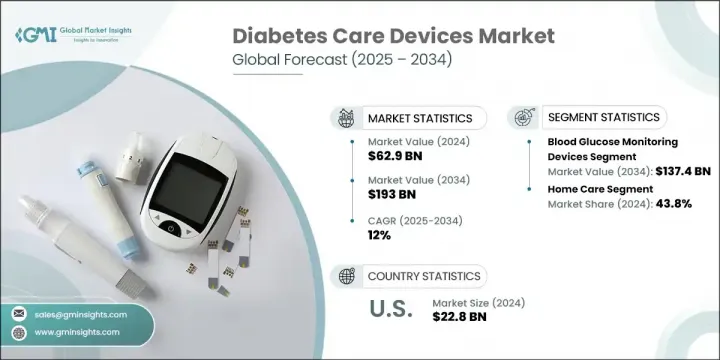

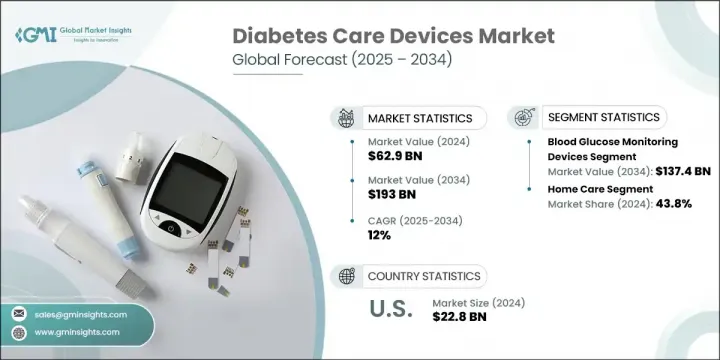

2024年,全球糖尿病护理设备市场规模达629亿美元,预计2034年将以12%的复合年增长率成长,达到1,930亿美元。这一增长主要源于全球糖尿病负担的增加、持续的技术突破以及公共和私营部门资金的增加。糖尿病照护设备是重要的医疗工具,透过有效的血糖监测和胰岛素给药,帮助患者管理糖尿病。随着全球糖尿病患者数量的持续增长,对可靠且用户友好的护理设备的需求也持续增长。

致力于降低这些工具的侵入性、提高准确性和成本效益的创新正在推动需求成长。各公司正大力投资研发,以推出能确保更舒适和疾病管理的先进设备。市场也正在向更智慧、整合的解决方案转变,这些解决方案能够提供无缝的血糖追踪和胰岛素输送,以满足日益增长的消费者期望。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 629亿美元 |

| 预测值 | 1930亿美元 |

| 复合年增长率 | 12% |

2024年,血糖监测设备市场规模达422亿美元,预计2034年将达到1,374亿美元,复合年增长率为12.7%。这些设备在医院、诊断实验室和家庭护理机构的广泛应用支撑了这一成长。动态血糖监测仪(CGM)和自我监测仪等设备提供持续更新,帮助使用者根据即时血糖资料调节生活方式、食物摄取和胰岛素给药方案。定期监测对于避免血糖水平突然飙升或下降至关重要,因为血糖水平突然下降可能导致严重的健康问题。这些工具提供全天候回馈,确保使用者在糖尿病管理方面保持主动性,并最大限度地减少长期併发症。

2024年,家庭护理市场占了43.8%的份额。居家管理糖尿病已成为许多人的一大便利,无需频繁就诊。如今,家用设备的功能已与专业设备相媲美。即时血糖趋势分析、警报和资料追踪等进阶功能可帮助患者快速、明智地决定食物摄取量、胰岛素剂量和日常习惯。居家糖尿病管理的这种日益增长的趋势,持续吸引那些寻求独立生活和提升生活品质的人。

2024年,美国糖尿病护理设备市场规模达228亿美元。强劲成长得益于糖尿病患者数量的成长以及创新糖尿病技术的快速普及。老龄化人口更容易患慢性病,进一步加剧了对高效糖尿病管理解决方案的需求。该地区市场的发展势头得益于高端医疗基础设施的普及、优惠的报销方案以及消费者对预防保健和早期诊断的认知。

影响全球糖尿病照护设备市场的关键公司包括 Tandem Diabetes Care、Becton、Dickinson and Company、Ypsomed Holding、Insulet、Sanofi、Dr. Reddy's Laboratories、Medtronic、Dexcom、Ascensia Diabetes Care、Sinocare、Platinum Equity Advisors、Abbott Company Laborator Advisors、Evo、Eunyet, 或Ekario、Equity Advisors. Nordisk、F. Hoffmann-La Roche、Bionime 和 Nova Biomedical。糖尿病护理设备市场的领导者正致力于加强产品创新和产品组合多样化,以满足用户不断变化的需求。该公司正在推出具有即时资料分析和蓝牙连接功能的智慧穿戴设备,以改善血糖追踪。与数位健康平台的策略合作有助于将资料整合到更广泛的健康生态系统中。併购也被用来扩大地理覆盖范围和获取新的客户群。持续的研发投资确保设备侵入性更小、更准确、更易于使用。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 全球糖尿病盛行率不断上升

- 糖尿病照护设备的技术进步日新月异

- 公共和私人组织增加对糖尿病护理的投资

- 产业陷阱与挑战

- 糖尿病照护设备成本高昂

- 严格的监管框架

- 市场机会

- 新兴市场的扩张

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 技术进步

- 当前的技术趋势

- 新兴技术

- 供应链和分销分析

- 报销场景

- 编码和报销

- 胰岛素输送系统的报销政策和公共医疗部门保险覆盖范围

- 我们

- 欧洲

- 2024年定价分析

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 血糖监测设备

- 自我监测血糖仪

- 连续血糖监测仪

- 测试条

- 刺血针

- 胰岛素输送装置

- 胰岛素帮浦

- 管式帮浦

- 无内胎帮浦

- 钢笔

- 可重复使用的

- 一次性的

- 笔针

- 标准

- 安全

- 注射器

- 其他胰岛素输送装置

- 胰岛素帮浦

第六章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 诊断中心

- 居家护理

- 其他最终用途

第七章:市场估计与预测:按国家/地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 荷兰

- 瑞典

- 比利时

- 丹麦

- 芬兰

- 挪威

- 立陶宛

- 拉脱维亚

- 爱沙尼亚

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- 智利

- 秘鲁

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 埃及

- 以色列

- 科威特

- 卡达

第八章:公司简介

- Abbott Laboratories

- ARKRAY

- Ascensia Diabetes Care

- B. Braun Melsungen

- Becton, Dickinson and Company

- Bionime

- DarioHealth

- Dexcom

- Dr. Reddy's Laboratories

- Eli Lilly and Company

- F. Hoffmann-La Roche

- Insulet

- Medtronic

- Nova Biomedical

- Novo Nordisk

- Pendiq

- Platinum Equity Advisors

- Sanofi

- Sinocare

- Tandem Diabetes Care

- Ypsomed Holding

The Global Diabetes Care Devices Market was valued at USD 62.9 billion in 2024 and is estimated to grow at a CAGR of 12% to reach USD 193 billion by 2034. This growth is driven by the rising global diabetes burden, continuous technological breakthroughs, and increased funding from both public and private sectors. Diabetes care devices are essential medical tools that support individuals in managing diabetes by enabling effective blood glucose monitoring and insulin administration. As the number of individuals living with diabetes continues to rise worldwide, the demand for reliable and user-friendly care devices continues to grow.

Innovations focused on making these tools less invasive, more accurate, and cost-effective are propelling demand. Companies are investing heavily in R&D to bring forward advanced devices that ensure better comfort and disease management. The market is also experiencing a shift toward smarter, integrated solutions that provide seamless glucose tracking and insulin delivery to meet growing consumer expectations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $62.9 Billion |

| Forecast Value | $193 Billion |

| CAGR | 12% |

In 2024, the blood glucose monitoring devices segment generated USD 42.2 billion and projected to hit USD 137.4 billion by 2034, growing at a CAGR of 12.7%. Their extensive use in hospitals, diagnostic labs, and homecare setups underpins this growth. Devices like CGMs and self-monitoring meters offer continuous updates, helping users regulate their lifestyle, food intake, and insulin schedules based on real-time glucose data. Regular monitoring is vital to avoid spikes or drops in glucose levels, which can lead to serious health issues. These tools provide round-the-clock feedback, ensuring users remain proactive in their diabetes management and minimizing long-term complications.

The home care segment held 43.8% share in 2024. The ability to manage diabetes at home has become a crucial convenience for many, eliminating the need for frequent clinical visits. Devices designed for home use now offer similar capabilities as those used in professional settings. Advanced features like real-time glucose trend analysis, alarms, and data tracking help patients make quick and informed decisions about food intake, insulin doses, and daily routines. This growing trend of home-based diabetes management continues to attract individuals looking for independence and improved quality of life.

United States Diabetes Care Devices Market generated USD 22.8 billion in 2024. This strong performance is due to the growing diabetic population and the rapid adoption of innovative diabetes technologies. An aging population more prone to chronic conditions further intensifies demand for efficient diabetes management solutions. The market's momentum in the region is supported by access to high-end healthcare infrastructure, favorable reimbursement scenarios, and consumer awareness around preventative care and early diagnosis.

Key companies influencing the Global Diabetes Care Devices Market include Tandem Diabetes Care, Becton, Dickinson and Company, Ypsomed Holding, Insulet, Sanofi, Dr. Reddy's Laboratories, Medtronic, Dexcom, Ascensia Diabetes Care, Sinocare, Platinum Equity Advisors, Abbott Laboratories, ARKRAY, DarioHealth, Eli Lilly and Company, Pendiq, Novo Nordisk, F. Hoffmann-La Roche, Bionime, and Nova Biomedical. Leading players in the diabetes care devices market are focusing on enhancing product innovation and portfolio diversification to meet the evolving needs of users. Companies are introducing smart, wearable devices with real-time data analytics and Bluetooth connectivity to improve glucose tracking. Strategic collaborations with digital health platforms help integrate data into broader health ecosystems. Mergers and acquisitions are also being used to expand geographic presence and access new customer bases. Continuous investments in R&D ensure devices become less invasive, more accurate, and easier to use.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of diabetes across the world

- 3.2.1.2 Rising technological advancements in diabetes care devices

- 3.2.1.3 Increasing investments by public and private organizations for diabetes care

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of diabetes care devices

- 3.2.2.2 Rigorous regulatory framework

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain and distribution analysis

- 3.7 Reimbursement scenario

- 3.7.1 Coding and reimbursement

- 3.7.2 Reimbursement policies and public healthcare sector insurance coverage for insulin delivery systems

- 3.7.2.1 U.S.

- 3.7.2.2 Europe

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Blood glucose monitoring devices

- 5.2.1 Self-monitoring blood glucose meters

- 5.2.2 Continuous glucose monitors

- 5.2.3 Testing strips

- 5.2.4 Lancets

- 5.3 Insulin delivery devices

- 5.3.1 Insulin pumps

- 5.3.1.1 Tubed pumps

- 5.3.1.2 Tubeless pumps

- 5.3.2 Pens

- 5.3.2.1 Reusable

- 5.3.2.2 Disposable

- 5.3.3 Pen needles

- 5.3.3.1 Standard

- 5.3.3.2 Safety

- 5.3.4 Syringes

- 5.3.5 Other insulin delivery devices

- 5.3.1 Insulin pumps

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospital

- 6.3 Ambulatory surgical centres

- 6.4 Diagnostic centres

- 6.5 Homecare

- 6.6 Other end use

Chapter 7 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 UK

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.3.7 Sweden

- 7.3.8 Belgium

- 7.3.9 Denmark

- 7.3.10 Finland

- 7.3.11 Norway

- 7.3.12 Lithuania

- 7.3.13 Latvia

- 7.3.14 Estonia

- 7.4 Asia Pacific

- 7.4.1 Japan

- 7.4.2 China

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Colombia

- 7.5.5 Chile

- 7.5.6 Peru

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

- 7.6.4 Turkey

- 7.6.5 Egypt

- 7.6.6 Israel

- 7.6.7 Kuwait

- 7.6.8 Qatar

Chapter 8 Company Profiles

- 8.1 Abbott Laboratories

- 8.2 ARKRAY

- 8.3 Ascensia Diabetes Care

- 8.4 B. Braun Melsungen

- 8.5 Becton, Dickinson and Company

- 8.6 Bionime

- 8.7 DarioHealth

- 8.8 Dexcom

- 8.9 Dr. Reddy’s Laboratories

- 8.10 Eli Lilly and Company

- 8.11 F. Hoffmann-La Roche

- 8.12 Insulet

- 8.13 Medtronic

- 8.14 Nova Biomedical

- 8.15 Novo Nordisk

- 8.16 Pendiq

- 8.17 Platinum Equity Advisors

- 8.18 Sanofi

- 8.19 Sinocare

- 8.20 Tandem Diabetes Care

- 8.21 Ypsomed Holding