|

市场调查报告书

商品编码

1640323

风力发电机齿轮箱:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Wind Turbine Gearbox - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

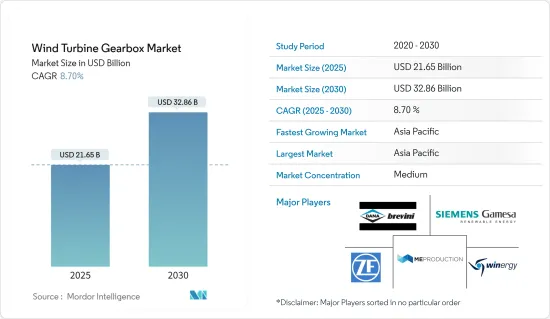

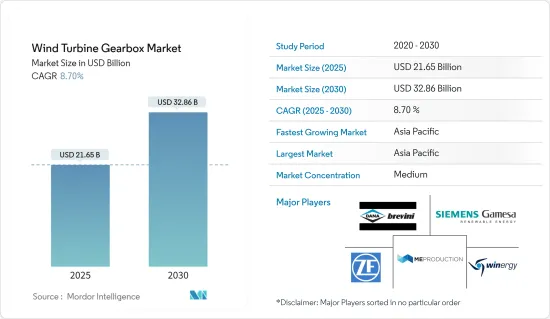

风力发电机齿轮箱市场规模预计到2025年为216.5亿美元,预计到2030年将达到328.6亿美元,预测期内(2025-2030年)复合年增长率为8.7%。

主要亮点

- 从中期来看,风力发电需求成长和风力发电计划投资增加等因素预计将成为预测期内风力发电机齿轮箱市场的最大驱动力之一。

- 同时,太阳能和水力发电等其他再生能源来源也越来越受欢迎。这对预测期内的风力发电机机齿轮箱市场构成威胁。

- 风力发电与能源储存的融合以及全球雄心勃勃的风力发电建设是预计未来为市场创造多个机会的关键因素。

- 由于亚太地区在风力发电方面的巨大份额以及中国、印度和日本等国家的製造技术中心的存在,预计亚太地区将成为最大和成长最快的市场。

风力发电机齿轮箱市场趋势

海工产业录得高成长

- 海上风能领域正在全球快速成长。各国政府和能源公司正在加大对离岸风电计划的投资,以利用海上强大而稳定的风能资源。

- 全球风力发电理事会报告称,2022年将新增8GW离岸风电装置容量,使全球装置容量达到64GW。这比 2021 年装置容量56GW 有所增加。离岸风电装置容量的扩大将导致对风力发电机齿轮箱的需求增加,以支持离岸风电场的发展。

- 许多国家因其地理位置和有利的风力条件而拥有巨大的海上风力发电潜力。北欧、美国、中国、台湾等地区正积极开发离岸风资源。这些地区为风力发电机齿轮箱製造商提供了重要的市场机会,以满足离岸风电开发日益增长的需求。

- 例如,2023年1月,德国宣布製定新的离岸风力发电机址发展策略,以实现2030年风电装置容量达到30吉瓦(GW)的目标。联邦海事和水道测量局 (BSH) 制定了这些计划,以确保实现既定目标。

- 同样,印度的目标是透过挖掘其 7,600 公里广阔海岸线上尚未开发的离岸风电潜力,以实现绿色能源组合多元化。新能源和可再生能源部製定了2030年实现离岸风电装置容量30GW的目标。这些雄心勃勃的目标预计将刺激大型离岸风电发电工程的发展,并推动对风力发电机齿轮箱的需求。

- 因此,鑑于上述几点,预计海工领域将在预测期内占据市场主导地位。

亚太地区实现显着成长

- 亚太地区风电装置容量正在显着增加。中国、印度、日本和澳洲等国家正大力投资风发电工程,以满足不断增长的电力需求并减少温室气体排放。该地区风力发电能力的扩大正在推动对风力发电机齿轮箱的需求。

- 据全球风能理事会称,仅2022年亚太地区就将新增约37GW风电装置,显示该地区风力发电的显着成长。

- 亚太地区许多国家都实施了支持措施和奖励来推广包括风电在内的可再生能源。这些措施为风力发电发展创造了有利的环境,并吸引了风力发电机安装的投资。

- 例如,东协各国政府宣布了雄心勃勃的五年永续性计划,作为2021年至2025年东协能源合作行动计划(APAEC)第二阶段的一部分。根据该计划,东南亚国协能源部长的目标是到2025年将可再生能源占东协初级能源供应总量的比重提高到23%,将可再生能源占东协发电能力的比重提高到35%。目标为了实现这些目标,到 2025 年需要增加约 35GW 至 40GW 的可再生能源容量。由于大多数国家都拥有巨大的风电潜力,预计该地区的风电装置量将会增加。

- 未来十年,在亚太地区快速扩大的装置基础和政府支援措施的推动下,风力发电机齿轮箱维修和维修市场预计将出现重大成长机会。

风力发电机箱产业概况

风力发电机齿轮箱市场适度整合。主要企业(排名不分先后)包括:Siemens Gamesa Renewable Energy SA、Dana Brevini SpA、ME Production A/S、Winergy Group 和 ZF Friedrichshafen AG。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2028年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 增加风力发电部署

- 加大风力发电投资

- 抑制因素

- 扩大其他再生能源来源

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 部署地点

- 陆上

- 离岸

- 2028年之前的市场规模和需求预测(按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 其他亚太地区

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东地区

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Dana Brevini SpA

- Siemens Gamesa Renewable Energy SA

- ME Production AS

- Stork Gears & Services BV

- Winergy Group

- ZF Friedrichshafen AG

- Turbine Repair Solutions

- Elecon Engineering Company Limited

第七章 市场机会及未来趋势

- 能源储存一体化

简介目录

Product Code: 51400

The Wind Turbine Gearbox Market size is estimated at USD 21.65 billion in 2025, and is expected to reach USD 32.86 billion by 2030, at a CAGR of 8.7% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as growing demand for wind energy and increasing investment in wind energy projects are expected to be one of the most significant drivers for the wind turbine gearbox market during the forecast period.

- On the other hand, increasing penetration of other sources of renewable energy such as solar, hydro and others. This poses a threat to the wind turbine gearbox market during the forecast period.

- Nevertheless, energy storage integration with wind energy and ambitious wind energy tsrgets acrossb the globe are significant factors expected to create several opportunities for the market in the future.

- The Asia-Pacific region is expected to be the largest and fastest-growing market, owing to the significant share in terms of wind power generation and the presence of manufacturing and technology hubs in countries like China, India, Japan, etc.

Wind Turbine Gearbox Market Trends

Offshore Segment to Register Higher Growth

- The offshore wind sector has been experiencing rapid growth worldwide. Governments and energy companies increasingly invest in offshore wind projects to harness the strong and consistent wind resources available at sea.

- In 2022, the Global Wind Energy Council reported the addition of 8 GW of offshore wind energy capacity, resulting in a global installed capacity of 64 GW. This marks an increase compared to the 56 GW installed capacity in 2021. The expansion of offshore wind capacity translates into higher demand for wind turbine gearboxes to support the development of offshore wind farms.

- Many countries possess significant offshore wind energy potential due to their geographical location and favorable wind conditions. Regions such as Northern Europe, the United States, China, and Taiwan are actively developing their offshore wind resources. These regions offer substantial market opportunities for wind turbine gearbox manufacturers to cater to the growing demand driven by offshore wind development.

- For instance, in January 2023, Germany announced the formulation of new development strategies for offshore wind turbine sites in order to achieve a target of 30 gigawatts (GW) of installed wind power capacity by 2030. The Federal Maritime and Hydrographic Agency (BSH) has devised these plans to ensure the successful attainment of the set target.

- In a similar vein, India aims to diversify its green energy portfolio by tapping into the untapped offshore wind energy potential across its extensive 7,600-kilometer coastline. The Ministry of New and Renewable Energy has established a target of achieving 30 GW of offshore wind capacity by 2030. These ambitious goals are projected to spur the development of large-scale offshore wind projects, thereby driving the demand for wind turbine gearboxes.

- Therefore as per the above-mentioned points the offshore segment is expected to dominate the market during the forecasted period.

Asia-Pacific to Witness Significant Growth

- The Asia Pacific region has been witnessing substantial growth in wind power capacity installations. Countries like China, India, Japan, and Australia are making significant investments in wind energy projects to meet their growing electricity demands and reduce greenhouse gas emissions. This region's expansion of wind power capacity drives the demand for wind turbine gearboxes.

- According to Global Wind Energy Council the Asia-Pacific region added almost 37GW of wind energy capacity in 2022 alone signifying significant growth of wind energy in the region with China contributing 87% of its 2022 additions consequently driving the demand for wind turbine gearboxes.

- Many countries in the Asia Pacific region have implemented supportive policies and incentives to promote renewable energy, including wind power. These policies create a conducive environment for wind energy development and attract investments in wind turbine installations.

- For instance, ASEAN governments have unveiled an ambitious five-year sustainability plan as part of the second phase of the ASEAN Plan of Action for Energy Cooperation (APAEC) from 2021 to 2025. As per this plan, energy ministers from ASEAN countries have agreed to a target of achieving a 23% share of renewable energy in the total primary energy supply across the region, along with a 35% share in ASEAN's installed power capacity by 2025. Meeting these targets would necessitate the addition of approximately 35GW-40GW of renewable energy capacity by 2025. This is expected to increase the installations of wind energy in the region due to the high wind energy potential in the majority of the countries.

- Over the next decade, the wind turbine gearbox repair and refurbishment market is anticipated to witness substantial growth opportunities driven by the rapidly expanding installed base in the Asia-Pacific region and supportive government policies.

Wind Turbine Gearbox Industry Overview

The wind turbine gearbox market is moderately consolidated. Some of the major companies (in no particular order) include Siemens Gamesa Renewable Energy SA, Dana Brevini SpA, ME Production A/S, Winergy Group, and ZF Friedrichshafen AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Wind Energy

- 4.5.1.2 Growing Investments in Wind Energy

- 4.5.2 Restraints

- 4.5.2.1 Increasing Penetration of Other Sources of Renewable Energy

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Geography [Market Size and Demand Forecast till 2028 (for regions only)]

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Asia-Pacific

- 5.2.2.1 China

- 5.2.2.2 India

- 5.2.2.3 Japan

- 5.2.2.4 Asutralia

- 5.2.2.5 Rest of Asia-Pacific

- 5.2.3 Europe

- 5.2.3.1 United Kingdom

- 5.2.3.2 Germany

- 5.2.3.3 France

- 5.2.3.4 Spain

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Chile

- 5.2.4.4 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle East

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Dana Brevini SpA

- 6.3.2 Siemens Gamesa Renewable Energy SA

- 6.3.3 ME Production AS

- 6.3.4 Stork Gears & Services BV

- 6.3.5 Winergy Group

- 6.3.6 ZF Friedrichshafen AG

- 6.3.7 Turbine Repair Solutions

- 6.3.8 Elecon Engineering Company Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Energy Storage Integration

02-2729-4219

+886-2-2729-4219