|

市场调查报告书

商品编码

1833435

汽车订阅服务市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Vehicle Subscription Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

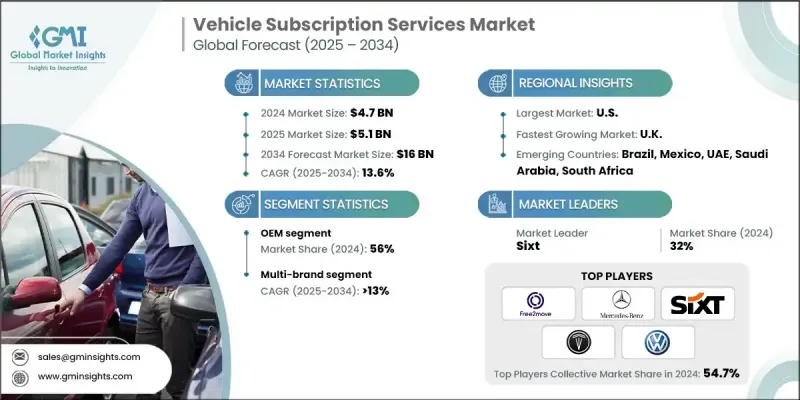

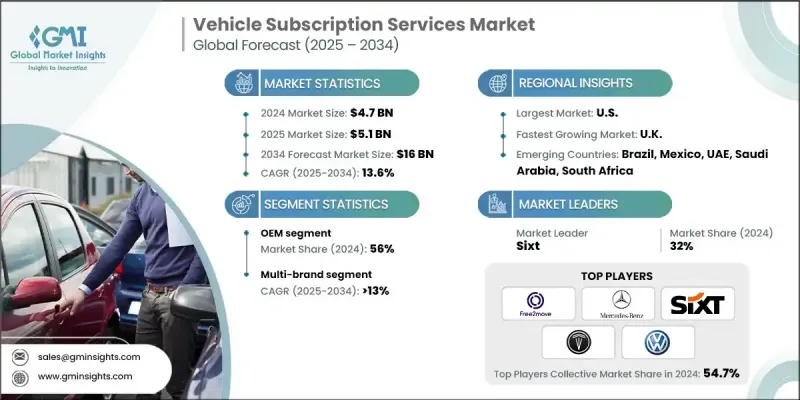

2024 年全球汽车订阅服务市场价值为 47 亿美元,预计到 2034 年将以 13.6% 的复合年增长率增长至 160 亿美元。

消费者正从传统的汽车所有权转向更灵活、更方便的出行方式。这种转变源自于他们希望避免购买或租赁汽车所带来的长期财务和维护成本。汽车订阅服务让使用者能够根据需要使用不同类型的车辆,无论是日常通勤、週末出行还是特殊场合,而无需承担拥有车辆的麻烦。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 47亿美元 |

| 预测值 | 160亿美元 |

| 复合年增长率 | 13.6% |

OEM获得发展动力

2024年, OEM在汽车订阅服务市场中占据了显着份额。汽车製造商正利用其品牌忠诚度和丰富的车型组合,提供订阅服务,让用户可以无缝存取其车型。这种方式使OEM能够透过提供灵活的购车方案,并将维护、保险和道路救援服务捆绑到单一套餐中,从而深化客户关係。透过整合数位平台和个人化服务,OEM正在将自己定位为不断发展的出行格局中的关键参与者,吸引精通科技且注重便利性的消费者。

多品牌需求不断成长

多品牌细分市场在2024年占据了相当大的份额,这得益于用户可以透过第三方平台存取来自不同製造商的各种车型。多品牌服务提供从经济型到豪华型等各种车型的选择,以满足不同的客户偏好。在该领域运营的公司强调用户友好的应用程式、透明的定价和便捷的订阅流程,以脱颖而出。与经销商和车队营运商的策略合作伙伴关係使这些平台能够维护广泛且动态的库存,从而提高客户保留率和市场覆盖率。

美国将成为推动力地区

美国汽车订阅服务市场正经历强劲成长,预计未来五年规模将超过50亿美元,这得益于城镇化、消费者偏好的转变以及技术进步。美国消费者越来越青睐灵活、经济高效的出行解决方案,以减轻购车负担。该市场的供应商专注于透过无缝的数位介面、量身定制的订阅计划以及保险和维护等增值服务来提升客户体验。为了巩固市场地位,各公司正在投资在地化车队扩张,与汽车製造商和经销商建立联盟,并运用资料分析来优化车辆可用性和用户参与度。

汽车订阅服务市场的主要参与者有大众、TeslaRents、现代化、FINN、Myles、塔塔汽车、Sixt、梅赛德斯-奔驰、Free2move 和 Carvolution。

汽车订阅服务市场中的公司正在采取多项关键策略来巩固其市场地位。首先,他们大力投资数位平台,以实现顺畅的订阅管理和个人化的使用者体验。其次,与原始设备製造商和经销商的合作有助于确保多样化的车辆库存并提升品牌信誉。第三,公司专注于灵活的订阅计划,以满足不同客户群的需求,包括短期和长期选择。第四,整合涵盖保险、维护和道路救援的综合服务套餐,提升价值并带来便利。最后,有针对性的行销和忠诚度计划有助于在竞争激烈的环境中提高客户留存率并扩大用户群。

目录

第一章:方法论

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- GMI 专有 AI 系统

- 人工智慧驱动的研究增强

- 来源一致性协议

- 人工智慧准确度指标

- 预测模型

- 初步研究和验证

- 市场估计的主要趋势

- 量化市场影响分析

- 生长参数对预测的数学影响

- 情境分析框架

- 一些主要来源(但不限于)

- 资料探勘来源

- 次要

- 付费来源

- 公共资源

- 来源(按地区)

- 次要

- 研究轨迹和信心评分

- 研究路线组成部分

- 评分组件

- 研究透明度附录

- 来源归因框架

- 品质保证指标

- 我们对信任的承诺

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 从所有权转向基于存取权的移动性

- 订阅平台推动电动车普及率上升

- 数位化和基于应用程式的行动生态系统日益完善

- 为个人和商业用户提供灵活的合约

- 永续性和循环经济趋势

- 产业陷阱与挑战

- 订阅成本高昂,而非租赁/融资

- 部分地区车型供应有限

- 复杂的保险和责任问题

- 与叫车、租赁和汽车租赁的竞争

- 新兴经济体认知度较低

- 市场机会

- 多品牌和电动车队的整合

- 与原始设备製造商、经销商和车队营运商建立合作伙伴关係

- 中小企业和物流企业越来越多地采用

- 亚太及拉丁美洲新兴市场

- 人工智慧车队管理和预测性维护

- 成长动力

- 成长潜力分析

- 监管格局

- NHTSA 法规和安全标准

- 资料隐私和连网汽车法规

- 跨境数位贸易合规

- 州和地方监管差异

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 连网汽车订阅服务

- 物联网整合和即时监控

- 数据分析和预测性维护

- 提升客户体验

- 隐私和资料安全框架

- 自动驾驶汽车订阅准备情况

- AV 技术整合时间表

- 监理框架发展

- 安全标准和测试要求

- 市场准备与消费者接受度

- 传统车辆订阅模式

- 服务交付优化

- 营运效率提升

- 客户服务与支援系统

- 支援远端资讯处理的订阅服务

- 车辆追踪和使用情况监控

- 效能分析与优化

- 保险整合与风险管理

- 维护计划和预测服务

- 连网汽车订阅服务

- 专利分析

- 生产统计

- 进出口

- 主要进口国家

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

- 用例和应用分析

- 消费者用例

- 城市交通解决方案

- 临时交通需求

- 车辆试乘及购买决策支持

- 季节性和偶尔使用场景

- 多车家庭优化

- 商业用例

- 企业车队现代化

- 员工流动计划

- 基于专案的运输需求

- 地理扩展支持

- 成本管理与预算优化

- 政府和公共部门用例

- 舰队现代化倡议

- 紧急应变和灾害管理

- 机构间车辆共享

- 试点专案和技术测试

- 产业特定应用

- 医疗保健和医疗服务

- 房地产和物业管理

- 咨询和专业服务

- 施工及现场服务

- 最佳案例和成功案例

- 最佳市场条件分析

- 高效能用例范例

- 投资报酬率最大化策略

- 客户满意度卓越模型

- 消费者用例

- 定价分析和成本结构

- 定价模型和策略

- 每月订阅定价等级

- 基于使用情况的定价模型

- 全包定价与模组化定价

- 动态定价和基于需求的调整

- 企业和车队定价结构

- 成本分解分析

- 车辆购置和折旧成本

- 保险和责任保险费用

- 维护和服务交付成本

- 技术平台和数位基础设施

- 客户获取和行销费用

- 营运和管理费用

- 区域定价差异

- 北美定价基准

- 欧洲市场定价分析

- 亚太定价策略

- 新兴市场定价调整

- 竞争性定价分析

- 高端市场与经济型市场定价

- 价值主张与价格论证

- 价格弹性和需求敏感度

- 定价策略优化

- 定价模型和策略

- 客户行为与市场采用

- 消费者人口统计与心理统计

- 年龄组分析和代际偏好

- 收入水平和经济地位的影响

- 地理与城市模式与乡村模式

- 生活方式与旅游偏好相关性

- 客户旅程和决策过程

- 意识和考虑阶段

- 评估标准和选择因素

- 入职和初步体验

- 使用模式和服务利用率

- 保留和忠诚度发展

- 行为細項分析

- 早期采用者和技术爱好者

- 务实的使用者和价值追求者

- 注重便利的消费者

- 可持续发展驱动的客户

- 客户满意度和体验指标

- 净推荐值(NPS)分析

- 客户生命週期价值(CLV)评估

- 流失率和留存率分析

- 服务品质和绩效指标

- 采用障碍和阻力因素

- 收养的心理障碍

- 经济和金融问题

- 服务品质和可靠性问题

- 科技与数位素养挑战

- 消费者人口统计与心理统计

- 投资分析与市场机会

- 市场成长预测与情境分析

- 投资要求和资本配置

- 投资报酬率分析与获利能力指标

- 风险评估和缓解策略

- 融资格局与资金来源

- 策略合作机会

- 地域扩张投资重点

- 技术开发与创新投资

- 市场进入策略和时机考虑

- 退出策略和价值实现

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按服务供应商,2021 - 2034 年

- 主要趋势

- OEM /自营企业

- 第三方/独立提供者

第六章:市场估计与预测:按订阅量,2021 - 2034

- 主要趋势

- 多品牌订阅

- 单一品牌订阅

第七章:市场估计与预测:依认购期,2021 - 2034

- 主要趋势

- 1-6个月

- 6-12个月

- 超过12个月

第八章:市场估计与预测:依车型,2021 - 2034

- 主要趋势

- 豪华轿车

- 行政车

- 经济型轿车

- 其他的

第九章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 个人的

- 商业的

第十章:市场估计与预测:按燃料,2021 - 2034

- 主要趋势

- 冰

- 纯电动车

- 插电式混合动力

- 油电混合车

第 11 章:市场估计与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 12 章:公司简介

- 全球参与者

- Audi

- BMW Group

- Cadillac

- Ford Motor Company

- General Motors

- Hyundai Motor

- Jaguar Land Rover

- Lexus

- Mercedes-Benz Group

- Regional Champions

- Autolib

- Cambio CarSharing

- Car2 Go

- DriveNow

- Enterprise CarShare

- Europcar Mobility Group

- Getaround

- GreenMobility

- Hertz Corporation

- Miles Mobility

- Mobility Cooperative

- 新兴企业和技术推动者

- Carbar

- Cazoo

- Cluno

- Communauto

- Drover

- Evo Car Share

- Fair

- Flexdrive

- GoGet

- INVERS

The Global Vehicle Subscription Services Market was valued at USD 4.7 billion in 2024 and is estimated to grow at a CAGR of 13.6% to reach USD 16 billion by 2034.

Consumers are shifting away from traditional car ownership toward more flexible and convenient mobility options. This change is fueled by a desire to avoid the long-term financial and maintenance commitments associated with buying or leasing a vehicle. Vehicle subscription services offer users the ability to access different types of vehicles as needed, whether for daily commuting, weekend trips, or special occasions, without the hassles of ownership.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.7 Billion |

| Forecast Value | $16 Billion |

| CAGR | 13.6% |

OEM to Gain Traction

The OEM segment in the vehicle subscription services market held a notable share in 2024. Automakers are leveraging their brand loyalty and extensive vehicle portfolios to offer subscription services that provide seamless access to their models. This approach allows OEMs to deepen customer relationships by providing flexible ownership alternatives and bundling maintenance, insurance, and roadside assistance into single packages. By integrating digital platforms and personalized offerings, OEMs are positioning themselves as key players in the evolving mobility landscape, attracting tech-savvy and convenience-oriented consumers.

Rising Demand for Multi-Brand

The multi-brand segment generated a substantial share in 2024, driven by subscribers' access to a wide range of vehicles from various manufacturers, often through third-party platforms. Multi-brand services provide options across vehicle classes, from economy to luxury, catering to diverse customer preferences. Companies operating in this space emphasize user-friendly apps, transparent pricing, and hassle-free subscription processes to differentiate themselves. Strategic partnerships with dealerships and fleet operators enable these platforms to maintain a broad and dynamic inventory, enhancing customer retention and market reach.

U.S. to Emerge as a Propelling Region

The U.S. vehicle subscription services market is experiencing robust growth, projected to surpass USD 5 billion in the next five years, driven by urbanization, evolving consumer preferences, and technological advancements. American consumers are increasingly favoring flexible, cost-effective transportation solutions that eliminate the burdens of ownership. Providers in this market focus on enhancing customer experience through seamless digital interfaces, tailored subscription plans, and value-added services such as insurance and maintenance. To strengthen their market foothold, companies are investing in localized fleet expansions, forging alliances with automakers and dealerships, and employing data analytics to optimize vehicle availability and subscriber engagement.

Major players in the vehicle subscription services market are Volkswagen, TeslaRents, Hyundai, FINN, Myles, Tata Motors, Sixt, Mercedes-Benz, Free2move, and Carvolution.

Companies in the vehicle subscription services market are adopting several key strategies to solidify their market position. First, they are investing heavily in digital platforms that enable smooth subscription management and personalized user experiences. Second, partnerships with OEMs and dealerships help secure diverse vehicle inventories and enhance brand credibility. Third, companies focus on flexible subscription plans that cater to different customer segments, including short-term and long-term options. Fourth, integrating comprehensive service packages covering insurance, maintenance, and roadside assistance adds value and convenience. Lastly, targeted marketing and loyalty programs help increase customer retention and expand their subscriber base in a competitive landscape.

Table of Contents

Chapter 1 Methodology

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.1.6 GMI proprietary AI system

- 1.1.6.1 AI-Powered research enhancement

- 1.1.6.2 Source consistency protocol

- 1.1.6.3 AI accuracy metrics

- 1.2 Forecast model

- 1.3 Primary research and validation

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario Analysis Framework

- 1.4 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Secondary

- 1.5.1.1 Paid Sources

- 1.5.1.2 Public Sources

- 1.5.1.3 Sources, by region

- 1.5.1 Secondary

- 1.6 Research trail & confidence scoring

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Service provider

- 2.2.3 Subscription

- 2.2.4 Subscription period

- 2.2.5 Vehicle

- 2.2.6 Fuel

- 2.2.7 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Shift from ownership to access-based mobility

- 3.2.1.2 Rising EV adoption supported by subscription platforms

- 3.2.1.3 Increasing digitalization & app-based mobility ecosystems

- 3.2.1.4 Flexible contracts for personal & commercial users

- 3.2.1.5 Sustainability and circular economy trends

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High subscription costs vs. leasing/financing

- 3.2.2.2 Limited availability of vehicle models in some regions

- 3.2.2.3 Complex insurance & liability issues

- 3.2.2.4 Competition with ride-hailing, leasing, and car rental

- 3.2.2.5 Low awareness in emerging economies

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of multi-brand and EV fleets

- 3.2.3.2 Partnerships with OEMs, dealers, and fleet operators

- 3.2.3.3 Growing adoption by SMEs and logistics players

- 3.2.3.4 Emerging markets in APAC & LATAM

- 3.2.3.5 AI-enabled fleet management & predictive maintenance

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 NHTSA regulations & safety standards

- 3.4.2 Data privacy & connected vehicle regulations

- 3.4.3 Cross-border digital trade compliance

- 3.4.4 State & local regulatory variations

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Connected vehicle subscription services

- 3.7.1.1 IoT integration & real-time monitoring

- 3.7.1.2 Data analytics & predictive maintenance

- 3.7.1.3 Customer experience enhancement

- 3.7.1.4 Privacy & data security frameworks

- 3.7.2 Autonomous vehicle subscription readiness

- 3.7.2.1 AV technology integration timeline

- 3.7.2.2 Regulatory framework development

- 3.7.2.3 Safety standards & testing requirements

- 3.7.2.4 Market readiness & consumer acceptance

- 3.7.3 Traditional vehicle subscription models

- 3.7.3.1 Service delivery optimization

- 3.7.3.2 Operational efficiency improvements

- 3.7.3.3 Customer service & support systems

- 3.7.4 Telematics-enabled subscription services

- 3.7.4.1 Vehicle tracking & usage monitoring

- 3.7.4.2 Performance analytics & optimization

- 3.7.4.3 Insurance integration & risk management

- 3.7.4.4 Maintenance scheduling & predictive services

- 3.7.1 Connected vehicle subscription services

- 3.8 Patent analysis

- 3.9 Production statistics

- 3.9.1 Import and export

- 3.9.2 Major import countries

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use Cases & Application Analysis

- 3.11.1 Consumer use cases

- 3.11.1.1 Urban mobility solutions

- 3.11.1.2 Temporary transportation needs

- 3.11.1.3 Vehicle trial & purchase decision support

- 3.11.1.4 Seasonal & occasional use scenarios

- 3.11.1.5 Multi-vehicle household optimization

- 3.11.2 Business use cases

- 3.11.2.1 Corporate fleet modernization

- 3.11.2.2 Employee mobility programs

- 3.11.2.3 Project-based transportation needs

- 3.11.2.4 Geographic expansion support

- 3.11.2.5 Cost management & budget optimization

- 3.11.3 Government & public sector use cases

- 3.11.3.1 Fleet modernization initiatives

- 3.11.3.2 Emergency response & disaster management

- 3.11.3.3 Inter-agency vehicle sharing

- 3.11.3.4 Pilot programs & technology testing

- 3.11.4 Industry-specific applications

- 3.11.4.1 Healthcare & medical services

- 3.11.4.2 Real estate & property management

- 3.11.4.3 Consulting & professional services

- 3.11.4.4 Construction & field services

- 3.11.5 Best case scenarios & success stories

- 3.11.5.1 Optimal market conditions analysis

- 3.11.5.2 High-performance use case examples

- 3.11.5.3 ROI maximization strategies

- 3.11.5.4 Customer satisfaction excellence models

- 3.11.1 Consumer use cases

- 3.12 Pricing analysis & cost structure

- 3.12.1 Pricing models & strategies

- 3.12.1.1 Monthly subscription pricing tiers

- 3.12.1.2 Usage-based pricing models

- 3.12.1.3 All-inclusive vs. Modular pricing

- 3.12.1.4 Dynamic pricing & demand-based adjustments

- 3.12.1.5 Corporate & fleet pricing structures

- 3.12.2 Cost breakdown analysis

- 3.12.2.1 Vehicle acquisition & depreciation costs

- 3.12.2.2 Insurance & liability coverage expenses

- 3.12.2.3 Maintenance & service delivery costs

- 3.12.2.4 Technology platform & digital infrastructure

- 3.12.2.5 Customer acquisition & marketing expenses

- 3.12.2.6 Operational & administrative overheads

- 3.12.3 Regional pricing variations

- 3.12.3.1 North American pricing benchmarks

- 3.12.3.2 European market pricing analysis

- 3.12.3.3 Asia Pacific pricing strategies

- 3.12.3.4 Emerging market pricing adaptations

- 3.12.4 Competitive pricing analysis

- 3.12.4.1 Premium vs. Economy segment pricing

- 3.12.4.2 Value proposition & price justification

- 3.12.4.3 Price elasticity & demand sensitivity

- 3.12.4.4 Pricing strategy optimization

- 3.12.1 Pricing models & strategies

- 3.13 Customer behavior & market adoption

- 3.13.1 Consumer demographics & psychographics

- 3.13.1.1 Age group analysis & generational preferences

- 3.13.1.2 Income level & economic status impact

- 3.13.1.3 Geographic & urban vs. Rural patterns

- 3.13.1.4 Lifestyle & mobility preference correlation

- 3.13.2 Customer journey & decision-making process

- 3.13.2.1 Awareness & consideration stages

- 3.13.2.2 Evaluation criteria & selection factors

- 3.13.2.3 Onboarding & initial experience

- 3.13.2.4 Usage patterns & service utilization

- 3.13.2.5 Retention & loyalty development

- 3.13.3 Behavioral segmentation analysis

- 3.13.3.1 Early adopters & technology enthusiasts

- 3.13.3.2 Pragmatic users & value seekers

- 3.13.3.3 Convenience-focused consumers

- 3.13.3.4 Sustainability-driven customers

- 3.13.4 Customer satisfaction & experience metrics

- 3.13.4.1 Net promoter score (NPS) analysis

- 3.13.4.2 Customer lifetime value (CLV) assessment

- 3.13.4.3 Churn rate & retention analysis

- 3.13.4.4 Service quality & performance indicators

- 3.13.5 Adoption barriers & resistance factors

- 3.13.5.1 Psychological barriers to adoption

- 3.13.5.2 Economic & financial concerns

- 3.13.5.3 Service quality & reliability issues

- 3.13.5.4 Technology & digital literacy challenges

- 3.13.1 Consumer demographics & psychographics

- 3.14 Investment analysis & market opportunities

- 3.14.1 Market growth projections & scenario analysis

- 3.14.2 Investment requirements & capital allocation

- 3.14.3 ROI analysis & profitability metrics

- 3.14.4 Risk assessment & mitigation strategies

- 3.14.5 Funding landscape & capital sources

- 3.14.6 Strategic partnership opportunities

- 3.14.7 Geographic expansion investment priorities

- 3.14.8 Technology development & innovation investments

- 3.14.9 Market entry strategies & timing considerations

- 3.14.10 Exit strategies & value realization

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Service Provider, 2021 - 2034 ($Bn, Fleet Size)

- 5.1 Key trends

- 5.2 OEM / Captives

- 5.3 Third-Party / Independent Providers

Chapter 6 Market Estimates & Forecast, By Subscription, 2021 - 2034 ($Bn, Fleet Size)

- 6.1 Key trends

- 6.2 Multi-brand subscriptions

- 6.3 Single-brand subscriptions

Chapter 7 Market Estimates & Forecast, By Subscription Period, 2021 - 2034 ($Bn, Fleet Size)

- 7.1 Key trends

- 7.2 1-6 months

- 7.3 6-12 months

- 7.4 More than 12 months

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Fleet Size)

- 8.1 Key trends

- 8.2 Luxury car

- 8.3 Executive car

- 8.4 Economy car

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Fleet Size)

- 9.1 Key trends

- 9.2 Personal

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Fuel , 2021 - 2034 ($Bn, Fleet Size)

- 10.1 Key trends

- 10.2 ICE

- 10.3 BEV

- 10.4 PHEV

- 10.5 HEV

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 ($Bn, Fleet Size)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 Audi

- 12.1.2 BMW Group

- 12.1.3 Cadillac

- 12.1.4 Ford Motor Company

- 12.1.5 General Motors

- 12.1.6 Hyundai Motor

- 12.1.7 Jaguar Land Rover

- 12.1.8 Lexus

- 12.1.9 Mercedes-Benz Group

- 12.2 Regional Champions

- 12.2.1 Autolib

- 12.2.2 Cambio CarSharing

- 12.2.3. Car2 Go

- 12.2.4 DriveNow

- 12.2.5 Enterprise CarShare

- 12.2.6 Europcar Mobility Group

- 12.2.7 Getaround

- 12.2.8 GreenMobility

- 12.2.9 Hertz Corporation

- 12.2.10 Miles Mobility

- 12.2.11 Mobility Cooperative

- 12.3 Emerging Players & Technology Enablers

- 12.3.1 Carbar

- 12.3.2 Cazoo

- 12.3.3 Cluno

- 12.3.4 Communauto

- 12.3.5 Drover

- 12.3.6 Evo Car Share

- 12.3.7 Fair

- 12.3.8 Flexdrive

- 12.3.9 GoGet

- 12.3.10 INVERS