|

市场调查报告书

商品编码

1822564

财务健康软体市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Financial Wellness Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

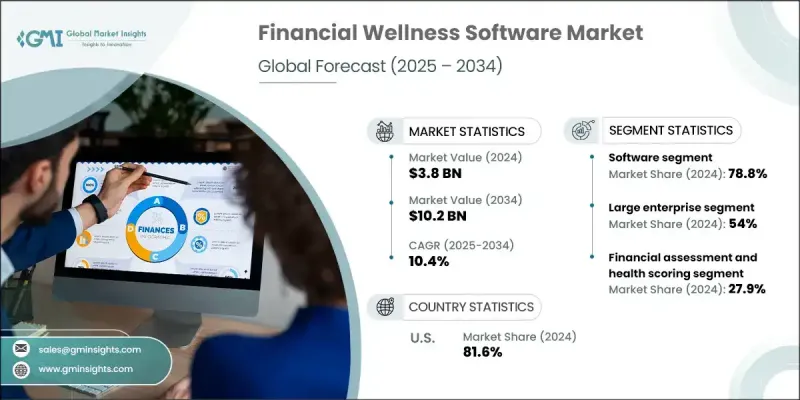

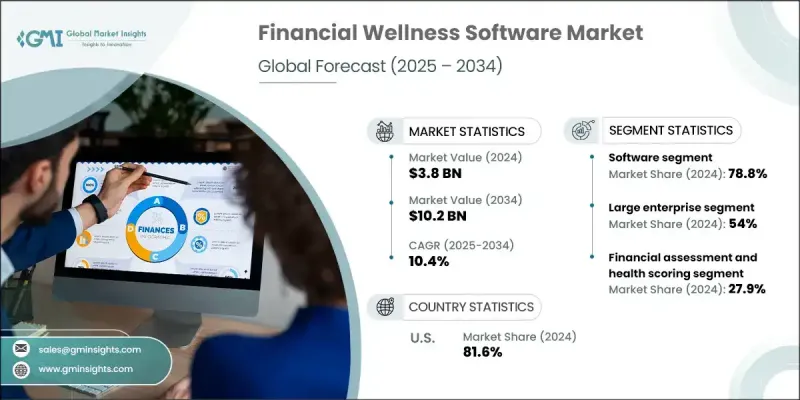

2024 年全球财务健康软体市场价值为 38 亿美元,预计将以 10.4% 的复合年增长率成长,到 2034 年达到 102 亿美元。

各收入阶层的员工日益增长的财务压力正在推动市场成长。随着生活成本的上升、个人债务的增加以及经济不确定性的加剧,越来越多的个人难以有效地管理自己的财务。这促使雇主将投资财务健康平台作为员工福利策略的一部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 38亿美元 |

| 预测值 | 102亿美元 |

| 复合年增长率 | 10.4% |

软体采用率不断上升

2024年,软体领域维持了可持续的市场份额,这得益于可扩展且技术驱动的平台,这些平台可根据员工需求进行客製化。这些软体解决方案提供强大的工具,涵盖预算、目标设定、债务管理和个人化财务建议,所有功能都集中在一个数位化平台中。随着远距办公和混合办公环境成为常态,基于云端的财务健康软体可确保全天候存取、安全的资料整合和即时更新。

大型企业获得发展动力

大型企业在2024年占据了显着的市场份额,这得益于员工健康项目投资的不断增长。大公司深知,财务压力不仅会影响个人,还会影响绩效、士气和员工流动率。由于需要支援数千名员工,大型组织正在采用可扩展的财务健康平台,提供个人化的洞察、分析和参与度追踪。

财务评估和健康评分日益盛行

随着雇主寻求各种方法来评估员工的财务状况,预计到2034年,财务评估和健康评分领域将占据显着份额。这些工具透过个人化的财务健康评分,帮助使用者了解自身财务状况,识别风险领域并提供可行的改善措施。

区域洞察

美国将崛起为利润丰厚的地区

2024年,美国财务健康软体市场占据了相当大的份额,这得益于较高的金融素养、雇主驱动的健康计划以及强大的人力资源技术生态系统。在优先考虑员工财务健康方面,美国公司处于领先地位。由于通货膨胀、学生贷款和退休计画给员工带来沉重负担,美国雇主正积极转向数位平台,提供即时支援。

金融健康软体市场的主要参与者包括 PayActiv、Thrive Global、LearnLux、Origin Financial、Prudential Financial、BrightDime、Mercer LLC、Financial Finesse、Enrich (iGrad Inc.)、SmartDollar。

财务健康软体市场的领导者正专注于产品创新、策略合作伙伴关係和个人化,以提升其市场影响力。许多公司正在投资人工智慧驱动的平台,为用户提供客製化的财务建议、预算工具和即时支援。 LearnLux、Financial Finesse 和 PayActiv 等公司正在透过与雇主、人力资源平台和福利提供者合作来扩展其产品线,将财务健康工具直接整合到现有的员工福利生态系统中。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 员工财务压力不断上升

- 云端运算和人工智慧技术的日益普及

- 雇主关注员工的整体福祉

- 监管和政府激励措施

- 产业陷阱与挑战

- 资料隐私和安全问题

- 与传统人力资源系统集成

- 市场机会

- 与金融科技和个人化服务的融合

- 采用基于云端和行动优先的平台

- 与企业福利平台集成

- 人工智慧和预测分析的出现

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 技能差距分析与劳动发展

- 目前资料中心技能短缺评估

- 未来劳动力需求

- 技能再培训和技能提升计划

- 企业培训与个人认证

- 学术机构合作伙伴关係

- 政府培训项目

- 资料中心管理的职业道路发展

- 定价分析与成本模型

- 基础设施成本结构分析

- 供应商定价策略

- 订阅模式与消费模式

- 主机託管定价套餐

- 电力使用成本明细

- 投资报酬率评估

- 跨地区成本比较

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

- 员工福利与健康市场背景

- 全球员工福利市场演变

- 市场规模及成长趋势分析

- 福利计划现代化与数位转型

- 员工期望与体验提升

- 福利偏好的世代差异

- 财务压力与员工福利危机

- 财务压力对员工生产力的影响

- 心理健康与财务健康的相关性

- 缺勤和人员流动成本分析

- 医疗成本影响与医疗债务问题

- 工作场所健康计画的演变

- 传统健康向整体健康转变

- 身体、心理和财务健康整合

- 预防保健和早期介入重点

- 投资报酬率测量和专案有效性

- 人力资源技术与福利管理转型

- HRIS 和福利平台集成

- 自助服务和员工体验增强

- 数据分析与个人化功能

- 行动优先和数位原生解决方案

- 全球员工福利市场演变

- 财务健康状况与消费者行为

- 个人财务管理挑战

- 家庭债务和信用管理问题

- 退休储蓄和规划不足

- 应急基金和金融韧性缺口

- 金融知识和教育缺陷

- 行为金融学与决策心理学

- 认知偏误与财务决策

- 行为推动与介入效果

- 习惯养成和可持续的行为改变

- 游戏化与参与心理学

- 数位金融服务采用趋势

- 手机银行和数位支付的采用

- 机器人咨询和自动化投资成长

- 个人理财应用程式的使用和参与度

- 人工智慧金融辅导与指导

- 代际财务行为与偏好

- 千禧世代和数位优先财务管理

- Z 世代与行动原生期望

- X 世代与退休计画重点

- 婴儿潮世代与传统金融服务

- 个人财务管理挑战

- 财务健康软体的功能和能力

- 财务评估和健康评分

- 全面的财务健康评估

- 信用评分监控与改进

- 债务收入比和债务管理

- 储蓄率和应急基金分析

- 预算和费用管理

- 自动费用分类和跟踪

- 预算制定和目标设定

- 消费模式分析和见解

- 帐单提醒和付款自动化

- 储蓄和投资指导

- 自动储蓄和汇总程序

- 投资教育与投资组合指导

- 退休计划和 401(K) 优化

- 基于目标的储蓄和投资策略

- 债务管理和信用改善

- 债务合併和偿还策略

- 信用评分改进和监控

- 学生贷款管理和减免计划

- 抵押贷款和购屋指导

- 金融教育与辅导

- 个人化金融教育内容

- 互动学习模组和评估

- 一对一财务指导与咨询

- 同侪学习和社区功能

- 财务评估和健康评分

- 资料安全和隐私框架

- 财务资料保护与安全

- 银行级安全和加密标准

- 多因素身份验证和存取控制

- 资料标记化和 PCI DSS 合规性

- 诈欺检测与预防系统

- 隐私合规和监管框架

- GDPR 与资料保护法规合规性

- CCPA 和州隐私法合规性

- HIPAA 和健康资讯保护

- SOC 2 与安全审计合规性

- 资料治理与管理

- 资料分类和处理程序

- 同意管理和用户控制

- 资料保留和删除政策

- 第三方资料共享和合作伙伴关係

- 事件回应和业务连续性

- 安全事件回应和恢復

- 业务连续性和灾难復原

- 供应商风险管理与尽职调查

- 保险和责任范围

- 财务资料保护与安全

- 员工敬业度与行为改变

- 用户采用和参与策略

- 入职和初始使用者体验

- 游戏化和激励计划

- 社交特征和同行比较

- 推播通知和提醒系统

- 行为改变和习惯养成

- 行为经济学与助推理论应用

- 目标设定和进度跟踪

- 微学习和简短内容

- 庆祝和成就认可

- 个性化和客製化

- 个人财务状况评估

- 个人化建议和行动计划

- 文化和人口定制

- 学习风格和偏好适应

- 测量和分析

- 参与度指标和使用分析

- 行为变化测量和跟踪

- 财务结果评估和相关性

- 项目有效性和投资报酬率计算

- 用户采用和参与策略

- 整合与生态系连结性

- 人力资源资讯系统(HRIS)集成

- 员工资料同步与管理

- 单一登入 (SSO) 和身份验证

- 工资系统整合和资料流

- 福利登记与管理整合

- 金融机构与银行业整合

- 银行帐户汇总和交易资料

- 信用评分和信用报告整合

- 投资帐户和 401(K) 连接

- 贷款和抵押资讯整合

- 第三方服务提供者集成

- 财务规划与咨询服务

- 信用咨询和债务管理服务

- 保险和保障产品整合

- 教育内容与学习平台整合

- 健康平台与生态系整合

- 身体健康与健康平台整合

- 心理健康与 EAP 计划的联繫

- 福利管理平台整合

- 奖励和认可计划整合

- 人力资源资讯系统(HRIS)集成

- 个人化和人工智慧洞察

- 人工智慧和机器学习应用

- 预测分析和风险评估

- 个人化推荐引擎

- 自然语言处理与聊天机器人

- 行为模式识别与分析

- 数据驱动的个人化和客製化

- 个人财务状况及状况分析

- 基于目标的建议和行动计划

- 生活事件检测与自适应指导

- 风险承受能力和投资偏好评估

- 行为洞察与介入策略

- 消费模式分析和警报

- 节省机会识别和自动化

- 债务减免策略优化

- 财务目标达成追踪和支持

- 持续学习和模型改进

- 使用者回馈整合与模型训练

- A/B测试和优化

- 结果测量和演算法改进

- 偏见检测和公平性优化

- 人工智慧和机器学习应用

- 未来技术路线图与创新时间表

- 技术演进与增强(2024-2034)

- 人工智慧和机器学习的进步

- 语音介面和对话式人工智慧

- 扩增实境与沉浸式学习

- 区块链与安全身分管理

- 金融服务融合创新

- 嵌入式金融与银行即服务

- 即时支付和即时结算

- 开放银行和资料可携性增强

- 中央银行数位货币(CBDC)整合

- 行为科学与心理学整合

- 高阶行为推动与介入

- 神经经济学与脑科学应用

- 社会心理学与同侪影响整合

- 习惯养成和行为改变优化

- 平台演进与生态系发展

- 超应用及综合平台开发

- 市场和第三方整合

- B2B2C和白标平台扩展

- 行业特定和垂直解决方案开发

- 技术演进与增强(2024-2034)

- 技术与创新格局

- 技术与架构

- 微服务、云端、行动、API、安全、AI/ML、区块链、AR/VR、资料管理、集成

- DevOps 与持续部署(CI/CD、自动化测试、发布管理)

- 效能、正常运作时间和 SLAS(延迟、灾难復原、高可用性)

- 低程式码/无程式码支援(客製化、工作流程自动化)

- 数据与分析

- 即时分析、资料湖/仓库、隐私、同意、货币化

- 可解释人工智慧(XAI)

- 资料主权(跨境资料传输、驻留)

- 合成资料(模型训练/测试、隐私)

- 使用者体验和可访问性

- 行动优先、可访问性、个人化

- 全通路体验(网路、行动、聊天、语音、面对面)

- 在地化(语言、货币、监管、文化适应)

- 创新与新兴趋势

- 区块链、AR/VR、对话式 UI、嵌入式金融、生物识别

- 量子计算(对加密、安全、分析的影响)

- 大规模个人化推动(超个人化、情境感知介入)

- 穿戴式装置整合(健康与金融健康融合)

- 技术与架构

- 用例

- 网路安全与资料保护分析

- 互通性和标准分析

- 培训和变革管理

- 数位转型影响分析

- 新兴用例和应用

- 最佳情况

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依组件划分,2021 - 2034 年

- 主要趋势

- 软体

- 服务

第六章:市场估计与预测:依部署模型,2021 - 2034 年

- 主要趋势

- 基于云端

- 本地

- 杂交种

第七章:市场估计与预测:依组织规模,2021 - 2034 年

- 主要趋势

- 大型企业

- 中小企业

第 8 章:市场估计与预测:按解决方案,2021 年至 2034 年

- 主要趋势

- 财务评估和健康评分

- 预算和费用管理

- 储蓄和投资指导

- 债务管理和信用改善

- 金融教育与辅导

第九章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 金融服务业协会

- 资讯科技和电信

- 卫生保健

- 製造业

- 零售与电子商务

- 其他的

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 全球参与者

- Betterment at Work

- Enrich (iGrad Inc.)

- Financial Finesse

- LearnLux

- Mercer LLC

- Origin Financial

- PayActiv

- Prudential Financial

- Salary Finance

- SmartDollar (Dave Ramsey Solutions)

- SoFi at Work

- 区域参与者

- BrightDime

- BrightPlan

- Commonwealth

- Edukate

- Even Responsible Finance

- FinFit

- Holisticly

- My Secure Advantage (MSA)

- Thrive Global

The Global Financial Wellness Software Market was valued at USD 3.8 billion in 2024 and is estimated to grow at a CAGR of 10.4% to reach USD 10.2 billion by 2034.

The increasing financial stress experienced by employees across all income levels is fueling the market growth. With rising living costs, mounting personal debt, and economic uncertainty, more individuals are struggling to manage their finances effectively. This has prompted employers to invest in financial wellness platforms as part of their employee benefits strategy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 Billion |

| Forecast Value | $10.2 Billion |

| CAGR | 10.4% |

Rising Adoption in Software

The software segment held sustainable share in 2024 driven by scalable and tech-driven platforms that can be customized to employee needs. These software solutions offer robust tools budgeting, goal setting, debt management, and personalized financial advice all under one digital roof. With remote work and hybrid environments becoming the norm, cloud-based financial wellness software ensures 24/7 accessibility, secure data integration, and real-time updates.

Large Enterprise to Gain Traction

The large enterprise segment generated notable share in 2024, driven by growing investment in employee well-being programs. Big companies understand that financial stress doesn't just impact individuals however, it affects performance, morale, and turnover. With thousands of employees to support, large organizations are adopting scalable financial wellness platforms that offer personalized insights, analytics, and engagement tracking.

Growing Prevalence in Financial Assessment and Health Scoring

The financial assessment and health scoring segment is expected to generate significant share by 2034, as employers seek immeasurable ways to evaluate financial well-being. These tools help users understand where they stand through personalized financial health scores, identifying risk areas and offering actionable steps to improve them.

Regional Insights

U.S to Emerge as a Lucrative Region

U.S. financial wellness software market held sizeable share in 2024, owing to a combination of high financial literacy, employer-driven wellness initiatives, and a robust HR tech ecosystem. American companies are leading the charge when it comes to prioritizing employee financial health. With inflation, student loans, and retirement planning weighing heavily on workers, U.S. employers are proactively turning to digital platforms to offer real-time support.

Major players in the financial wellness software market include PayActiv, Thrive Global, LearnLux, Origin Financial, Prudential Financial, BrightDime, Mercer LLC, Financial Finesse, Enrich (iGrad Inc.), SmartDollar.

Leading players in the financial wellness software market are focusing on product innovation, strategic partnerships, and personalization to enhance their market presence. Many are investing in AI-driven platforms that deliver tailored financial advice, budgeting tools, and real-time support to users. Companies like LearnLux, Financial Finesse, and PayActiv are expanding their offerings through collaborations with employers, HR platforms, and benefits providers, integrating financial wellness tools directly into existing employee benefit ecosystems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.1.6 GMI proprietary AI system

- 1.1.6.1 AI-Powered research enhancement

- 1.1.6.2 Source consistency protocol

- 1.1.6.3 AI accuracy metrics

- 1.2 Forecast model

- 1.3 Primary research and validation

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario Analysis Framework

- 1.4 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Secondary

- 1.5.1.1 Paid Sources

- 1.5.1.2 Public Sources

- 1.5.1.3 Sources, by region

- 1.5.1 Secondary

- 1.6 Research Trail & Confidence Scoring

- 1.6.1 Research Trail Components:

- 1.6.2 Scoring Components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment Model

- 2.2.4 Organization Size

- 2.2.5 Solution

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising Employee Financial Stress

- 3.2.1.2 Growing Adoption of Cloud & AI Technologies

- 3.2.1.3 Employer Focus on Holistic Employee Well-being

- 3.2.1.4 Regulatory and Government Incentives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data Privacy and Security Concerns

- 3.2.2.2 Integration with Legacy HR Systems

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with FinTech and Personalized Services

- 3.2.3.2 Adoption of Cloud-Based and Mobile-First Platforms

- 3.2.3.3 Integration with Corporate Benefits Platforms

- 3.2.3.4 Emergence of AI and Predictive Analytics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Skills gap analysis and workforce development

- 3.8.1 Current data center skills shortage assessment

- 3.8.2 Future workforce requirements

- 3.8.3 Reskilling and upskilling initiatives

- 3.8.4 Corporate training vs individual certification

- 3.8.5 Academic institution partnerships

- 3.8.6 Government training programs

- 3.8.7 Career path development in data center management

- 3.9 Pricing analysis and cost models

- 3.9.1 Infrastructure cost structure analysis

- 3.9.2 Vendor pricing strategies

- 3.9.3 Subscription vs consumption-based models

- 3.9.4 Colocation pricing packages

- 3.9.5 Power usage cost breakdown

- 3.9.6 ROI assessment for investment

- 3.9.7 Cost comparison across regions

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Employee benefits and wellness market context

- 3.12.1 Global employee benefits market evolution

- 3.12.1.1 Market size and growth trends analysis

- 3.12.1.2 Benefits program modernization and digital transformation

- 3.12.1.3 Employee expectations and experience enhancement

- 3.12.1.4 Generational differences in benefits preferences

- 3.12.2 Financial stress and employee wellbeing crisis

- 3.12.2.1 Financial stress impact on employee productivity

- 3.12.2.2 Mental health and financial wellness correlation

- 3.12.2.3 Absenteeism and turnover cost analysis

- 3.12.2.4 Healthcare cost impact and medical debt issues

- 3.12.3 Workplace wellness program evolution

- 3.12.3.1 Traditional wellness to holistic wellbeing shift

- 3.12.3.2 Physical, mental, and financial wellness integration

- 3.12.3.3 Preventive care and early intervention focus

- 3.12.3.4 ROI measurement and program effectiveness

- 3.12.4 HR technology and benefits administration transformation

- 3.12.4.1 HRIS and benefits platform integration

- 3.12.4.2 Self-service and employee experience enhancement

- 3.12.4.3 Data analytics and personalization capabilities

- 3.12.4.4 Mobile-first and digital-native solutions

- 3.12.1 Global employee benefits market evolution

- 3.13 Financial wellness landscape and consumer behavior

- 3.13.1 Personal financial management challenges

- 3.13.1.1 Household debt and credit management issues

- 3.13.1.2 Retirement savings and planning inadequacy

- 3.13.1.3 Emergency fund and financial resilience gaps

- 3.13.1.4 Financial literacy and education deficits

- 3.13.2 Behavioral finance and decision-making psychology

- 3.13.2.1 Cognitive biases and financial decision making

- 3.13.2.2 Behavioral nudges and intervention effectiveness

- 3.13.2.3 Habit formation and sustainable behavior change

- 3.13.2.4 Gamification and engagement psychology

- 3.13.3 Digital financial services adoption trends

- 3.13.3.1 Mobile banking and digital payment adoption

- 3.13.3.2 Robo-advisory and automated investment growth

- 3.13.3.3 Personal finance app usage and engagement

- 3.13.3.4 Ai-powered financial coaching and guidance

- 3.13.4 Generational financial behavior and preferences

- 3.13.4.1 Millennials and digital-first financial management

- 3.13.4.2 Generation Z and mobile-native expectations

- 3.13.4.3 Generation X and retirement planning focus

- 3.13.4.4 Baby boomers and traditional financial services

- 3.13.1 Personal financial management challenges

- 3.14 Financial wellness software features and capabilities

- 3.14.1 Financial assessment and health scoring

- 3.14.1.1 Comprehensive financial health assessment

- 3.14.1.2 Credit score monitoring and improvement

- 3.14.1.3 Debt-to-income ratio and debt management

- 3.14.1.4 Savings rate and emergency fund analysis

- 3.14.2 Budgeting and expense management

- 3.14.2.1 Automated expense categorization and tracking

- 3.14.2.2 Budget creation and goal setting

- 3.14.2.3 Spending pattern analysis and insights

- 3.14.2.4 Bill reminder and payment automation

- 3.14.3 Savings and investment guidance

- 3.14.3.1 Automated savings and round-up programs

- 3.14.3.2 Investment education and portfolio guidance

- 3.14.3.3 Retirement planning and 401(K) optimization

- 3.14.3.4 Goal-based savings and investment strategies

- 3.14.4 Debt management and credit improvement

- 3.14.4.1 Debt consolidation and payoff strategies

- 3.14.4.2 Credit score improvement and monitoring

- 3.14.4.3 Student loan management and forgiveness programs

- 3.14.4.4 Mortgage and home buying guidance

- 3.14.5 Financial education and coaching

- 3.14.5.1 Personalized financial education content

- 3.14.5.2 Interactive learning modules and assessments

- 3.14.5.3 One-on-one financial coaching and counseling

- 3.14.5.4 Peer learning and community features

- 3.14.1 Financial assessment and health scoring

- 3.15 Data security and privacy framework

- 3.15.1 Financial data protection and security

- 3.15.1.1 Bank-level security and encryption standards

- 3.15.1.2 Multi-factor authentication and access control

- 3.15.1.3 Data tokenization and PCI DSS compliance

- 3.15.1.4 Fraud detection and prevention systems

- 3.15.2 Privacy compliance and regulatory framework

- 3.15.2.1 GDPR and data protection regulation compliance

- 3.15.2.2 CCPA and state privacy law compliance

- 3.15.2.3 HIPAA and health information protection

- 3.15.2.4 SOC 2 and security audit compliance

- 3.15.3 Data governance and management

- 3.15.3.1 Data classification and handling procedures

- 3.15.3.2 Consent management and user control

- 3.15.3.3 Data retention and deletion policies

- 3.15.3.4 Third-party data sharing and partnerships

- 3.15.4 Incident response and business continuity

- 3.15.4.1 Security incident response and recovery

- 3.15.4.2 Business continuity and disaster recovery

- 3.15.4.3 Vendor risk management and due diligence

- 3.15.4.4 Insurance and liability coverage

- 3.15.1 Financial data protection and security

- 3.16 Employee engagement and behavioral change

- 3.16.1 User adoption and engagement strategies

- 3.16.1.1 Onboarding and initial user experience

- 3.16.1.2 Gamification and incentive programs

- 3.16.1.3 Social features and peer comparison

- 3.16.1.4 Push notifications and reminder systems

- 3.16.2 Behavioral change and habit formation

- 3.16.2.1 Behavioral economics and nudge theory application

- 3.16.2.2 Goal setting and progress tracking

- 3.16.2.3 Micro-learning and bite-sized content

- 3.16.2.4 Celebration and achievement recognition

- 3.16.3 Personalization and customization

- 3.16.3.1 Individual financial situation assessment

- 3.16.3.2 Personalized recommendations and action plans

- 3.16.3.3 Cultural and demographic customization

- 3.16.3.4 Learning style and preference adaptation

- 3.16.4 Measurement and analytics

- 3.16.4.1 Engagement metrics and usage analytics

- 3.16.4.2 Behavioral change measurement and tracking

- 3.16.4.3 Financial outcome assessment and correlation

- 3.16.4.4 Program effectiveness and ROI calculation

- 3.16.1 User adoption and engagement strategies

- 3.17 Integration and ecosystem connectivity

- 3.17.1 HR information system (HRIS) integration

- 3.17.1.1 Employee data synchronization and management

- 3.17.1.2 Single sign-on (SSO) and authentication

- 3.17.1.3 Payroll system integration and data flow

- 3.17.1.4 Benefits enrollment and administration integration

- 3.17.2 Financial institution and banking integration

- 3.17.2.1 Bank account aggregation and transaction data

- 3.17.2.2 Credit score and credit report integration

- 3.17.2.3 Investment account and 401(K) connectivity

- 3.17.2.4 Loan and mortgage information integration

- 3.17.3 Third-party service provider integration

- 3.17.3.1 Financial planning and advisory services

- 3.17.3.2 Credit counseling and debt management services

- 3.17.3.3 Insurance and protection product integration

- 3.17.3.4 Educational content and learning platform integration

- 3.17.4 Wellness platform and ecosystem integration

- 3.17.4.1 Physical wellness and health platform integration

- 3.17.4.2 Mental health and EAP program connectivity

- 3.17.4.3 Benefits administration platform integration

- 3.17.4.4 Rewards and recognition program integration

- 3.17.1 HR information system (HRIS) integration

- 3.18 Personalization and AI-powered insights

- 3.18.1 Artificial intelligence and machine learning applications

- 3.18.1.1 Predictive analytics and risk assessment

- 3.18.1.2 Personalized recommendation engines

- 3.18.1.3 Natural language processing and chatbots

- 3.18.1.4 Behavioral pattern recognition and analysis

- 3.18.2 Data-driven personalization and customization

- 3.18.2.1 Individual financial profile and situation analysis

- 3.18.2.2 Goal-based recommendations and action plans

- 3.18.2.3 Life event detection and adaptive guidance

- 3.18.2.4 Risk tolerance and investment preference assessment

- 3.18.3 Behavioral insights and intervention strategies

- 3.18.3.1 Spending pattern analysis and alerts

- 3.18.3.2 Savings opportunity identification and automation

- 3.18.3.3 Debt reduction strategy optimization

- 3.18.3.4 Financial goal achievement tracking and support

- 3.18.4 Continuous learning and model improvement

- 3.18.4.1 User feedback integration and model training

- 3.18.4.2 A/B testing and optimization

- 3.18.4.3 Outcome measurement and algorithm refinement

- 3.18.4.4 Bias detection and fairness optimization

- 3.18.1 Artificial intelligence and machine learning applications

- 3.19 Future technology roadmap and innovation timeline

- 3.19.1 Technology evolution and enhancement (2024-2034)

- 3.19.1.1 AI and machine learning advancement

- 3.19.1.2 Voice interface and conversational AI

- 3.19.1.3 Augmented reality and immersive learning

- 3.19.1.4 Blockchain and secure identity management

- 3.19.2 Financial services integration and innovation

- 3.19.2.1 Embedded finance and banking-as-a-service

- 3.19.2.2 Real-time payments and instant settlement

- 3.19.2.3 Open banking and data portability enhancement

- 3.19.2.4 Central bank digital currency (CBDC) integration

- 3.19.3 Behavioral science and psychology integration

- 3.19.3.1 Advanced behavioral nudging and intervention

- 3.19.3.2 Neuroeconomics and brain science application

- 3.19.3.3 Social psychology and peer influence integration

- 3.19.3.4 Habit formation and behavior change optimization

- 3.19.4 Platform evolution and ecosystem development

- 3.19.4.1 Super app and comprehensive platform development

- 3.19.4.2 Marketplace and third-party integration

- 3.19.4.3 B2B2C and white-label platform expansion

- 3.19.4.4 Industry-specific and vertical solution development

- 3.19.1 Technology evolution and enhancement (2024-2034)

- 3.20 Technology & innovation landscape

- 3.20.1 Technology & architecture

- 3.20.1.1 Microservices, cloud, mobile, APIs, security, AI/ML, blockchain, AR/VR, data management, integration

- 3.20.1.2 DevOps & continuous deployment (CI/CD, automated testing, release management)

- 3.20.1.3 Performance, uptime, and SLAS (latency, disaster recovery, high-availability)

- 3.20.1.4 Low-code/no-code enablement (customization, workflow automation)

- 3.20.2 Data & analytics

- 3.20.2.1 Real-time analytics, data lake/warehouse, privacy, consent, monetization

- 3.20.2.2 Explainable AI (XAI)

- 3.20.2.3 Data sovereignty (cross-border data transfer, residency)

- 3.20.2.4 Synthetic data (model training/testing, privacy)

- 3.20.3 User experience & accessibility

- 3.20.3.1 Mobile-first, accessibility, personalization

- 3.20.3.2 Omnichannel experience (web, mobile, chat, voice, in-person)

- 3.20.3.3 Localization (language, currency, regulatory, cultural adaptation)

- 3.20.4 Innovation & emerging trends

- 3.20.4.1 Blockchain, AR/VR, conversational UI, embedded finance, biometrics

- 3.20.4.2 Quantum computing (impact on encryption, security, analytics)

- 3.20.4.3 Personalized nudging at scale (hyper-personalized, context-aware interventions)

- 3.20.4.4 Wearables integration (health-financial wellness convergence)

- 3.20.1 Technology & architecture

- 3.21 Use cases

- 3.21.1 Cybersecurity and data protection analysis

- 3.21.2 Interoperability and standards analysis

- 3.21.3 Training and change management

- 3.21.4 Digital transformation impact analysis

- 3.21.5 Emerging use cases and applications

- 3.22 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Service

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cloud-based

- 6.3 On-premises

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Large enterprises

- 7.3 SME

Chapter 8 Market Estimates & Forecast, By Solution, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Financial assessment and health scoring

- 8.3 Budgeting and expense management

- 8.4 Savings and investment guidance

- 8.5 Debt management and credit improvement

- 8.6 Financial education and coaching

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 IT & Telecom

- 9.4 Healthcare

- 9.5 Manufacturing

- 9.6 Retail & E-commerce

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Betterment at Work

- 11.1.2 Enrich (iGrad Inc.)

- 11.1.3 Financial Finesse

- 11.1.4 LearnLux

- 11.1.5 Mercer LLC

- 11.1.6 Origin Financial

- 11.1.7 PayActiv

- 11.1.8 Prudential Financial

- 11.1.9 Salary Finance

- 11.1.10 SmartDollar (Dave Ramsey Solutions)

- 11.1.11 SoFi at Work

- 11.2 Regional Players

- 11.2.1 BrightDime

- 11.2.2 BrightPlan

- 11.2.3 Commonwealth

- 11.2.4 Edukate

- 11.2.5 Even Responsible Finance

- 11.2.6 FinFit

- 11.2.7 Holisticly

- 11.2.8 My Secure Advantage (MSA)

- 11.2.9 Thrive Global