|

市场调查报告书

商品编码

1833454

网路探测器市场机会、成长动力、产业趋势分析与预测 2025 - 2034Network Probe Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

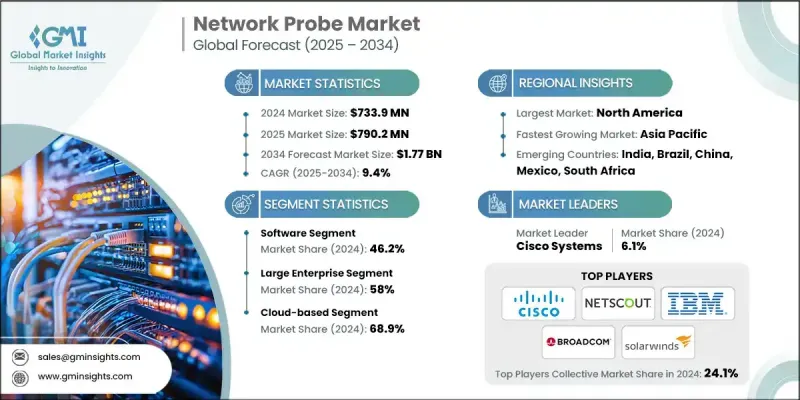

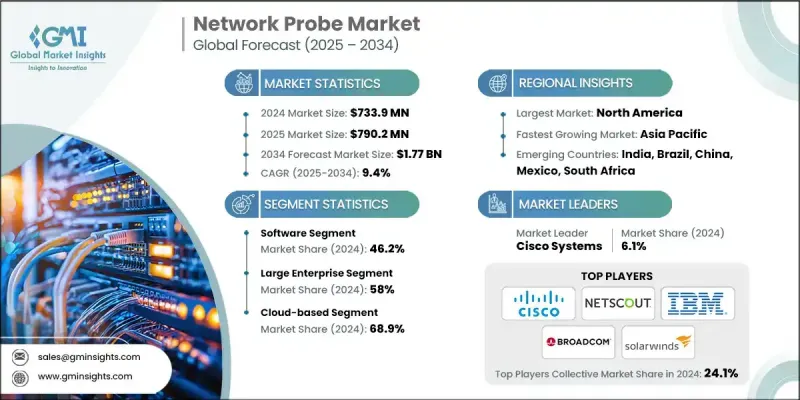

2024 年全球网路探测器市场价值为 7.339 亿美元,预计到 2034 年将以 9.4% 的复合年增长率增长至 17.7 亿美元。

数位技术、5G 网路、物联网生态系统和云端基础设施的日益普及,显着增加了复杂分散式 IT 和电信网路中的资料流量。这种转变推动了对网路探测器的需求,这些探测器能够提供深入的监控、效能诊断和即时分析。企业需要这些工具来管理拥塞、侦测异常情况并确保高效能连线。随着网路威胁日益频繁和复杂,企业优先考虑端到端可视性,以保护关键系统并减少停机时间。网路探测器支援合规性工作、优化正常运作时间并发出主动安全警报,已成为企业基础设施的重要组成部分。向软体定义和云端原生网路的过渡进一步加速了探测器的采用,因为企业需要可扩展、可远端部署且可在混合云和多云环境中运行的解决方案。网路视觉性已成为数位转型的基础,尤其是在北美等地区,超大规模云端成长、人工智慧的采用和下一代运算正在重塑企业基础设施需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.339亿美元 |

| 预测值 | 17.7亿美元 |

| 复合年增长率 | 9.4% |

2024年,基于软体的网路探测器市场占有46.2%的份额。这些解决方案因其可扩展性、远端管理功能以及与人工智慧分析平台的整合而日益受到青睐。与传统硬体不同,云端原生软体探测器能够即时诊断,提供预测性洞察,并为管理大规模分散式网路的企业带来成本效益。它们越来越多地被用于简化网路营运、提升安全性和灵活性,同时又不会给IT团队带来负担。

2024年,基于云端的部署领域占了68.9%的份额。它们的受欢迎程度源于快速部署、减少对硬体的依赖,以及包含机器学习驱动的异常检测和预测分析等高级功能。这支援主动网路管理,并更快地解决不同企业环境中的问题。

北美网路探测器市场占据40.3%的市场份额,2024年市场规模达2.958亿美元。该地区在5G部署、人工智慧整合和物联网扩展方面的领先地位,需要对高速、数据丰富的网路进行持续监控。探测器在支援可靠性能和快速威胁响应方面发挥关键作用。北美各地的大型科技公司正在投资大型资料中心,以满足日益增长的云端服务和人工智慧应用需求,这进一步推动了对智慧监控工具的需求,以管理效能和网路安全。

全球网路探测产业的主要参与者包括瞻博网路、思科系统、博通、IBM、Riverbed Technology、SolarWinds Worldwide、NETSCOUT Systems、Paessler、ManageEngine(Zoho Corporation)和 Dynatrace。网路探测产业的公司正在积极投资人工智慧驱动的分析技术,以增强即时威胁侦测、自动化网路诊断并优化效能监控。他们也正在开发基于软体的云端原生探测解决方案,这些解决方案易于扩展、部署并与多云和混合 IT 环境整合。与云端服务供应商和电信公司的策略联盟正在帮助扩展服务组合。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 网路流量增加

- 网路安全问题

- 云端和软体定义网络

- 5G 和边缘运算的发展

- 产业特定采用

- 产业陷阱与挑战

- 资料隐私和监管问题

- 技能型劳动力有限

- 市场机会

- 云端运算应用日益普及

- 5G和物联网网路的扩展

- 产业特定解决方案

- 与人工智慧和分析的集成

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 成本分解分析

- 专利分析

- 技术和创新格局

- 主动探测技术

- 综合交易监控的演变

- 应用层测试方法

- 网路品质评估演算法

- 绩效基线建立技术

- 被动监测技术

- 深度包检测(DPI)的演进

- 基于流的分析方法

- 元资料撷取与分析技术

- 即时串流处理技术

- 混合式智慧监控

- AI/ML增强侦测演算法

- 行为分析和异常检测

- 预测故障分析能力

- 自动回应和补救系统

- 下一代技术

- 量子安全监测协议

- 6G网路准备要求

- 卫星网路监测能力

- 可程式网路探测架构

- 主动探测技术

- 供应商选择并实施框架

- 用例

- 电信和服务供应商

- 5G网路切片监控需求

- 客户体验管理集成

- 收入保证和欺诈检测

- SLA 合规自动化(独特)

- 金融服务

- 高频交易网路监控

- PCI DSS 合规性自动化

- 即时诈欺检测集成

- 监管报告自动化(独特)

- 卫生保健

- 医疗器材网路安全

- HIPAA合规性监控

- 远距医疗品质保证

- 病患资料保护验证(独特)

- 政府与国防

- FISMA 持续监控要求

- 分类网路监控协议

- 关键基础设施保护

- 内部威胁侦测功能(独特)

- 企业与公司

- 远端工作基础设施监控

- BYOD 安全合规性

- 云端迁移监控

- 数位转型投资报酬率衡量

- 电信和服务供应商

- 最佳情况

- 投资与融资趋势分析

- 供应链动态与依赖关係

- 各地区市场成熟度评估

- 供应商锁定风险评估框架

- 技能差距影响分析和培训需求

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 供应商路线图一致性评估

- 客户转换成本分析

- 重要新闻和倡议

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依组件划分,2021 - 2034 年

- 主要趋势

- 硬体

- 资料包代理

- 网路交换机

- 专用处理单元(基于 FPGA/ASIC)

- 软体

- 服务

- 专业服务

- 託管服务

第六章:市场估计与预测:依组织规模,2021 - 2034 年

- 主要趋势

- 大型企业

- 中小企业

第七章:市场估计与预测:依部署模式服务,2021 - 2034

- 主要趋势

- 基于云端

- 本地

第 8 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 资讯科技和电信

- 金融服务业协会

- 政府

- 卫生保健

- 零售

- 製造业

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧人

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 全球参与者

- NETSCOUT Systems

- Keysight Technologies

- VIAVI Solutions

- Cisco Systems

- Broadcom

- Juniper Networks

- IBM

- SolarWinds

- Riverbed Technology

- HPE

- Regional Champions

- Progress Software

- ManageEngine (Zoho Corp)

- Gigamon

- Paessler

- SevOne

- LiveAction

- Plixer

- Corvil

- Dynatrace

- 新兴企业和颠覆者

- Qualys

- ExtraHop Networks

- Netskope

- Kentik

- Nyansa

- Catchpoint Systems

The Global Network Probe Market was valued at USD 733.9 million in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 1.77 billion by 2034.

The increasing adoption of digital technologies, 5G networks, IoT ecosystems, and cloud-based infrastructure is significantly increasing data traffic across complex, distributed IT and telecom networks. This shift is fueling demand for network probes, which provide in-depth monitoring, performance diagnostics, and real-time analytics. Organizations require these tools to manage congestion, detect irregularities, and ensure high-performance connectivity. As cyber threats grow more frequent and sophisticated, companies are prioritizing end-to-end visibility to safeguard critical systems and reduce downtime. Network probes support compliance efforts, optimize uptime, and deliver proactive security alerts, becoming a vital part of enterprise infrastructure. The transition to software-defined and cloud-native networks further accelerates probe adoption, as businesses demand scalable, remotely deployable solutions that work across hybrid and multi-cloud environments. Network visibility has become foundational for digital transformation, particularly in regions like North America, where hyperscale cloud growth, AI adoption, and next-gen computing are reshaping enterprise infrastructure needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $733.9 Million |

| Forecast Value | $1.77 Billion |

| CAGR | 9.4% |

The software-based network probes segment held a 46.2% share in 2024. These solutions are gaining traction due to their scalability, remote management capabilities, and integration with AI-powered analytics platforms. Unlike traditional hardware, cloud-native software probes enable real-time diagnostics, deliver predictive insights, and offer cost efficiency for businesses managing large-scale, distributed networks. They are increasingly used to streamline network operations, boost security, and enhance agility without burdening IT teams.

The cloud-based deployment segment held a 68.9% share in 2024. Their popularity stems from quick deployment, reduced hardware dependency, and the inclusion of advanced features like machine learning-driven anomaly detection and predictive analytics. This supports proactive network management and faster resolution of issues across diverse enterprise environments.

North America Network Probe Market held a 40.3% share and generated USD 295.8 million in 2024. The region's leadership in 5G rollout, AI integration, and IoT expansion requires continuous monitoring of high-speed, data-rich networks. Probes play a critical role in supporting reliable performance and rapid threat response. Major tech companies across North America are investing in large-scale data centers to handle growing demand for cloud services and AI applications, further driving the need for intelligent monitoring tools to manage performance and cybersecurity.

Key players in the Global Network Probe Industry include Juniper Networks, Cisco Systems, Broadcom, IBM, Riverbed Technology, SolarWinds Worldwide, NETSCOUT Systems, Paessler, ManageEngine (Zoho Corporation), and Dynatrace. Companies in the network probe industry are actively investing in AI-driven analytics to enhance real-time threat detection, automate network diagnostics, and optimize performance monitoring. They are also developing cloud-native, software-based probe solutions that are easy to scale, deploy, and integrate with multi-cloud and hybrid IT environments. Strategic alliances with cloud service providers and telecom companies are helping expand service portfolios.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Component

- 2.2.2 Organization size

- 2.2.3 Deployment mode

- 2.2.4 End use

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing Network Traffic

- 3.2.1.2 Cybersecurity Concerns

- 3.2.1.3 Cloud & Software-Defined Networks

- 3.2.1.4 Growth of 5G & Edge Computing

- 3.2.1.5 Industry-Specific Adoption

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data Privacy & Regulatory Concerns

- 3.2.2.2 Limited Skilled Workforce

- 3.2.3 Market opportunities

- 3.2.3.1 Growing Cloud Adoption

- 3.2.3.2 Expansion in 5G and IoT Networks

- 3.2.3.3 Industry-Specific Solutions

- 3.2.3.4 Integration with AI & Analytics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Technology and Innovation landscape

- 3.10.1 Active Probing Technologies

- 3.10.1.1 Synthetic Transaction Monitoring Evolution

- 3.10.1.2 Application Layer Testing Methodologies

- 3.10.1.3 Network Quality Assessment Algorithms

- 3.10.1.4 Performance Baseline Establishment Techniques

- 3.10.2 Passive Monitoring Technologies

- 3.10.2.1 Deep Packet Inspection (DPI) Evolution

- 3.10.2.2 Flow-based Analysis Methodologies

- 3.10.2.3 Metadata Extraction & Analysis Techniques

- 3.10.2.4 Real-time Stream Processing Technologies

- 3.10.3 Hybrid & Intelligent Monitoring

- 3.10.3.1 AI/ML-Enhanced Detection Algorithms

- 3.10.3.2 Behavioral Analytics & Anomaly Detection

- 3.10.3.3 Predictive Failure Analysis Capabilities

- 3.10.3.4 Automated Response & Remediation Systems

- 3.10.4 Next-Generation Technologies

- 3.10.4.1 Quantum-Safe Monitoring Protocols

- 3.10.4.2 6G Network Preparation Requirements

- 3.10.4.3 Satellite Network Monitoring Capabilities

- 3.10.4.4 Programmable Network Probe Architectures

- 3.10.1 Active Probing Technologies

- 3.11 Vendor Selection & Implementation Framework

- 3.12 Use cases

- 3.12.1 Telecommunications & Service Providers

- 3.12.1.1 5G Network Slice Monitoring Requirements

- 3.12.1.2 Customer Experience Management Integration

- 3.12.1.3 Revenue Assurance & Fraud Detection

- 3.12.1.4 SLA Compliance Automation (Unique)

- 3.12.2 Financial Services

- 3.12.2.1 High-Frequency Trading Network Monitoring

- 3.12.2.2 PCI DSS Compliance Automation

- 3.12.2.3 Real-time Fraud Detection Integration

- 3.12.2.4 Regulatory Reporting Automation (Unique)

- 3.12.3 Healthcare

- 3.12.3.1 Medical Device Network Security

- 3.12.3.2 HIPAA Compliance Monitoring

- 3.12.3.3 Telemedicine Quality Assurance

- 3.12.3.4 Patient Data Protection Validation (Unique)

- 3.12.4 Government & Defense

- 3.12.4.1 FISMA Continuous Monitoring Requirements

- 3.12.4.2 Classified Network Monitoring Protocols

- 3.12.4.3 Critical Infrastructure Protection

- 3.12.4.4 Insider Threat Detection Capabilities (Unique)

- 3.12.5 Enterprise & Corporate

- 3.12.5.1 Remote Work Infrastructure Monitoring

- 3.12.5.2 BYOD Security Compliance

- 3.12.5.3 Cloud Migration Monitoring

- 3.12.5.4 Digital Transformation ROI Measurement

- 3.12.1 Telecommunications & Service Providers

- 3.13 Best-case scenario

- 3.14 Investment & Funding Trends Analysis

- 3.15 Supply Chain Dynamics & Dependencies

- 3.16 Market Maturity Assessment by Region

- 3.17 Vendor Lock-in Risk Assessment Framework

- 3.18 Skills Gap Impact Analysis & Training Requirements

- 3.19 Sustainability and environmental aspects

- 3.19.1 Sustainable practices

- 3.19.2 Waste reduction strategies

- 3.19.3 Energy efficiency in production

- 3.19.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Vendor Roadmap Alignment Assessment

- 4.7 Customer Switching Cost Analysis

- 4.8 Key news and initiatives

- 4.8.1 Mergers & acquisitions

- 4.8.2 Partnerships & collaborations

- 4.8.3 New Product Launches

- 4.8.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Packet Brokers

- 5.2.2 Network Switches

- 5.2.3 Specialized Processing Units (FPGA / ASIC-based)

- 5.3 Software

- 5.4 Services

- 5.4.1 Professional Services

- 5.4.2 Managed Services

Chapter 6 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Large enterprise

- 6.3 SME

Chapter 7 Market Estimates & Forecast, By Deployment mode Service, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Cloud Based

- 7.3 On-premises

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 IT & Telecom

- 8.3 BFSI

- 8.4 Government

- 8.5 Healthcare

- 8.6 Retail

- 8.7 Manufacturing

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 NETSCOUT Systems

- 10.1.2 Keysight Technologies

- 10.1.3 VIAVI Solutions

- 10.1.4 Cisco Systems

- 10.1.5 Broadcom

- 10.1.6 Juniper Networks

- 10.1.7 IBM

- 10.1.8 SolarWinds

- 10.1.9 Riverbed Technology

- 10.1.10 HPE

- 10.2 Regional Champions

- 10.2.1 Progress Software

- 10.2.2 ManageEngine (Zoho Corp)

- 10.2.3 Gigamon

- 10.2.4 Paessler

- 10.2.5 SevOne

- 10.2.6 LiveAction

- 10.2.7 Plixer

- 10.2.8 Corvil

- 10.2.9 Dynatrace

- 10.3 Emerging Players & Disruptors

- 10.3.1 Qualys

- 10.3.2 ExtraHop Networks

- 10.3.3 Netskope

- 10.3.4 Kentik

- 10.3.5 Nyansa

- 10.3.6 Catchpoint Systems