|

市场调查报告书

商品编码

1829982

全球糖尿病护理设备市场(按产品类型、疾病类型、患者治疗设施和地区划分)- 预测至 2030 年Diabetes Care Devices Market by Product Type (Blood Glucose Monitoring (CGM), Insulin Delivery Devices (Insulin Pumps (Tethered), Insulin Pens, Pen Needles), Application) Disease Type (Type 1, Type 2), End User (Homecare/Self) - Global Forecast to 2030 |

||||||

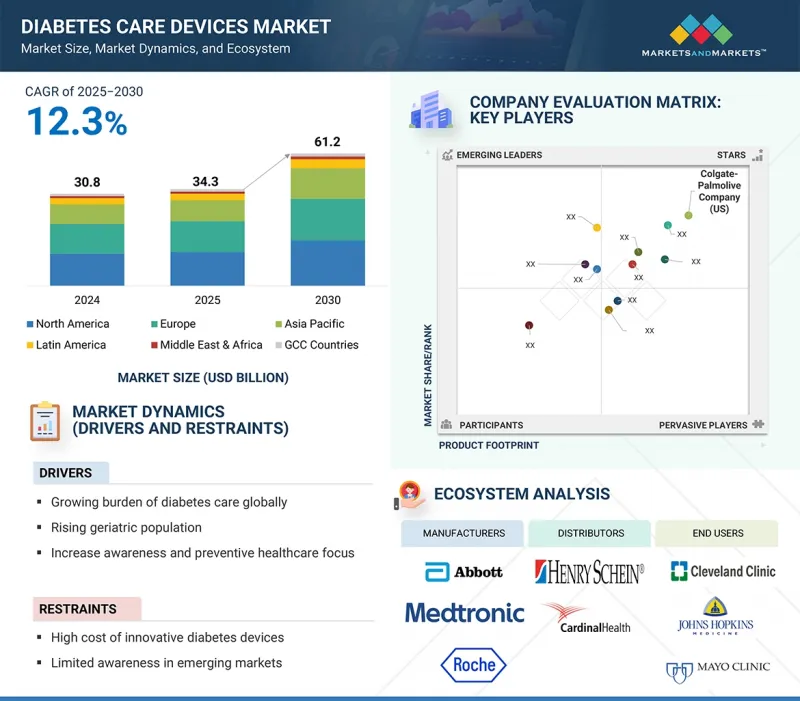

全球糖尿病护理设备市场预计将从 2025 年的 343 亿美元成长到 2030 年的 612 亿美元,预测期内的复合年增长率为 12.3%。

| 调查范围 | |

|---|---|

| 调查年份 | 2024-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(十亿美元) |

| 部分 | 按产品类型、疾病类型、患者治疗设施和地区 |

| 目标区域 | 北美、亚太、拉丁美洲、中东和非洲 |

由于久坐不动的生活方式、肥胖和饮食习惯改变等因素,糖尿病盛行率不断上升,显着增加了对有效的糖尿病监测和管理工具的需求。老年人口的不断增长,使他们更容易患上第2型糖尿病及其併发症,这进一步推动了对血糖监测设备的需求。此外,人们对预防性医疗保健的认识和重视程度的提高,也促进了早期诊断和自我管理工具的使用,从而扩大了家用设备的使用范围。技术进步也使这些设备对患者和医疗保健提供者更具吸引力。

更广泛的市场采用可能会受到设备高成本以及某些市场消费者接受度和依从性低的限制。

全球糖尿病照护设备市场分为三大板块:血糖值监测系统、胰岛素给药设备和糖尿病管理行动应用。血糖值监测系统凭藉其强大的功能优势和医疗支持,占据了最大的市场份额。这些设备提供准确的即时跟踪,并有助于预防併发症。糖尿病盛行率的上升、医生的建议以及智慧型手机整合等技术创新,进一步推动了其在家庭环境中的普及。

全球糖尿病照护设备市场按患者治疗机构细分为自助/居家医疗、医院和专科糖尿病诊所。其中,自助/家庭医疗保健预计将占据最大的市场份额。对便利且经济高效的设备日益增长的需求推动了这一细分市场的成长。许多人依赖连续血糖监测仪等自我检测设备,这减少了就诊需求。预防保健意识的增强、可携式和连网技术的进步以及易患2型糖尿病的老年人口的不断增长,都推动了自助/家庭护理设备的需求不断增长。

这种主导地位主要是由于人群中2型糖尿病的盛行率不断上升,而这种盛行率的上升是由久坐行为、饮食习惯和肥胖率上升等生活方式相关的风险因素造成的。高热量饮食、加工食品和缺乏运动导致肥胖率上升,这是造成这种快速增长的主要原因。都市化和现代化进一步减少了日常体力活动,而速食的普及导致已开发国家和开发中国家的肥胖率都在上升。此外,糖尿病是一种与老龄化密切相关的疾病,老年人更容易患上这种疾病。随着全球人口老化,其盛行率持续上升。

糖尿病患者数量的快速增长以及对先进糖尿病治疗的需求不断增长,推动了亚太地区对糖尿病治疗设备的强劲需求。此外,全球领先的糖尿病护理产品公司正在透过推出先进配方和数位整合的糖尿病治疗设备来扩大其在亚太地区的业务。

本报告研究了全球糖尿病治疗设备市场,提供了按产品类型、疾病类型、患者治疗设施和地区分類的趋势信息,以及参与市场的公司概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概况

- 介绍

- 市场动态

- 产业趋势

- 技术分析

- 定价分析

- 生态系分析

- 还款情境分析

- 价值链分析

- 波特五力分析

- 主要相关人员和采购标准

- 贸易分析

- 监管分析

- 专利分析

- 2025-2026年主要会议和活动

- 邻近市场分析

- 影响客户业务的趋势/中断

- 未满足的需求/最终用户期望

- 人工智慧/产生人工智慧对糖尿病护理设备市场的影响

- 案例研究分析

- 投资金筹措场景

- 2025年美国关税对糖尿病照护设备市场的影响

第六章糖尿病护理设备市场(依产品类型)

- 介绍

- 血糖监测系统

- 胰岛素输送装置

- 糖尿病管理行动应用程式

第七章糖尿病治疗设备市场(依疾病类型)

- 介绍

- 1型糖尿病

- 2型糖尿病

第 8 章糖尿病照护设备市场(依病患治疗设施)

- 介绍

- 自我/居家医疗

- 医院和糖尿病诊所

第九章糖尿病治疗设备市场(按地区)

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 欧洲

- 欧洲宏观经济展望

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他的

- 亚太地区

- 亚太宏观经济展望

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他的

- 拉丁美洲

- 拉丁美洲宏观经济展望

- 巴西

- 墨西哥

- 其他的

- 中东和非洲

- 糖尿病管理中对早期诊断和血糖控制的意识提升将推动市场成长

- 中东和非洲宏观经济展望

- 海湾合作委员会国家

- 糖尿病盛行率上升和人均医疗成本上升将推动市场

- 海湾合作委员会国家宏观经济展望

第十章 竞争格局

- 介绍

- 主要参与企业的策略/优势

- 2020-2024年收益分析

- 2024年市占率分析

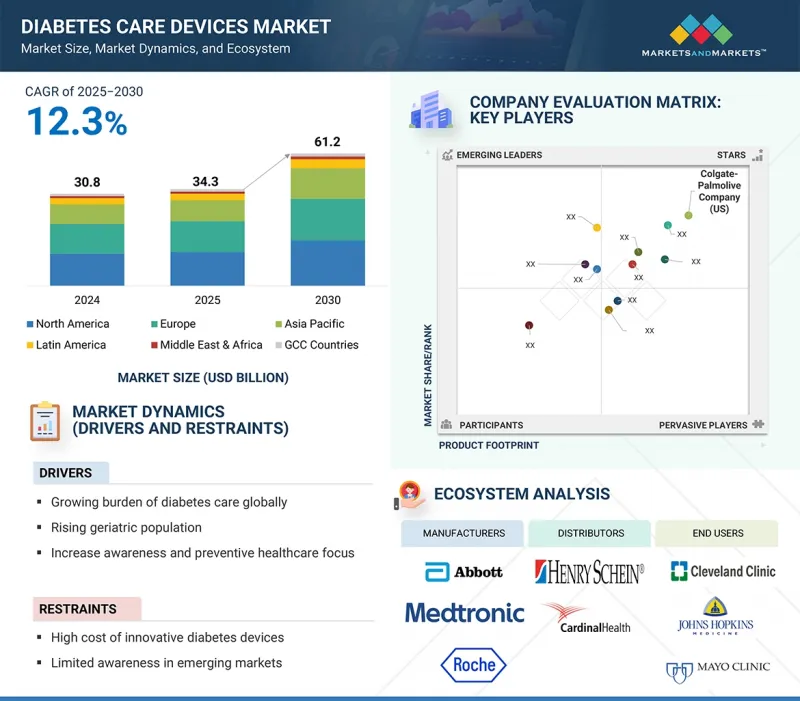

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 估值和财务指标

- 品牌/产品比较

- 主要企业研发支出

- 竞争场景

第十一章 公司简介

- 主要参与企业

- F. HOFFMAN-LA ROCHE LTD.

- ABBOTT

- DEXCOM, INC.

- MEDTRONIC

- B. BRAUN SE

- EMBECTA CORP.

- NIPRO

- SENSEONICS

- YPSOMED

- I-SENS, INC.

- TANDEM DIABETES CARE, INC.

- INSULET CORPORATION

- ACON LABORATORIES, INC.

- ARKRAY, INC.

- TERUMO CORPORATION

- 其他公司

- SINOCARE

- AGAMATRIX

- LIFESCAN IP HOLDINGS, LLC

- SD BIOSENSOR, INC.

- DEBIOTECH SA

- SUNGSHIM MEDICAL CO., LTD.

- SOOIL DEVELOPMENTS CO., LTD.

- HINDUSTAN SYRINGES & MEDICAL DEVICES LTD.

- MICROGENE DIAGNOSTIC SYSTEMS(P)LTD.

- ROSSMAX INTERNATIONAL LTD.

第十二章 附录

The global diabetes care devices market is projected to reach 61.2 billion in 2030 from USD 34.3 billion in 2025, at a CAGR of 12.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product Type, Disease Type, Patient Care Settings, and Region |

| Regions covered | Europe, North America, Asia Pacific, Latin America, Middle East, and Africa |

The rising prevalence of diabetes, driven by sedentary lifestyles, obesity, and changes in dietary habits, is significantly increasing the demand for effective monitoring and management tools for diabetes care. The growing geriatric population, which is more susceptible to type 2 diabetes and its complications, further boosts the demand for glucose monitoring devices. Additionally, increased awareness and a greater focus on preventive healthcare are encouraging early diagnosis and self-management tools, which are enhancing the use of home-based devices. Technological advancements also make these devices more appealing to both patients and healthcare providers.

Wider market adoption may be limited by the high cost of devices and, in certain markets, low consumer acceptance or adherence.

By product type, the blood glucose monitoring segment is expected to account for the largest share of the global diabetes care devices market.

The global diabetes care devices market is divided into three main segments: blood glucose monitoring systems, insulin delivery devices, and diabetes management mobile applications. The blood glucose monitoring system segment holds the largest market share due to its strong functional advantages and medical support. These devices provide accurate real-time tracking, which helps prevent complications. Rising diabetes prevalence, physician recommendations, and innovations like smartphone integration further increase home adoption settings.

By patient care settings, the self/home healthcare segment is expected to account for the largest share of the global diabetes care devices market.

The global diabetes care devices market is segmented by patient care settings into the following categories: self/home healthcare and hospitals & diabetes specialty clinics. Among these, the self/home healthcare segment is expected to hold the largest market share. The increasing demand for convenient, cost-effective devices is driving growth in this area. Many people rely on self-testing devices, such as continuous blood glucose monitors, which reduce the need for clinical visits. Rising awareness of preventive care, advancements in both portable and connected technologies, and an increasing geriatric population, which is more susceptible to type 2 diabetes, are fueling the growth in demand for self/homecare devices.

By disease type, the type 2 diabetes segment is expected to account for the largest share of the global diabetes care devices market.

This dominance is mainly driven by lifestyle-related risk factors such as sedentary behavior, dietary habits, and increasing obesity, which make type 2 diabetes more prevalent in the population. The rise in obesity, fueled by high-calorie diets, processed foods, and physical inactivity, is the primary contributor to its rapid growth. Urbanization and modernization have further reduced daily physical activity while increasing access to fast food, leading to rising rates across both developed and developing countries. The disease is also strongly age-related, with older adults being more susceptible, and as global populations age, the prevalence naturally continues to rise.

The diabetes care devices market in the Asia Pacific is expected to grow at the highest CAGR during the forecast period.

The rapid rise in diabetes cases and the increasing demand for advanced diabetes care are driving a strong need for diabetes care devices in the Asia Pacific region. Additionally, global leaders in diabetes care products are expanding their footprint in the Asia Pacific by launching advanced formulations and digitally integrated diabetes care devices.

A breakdown of the primary participants (supply side) for the diabetes care devices market referred to in this report is provided below:

- By Company Type: Tier 1 (30%), Tier 2 (35%), and Tier 3 (35%)

- By Designation: C-level Executives (20%), Directors (35%), and Others (45%)

- By Region: North America (30%), Europe (25%), Asia Pacific (20%), Latin America (20%), Middle East & Africa (2%), GCC Countries (3%)

Prominent players in the diabetes care devices market include F. Hoffmann Roche Ltd (Switzerland), Abbott Laboratories (US), Medtronic (Ireland), Dexcom (US), Insulet Corporation (US), B Braun Se (Germany), Embecta Corp (US), Nipro (Japan), Senseonics (US), Ypsomed (Switzerland), i-Sens, Inc (South Korea), Tandem Diabetes Care, Inc (US), ACON LABORATORIES, INC (US), ARKRAY, INC(Japan), Terumo Corporation (Japan), Sinocare Inc (Japan), Waveform Diabetes (AgaMatrix) (US), Lifescan IP Holdings (US), SD Biosensor, Inc (South Korea), DeBiotech SA. (Switzerland), Sungshim Medical Co, Ltd (South Korea), Sooil Developments Co., Ltd (South Korea), Hindustan syringes and medical devices (India), Microgene Diagnostic Systems Pvt Ltd (India), Rossmax International Ltd (Taiwan)

Research Coverage

The report provides an analysis of the diabetes care devices market, focusing on estimating the market size and potential for future growth across various segments, including distribution channels, regions, indications, and product types. Additionally, the report features a competitive analysis of the key players in the market, detailing their company profiles, product and service offerings, recent developments, and key market insights strategies.

Reasons to Buy the Report

The report offers valuable insights for both market leaders and new entrants in the diabetes care devices industry, providing estimated revenue figures for the entire market and its subsegments. It helps stakeholders understand the competitive landscape, allowing them to better position their businesses and develop effective go-to-market strategies. Additionally, the report emphasizes key market drivers, restraints, challenges, and opportunities, assisting stakeholders in assessing the current state of the market.

This report provides insights into the following pointers:

- Analysis of key drivers (growing burden of diabetes care globally, rising geriatric population, increasing awareness and preventive healthcare focus, technological advancements), restraints (high cost of innovative diabetes devices, limited awareness in emerging markets), opportunities (enhanced diabetes management with advanced patient-implantable CGM devices) and challenges (limited sensor durability leading to repeated and costly replacements, high cost and socio-economic disparities in access to devices).

- Market Penetration: This report provides detailed information on the product portfolios offered by major players in the global diabetes care devices market. It covers various segments, including product types, patient care settings, and regions.

- Product Enhancement/Innovation: Comprehensive details about new product launches and anticipated trends in the global diabetes care devices market.

- Market Development: Thorough knowledge and analysis of the profitable rising markets by product types, patient care settings, disease type, and regions.

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global diabetes care devices market.

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings of products and services, and capacities of the major competitors in the global diabetes care devices market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

- 1.5.1 REFINEMENTS IN SCOPE

- 1.5.2 COVERAGE OF NEW PLAYERS

- 1.5.3 ADDITION OF SEGMENTS

- 1.5.4 UPDATED MARKET DEVELOPMENTS OF PROFILED PLAYERS

- 1.5.5 UPDATED FINANCIAL INFORMATION/PRODUCT PORTFOLIOS OF PLAYERS

- 1.5.6 UPDATED GEOGRAPHIC ANALYSIS

- 1.5.7 IMPACT OF AI

- 1.5.8 IMPACT OF US TARIFF

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key objectives of primary research

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 REVENUE SHARE ANALYSIS

- 2.2.2 BOTTOM-UP APPROACH (SUPPLY-SIDE ANALYSIS)

- 2.2.3 COMPANY PRESENTATIONS & PRIMARY INTERVIEWS

- 2.2.4 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 SCOPE-RELATED LIMITATIONS

- 2.6.2 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 DIABETES CARE DEVICES MARKET OVERVIEW

- 4.2 ASIA PACIFIC: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE AND COUNTRY (2024)

- 4.3 DIABETES CARE DEVICES MARKET: GEOGRAPHICAL MIX

- 4.4 DIABETES CARE DEVICES MARKET: REGIONAL MIX

- 4.5 DIABETES CARE DEVICES MARKET: DEVELOPED VS. EMERGING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surging global diabetes patient population requiring continuous care

- 5.2.1.2 Rapidly growing geriatric population

- 5.2.1.3 Increasing efforts toward public awareness and preventive healthcare

- 5.2.1.4 Rapid technological advancements in diabetes care

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of advanced diabetes care devices

- 5.2.2.2 Limited awareness in emerging healthcare markets

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Enhanced diabetes management with advanced patient-implantable continuous glucose monitoring devices

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited sensor durability with repeated and costly replacements

- 5.2.4.2 High cost and socio-economic disparities in access to diabetes care devices

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 RISING ADOPTION OF DIGITAL HEALTH SOLUTIONS AND TELEMEDICINE INTEGRATION IN DIABETES CARE

- 5.3.2 ACCELERATING SHIFT TOWARD HOME-BASED, PATIENT-CENTRIC, AND SELF-MANAGED DIABETES CARE

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Implantable sensors

- 5.4.1.2 Smart automated insulin pumps

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Telehealth services

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Cutting-edge and smartphone-enabled diabetes self-management technologies

- 5.4.1 KEY TECHNOLOGIES

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF DIABETES CARE DEVICES, BY KEY PLAYER, 2022-2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF DIABETES CARE DEVICES, BY REGION, 2022-2024

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 ROLE IN ECOSYSTEM

- 5.7 REIMBURSEMENT SCENARIO ANALYSIS

- 5.8 VALUE CHAIN ANALYSIS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 THREAT OF NEW ENTRANTS

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 KEY BUYING CRITERIA

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA FOR HS CODE 9027, 2020-2024

- 5.11.2 EXPORT DATA FOR HS CODE 9027, 2020-2024

- 5.12 REGULATORY ANALYSIS

- 5.12.1 REGULATORY FRAMEWORK

- 5.12.1.1 North America

- 5.12.1.1.1 US

- 5.12.1.1.2 Canada

- 5.12.1.2 Europe

- 5.12.1.3 Asia Pacific

- 5.12.1.3.1 China

- 5.12.1.3.2 Japan

- 5.12.1.3.3 India

- 5.12.1.4 Latin America

- 5.12.1.4.1 Brazil

- 5.12.1.4.2 Mexico

- 5.12.1.5 Middle East

- 5.12.1.6 Africa

- 5.12.1.1 North America

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

- 5.12.1 REGULATORY FRAMEWORK

- 5.13 PATENT ANALYSIS

- 5.13.1 PATENT PUBLICATION TRENDS FOR DIABETES CARE DEVICES MARKET

- 5.13.2 JURISDICTION ANALYSIS: TOP APPLICANTS FOR PATENTS IN DIABETES CARE DEVICES

- 5.13.3 LIST OF MAJOR PATENTS

- 5.14 KEY CONFERENCES & EVENTS, 2025-2026

- 5.15 ADJACENT MARKET ANALYSIS

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.17 UNMET NEEDS/END-USER EXPECTATIONS

- 5.17.1 UNMET NEEDS

- 5.17.2 END-USER EXPECTATIONS

- 5.18 IMPACT OF AI/GEN AI IN DIABETES CARE DEVICES MARKET

- 5.19 CASE STUDY ANALYSIS

- 5.19.1 LONG-TERM GLUCOSE MONITORING FOR SENSITIVE SKIN PATIENTS USING SENSEONICS' EVERSENSE E3 IMPLANTABLE SENSORS

- 5.19.2 ENHANCING PATIENT ADHERENCE AND GLYCEMIC CONTROL USING ABBOTT'S FREESTYLE LIBRE 2 CGM

- 5.19.3 MEDTRONIC MINIMED INSULIN PUMP TO ENHANCE GLUCOSE CONTROL AND IMPROVE DAILY MANAGEMENT FOR PEOPLE WITH DIABETES

- 5.20 INVESTMENT & FUNDING SCENARIO

- 5.21 IMPACT OF 2025 US TARIFF ON DIABETES CARE DEVICES MARKET

- 5.21.1 INTRODUCTION

- 5.21.2 KEY TARIFF RATES

- 5.21.3 PRICE IMPACT ANALYSIS

- 5.21.4 IMPACT ON END-USE INDUSTRIES

6 DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.2 BLOOD GLUCOSE MONITORING SYSTEMS

- 6.2.1 SELF-MONITORING BLOOD GLUCOSE SYSTEMS

- 6.2.1.1 Need for self-monitoring in type 1 and type 2 diabetes management to propel market growth

- 6.2.2 CONTINUOUS GLUCOSE MONITORING SYSTEMS

- 6.2.2.1 Technological advancements in continuous glucose monitoring systems to track trends and enhance diabetes management

- 6.2.3 TEST STRIPS/TEST PAPERS

- 6.2.3.1 Shift toward non-invasive methods for blood glucose monitoring to restrain market growth

- 6.2.4 LANCETS/LANCING DEVICES

- 6.2.4.1 Need for infection and accidental pricking to increase popularity of safety lancets/lancing devices

- 6.2.1 SELF-MONITORING BLOOD GLUCOSE SYSTEMS

- 6.3 INSULIN DELIVERY DEVICES

- 6.3.1 INSULIN PUMPS & ACCESSORIES

- 6.3.1.1 Tethered pumps

- 6.3.1.1.1 Increase in collaborations and partnerships among companies to develop integrated insulin systems

- 6.3.1.2 Tubeless insulin pumps

- 6.3.1.2.1 Use of artificial intelligence to replace traditional vial-syringe combinations with tubeless pumps

- 6.3.1.1 Tethered pumps

- 6.3.2 INSULIN PENS

- 6.3.2.1 Reusable insulin pens

- 6.3.2.1.1 Technology innovations and cost-effectiveness to boost market growth

- 6.3.2.2 Disposable insulin pens

- 6.3.2.2.1 Ease of use, accurate dose measurement, and built-in cartridges to propel segment growth

- 6.3.2.1 Reusable insulin pens

- 6.3.3 PEN NEEDLES

- 6.3.3.1 Reduced chances of infection and accidental pricking to augment market growth

- 6.3.4 INSULIN SYRINGES & NEEDLES

- 6.3.4.1 Safety concerns and need for affordable alternatives to limit market growth

- 6.3.5 OTHER INSULIN DELIVERY DEVICES

- 6.3.1 INSULIN PUMPS & ACCESSORIES

- 6.4 DIABETES MANAGEMENT MOBILE APPLICATIONS

- 6.4.1 INCREASING PREVALENCE OF DIABETES AND RISING ADOPTION OF BLOOD GLUCOSE TRACKING APPLICATIONS TO DRIVE MARKET

7 DIABETES CARE DEVICES MARKET, BY DISEASE TYPE

- 7.1 INTRODUCTION

- 7.2 TYPE 1 DIABETES

- 7.2.1 CHRONIC NATURE OF TYPE 1 DIABETES AND NEED FOR IMPROVED DIAGNOSIS TO AID MARKET GROWTH

- 7.3 TYPE 2 DIABETES

- 7.3.1 RISING BURDEN OF TYPE 2 DIABETES TO INCREASE NEED FOR SCALABLE CARE DEVICE SOLUTIONS

8 DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS

- 8.1 INTRODUCTION

- 8.2 SELF/HOME HEALTHCARE

- 8.2.1 INCREASING AFFORDABILITY OF SELF-MONITORING SYSTEMS AND INSULIN DELIVERY DEVICES TO FUEL PREFERENCE

- 8.3 HOSPITALS & DIABETES SPECIALTY CLINICS

- 8.3.1 RISING DEMAND FOR POINT-OF-CARE TESTING IN HOSPITALS TO BOOST MARKET GROWTH

9 DIABETES CARE DEVICES MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 US to dominate North American diabetes care devices market during forecast period

- 9.2.3 CANADA

- 9.2.3.1 High prevalence of diabetes and supportive government disease management initiatives to spur market growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Advanced healthcare infrastructure to drive adoption of innovative diabetes care devices

- 9.3.3 UK

- 9.3.3.1 Increased government support and improved research funding to propel market growth

- 9.3.4 FRANCE

- 9.3.4.1 Substantial national spending on diabetes management and robust healthcare infrastructure to aid market growth

- 9.3.5 ITALY

- 9.3.5.1 High diabetes-related mortality and increased public investment to augment market growth

- 9.3.6 SPAIN

- 9.3.6.1 Minimal co-payments and full reimbursement to drive market

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Huge diabetic population and high government healthcare spending to spur market growth

- 9.4.3 JAPAN

- 9.4.3.1 Increased geriatric population and supportive healthcare policies to support market growth

- 9.4.4 INDIA

- 9.4.4.1 Rise in diabetes cases and affordable local manufacturing to fuel diabetes care devices demand

- 9.4.5 AUSTRALIA

- 9.4.5.1 Comprehensive government-backed initiatives and subsidies to support market growth

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Rise in diabetes cases and strong government healthcare support to boost market growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Increasing adoption of advanced diabetes monitoring and management solutions to aid market growth

- 9.5.3 MEXICO

- 9.5.3.1 Supportive regulatory frameworks and high burden of diabetes to propel market growth

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 INCREASING AWARENESS OF EARLY DIAGNOSIS AND GLYCEMIC CONTROL FOR DIABETES MANAGEMENT TO FAVOR MARKET GROWTH

- 9.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.7 GCC COUNTRIES

- 9.7.1 RISE IN DIABETES PREVALENCE AND HIGH PER CAPITA HEALTHCARE EXPENDITURE TO DRIVE MARKET

- 9.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN DIABETES CARE DEVICES MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Product type footprint

- 10.5.5.4 Patient care settings footprint

- 10.5.5.5 Disease type footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 R&D EXPENDITURE OF KEY PLAYERS

- 10.10 COMPETITIVE SCENARIO

- 10.10.1 PRODUCT LAUNCHES AND APPROVALS

- 10.10.2 DEALS

- 10.10.3 EXPANSIONS

- 10.10.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 F. HOFFMAN-LA ROCHE LTD.

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches & approvals

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 ABBOTT

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches & approvals

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Expansions

- 11.1.2.3.4 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 DEXCOM, INC.

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches & approvals

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 MEDTRONIC

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches & approvals

- 11.1.4.3.2 Deals

- 11.1.4.3.3 Expansions

- 11.1.4.3.4 Other developments

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 B. BRAUN SE

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses & competitive threats

- 11.1.6 EMBECTA CORP.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product approvals

- 11.1.6.3.2 Deals

- 11.1.6.3.3 Expansions

- 11.1.6.3.4 Other developments

- 11.1.7 NIPRO

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Expansions

- 11.1.8 SENSEONICS

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches & approvals

- 11.1.8.3.2 Deals

- 11.1.8.3.3 Other developments

- 11.1.9 YPSOMED

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches & approvals

- 11.1.9.3.2 Deals

- 11.1.9.3.3 Expansions

- 11.1.9.3.4 Other developments

- 11.1.10 I-SENS, INC.

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product approvals

- 11.1.10.3.2 Deals

- 11.1.11 TANDEM DIABETES CARE, INC.

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches & approvals

- 11.1.11.3.2 Deals

- 11.1.12 INSULET CORPORATION

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Product launches & approvals

- 11.1.12.3.2 Deals

- 11.1.12.3.3 Expansions

- 11.1.12.3.4 Other developments

- 11.1.13 ACON LABORATORIES, INC.

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions offered

- 11.1.14 ARKRAY, INC.

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Product launches

- 11.1.15 TERUMO CORPORATION

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Solutions offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Product launches

- 11.1.15.3.2 Deals

- 11.1.15.3.3 Expansions

- 11.1.15.3.4 Other developments

- 11.1.1 F. HOFFMAN-LA ROCHE LTD.

- 11.2 OTHER PLAYERS

- 11.2.1 SINOCARE

- 11.2.2 AGAMATRIX

- 11.2.3 LIFESCAN IP HOLDINGS, LLC

- 11.2.4 SD BIOSENSOR, INC.

- 11.2.5 DEBIOTECH S.A.

- 11.2.6 SUNGSHIM MEDICAL CO., LTD.

- 11.2.7 SOOIL DEVELOPMENTS CO., LTD.

- 11.2.8 HINDUSTAN SYRINGES & MEDICAL DEVICES LTD.

- 11.2.9 MICROGENE DIAGNOSTIC SYSTEMS (P) LTD.

- 11.2.10 ROSSMAX INTERNATIONAL LTD.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 DIABETES CARE DEVICES MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 STANDARD CURRENCY CONVERSION RATES

- TABLE 3 STUDY ASSUMPTIONS IN DIABETES CARE DEVICES MARKET

- TABLE 4 RISK ANALYSIS IN DIABETES CARE DEVICES MARKET

- TABLE 5 AVERAGE SELLING PRICE TREND OF DIABETES CARE DEVICES, BY KEY PLAYER, 2022-2024 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF DIABETES CARE, BY REGION, 2022-2024 (USD)

- TABLE 7 DIABETES CARE DEVICES MARKET: ROLE IN ECOSYSTEM

- TABLE 8 DIABETES CARE DEVICES MARKET: PORTER'S FIVE FORCES

- TABLE 9 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 10 KEY BUYING CRITERIA FOR MAJOR END USERS

- TABLE 11 IMPORT DATA FOR HS CODE 9027, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 EXPORT DATA FOR HS CODE 9027, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 LIST OF MAJOR PATENTS IN DIABETES CARE DEVICES MARKET, 2022-2024

- TABLE 19 DIABETES CARE DEVICES MARKET: LIST OF KEY CONFERENCES & EVENTS, JANUARY 2025-DECEMBER 2026

- TABLE 20 UNMET NEEDS IN DIABETES CARE DEVICES MARKET

- TABLE 21 END-USER EXPECTATIONS IN DIABETES CARE DEVICES MARKET

- TABLE 22 IMPACT OF AI/GEN AI IN DIABETES CARE DEVICES MARKET

- TABLE 23 CASE STUDY 1: LONG-TERM GLUCOSE MONITORING FOR SENSITIVE SKIN PATIENTS USING SENSEONICS' EVERSENSE E3 IMPLANTABLE SENSORS

- TABLE 24 CASE STUDY 2: ENHANCING PATIENT ADHERENCE AND GLYCEMIC CONTROL USING ABBOTT'S FREESTYLE LIBRE 2 CGM

- TABLE 25 CASE STUDY 3: MEDTRONIC MINIMED INSULIN PUMP TO ENHANCE GLUCOSE CONTROL AND IMPROVE DAILY MANAGEMENT FOR PEOPLE WITH DIABETES

- TABLE 26 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 27 DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 28 DIABETES CARE DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 30 DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 TEST STRIPS/TEST PAPERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 LANCETS/LANCING DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 36 DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 38 INSULIN PUMPS & ACCESSORIES MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 39 INSULIN PUMPS & ACCESSORIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 TETHERED INSULIN PUMPS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 TUBELESS INSULIN PUMPS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 43 INSULIN PENS MARKET, COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 REUSABLE INSULIN PENS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 DISPOSABLE INSULIN PENS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 PEN NEEDLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 INSULIN SYRINGES & NEEDLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 OTHER INSULIN DELIVERY DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 DIABETES CARE DEVICES MARKET FOR DIABETES MANAGEMENT MOBILE APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 51 TYPE 1 DIABETES CARE DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 TYPE 2 DIABETES CARE DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 54 DIABETES CARE DEVICES MARKET FOR SELF/HOME HEALTHCARE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 DIABETES CARE DEVICES MARKET FOR HOSPITAL & DIABETES SPECIALTY CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 DIABETES CARE DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: DIABETES CARE DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 65 US: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 66 US: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 67 US: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 68 US: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 69 US: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 70 US: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 71 US: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 72 CANADA: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 73 CANADA: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 74 CANADA: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 75 CANADA: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 76 CANADA: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 77 CANADA: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 78 CANADA: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 79 EUROPE: DIABETES CARE DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 EUROPE: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 81 EUROPE: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 82 EUROPE: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 83 EUROPE: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 84 EUROPE: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 85 EUROPE: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 86 EUROPE: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 87 GERMANY: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 88 GERMANY: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 89 GERMANY: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 90 GERMANY: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 GERMANY: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 92 GERMANY: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 93 GERMANY: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 94 UK: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 95 UK: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 96 UK: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 97 UK: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 UK: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 99 UK: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 100 UK: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 101 FRANCE: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 102 FRANCE: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 103 FRANCE: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 FRANCE: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 FRANCE: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 FRANCE: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 107 FRANCE: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 108 ITALY: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 109 ITALY: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 110 ITALY: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 111 ITALY: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 112 ITALY: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 ITALY: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 114 ITALY: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 115 SPAIN: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 116 SPAIN: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 117 SPAIN: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 118 SPAIN: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 SPAIN: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 SPAIN: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 121 SPAIN: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 122 REST OF EUROPE: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 123 REST OF EUROPE: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 124 REST OF EUROPE: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 REST OF EUROPE: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 REST OF EUROPE: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 REST OF EUROPE: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 128 REST OF EUROPE: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: DIABETES CARE DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 130 ASIA PACIFIC: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 ASIA PACIFIC: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 ASIA PACIFIC: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 136 ASIA PACIFIC: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 137 CHINA: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 138 CHINA: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 CHINA: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 CHINA: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 CHINA: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 142 CHINA: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 143 CHINA: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 144 JAPAN: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 145 JAPAN: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 JAPAN: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 JAPAN: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 JAPAN: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 JAPAN: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 150 JAPAN: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 151 INDIA: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 152 INDIA: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 153 INDIA: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 INDIA: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 INDIA: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 INDIA: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 157 INDIA: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 158 AUSTRALIA: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 159 AUSTRALIA: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 160 AUSTRALIA: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 AUSTRALIA: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 AUSTRALIA: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 AUSTRALIA: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 164 AUSTRALIA: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 165 SOUTH KOREA: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 166 SOUTH KOREA: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 167 SOUTH KOREA: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 SOUTH KOREA: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 SOUTH KOREA: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 SOUTH KOREA: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 171 SOUTH KOREA: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 REST OF ASIA PACIFIC: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 179 LATIN AMERICA: DIABETES CARE DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 180 LATIN AMERICA: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 181 LATIN AMERICA: DIABETES CARE DEVICES MARTKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 LATIN AMERICA: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 LATIN AMERICA: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 LATIN AMERICA: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 185 LATIN AMERICA: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 186 LATIN AMERICA: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 187 BRAZIL: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 188 BRAZIL: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 BRAZIL: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 BRAZIL: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 BRAZIL: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 192 BRAZIL: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 193 BRAZIL: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 194 MEXICO: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 195 MEXICO: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 MEXICO: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 MEXICO: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 MEXICO: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 199 MEXICO: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 200 MEXICO: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 201 REST OF LATIN AMERICA: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 202 REST OF LATIN AMERICA: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 203 REST OF LATIN AMERICA: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 204 REST OF LATIN AMERICA: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 205 REST OF LATIN AMERICA: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 REST OF LATIN AMERICA: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 207 REST OF LATIN AMERICA: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 215 GCC COUNTRIES: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 216 GCC COUNTRIES: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 217 GCC COUNTRIES: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 218 GCC COUNTRIES: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 219 GCC COUNTRIES: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 GCC COUNTRIES: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 221 GCC COUNTRIES: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 222 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN DIABETES CARE DEVICES MARKET, JANUARY 2022-AUGUST 2025

- TABLE 223 DIABETES CARE DEVICES MARKET: DEGREE OF COMPETITION

- TABLE 224 DIABETES CARE DEVICES MARKET: REGION FOOTPRINT

- TABLE 225 DIABETES CARE DEVICES MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 226 DIABETES CARE DEVICES MARKET: PATIENT CARE SETTINGS FOOTPRINT

- TABLE 227 DIABETES CARE DEVICES MARKET: DISEASE TYPE FOOTPRINT

- TABLE 228 DIABETES CARE DEVICES MARKET: DETAILED LIST OF KEY STARTUPS/SME PLAYERS

- TABLE 229 DIABETES CARE DEVICES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SME PLAYERS, BY PRODUCT TYPE AND REGION

- TABLE 230 DIABETES CARE DEVICES MARKET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022- JUNE 2025

- TABLE 231 DIABETES CARE DEVICES MARKET: DEALS, JANUARY 2022- JUNE 2025

- TABLE 232 DIABETES CARE DEVICES MARKET: EXPANSIONS, JANUARY 2022- JUNE 2025

- TABLE 233 DIABETES CARE DEVICES MARKET: OTHER DEVELOPMENTS, JANUARY 2022- JUNE 2025

- TABLE 234 F. HOFFMAN-LA ROCHE LTD.: COMPANY OVERVIEW

- TABLE 235 F. HOFFMAN-LA ROCHE LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 236 F. HOFFMANN-LA ROCHE LTD.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 237 F. HOFFMANN-LA ROCHE LTD.: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 238 F. HOFFMANN-LA ROCHE LTD.: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 239 ABBOTT: COMPANY OVERVIEW

- TABLE 240 ABBOTT: PRODUCTS/SOLUTIONS OFFERED

- TABLE 241 ABBOTT: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 242 ABBOTT: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 243 ABBOTT: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 244 ABBOTT: OTHER DEVELOPMENTS, JANUARY 2022-AUGUST 2025

- TABLE 245 DEXCOM, INC.: COMPANY OVERVIEW

- TABLE 246 DEXCOM, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 247 DEXCOM, INC.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 248 DEXCOM, INC.: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 249 DEXCOM, INC.: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 250 MEDTRONIC: COMPANY OVERVIEW

- TABLE 251 MEDTRONIC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 252 MEDTRONIC: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 253 MEDTRONIC: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 254 MEDTRONIC: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 255 MEDTRONIC: OTHER DEVELOPMENTS, JANUARY 2022-AUGUST 2025

- TABLE 256 B. BRAUN SE: COMPANY OVERVIEW

- TABLE 257 B. BRAUN SE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 258 EMBECTA CORP.: COMPANY OVERVIEW

- TABLE 259 EMBECTA CORP.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 260 EMBECTA CORP.: PRODUCTS APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 261 EMBECTA CORP.: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 262 EMBECTA CORP.: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 263 EMBECTA CORP.: OTHER DEVELOPMENTS, JANUARY 2022-AUGUST 2025

- TABLE 264 NIPRO: COMPANY OVERVIEW

- TABLE 265 NIPRO: PRODUCTS/SOLUTIONS OFFERED

- TABLE 266 NIPRO: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 267 SENSEONICS: COMPANY OVERVIEW

- TABLE 268 SENSEONICS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 269 SENSEONICS: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 270 SENSEONICS: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 271 SENSEONICS: OTHER DEVELOPMENTS, JANUARY 2022-AUGUST 2025

- TABLE 272 YPSOMED: COMPANY OVERVIEW

- TABLE 273 YPSOMED: PRODUCTS/SOLUTIONS OFFERED

- TABLE 274 YPSOMED: PRODUCTS LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 275 YPSOMED: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 276 YPSOMED: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 277 YPSOMED: OTHER DEVELOPMENTS, JANUARY 2022-AUGUST 2025

- TABLE 278 I-SENS, INC.: COMPANY OVERVIEW

- TABLE 279 I-SENS, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 280 I-SENS, INC.: PRODUCTS APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 281 I-SENS, INC.: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 282 TANDEM DIABETES CARE, INC.: COMPANY OVERVIEW

- TABLE 283 TANDEM DIABETES CARE, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 284 TANDEM DIABETES CARE, INC.: PRODUCTS LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 285 TANDEM DIABETES CARE, INC.: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 286 INSULET CORPORATION: COMPANY OVERVIEW

- TABLE 287 INSULET CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 288 INSULET CORPORATION: PRODUCTS LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 289 INSULET CORPORATION: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 290 INSULET CORPORATION: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 291 INSULET CORPORATION: OTHER DEVELOPMENTS, JANUARY 2022-AUGUST 2025

- TABLE 292 ACON LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 293 ACON LABORATORIES, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 294 ARKRAY, INC.: COMPANY OVERVIEW

- TABLE 295 ARKRAY, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 296 ARKRAY, INC.: PRODUCTS LAUNCHES, JANUARY 2022-AUGUST 2025

- TABLE 297 TERUMO CORPORATION: COMPANY OVERVIEW

- TABLE 298 TERUMO CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 299 TERUMO CORPORATION: PRODUCTS LAUNCHES, JANUARY 2022-AUGUST 2025

- TABLE 300 TERUMO CORPORATION: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 301 TERUMO CORPORATION: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 302 TERUMO CORPORATION: OTHER DEVELOPMENTS, JANUARY 2022-AUGUST 2025

- TABLE 303 SINOCARE: COMPANY OVERVIEW

- TABLE 304 AGAMATRIX: COMPANY OVERVIEW

- TABLE 305 LIFESCAN IP HOLDINGS, LLC: COMPANY OVERVIEW

- TABLE 306 SD BIOSENSOR, INC.: COMPANY OVERVIEW

- TABLE 307 DEBIOTECH S.A.: COMPANY OVERVIEW

- TABLE 308 SUNGSHIM MEDICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 309 SOOIL DEVELOPMENTS CO., LTD.: COMPANY OVERVIEW

- TABLE 310 HINDUSTAN SYRINGES & MEDICAL DEVICES LTD.: COMPANY OVERVIEW

- TABLE 311 MICROGENE DIAGNOSTIC SYSTEMS (P) LTD.: COMPANY OVERVIEW

- TABLE 312 ROSSMAX INTERNATIONAL LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 DIABETES CARE DEVICES MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 DIABETES CARE DEVICES MARKET: YEARS CONSIDERED

- FIGURE 3 DIABETES CARE DEVICES MARKET: RESEARCH DESIGN

- FIGURE 4 DIABETES CARE DEVICES MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 DIABETES CARE DEVICES MARKET: KEY PRIMARY SOURCES (SUPPLY AND DEMAND SIDES)

- FIGURE 6 DIABETES CARE DEVICES MARKET: KEY DATA FROM PRIMARY SOURCES

- FIGURE 7 DIABETES CARE DEVICES MARKET: KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- FIGURE 9 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 10 DIABETES CARE DEVICES MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2024)

- FIGURE 11 DIABETES CARE DEVICES MARKET: REVENUE SHARE ANALYSIS FOR ABBOTT (US) (2024)

- FIGURE 12 SUPPLY-SIDE ANALYSIS OF DIABETES CARE DEVICES MARKET (2024)

- FIGURE 13 DIABETES CARE DEVICES MARKET: CAGR PROJECTIONS (SUPPLY-SIDE ANALYSIS)

- FIGURE 14 DIABETES CARE DEVICES MARKET: BOTTOM-UP APPROACH

- FIGURE 15 CAGR PROJECTIONS FROM DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES ANALYSIS IN DIABETES CARE DEVICES MARKET (2025-2030)

- FIGURE 16 DIABETES CARE DEVICES MARKET: TOP-DOWN APPROACH

- FIGURE 17 DIABETES CARE DEVICES MARKET: DATA TRIANGULATION

- FIGURE 18 DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 20 DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2025 VS. 2030 (USD MILLION)

- FIGURE 21 REGIONAL SNAPSHOT OF DIABETES CARE DEVICES MARKET

- FIGURE 22 TECHNOLOGICAL ADVANCEMENTS IN DIABETES CARE DEVICES TO DRIVE MARKET

- FIGURE 23 CHINA AND BLOOD GLUCOSE MONITORING SYSTEMS COMMNADED LARGEST ASIA PACIFIC MARKET SHARE IN 2024

- FIGURE 24 JAPAN TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 25 ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 26 EMERGING MARKETS TO ACCOUNT FOR HIGHER GROWTH RATES DURING STUDY PERIOD

- FIGURE 27 DIABETES CARE DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 28 DIABETES CARE DEVICES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 DIABETES CARE DEVICES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 DIABETES CARE DEVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 32 KEY BUYING CRITERIA FOR MAJOR END USERS

- FIGURE 33 TOP PATENT APPLICANTS/OWNERS (COMPANIES/INSTITUTES) FOR DIABETES CARE DEVICES MARKET (JANUARY 2014-DECEMBER 2024)

- FIGURE 34 TOP PATENT APPLICANT COUNTRIES FOR PATENTS ON DIABETES CARE DEVICES (JANUARY 2014-DECEMBER 2024)

- FIGURE 35 ADJACENT MARKETS TO DIABETES CARE DEVICES MARKET

- FIGURE 36 DIABETES CARE DEVICES MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 37 IMPACT OF AI/GEN AI ON DIABETES CARE DEVICES MARKET

- FIGURE 38 FUNDING AND NUMBER OF DEALS IN DIABETES CARE DEVICES MARKET, 2019-2023 (USD MILLION)

- FIGURE 39 GEOGRAPHIC SNAPSHOT OF DIABETES CARE DEVICES MARKET

- FIGURE 40 NORTH AMERICA: DIABETES CARE DEVICES MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: DIABETES CARE DEVICES MARKET SNAPSHOT

- FIGURE 42 REVENUE SHARE ANALYSIS OF KEY PLAYERS IN DIABETES CARE DEVICES MARKET (2020-2024)

- FIGURE 43 MARKET SHARE ANALYSIS OF KEY PLAYERS IN DIABETES CARE DEVICES MARKET (2024)

- FIGURE 44 DIABETES CARE DEVICES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 DIABETES CARE DEVICES MARKET: COMPANY FOOTPRINT

- FIGURE 46 DIABETES CARE DEVICES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 EV/EBITDA OF KEY VENDORS

- FIGURE 48 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 49 DIABETES CARE DEVICES MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 50 R&D EXPENDITURE OF KEY PLAYERS IN DIABETES CARE DEVICES MARKET (2022-2024)

- FIGURE 51 F. HOFFMAN-LA ROCHE LTD.: COMPANY SNAPSHOT

- FIGURE 52 ABBOTT: COMPANY SNAPSHOT

- FIGURE 53 DEXCOM, INC.: COMPANY SNAPSHOT

- FIGURE 54 MEDTRONIC: COMPANY SNAPSHOT

- FIGURE 55 B. BRAUN SE: COMPANY SNAPSHOT

- FIGURE 56 EMBECTA CORP.: COMPANY SNAPSHOT

- FIGURE 57 NIPRO: COMPANY SNAPSHOT

- FIGURE 58 SENSEONICS: COMPANY SNAPSHOT

- FIGURE 59 YPSOMED: COMPANY SNAPSHOT

- FIGURE 60 I-SENS, INC.: COMPANY SNAPSHOT

- FIGURE 61 TANDEM DIABETES CARE, INC.: COMPANY SNAPSHOT

- FIGURE 62 INSULET CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 TERUMO CORPORATION: COMPANY SNAPSHOT