|

市场调查报告书

商品编码

1822609

再生能源碳信用市场机会、成长动力、产业趋势分析及2025-2034年预测Renewable Energy Carbon Credit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

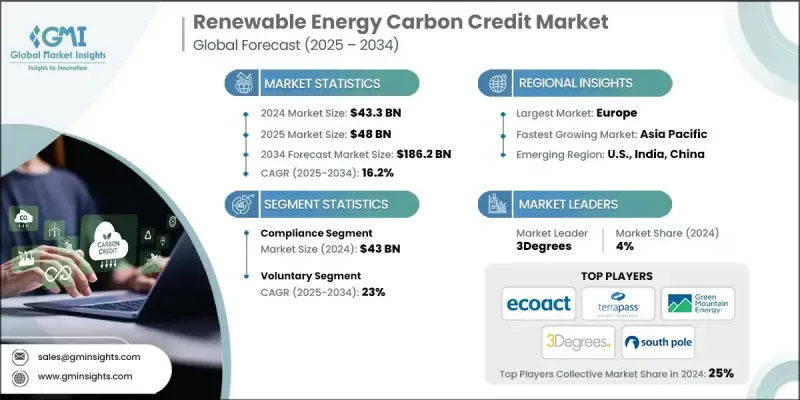

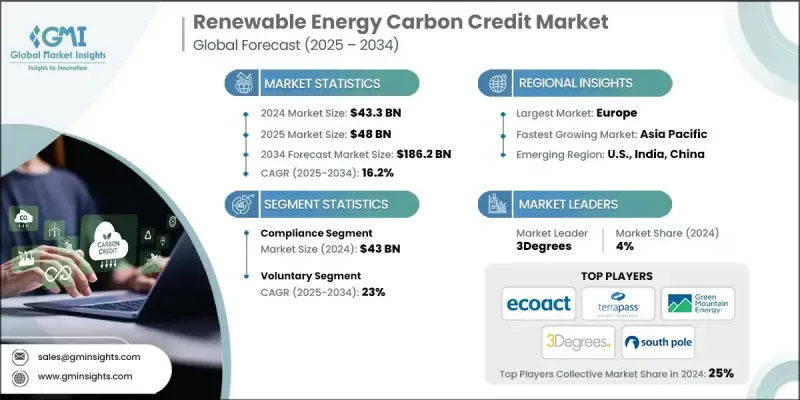

根据 Global Market Insights Inc. 发布的最新报告,2024 年全球再生能源碳信用市场规模估计为 433 亿美元,预计将从 2025 年的 480 亿美元增长到 2034 年的 1862 亿美元,复合年增长率为 16.2%。

世界各国政府和企业都在製定积极的净零排放目标,这导致对再生能源专案产生的碳信用额的需求激增。这些信用额度有助于弥补当前排放量与长期脱碳目标之间的差距。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 433亿美元 |

| 预测值 | 1862亿美元 |

| 复合年增长率 | 16.2% |

合规性获得牵引力

在政府规定的减排目标和监管框架的推动下,合规领域在2024年占据了显着份额。根据限额与交易和再生能源组合标准等计划,企业必须抵消部分排放,从而刺激了对认证再生能源信用额度的稳定需求。该领域受益于结构化的监管和标准化协议,为市场参与者提供了更高的可预测性。

自愿群体采用率不断上升

随着企业、机构和个人在监管要求之外积极主动地迈向永续发展,自愿性市场将在2025-2034年期间实现可观的复合年增长率。企业正在购买再生能源碳信用额,以展现其气候领导力、实现内部净零目标并增强ESG报告。该市场蓬勃发展,因为买家可以选择符合其品牌价值的项目,例如社区太阳能发电场或小型风力发电项目。

区域洞察

欧洲将崛起为利润丰厚的地区

2024年,在雄心勃勃的气候政策、成熟的碳交易体係以及再生能源技术的广泛应用的支持下,欧洲再生能源碳信用市场创造了可观的收入。该地区以欧盟排放交易体系(EU ETS)为主导的强大合规基础设施,为碳定价和透明度树立了全球标准。同时,随着欧洲企业努力实现净零排放承诺并寻求跨国清洁能源计画融资,自愿参与的人数也不断增加。

再生能源碳信用市场的主要参与者有 WayCarbon、Carbon Credit Capital, LLC.、TerraPass、Native Energy、Climate Impact Partners、Atmosfair、The Carbon Collective Company、Carbon Better、EcoAct、ClimeCo LLC.、South Pole、ALLCOT、Sterling Planet Inc.、PcoAct、ClimeCo LLC。

为了巩固自身地位,再生能源碳信用领域的公司正注重信誉、可扩展性和数位创新。许多公司直接与再生能源开发商合作,以确保新专案的长期信用供应,从而确保额外收入和未来收入来源。其他公司则投资于先进的监测和报告技术,包括卫星资料和人工智慧,以验证信用影响并赢得买家的信任。市场领导者也与金融科技公司建立策略联盟,以简化交易平台并提高透明度。此外,一些公司正在国际扩张,根据当地气候目标客製化信用产品,并与ICVCM和VCMI等全球标准接轨,提升声誉和竞争力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 新兴机会和趋势

- 数位化和物联网集成

- 新兴市场渗透

第四章:竞争格局

- 介绍

- 按地区分析公司市场份额

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 策略倡议

- 竞争基准测试

- 战略仪表板

- 创新与技术格局

第五章:市场规模及预测:依类型,2021 - 2034

- 主要趋势

- 自愿

- 遵守

第六章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

第七章:公司简介

- 3Degrees

- Atmosfair

- ALLCOT

- Carbon Better

- Carbon Credit Capital, LLC.

- Carbon Direct

- ClimeCo LLC.

- Climate Impact Partners

- CarbonClear

- Ecosecurities

- EcoAct

- Green Mountain Energy Company

- Native Energy

- PwC

- Sterling Planet Inc.

- South Pole

- The Carbon Trust

- The Carbon Collective Company

- TerraPass

- WayCarbon

The global renewable energy carbon credit market was estimated at USD 43.3 billion in 2024 and is expected to grow from USD 48 billion in 2025 to USD 186.2 billion by 2034, at a CAGR of 16.2%, according to the latest report published by Global Market Insights Inc.

Governments and corporations worldwide are setting aggressive net-zero targets, creating a surge in demand for carbon credits generated through renewable energy projects. These credits help bridge the gap between current emissions and long-term decarbonization goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $43.3 Billion |

| Forecast Value | $186.2 Billion |

| CAGR | 16.2% |

Compliance to Gain Traction

The compliance segment held a notable share in 2024, driven by government-mandated emissions reduction targets and regulatory frameworks. Under programs like cap-and-trade and renewable portfolio standards, companies are required to offset a portion of their emissions, fueling steady demand for certified renewable energy credits. This segment benefits from structured oversight and standardized protocols, offering more predictability for market participants.

Rising Adoption Among the Voluntary Segment

The voluntary segment will grow at a decent CAGR during 2025-2034, as corporations, institutions, and individuals take proactive steps toward sustainability beyond regulatory mandates. Businesses are purchasing renewable energy carbon credits to demonstrate climate leadership, meet internal net-zero targets, and enhance ESG reporting. The segment thrives on flexibility, with buyers selecting projects that align with their brand values, such as community-based solar farms or small-scale wind developments.

Regional Insights

Europe to Emerge as a Lucrative Region

Europe renewable energy carbon credit market generated significant revenues in 2024, supported by ambitious climate policies, mature carbon trading systems, and widespread adoption of renewable technologies. The region's strong compliance infrastructure-led by the EU Emissions Trading System (EU ETS)-has set the global standard for carbon pricing and transparency. Simultaneously, voluntary participation is growing, as European corporations push toward net-zero commitments and seek to finance clean energy projects across borders.

Major players in the renewable energy carbon credit market are WayCarbon, Carbon Credit Capital, LLC., TerraPass, Native Energy, Climate Impact Partners, Atmosfair, The Carbon Collective Company, Carbon Better, EcoAct, ClimeCo LLC., South Pole, ALLCOT, Sterling Planet Inc., PwC, Green Mountain Energy Company, 3Degrees, CarbonClear, Ecosecurities, The Carbon Trust, Carbon Direct.

To strengthen their position, companies operating in the renewable energy carbon credit space are focusing on credibility, scalability, and digital innovation. Many are partnering directly with renewable energy developers to secure long-term credit supply from new projects, ensuring both additionality and future revenue streams. Others are investing in advanced monitoring and reporting technologies, including satellite data and AI, to validate credit impact and gain trust with buyers. Market leaders are also entering strategic alliances with fintech firms to streamline trading platforms and offer greater transparency. Additionally, some are expanding internationally by tailoring credit offerings to local climate goals and aligning with global standards such as ICVCM and VCMI to boost their reputation and competitiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Voluntary

- 5.3 Compliance

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.3 Europe

- 6.4 Asia Pacific

- 6.5 Middle East & Africa

- 6.6 Latin America

Chapter 7 Company Profiles

- 7.1 3Degrees

- 7.2 Atmosfair

- 7.3 ALLCOT

- 7.4 Carbon Better

- 7.5 Carbon Credit Capital, LLC.

- 7.6 Carbon Direct

- 7.7 ClimeCo LLC.

- 7.8 Climate Impact Partners

- 7.9 CarbonClear

- 7.10 Ecosecurities

- 7.11 EcoAct

- 7.12 Green Mountain Energy Company

- 7.13 Native Energy

- 7.14 PwC

- 7.15 Sterling Planet Inc.

- 7.16 South Pole

- 7.17 The Carbon Trust

- 7.18 The Carbon Collective Company

- 7.19 TerraPass

- 7.20 WayCarbon