|

市场调查报告书

商品编码

1801940

电压检测系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Voltage Detection System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

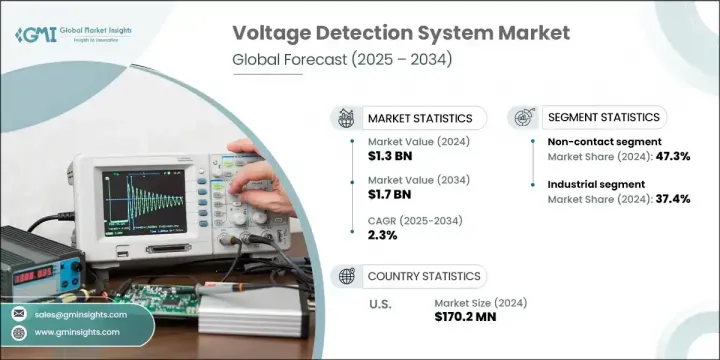

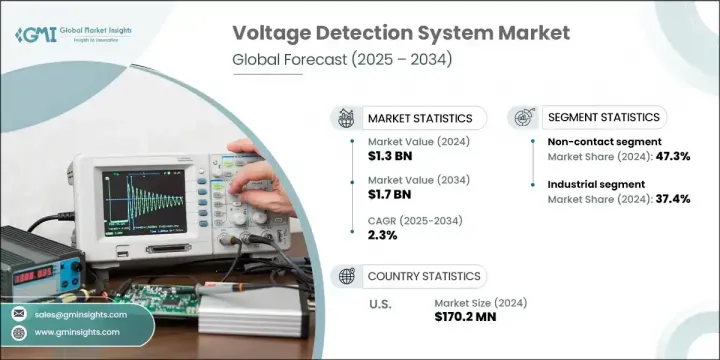

2024年,全球电压检测系统市场规模达13亿美元,预计2034年将以2.3%的复合年增长率成长,达到17亿美元。市场的成长动能源自于对高效能能源利用的日益重视,以及环境法规和永续发展计画的推动。智慧电网技术、自动化配电网和智慧计量领域的创新正在提升能源可靠性和系统性能。智慧电网框架的采用实现了即时电压监控,从而实现预测性诊断和远端维护。电压检测系统在安全性和准确性至关重要的工业自动化领域正变得至关重要。

如今,紧凑型高性能感测器已整合到复杂环境中,增强了在狭窄或敏感环境下的监控能力。与物联网平台的整合以及提供无线即时资料的能力,正在提高营运连续性,同时控制维护成本。基础设施升级和传统电网的现代化改造正在增强对先进检测系统的需求,尤其是那些能够提供无缝通讯和系统相容性的系统。随着全球电气化的持续推进,从公用事业到製造业,电压检测的精确度和安全性在各个领域都变得至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 17亿美元 |

| 复合年增长率 | 2.3% |

非接触式电压检测系统在2024年占据了47.3%的市场份额,预计到2034年复合年增长率将达到3.1%。这些系统的优点在于,它允许技术人员无需实际接触即可识别带电电线,从而降低触电风险,从而增强了安全性。这些工具广泛用于常规检查和快速诊断,操作简便,新手和经验丰富的操作员都适用。便利性和可靠性的结合使其在维护和安全应用中的应用日益广泛。

2024年,工业领域占37.4%的市场份额,预计2025年至2034年的复合年增长率为1.7%。工厂和製造设施等高压环境在启动上锁/挂牌(LOTO)等程序之前,需要进行精确验证。电压侦测系统对于保障人员安全并防止电弧闪光事故至关重要。将其整合到安全协定中,可确保设备始终符合安全标准,同时最大限度地降低营运风险。

2024年,美国电压检测系统市场规模达1.702亿美元。美国的成长得益于美国职业安全与健康管理局(OSHA)和美国国家消防协会(NFPA)70E等机构制定的严格职业安全法规,这些法规要求必须实施经验证的保持社交距离协议和安全检查。美国老化的电力基础设施也需要定期测试和维护,这促使工业和公用事业部门投资可靠的检测工具。太阳能和风能等再生能源占比的不断增长,正在扩大各种发电系统中电压监测的范围。

全球电压侦测系统市场的知名公司包括 Epoxy House、Chauvin Arnoux、Megger、PENTA、Electrisium International、Fluke Corporation、KK Sales Corporation、DEHN SE、Horstmann、厦门安达兴电气集团、Georg Jordan、C&S Electric Limited、Thorne & Derrick、KPB INTRA sro、Orion 、C&S Electric Limited、Thorne & Derrick、KPB INTRA sro、Orion 、Ci>C.F.Fy时间, G. MD srl、ARCUS ELEKTROTECHNIK ALOIS SCHIFFMANN GMBH、Dipl.-Ing. H. Horstmann GmbH、Arshon Technology、Kyoritsu 和 Cole-Parmer Instrument Company。为了加强在电压检测系统市场的地位,各公司正专注于产品创新和扩大全球分销网络。许多製造商正在整合物联网相容性和无线功能,以提高系统在工业和公用事业应用中的智慧性和适应性。重点放在微型感测器上,以支援在紧凑或远端环境中使用。与能源公用事业和基础设施公司的合作正帮助企业在智慧电网现代化专案中快速扩张。企业也在投资研发,以提高准确性和可靠性,以适应不断发展的安全标准。为了因应新兴经济体日益增长的需求,一些企业正在建立区域製造中心,以精简供应链并降低成本,从而在全球范围内提高经济高效、高效能检测解决方案的可及性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 原料和零件供应商

- 设计和工程

- 製造和装配

- 配送和物流

- 行销和销售

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL分析

- 2021-2034年价格趋势分析

- 进出口贸易分析

- 主要进口国

- 主要出口国

- 投资分析及未来展望

第四章:竞争格局

- 介绍

- 按地区分析公司市场份额

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 战略仪表板

- 策略倡议

- 重要伙伴关係与合作

- 重大併购活动

- 产品创新与发布

- 市场扩张策略

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依产品,2021 - 2034

- 主要趋势

- 接触

- 非接触式

第六章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 住宅

- 商业的

- 工业的

- 实用工具

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 澳洲

- 日本

- 韩国

- 印度

- 中国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- ARCUS ELEKTROTECHNIK ALOIS SCHIFFMANN GMBH

- Arshon Technology

- C&S Electric Limited

- CATU SAS

- Chauvin Arnoux

- Cole-Parmer Instrument Company

- DEHN SE

- Dipl.-Ing. H. Horstmann GmbH

- Electrisium International

- ELECTRONSYSTEM MD srl

- Epoxy House

- Fluke Corporation

- Georg Jordan

- KK Sales Corporation

- Klein Tools

- KPB INTRA sro

- Kries-Energietechnik GmbH & Co. KG

- Kyoritsu

- Megger

- Orion EE

- PENTA

- Thorne & Derrick

- Xiamen Andaxing Electric Group

The Global Voltage Detection System Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 2.3% to reach USD 1.7 billion by 2034. The market's upward trajectory is being driven by increasing emphasis on efficient energy usage, propelled by environmental regulations and sustainability initiatives. Innovations in smart grid technologies, automated distribution networks, and intelligent metering are improving energy reliability and system performance. The adoption of smart grid frameworks is enabling real-time voltage monitoring, allowing for predictive diagnostics and remote maintenance. Voltage detection systems are becoming essential in industrial automation, where safety and accuracy are paramount.

Compact, high-performance sensors are now integrated into complex environments, enhancing monitoring in confined or sensitive settings. Integration with IoT platforms and the ability to deliver wireless, real-time data is improving operational continuity while keeping maintenance costs in check. Infrastructural upgrades and modernization of legacy power networks are reinforcing the demand for advanced detection systems, particularly those offering seamless communication and system compatibility. As global electrification continues, precision and safety in voltage detection are becoming critical across sectors ranging from utilities to manufacturing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $1.7 Billion |

| CAGR | 2.3% |

The non-contact voltage detection systems held 47.3% share in 2024 and is expected to register a CAGR of 3.1% through 2034. These systems offer the benefit of enhanced safety by allowing technicians to identify live wires without making physical contact, reducing exposure to electric shock. Widely favored for routine inspections and rapid diagnostics, these tools are user-friendly and suitable for both novice and experienced operators. The combination of convenience and reliability is expanding their use across maintenance and safety applications.

The industrial sector held 37.4% share in 2024 and is forecasted to grow at a CAGR of 1.7% from 2025 to 2034. High-voltage environments such as factories and manufacturing facilities require precise verification before initiating procedures like lockout/tagout (LOTO). Voltage detection systems are critical in safeguarding personnel and preventing arc flash incidents. Their integration into safety protocols is ensuring equipment remains compliant with safety standards, while minimizing operational risk.

United States Voltage Detection System Market was valued at USD 170.2 million in 2024. Growth in the U.S. is fueled by strict occupational safety regulations under bodies such as OSHA and NFPA 70E, which necessitate verified distancing protocols and safety checks. The country's aging electrical infrastructure also demands regular testing and maintenance, encouraging industrial and utility sectors to invest in reliable detection tools. The increasing share of renewable energy sources, including solar and wind, is expanding the scope of voltage monitoring across diverse power generation systems.

Prominent companies in the Global Voltage Detection System Market include Epoxy House, Chauvin Arnoux, Megger, PENTA, Electrisium International, Fluke Corporation, K.K. Sales Corporation, DEHN SE, Horstmann, Xiamen Andaxing Electric Group, Georg Jordan, C&S Electric Limited, Thorne & Derrick, KPB INTRA s.r.o, Orion EE, Cyclotech, Kries-Energietechnik GmbH & Co. KG, ELECTRONSYSTEM MD srl, ARCUS ELEKTROTECHNIK ALOIS SCHIFFMANN GMBH, Dipl.-Ing. H. Horstmann GmbH, Arshon Technology, Kyoritsu, and Cole-Parmer Instrument Company. To strengthen their presence in the voltage detection system market, companies are focusing on product innovation and expanding global distribution networks. Many manufacturers are integrating IoT compatibility and wireless features to improve system intelligence and adaptability in both industrial and utility applications. Emphasis is placed on miniaturizing sensors to support use in compact or remote environments. Partnerships with energy utilities and infrastructure firms are helping companies scale quickly in smart grid modernization projects. Firms are also investing in R&D to enhance accuracy and reliability, aligning with evolving safety standards. In response to increasing demand across emerging economies, some players are establishing regional manufacturing hubs to streamline supply chains and reduce costs, thereby improving access to cost-effective, high-performance detection solutions worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1.1 Raw material and component suppliers

- 3.1.1.2 Design and engineering

- 3.1.1.3 Manufacturing and assembly

- 3.1.1.4 Distribution and logistics

- 3.1.1.5 Marketing and sales

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Price trend analysis, 2021-2034

- 3.8 Import/export trade analysis

- 3.8.1 Key importing countries

- 3.8.2 Key exporting countries

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (‘000 Units, USD Million)

- 5.1 Key trends

- 5.2 Contact

- 5.3 Non-contact

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (‘000 Units, USD Million)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

- 6.4 Industrial

- 6.5 Utilities

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (‘000 Units, USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 Australia

- 7.4.2 Japan

- 7.4.3 South Korea

- 7.4.4 India

- 7.4.5 China

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ARCUS ELEKTROTECHNIK ALOIS SCHIFFMANN GMBH

- 8.2 Arshon Technology

- 8.3 C&S Electric Limited

- 8.4 CATU SAS

- 8.5 Chauvin Arnoux

- 8.6 Cole-Parmer Instrument Company

- 8.7 DEHN SE

- 8.8 Dipl.-Ing. H. Horstmann GmbH

- 8.9 Electrisium International

- 8.10 ELECTRONSYSTEM MD srl

- 8.11 Epoxy House

- 8.12 Fluke Corporation

- 8.13 Georg Jordan

- 8.15 K.K. Sales Corporation

- 8.16 Klein Tools

- 8.17 KPB INTRA s.r.o

- 8.18 Kries-Energietechnik GmbH & Co. KG

- 8.19 Kyoritsu

- 8.20 Megger

- 8.21 Orion EE

- 8.22 PENTA

- 8.23 Thorne & Derrick

- 8.24 Xiamen Andaxing Electric Group