|

市场调查报告书

商品编码

1822635

工业用燃气涡轮机市场机会、成长动力、产业趋势分析及2025-2034年预测Industrial Gas Turbine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

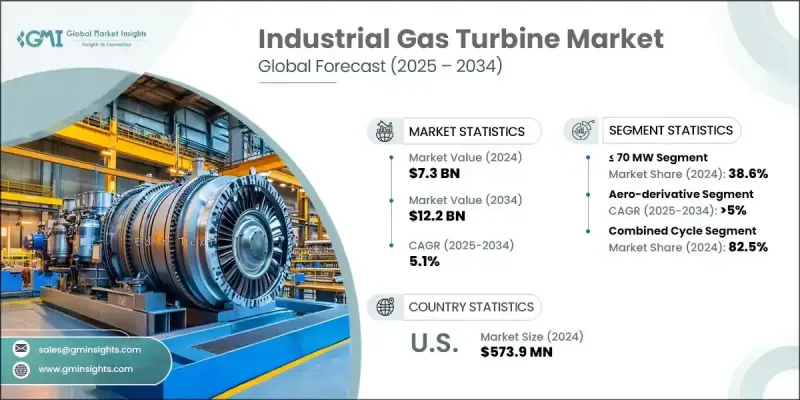

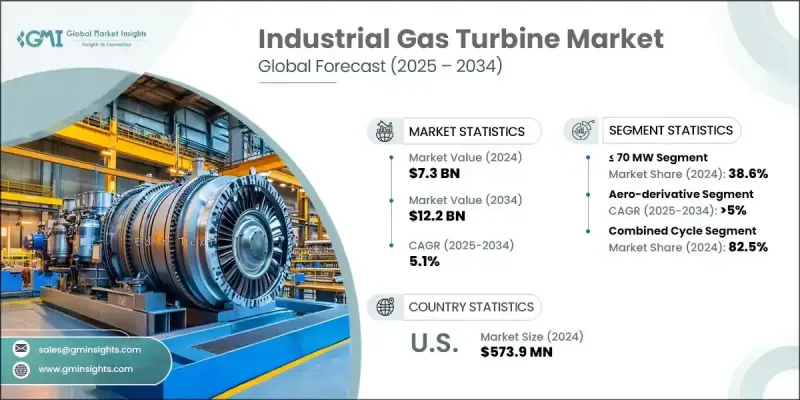

2024 年全球工业燃气涡轮机市场价值为 73 亿美元,预计到 2034 年将以 5.1% 的复合年增长率增长至 122 亿美元。

随着再生能源的不断扩张,对快速响应备用电源的需求推动了对能够快速提升发电量的燃气涡轮机的需求。当太阳能和风能发电量不稳定时,这些燃气涡轮机在确保电网稳定方面发挥着至关重要的作用。燃煤电厂的逐步淘汰,加上现有基础设施的可用性,预计将加速燃气涡轮机的更换和改造项目,尤其是在发展中经济体。燃气涡轮机能够提供稳定、灵活的发电能力,使其成为日益受多变性影响的现代能源系统中的战略资产。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 73亿美元 |

| 预测值 | 122亿美元 |

| 复合年增长率 | 5.1% |

工业燃气涡轮机是高性能发动机,旨在为各行各业输送电力或机械动力。它们采用布雷顿循环,压缩空气,将其与燃料混合,然后燃烧,形成高速气流穿过涡轮叶片,产生旋转能。由于暖气和运输行业的电气化趋势,对电网稳定资产的需求不断增长,这推动了对灵活燃气涡轮机解决方案的投资。资料中心的持续发展和城市电力拥塞也支持在正常运作时间至关重要的商业或工业场所安装燃气涡轮机。同时,越来越多的人支持将氢气作为更清洁的燃料替代品,以及使燃气涡轮机能够使用氢气或混合燃料的升级,这些都增强了先进的、面向未来的燃气涡轮机技术的应用。

2024年,装置容量小于等于70兆瓦的风力涡轮机占了38.6%的市场份额,预计到2034年将以5%的复合年增长率成长。这个细分市场受益于人们对分散式电力解决方案日益增长的兴趣,这些解决方案旨在为工业园区和偏远社区等局部区域输送电力。在尖峰负载和备用发电角色中部署的增加也促进了细分市场的扩张,尤其是在小型公用事业提供者和工业运营商中。

联合循环风电市场在2024年占了82.5%的市场份额,预计2025年至2034年的复合年增长率将达到4.5%。在再生能源併网率较高的地区,向开式循环风电的转变尤其显着,因为它们具有快速启动能力,有助于在再生能源间歇期稳定电网。开式循环风电的营运弹性使其成为平衡短期供需波动的不可或缺的工具,尤其是在清洁能源规模化发展的情况下。

美国工业用燃气涡轮机市场占53.3%的份额,2024年市场规模达5.739亿美元。美国公用事业公司越来越多地转向燃气涡轮机,以增强电力可靠性并应对再生能源产量的波动。以燃气发电系统取代旧式燃煤发电的趋势持续升温,尤其是在那些积极推行脱碳目标的州。航改型燃气涡轮机在军事设施、机场和工业设施等分散式发电领域的需求也日益增长,因为这些领域的电网独立性日益受到关注。

影响全球工业燃气涡轮机市场的主要参与者包括西门子能源、斗山、Vericor、MAN 能源解决方案、Flex 能源解决方案、三菱重工、MTU 航空发动机、索拉透平、瓦锡兰、IHI 株式会社、哈尔滨电气、贝克休斯、GE Vernova、JSC 联合发动机、BBharat 重型电气、Destce、Dests、Bululululultra绿色能源、川崎重工和南京汽轮马达。工业燃气涡轮机市场的领先公司正在透过氢兼容技术和燃料灵活的透平系统加速创新。策略投资集中在低排放燃烧系统和数位性能优化平台的研发。原始设备製造商也在对老旧的透平机组进行改造,升级燃烧器和控制系统,以满足清洁能源目标。与公用事业和政府机构的合作使人们能够参与展示氢能和氨基解决方案的示范计画。此外,公司正在扩大其全球服务网络,以提供长期维护和性能合同,提高客户保留率。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 原料可用性和采购分析

- 製造能力评估

- 供应链弹性和风险因素

- 配电网路分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 工业用燃气涡轮机成本结构分析

- 价格趋势分析

- 按地区

- 按容量

- 新兴机会和趋势

- 数位化和物联网集成

- 新兴市场渗透

- 投资分析及未来展望

第四章:竞争格局

- 介绍

- 按地区分析公司市场份额

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 战略仪表板

- 策略倡议

- 重要伙伴关係与合作

- 重大併购活动

- 产品创新与发布

- 市场扩张策略

- 竞争基准测试

- 创新与技术格局

第五章:市场规模及预测:依产能,2021 - 2034

- 主要趋势

- ≤70兆瓦

- > 70 兆瓦 - 300 兆瓦

- ≥300兆瓦

第六章:市场规模及预测:依产品,2021 - 2034

- 主要趋势

- 航改型

- 重负

第七章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 开放循环

- 复合循环

第 8 章:市场规模与预测:按应用,2021 - 2034 年

- 主要趋势

- 发电

- 石油和天然气

- 其他製造业

第九章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 俄罗斯

- 义大利

- 德国

- 法国

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 埃及

- 阿尔及利亚

- 拉丁美洲

- 巴西

- 阿根廷

第十章:公司简介

- Ansaldo Energia

- Baker Hughes

- Bharat Heavy Electricals

- Capstone Green Energy

- Destinus Energy

- Doosan

- Flex Energy Solutions

- GE Vernova

- Harbin Electric

- IHI Corporation

- JSC United Engine

- Kawasaki Heavy Industries

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- MTU Aero Engines

- Nanjing Turbine and Electric Machinery

- Rolls Royce

- Siemens Energy

- Solar Turbines

- Vericor

- Wartsila

The Global Industrial Gas Turbine Market was valued at USD 7.3 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 12.2 billion by 2034.

As renewable energy sources continue to expand, the need for rapid response backup power is fueling demand for gas turbines capable of quick ramp-ups. These turbines play a critical role in ensuring grid stability when solar and wind output is inconsistent. The gradual phase-out of coal plants, combined with the availability of legacy infrastructure, is expected to accelerate turbine replacement and repowering projects, particularly across developing economies. Their ability to provide firm, flexible generation makes gas turbines a strategic asset in modern energy systems increasingly defined by variability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.3 Billion |

| Forecast Value | $12.2 Billion |

| CAGR | 5.1% |

Industrial gas turbines are high-performance engines built to deliver electricity or mechanical power across various industrial sectors. They operate on the Brayton cycle by compressing air, mixing it with fuel, and combusting it to create high-speed gas flow through turbine blades, producing rotational energy. The rising demand for grid-stabilizing assets due to electrification trends in heating and transport sectors is advancing investments in flexible gas turbine solutions. The ongoing surge in data center development and urban power congestion also supports turbine installations at commercial or industrial sites where uptime is vital. Meanwhile, growing support for hydrogen as a cleaner fuel alternative and upgrades enabling turbines to run on hydrogen or blended fuels are strengthening the case for advanced, future-ready gas turbine technologies.

The turbines with <= 70 MW capacity held 38.6% share in 2024 and is anticipated to grow at a CAGR of 5% through 2034. This segment benefits from rising interest in distributed power solutions aimed at delivering electricity to localized zones, including industrial parks and remote communities. Increased deployment in peak-load and standby generation roles is also contributing to segment expansion, especially among small-scale utility providers and industrial operators.

The combined cycle segment held 82.5% share in 2024 and is forecast to grow at 4.5% CAGR from 2025 to 2034. The shift toward open cycle turbines is notable in regions with high renewable integration, as they provide fast-start capabilities to help stabilize the grid during periods of renewable intermittency. Their operational flexibility makes them an indispensable tool for balancing short-term supply and demand fluctuations, especially as clean energy sources scale.

United States Industrial Gas Turbine Market held a 53.3% share, generating USD 573.9 million in;2024. Utilities in the country are increasingly turning to gas turbines to reinforce power reliability and respond to fluctuating renewable output. The trend of replacing old coal assets with gas-fired systems continues to gain momentum, particularly in states pursuing aggressive decarbonization goals. Aeroderivative turbines are also seeing increased demand for decentralized power generation across military installations, airports, and industrial facilities where grid independence is a growing concern.

Major players shaping the Global Industrial Gas Turbine Market include Siemens Energy, Doosan, Vericor, MAN Energy Solutions, Flex Energy Solutions, Mitsubishi Heavy Industries, MTU Aero Engines, Solar Turbines, Wartsila, IHI Corporation, Harbin Electric, Baker Hughes, GE Vernova, JSC United Engine, Bharat Heavy Electricals, Destinus Energy, Rolls Royce, Ansaldo Energia, Capstone Green Energy, Kawasaki Heavy Industries, and Nanjing Turbine and Electric Machinery. Leading companies in the industrial gas turbine market are accelerating innovation through hydrogen-compatible technologies and fuel-flexible turbine systems. Strategic investments are focused on R&D for low-emission combustion systems and digital performance optimization platforms. OEMs are also engaging in retrofitting older turbine fleets with upgraded burners and control systems to meet clean energy targets. Partnerships with utilities and government bodies enable access to demonstration projects showcasing hydrogen and ammonia-based solutions. Further, companies are expanding their global service networks to offer long-term maintenance and performance contracts, increasing customer retention.;

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research and validation

- 1.4 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Secondary

- 1.5.1.1 Paid sources

- 1.5.1.2 Public sources

- 1.5.1.3 Sources, by region

- 1.5.1 Secondary

- 1.6 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Capacity trends

- 2.4 Product trends

- 2.5 Technology trends

- 2.6 Application trends

- 2.7 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of industrial gas turbine

- 3.8 Price trend analysis

- 3.8.1 By region

- 3.8.2 By capacity

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization and IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 ≤ 70 MW

- 5.3 > 70 MW - 300 MW

- 5.4 ≥ 300 MW

Chapter 6 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Aero-derivative

- 6.3 Heavy duty

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Open cycle

- 7.3 Combined cycle

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 Power generation

- 8.3 Oil & gas

- 8.4 Other manufacturing

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Russia

- 9.3.3 Italy

- 9.3.4 Germany

- 9.3.5 France

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Egypt

- 9.5.4 Algeria

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 Ansaldo Energia

- 10.2 Baker Hughes

- 10.3 Bharat Heavy Electricals

- 10.4 Capstone Green Energy

- 10.5 Destinus Energy

- 10.6 Doosan

- 10.7 Flex Energy Solutions

- 10.8 GE Vernova

- 10.9 Harbin Electric

- 10.10 IHI Corporation

- 10.11 JSC United Engine

- 10.12 Kawasaki Heavy Industries

- 10.13 MAN Energy Solutions

- 10.14 Mitsubishi Heavy Industries

- 10.15 MTU Aero Engines

- 10.16 Nanjing Turbine and Electric Machinery

- 10.17 Rolls Royce

- 10.18 Siemens Energy

- 10.19 Solar Turbines

- 10.20 Vericor

- 10.21 Wartsila