|

市场调查报告书

商品编码

1833418

风力涡轮机齿轮箱维修和翻新市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Wind Turbine Gearbox Repair and Refurbishment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

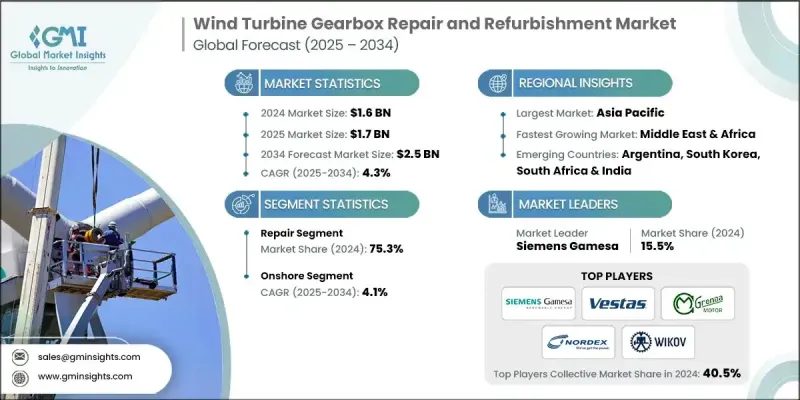

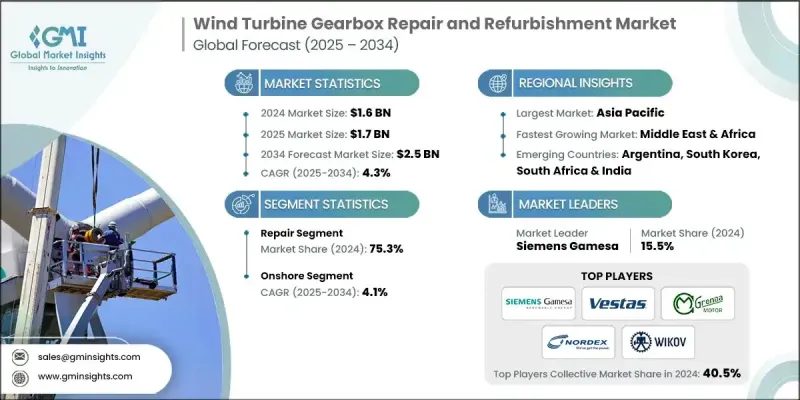

2024 年全球风力涡轮机齿轮箱维修和翻新市场价值为 16 亿美元,预计到 2034 年将以 4.3% 的复合年增长率增长至 25 亿美元。

随着全球风力涡轮机群的老化,许多涡轮机面临性能下降和机械故障,尤其是齿轮箱。这推动了对维修和翻新服务的需求,以延长现有资产的使用寿命并提高能源生产效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 16亿美元 |

| 预测值 | 25亿美元 |

| 复合年增长率 | 4.3% |

维修领域需求不断成长

随着车辆老化和磨损,维修领域在2024年经历了显着成长。随着全球风力涡轮机安装数量的不断增加,齿轮箱维修需求也达到了历史最高水准。操作员更倾向于选择维修而非更换,因为透过适当的维护可以实现成本效益和延长使用寿命。企业越来越多地投资于预测性维护技术和即时监控,以便在问题导致重大故障之前发现它们,从而减少停机时间和维护成本。

陆上采用率不断提高

受全球陆域风电场普及的推动,2024年陆上风电市场将占显着份额。陆域风力涡轮机比离岸风力涡轮机更容易安装,维修也更方便、更经济。随着营运商越来越重视优化陆上涡轮机的使用寿命,许多业者开始选择翻新服务,而非彻底更换。

亚太地区将成为推动力地区

2024年,亚太地区风力涡轮机齿轮箱维修和翻新市场将保持可持续的份额,这得益于该地区对再生能源投资的不断增加,尤其是在中国、印度和日本等国家。随着该地区风能装置容量的扩大,对齿轮箱维修和翻新服务的需求也随之激增。

风力涡轮机齿轮箱维修和翻新市场的主要参与者有 Prokon Energy、Siemens Gamesa、DBSantasalo、REM Surface Engineering、Vestas、Turbine Repair Solutions、H&N Wind、GBS Gearbox Services International、Metalock Engineering、Multigear GmbH、ABS Wind、BHI、Connected Wind Services、Metalock Engineering、Multigear GmbH、ABS Wind Services、BHI、Connected Wind Services、Norda、Dalr. FGGS Field Services。

为了巩固市场地位,风力涡轮机齿轮箱维修和翻新市场的公司正在采取多项关键策略。技术创新是重中之重,各公司纷纷投资先进的诊断工具、预测性维护和资料分析技术,以提高维修的准确性和效率。此外,许多公司正在扩大其地理覆盖范围,尤其是在亚太和欧洲等地区,以满足不断增长的需求。最后,各公司正致力于提高供应链的弹性,以解决零件供应问题并缩短交货时间,确保更快的反应时间并最大限度地减少涡轮机停机时间。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 原料可用性和采购分析

- 製造能力评估

- 供应链弹性和风险因素

- 配电网路分析

- 成本结构分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL分析

第四章:竞争格局

- 介绍

- 按地区分析公司市场份额

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 战略仪表板

- 策略倡议

- 公司标竿分析

- 创新与技术格局

第五章:市场规模及预测:依类型,2021 - 2034

- 主要趋势

- 维修

- 翻新

第六章:市场规模及预测:依部署,2021 - 2034

- 主要趋势

- 陆上

- 海上

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 义大利

- 英国

- 法国

- 亚太地区

- 中国

- 印度

- 澳洲

- 韩国

- 中东和非洲

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- ABS Wind

- AIS Wind Energy

- BHI Energy

- Connected Wind Services

- Dana Incorporated

- DBSantasalo

- FGGS Field Services

- GBS Gearbox Services International

- Grenaa Motorfabrik

- H&N Wind

- Metalock Engineering

- Multigear GmbH

- Nordex SE

- Prokon Energy

- REM Surface Engineering

- Sadler Machine Co

- Siemens Gamesa

- Turbine Repair Solutions

- Vestas

- Wikov

The Global Wind Turbine Gearbox Repair and Refurbishment Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 2.5 billion by 2034.

As the global fleet of wind turbines ages, many turbines are facing performance degradation and mechanical failures, especially in their gearboxes. This drives the need for repair and refurbishment services to extend the operational life of existing assets and improve energy production efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 4.3% |

Rising Demand in the Repair Segment

The repair segment experienced significant growth in 2024, as vehicles age and undergo wear and tear. With the rising number of installed wind turbines globally, demand for gearbox repairs is at an all-time high. Operators prefer repairs over replacements due to the cost-effectiveness and extended lifespan that can be achieved through proper maintenance. Companies are increasingly investing in predictive maintenance technologies and real-time monitoring to identify issues before they lead to significant failures, thereby reducing downtime and maintenance costs.

Increasing Adoption in Onshore

The onshore segment held a significant share in 2024, driven by the prevalence of onshore wind farms around the world. Onshore wind turbines are more accessible than their offshore counterparts, making repairs easier and more affordable. With an increasing emphasis on optimizing the lifespan of onshore turbines, many operators are turning to refurbishment services rather than complete replacements.

Asia Pacific to Emerge as a Propelling Region

Asia Pacific wind turbine gearbox repair and refurbishment market held a sustainable share in 2024, driven by the region's increasing investments in renewable energy, particularly in countries like China, India, and Japan. As wind energy capacity expands across the region, the demand for gearbox repairs and refurbishment services is surging.

Major players in the wind turbine gearbox repair and refurbishment market are Prokon Energy, Siemens Gamesa, DBSantasalo, REM Surface Engineering, Vestas, Turbine Repair Solutions, H&N Wind, GBS Gearbox Services International, Metalock Engineering, Multigear GmbH, ABS Wind, BHI Energy, Connected Wind Services, Nordex SE, Wikov, Dana Incorporated, Grenaa Motorfabrik, Sadler Machine Co., and FGGS Field Services.

To strengthen their market position, companies in the wind turbine gearbox repair and refurbishment market are employing several key strategies. Technological innovation is at the forefront, with companies investing in advanced diagnostic tools, predictive maintenance, and data analytics to improve repair accuracy and efficiency. Additionally, many companies are expanding their geographic footprint, especially in regions like Asia Pacific and Europe, to meet the rising demand. Lastly, firms are focusing on improving supply chain resilience to address parts availability and reduce lead times, ensuring faster response times and minimizing turbine downtime.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Type trends

- 2.4 Deployment trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Cost structure analysis

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Legal factors

- 3.7.6 Environmental factors

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Repair

- 5.3 Refurbishment

Chapter 6 Market Size and Forecast, By Deployment, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Onshore

- 6.3 Offshore

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 Italy

- 7.3.3 UK

- 7.3.4 France

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Australia

- 7.4.4 South Korea

- 7.5 Middle East & Africa

- 7.5.1 South Africa

- 7.5.2 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABS Wind

- 8.2 AIS Wind Energy

- 8.3 BHI Energy

- 8.4 Connected Wind Services

- 8.5 Dana Incorporated

- 8.6 DBSantasalo

- 8.7 FGGS Field Services

- 8.8 GBS Gearbox Services International

- 8.9 Grenaa Motorfabrik

- 8.10 H&N Wind

- 8.11 Metalock Engineering

- 8.12 Multigear GmbH

- 8.13 Nordex SE

- 8.14 Prokon Energy

- 8.15 REM Surface Engineering

- 8.16 Sadler Machine Co

- 8.17 Siemens Gamesa

- 8.18 Turbine Repair Solutions

- 8.19 Vestas

- 8.20 Wikov