|

市场调查报告书

商品编码

1822566

专业纸巾市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Professional Tissue Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

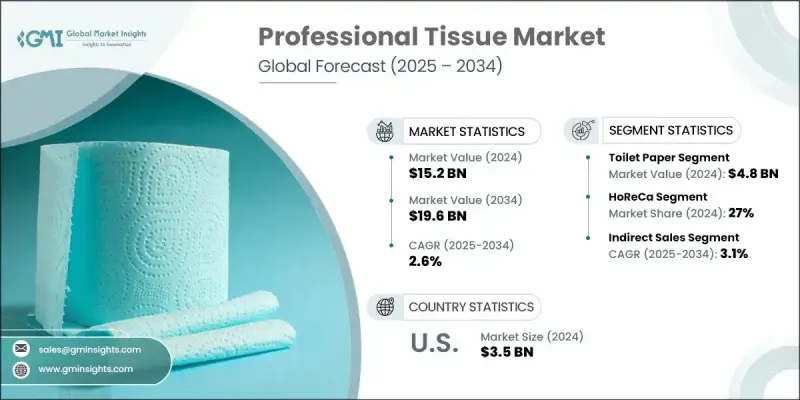

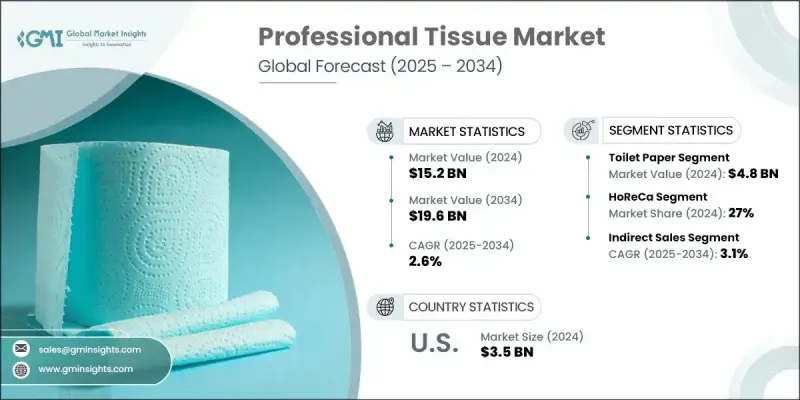

2024 年全球专业纸巾市场价值为 152 亿美元,预计到 2034 年将以 2.6% 的复合年增长率增长至 196 亿美元。

医疗保健、饭店、餐饮和教育等行业卫生法规日益严格,导致对纸巾、卫生纸和餐巾纸等专业卫生纸产品的需求不断增加。各机构将清洁度放在首位,以确保安全和合规。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 152亿美元 |

| 预测值 | 196亿美元 |

| 复合年增长率 | 2.6% |

卫生纸市场接受度不断上升

2024年,卫生纸市场占据了显着份额,这得益于办公大楼、机场、医院和教育机构等人流量大的环境。持续的卫生维护需求,加上公共和商业场所客流量的增加,持续推动卫生纸销售的成长。企业优先批量采购柔软、容量大的捲筒卫生纸,以减少维护和补货的频率。供应商也纷纷推出无芯捲筒卫生纸和巨型纸盒等创新产品,进一步优化产品使用,减少浪费。

HoReCa获得发展动力

2024年,饭店餐饮业(HoReCa)市场占据了显着份额,这得益于高品质专业卫生纸产品的支撑。面向顾客的环境需要兼具功能性和美观性的卫生解决方案,包括餐巾纸、手巾纸和麵巾纸。营运商正在寻求兼顾奢华与永续性的产品,这促使卫生纸供应商在不影响性能或外观的前提下提供环保解决方案。

间接市场需求不断成长

2024年,间接销售领域占据了显着份额,这得益于分销商、批发商和设施管理公司等中介机构的推动。该通路规模大、效率高,尤其适合涵盖那些可能无法直接从製造商采购的中小企业。间接销售领域因其能够服务分散的市场、提供客製化解决方案和灵活的供应模式而持续成长。

区域洞察

北美将成为推动力地区

2024年,北美专业卫生纸市场占据了相当大的份额,这得益于人们卫生意识的提升、商业基础设施的扩张以及日益严格的卫生标准。医疗保健、教育、餐饮服务和办公空间等行业推动了需求成长,这些产业都需要一致且安全的卫生解决方案。永续实践的转变进一步推动了成长,促使机构买家寻求可回收和FSC认证的产品。人们对健康和清洁的日益关注,已将卫生纸产品从商品转变为关键的营运必需品。

专业纸巾市场的主要参与者有 Pro-Gest、Kimberly-Clark、CMPC、WEPA Hygieneprodukte、Cascades、宝洁、Metsa Tissue、Kruger、Renova、Sofidel、Lucart、Ontex、Industrie Celtex、Georgia-Pacific 和 Essity。

为了巩固市场地位,专业卫生纸市场的公司正在采取永续发展创新、产品差异化和数位转型相结合的策略。他们正在拓展环保产品线,使用再生材料、竹纤维和可生物降解包装,以符合日益严格的环保法规和客户期望。同时,许多公司正在开发分配系统,以减少浪费、改善卫生状况并提升商业场所的品牌忠诚度。强大的经销商网路、自动化生产投资以及整合的B2B订购平台对于确保快速交付和营运效率至关重要。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 原料分析

- 贸易统计

- 主要进口国

- 主要出口国

- 波特五力分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 卫生纸

- 单层

- 双层

- 其他(三层等)

- 面纸

- 纸巾

- 捲毛巾

- 折迭毛巾

- 其他(中心拉毛巾等)

- 餐巾

- 湿纸巾

- 其他(药用纸、厨房用纸等)

第六章:市场估计与预测:按来源,2021 - 2034

- 主要趋势

- 原生纸浆

- 再生纸

- 其他的

第七章:市场估计与预测:按价格,2021 - 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第 8 章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 卫生保健

- HoReCa

- 公司办公室

- 工业和製造业

- 运输与物流

- 公部门

- 教育

- 其他(设施管理等)

第九章:市场估计与预测:按配销通路,2021 - 2034

- 主要趋势

- 直销

- 间接销售

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Cascades

- CMPC

- Essity

- Georgia-Pacific

- Industrie Celtex

- Kimberly-Clark

- Kruger

- Lucart

- Metsa Tissue

- Ontex

- Procter & Gamble

- Pro-Gest

- Renova

- Sofidel

- WEPA Hygieneprodukte

The Global Professional Tissue Market was valued at USD 15.2 billion in 2024 and is estimated to grow at a CAGR of 2.6% to reach USD 19.6 billion by 2034.

Stricter hygiene regulations in sectors like healthcare, hospitality, food service, and education are increasing the demand for professional tissue products such as paper towels, toilet tissue, and napkins. Organizations are prioritizing cleanliness to ensure safety and compliance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.2 Billion |

| Forecast Value | $19.6 Billion |

| CAGR | 2.6% |

Rising Adoption of the Toilet Paper Segment

The toilet paper segment held a notable share in 2024, driven by high-traffic environments such as office buildings, airports, hospitals, and educational institutions. Consistent demand for hygiene maintenance, combined with increasing footfall in public and commercial spaces, continues to drive volume growth. Businesses are prioritizing bulk purchasing of soft, high-capacity rolls that reduce the frequency of maintenance and restocking. Suppliers are also responding with innovations such as coreless rolls and jumbo dispensers, further optimizing product usage and minimizing waste.

HoReCa to Gain Traction

The HoReCa segment generated a significant share in 2024, backed by premium-quality professional tissue products. Customer-facing environments require functional and aesthetically pleasing hygiene solutions, including napkins, hand towels, and facial tissues. Operators are seeking products that balance luxury and sustainability, pushing tissue suppliers to offer environmentally friendly solutions without compromising performance or presentation.

Increasing Demand for the Indirect Segment

The indirect sales segment held a notable share in 2024, fueled by intermediaries such as distributors, wholesalers, and facility management companies. This channel offers scale and efficiency, especially for reaching small and medium-sized enterprises that may not purchase directly from manufacturers. The indirect segment continues to grow due to its ability to serve fragmented markets, offering tailored solutions and flexible supply models.

Regional Insights

North America to Emerge as a Propelling Region

North America professional tissue market generated a sizeable share in 2024, driven by heightened awareness around hygiene, expanding commercial infrastructure, and increasingly stringent sanitation standards. Demand is fueled by sectors such as healthcare, education, food service, and office spaces-all requiring consistent and safe hygiene solutions. Growth is further supported by a shift toward sustainable practices, prompting institutional buyers to seek recycled and FSC-certified products. Rising focus on health and cleanliness has transformed tissue products from commodities to critical operational essentials.

Major players involved in the professional tissue market are Pro-Gest, Kimberly-Clark, CMPC, WEPA Hygieneprodukte, Cascades, Procter & Gamble, Metsa Tissue, Kruger, Renova, Sofidel, Lucart, Ontex, Industrie Celtex, Georgia-Pacific, and Essity.

To reinforce their market presence, companies in the professional tissue market are adopting a combination of sustainability innovation, product differentiation, and digital transformation. They are expanding eco-friendly product lines using recycled content, bamboo fiber, and biodegradable packaging to align with growing environmental regulations and customer expectations. In parallel, many are developing dispenser systems that reduce waste, enhance hygiene, and encourage brand loyalty in commercial spaces. Strong distributor networks, investments in automated production, and integrated B2B ordering platforms have become crucial in ensuring fast delivery and operational efficiency.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 By product type

- 2.2.3 By source

- 2.2.4 By price

- 2.2.5 By end use industry

- 2.2.6 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Raw material analysis

- 3.9 Trade statistics

- 3.9.1 Major importing countries

- 3.9.2 Major exporting countries

- 3.10 Porter's five forces analysis

- 3.11 PESTEL analysis

- 3.12 Consumer behavior analysis

- 3.12.1 Purchasing patterns

- 3.12.2 Preference analysis

- 3.12.3 Regional variations in consumer behavior

- 3.12.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Billion, Million Units)

- 5.1 Key trends

- 5.2 Toilet paper

- 5.2.1 Single ply

- 5.2.2 Double ply

- 5.2.3 Others (triple ply, etc.)

- 5.3 Facial tissues

- 5.4 Paper towels

- 5.4.1 Roll towels

- 5.4.2 Folded towels

- 5.4.3 Others (center-pull towels, etc.)

- 5.5 Napkins

- 5.6 Wet wipes

- 5.7 Others (medicinal paper, kitchen paper, etc.)

Chapter 6 Market Estimates & Forecast, By Source, 2021 - 2034 ($Billion, Million Units)

- 6.1 Key trends

- 6.2 Virgin pulp

- 6.3 Recycled paper

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034 ($Billion, Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By End Use industry, 2021 - 2034 ($Billion, Million Units)

- 8.1 Key trends

- 8.2 Healthcare

- 8.3 HoReCa

- 8.4 Corporate offices

- 8.5 Industries & manufacturing

- 8.6 Transport & logistics

- 8.7 Public sector

- 8.8 Education

- 8.9 Others (facility management etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Million Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Cascades

- 11.2 CMPC

- 11.3 Essity

- 11.4 Georgia-Pacific

- 11.5 Industrie Celtex

- 11.6 Kimberly-Clark

- 11.7 Kruger

- 11.8 Lucart

- 11.9 Metsa Tissue

- 11.10 Ontex

- 11.11 Procter & Gamble

- 11.12 Pro-Gest

- 11.13 Renova

- 11.14 Sofidel

- 11.15 WEPA Hygieneprodukte