|

市场调查报告书

商品编码

1822639

土工泡沫市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Geofoam Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

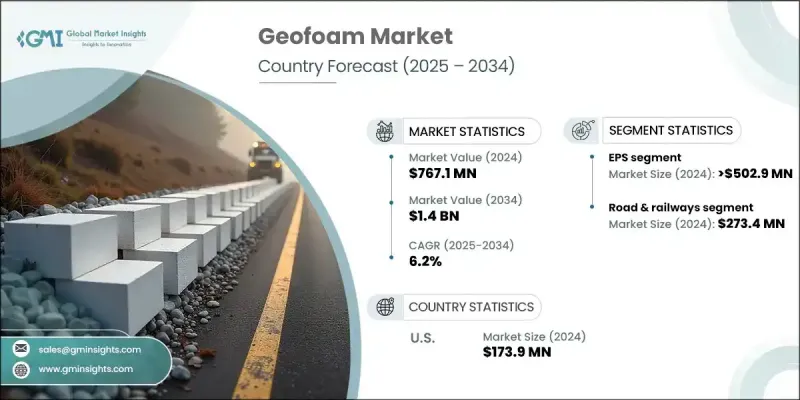

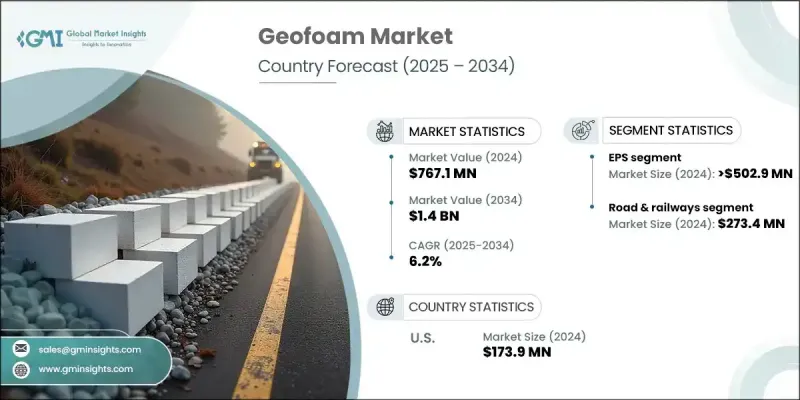

2024年,全球土工泡沫市场规模达7.671亿美元,预计2034年将以6.2%的复合年增长率成长,达到14亿美元。这一增长主要源于基础建设对轻质耐用建筑材料日益增长的需求。随着全球都市化进程持续推进,尤其是在发展中经济体,对土工泡沫等高承载力材料的需求日益增长。土工泡棉的轻质结构不仅简化了运输,还降低了结构荷载,使其成为路堤、跑道和边坡加固等需要土壤稳定处理的项目的首选材料。

土工泡沫能够显着降低结构静载荷,使其成为增强基础设施耐久性和稳定性的宝贵资产。产业报告显示,土工泡沫在建筑业的使用量稳步上升,尤其是在北美,其使用率在过去五年中持续成长。这一趋势凸显了人们日益认识到土工泡沫在为复杂建筑需求提供经济高效的解决方案方面所发挥的作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.671亿美元 |

| 预测值 | 14亿美元 |

| 复合年增长率 | 6.2% |

在各类土工泡棉中,发泡聚苯乙烯 (EPS) 在 2023 年的市占率为 4.854 亿美元,预计到 2032 年将以 6.4% 的复合年增长率成长。 EPS 凭藉其轻质特性、成本效益以及在各种应用中的适应性,将继续占据主导地位。其隔热性能和易塑性使其成为建筑专案的多功能选择,尤其是在挡土墙和道路专案中。与其他替代品相比,EPS 在价格方面具有竞争优势,这进一步推动了其广泛应用,尤其是在大型基础设施项目中。

在分销方面,2023年直销通路占据了泡沫土工布市场的65.6%,预计到2032年将以6.4%的复合年增长率成长。对于需要客製化解决方案的大型项目,直销通常是首选,这使得製造商能够与客户紧密合作,提供量身定制的泡沫土工布产品和服务。这种方法可以确保精准有效率地满足专案的特定需求,从而提高客户满意度和专案成果。

光是美国土工泡沫市场在 2023 年的规模就超过了 1.679 亿美元,预计到 2032 年仍将以同样的速度成长。这种材料的轻质结构和出色的承重能力使其成为关键基础设施项目的理想选择,从而巩固了其在整个地区建筑行业中的重要性。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 基础建设不断推进

- 环境效益和永续性

- 成本和时间效率

- 产业陷阱与挑战

- 认识和知识有限

- 环境问题和法规

- 机会

- 永续建筑的扩张

- 先进土工泡沫材料的开发

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 - 2034

- 主要趋势

- 每股盈余

- XPS

第六章:市场估计与预测:按密度,2021 - 2034

- 主要趋势

- 低的

- 中等的

- 高的

第七章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 空隙填充

- 边坡稳定

- 堤岸

- 挡土结构

- 绝缘

- 其他的

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 公路和铁路

- 建筑和基础设施

- 机场基础设施

- 景观美化

- 其他的

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直接的

- 间接

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Alleguard

- Atlas Molded Products

- Beaver Plastics

- Benchmark Foam

- Carlisle Companies

- Cellofoam北美公司

- EXPOL

- Galaxy Polystyrene LLC

- Geofoam America

- Geofoam International LLC

- Legerlite

- Pacific Allied Products Ltd

- Technopol SA

- ThermaFoam, LLC

- Universal Construction Foam

The global geofoam market was valued at USD 767.1 million in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 1.4 billion by 2034. This growth is largely driven by the rising demand for lightweight and durable construction materials in infrastructure development. As urbanization continues to surge globally, particularly in developing economies, the need for high-load-bearing materials like geofoam is becoming increasingly critical. Its lightweight composition not only simplifies transportation but also reduces structural loads, making it a preferred material for projects requiring soil stabilization, such as embankments, runways, and slope reinforcement.

Geofoam's ability to significantly lower dead loads on structures makes it a valuable asset in enhancing the durability and stability of infrastructure. Industry reports indicate a steady rise in geofoam usage in construction, particularly in North America, where adoption rates have consistently grown over the past five years. This trend highlights the growing recognition of geofoam's role in delivering cost-effective and efficient solutions for complex construction needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $767.1 million |

| Forecast Value | $1.4 billion |

| CAGR | 6.2% |

Among the various types of geofoam, Expanded Polystyrene (EPS) held a market share valued at USD 485.4 million in 2023 and is expected to expand at a 6.4% CAGR through 2032. EPS continues to dominate due to its lightweight properties, cost efficiency, and adaptability across a range of applications. Its thermal insulation capabilities and ease of shaping make it a versatile choice for construction projects, particularly those involving retaining walls and roadways. Compared to other alternatives, EPS offers a competitive advantage in pricing, which further fuels its widespread use, especially in large-scale infrastructure initiatives.

In terms of distribution, the direct sales channel accounted for 65.6% of the geofoam market in 2023 and is anticipated to grow at a 6.4% CAGR through 2032. Direct distribution is often preferred for large projects that require customized solutions, allowing manufacturers to closely collaborate with clients and provide tailored geofoam products and services. This approach ensures that project-specific requirements are met with precision and efficiency, enhancing customer satisfaction and project outcomes.

The U.S. geofoam market alone surpassed USD 167.9 million in 2023 and is expected to grow at a similar pace through 2032. The material's lightweight structure and impressive load-bearing capabilities make it an ideal choice for critical infrastructure projects, reinforcing its importance in the construction industry across the region.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Density

- 2.2.4 Application

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing infrastructure development

- 3.2.1.2 Environmental benefits and sustainability

- 3.2.1.3 Cost and time efficiency

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Limited awareness and knowledge

- 3.2.2.2 Environmental concerns and regulations

- 3.2.3 Opportunities

- 3.2.3.1 Expansion in sustainable construction

- 3.2.3.2 Development of advanced geofoam materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million) (Thousand Square Meters)

- 5.1 Key trends

- 5.2 EPS

- 5.3 XPS

Chapter 6 Market Estimates and Forecast, By Density, 2021 - 2034 (USD Million) (Thousand Square Meters)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Thousand Square Meters)

- 7.1 Key trends

- 7.2 Void fill

- 7.3 Slope stabilization

- 7.4 Embankments

- 7.5 Retaining structures

- 7.6 Insulation

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million) (Thousand Square Meters)

- 8.1 Key trends

- 8.2 Road & railways

- 8.3 Building & infrastructure

- 8.4 Airport infrastructure

- 8.5 Landscaping

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Thousand Square Meters)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Thousand Square Meters)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Alleguard

- 11.2 Atlas Molded Products

- 11.3 Beaver Plastics

- 11.4 Benchmark Foam

- 11.5 Carlisle Companies

- 11.6 Cellofoam North America Inc

- 11.7 EXPOL

- 11.8 Galaxy Polystyrene LLC

- 11.9 Geofoam America

- 11.10 Geofoam International LLC

- 11.11 Legerlite

- 11.12 Pacific Allied Products Ltd

- 11.13 Technopol SA

- 11.14 ThermaFoam, LLC

- 11.15 Universal Construction Foam