|

市场调查报告书

商品编码

1833619

氢气管道市场机会、成长动力、产业趋势分析及2025-2035年预测Hydrogen Pipeline Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2035 |

||||||

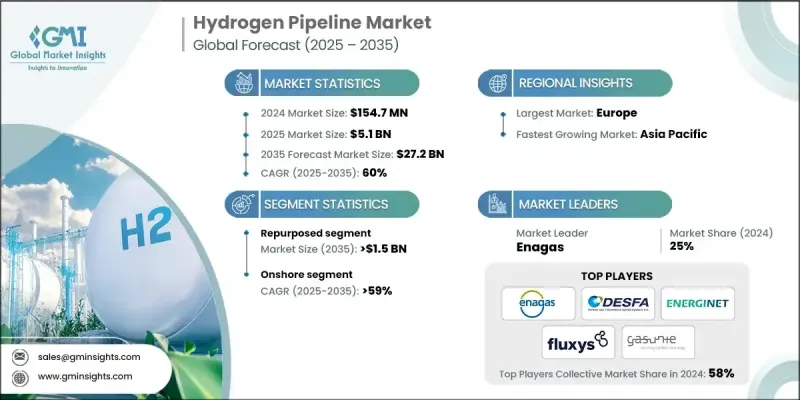

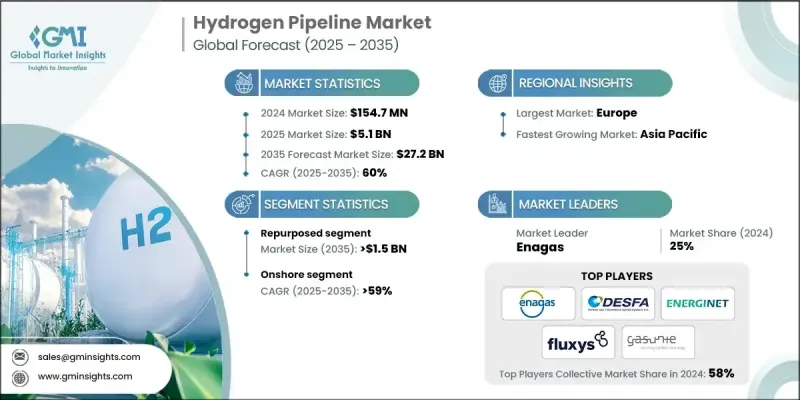

2024 年全球氢气管道市场规模估计为 1.547 亿美元,预计将从 2025 年的 51 亿美元成长到 2035 年的 272 亿美元,复合年增长率为 60%。

世界各国政府和各行各业都致力于实现净零排放目标,大力投资清洁氢能,将其作为重要的脱碳工具,尤其是在钢铁、化学和重型运输等难以减排的行业。这刺激了对包括管道在内的可靠氢能运输基础设施的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2035 |

| 起始值 | 1.547亿美元 |

| 预测值 | 272亿美元 |

| 复合年增长率 | 60% |

再利用领域需求不断成长

由于营运商寻求经济高效的解决方案来加速基础设施部署,氢能改造领域在2024年将占据显着份额。企业不再从零开始建造新管线,而是将现有的天然气管道改造成氢气输送管道,这种方法可以降低资本支出并缩短开发週期。这种方法在拥有大量传统天然气管网的地区尤其具有吸引力,因为它在现有的化石能源系统和未来的绿色能源分配之间架起了一座实用的桥樑。

陆上需求不断成长

2024年,陆上管道业务创造了可观的收入,这得益于其物流优势、更低的安装成本以及与海上基础设施相比更容易获得监管审批。陆上管道对于连接电解厂等生产基地与工业用户、加氢站和出口终端至关重要。这一领域对于在工业园区之间建立区域氢能枢纽和走廊尤其重要。

欧洲将崛起为利润丰厚的地区

2024年,欧洲氢气管道市场占据了相当大的份额,这得益于雄心勃勃的气候目标、协调一致的基础设施规划以及欧盟氢能战略强有力的监管支持。德国、荷兰和西班牙等主要国家正大力投资建立跨国管线网络,以连结跨境生产和消费中心。此外,跨产业合作、政府资助以及「欧洲氢能骨干网路」等倡议下的天然气管道改造也推动了这一成长。

氢气管道市场的主要参与者包括 Denys、Terega、ENERGINET、Siemens Energy、GRTgaz、REN、Fluxys、Bonatti、Tekfen、The ROSEN Group、Spiecapag、Corinth Pipeworks、TENARIS、DESFA、SROnam、ONTRAS Gasport、EnAZAZs、SYS膜、EnAZs、Gasunie、EU

为了巩固其在不断发展的氢气管道市场中的地位,各公司正在寻求技术创新、战略合作伙伴关係和监管协调相结合的方案。许多公司正在投资先进的管道材料和监控系统,以应对氢气的安全挑战并满足未来标准。与再生能源开发商和工业氢气用户的合作正在实现垂直整合的价值炼和保障需求。此外,各公司正积极与政策制定者合作,以建立监管框架,确保专案审批和融资资格更加顺畅。地理多元化,尤其是在欧洲和亚洲,是另一项关键策略,使公司能够进入高成长市场并平衡跨地区的专案风险。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成本结构分析

- 潜在的管道项目

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率(按地区划分)

- 北美洲

- 欧洲

- 亚太地区

- 战略仪表板

- 策略倡议

- 公司标竿分析

- 创新与技术格局

第五章:市场规模及预测:依类型,2021 - 2035

- 主要趋势

- 陆上

- 海上

第六章:市场规模及预测:依分类,2021 - 2035

- 主要趋势

- 新的

- 重新利用

第七章:市场规模及预测:按地区,2021 - 2035

- 主要趋势

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第八章:公司简介

- Bonatti

- Corinth Pipeworks

- DESFA

- Denys

- Enagas SA

- Energinet

- EUROPIPE

- Fluxys

- Gasunie

- GAZ-SYSTEM

- GRTgaz

- ONTRAS Gastransport GmbH

- REN

- Siemens Energy

- Spiecapag

- Snam

- Tekfen

- Tenaris

- Terega

- The ROSEN Group

The global hydrogen pipeline market was estimated at USD 154.7 million in 2024 and is expected to grow from USD 5.1 billion in 2025 to USD 27.2 billion by 2035, at a CAGR of 60%.

Governments and industries worldwide are committing to net-zero emissions targets, driving massive investments in clean hydrogen as a key decarbonization tool-especially for hard-to-abate sectors like steel, chemicals, and heavy transport. This fuels demand for reliable hydrogen transport infrastructure, including pipelines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2035 |

| Start Value | $154.7 Million |

| Forecast Value | $27.2 Billion |

| CAGR | 60% |

Rising Demand for the Repurposed Sector

The repurposed segment held a significant share in 2024, as operators look for cost-effective solutions to accelerate infrastructure deployment. Instead of building new lines from scratch, companies are converting existing natural gas pipelines to carry hydrogen an approach that reduces capital expenditure and shortens development timelines. This method is particularly appealing in regions with extensive legacy gas networks, offering a practical bridge between current fossil-based systems and future green energy distribution.

Increasing Demand for Onshore

The onshore segment generated significant revenues in 2024, owing to its logistical advantages, lower installation costs, and easier regulatory approvals compared to offshore infrastructure. Onshore pipelines are essential for connecting production sites, such as electrolysis plants, with industrial users, hydrogen refueling stations, and export terminals. This segment is especially critical for enabling regional hydrogen hubs and corridors across industrial zones.

Europe to Emerge as a Lucrative Region

Europe hydrogen pipeline market held a sizeable share in 2024, fueled by ambitious climate goals, coordinated infrastructure plans, and strong regulatory support through the EU Hydrogen Strategy. Major countries like Germany, the Netherlands, and Spain are investing heavily in transnational pipeline networks to connect production and consumption hubs across borders. The growth is also benefiting from cross-industry collaborations, government funding, and repurposing gas networks under initiatives like the European Hydrogen Backbone.

Major players in the hydrogen pipeline market are Denys, Terega, ENERGINET, Siemens Energy, GRTgaz, REN, Fluxys, Bonatti, Tekfen, The ROSEN Group, Spiecapag, Corinth Pipeworks, TENARIS, DESFA, Snam, ONTRAS Gastransport, Enagas, Gasunie, EUROPIPE, and GAZ-SYSTEM.

To strengthen their position in the evolving hydrogen pipeline market, companies are pursuing a combination of technological innovation, strategic partnerships, and regulatory alignment. Many are investing in advanced pipeline materials and monitoring systems to address hydrogen's safety challenges and meet future standards. Collaborations with renewable energy developers and industrial hydrogen users are enabling vertically integrated value chains and guaranteed demand. In addition, firms are actively engaging with policymakers to shape regulatory frameworks, ensuring smoother project approvals and eligibility for funding. Geographic diversification, particularly in Europe and Asia, is another key strategy, allowing companies to tap into high-growth markets and balance project risk across regions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research & validation

- 1.3.1 Primary sources

- 1.4 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2035

- 2.2 Business trends

- 2.3 Type trends

- 2.4 Classification trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Cost structure analysis

- 3.5 Potential Pipeline Projects

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2035 (USD Million, Km)

- 5.1 Key trends

- 5.2 Onshore

- 5.3 Offshore

Chapter 6 Market Size and Forecast, By Classification, 2021 - 2035 (USD Million, Km)

- 6.1 Key trends

- 6.2 New

- 6.3 Repurposed

Chapter 7 Market Size and Forecast, By Region, 2021 - 2035 (USD Million, Km)

- 7.1 Key trends

- 7.2 North America

- 7.3 Europe

- 7.4 Asia Pacific

- 7.5 Rest of World

Chapter 8 Company Profiles

- 8.1 Bonatti

- 8.2 Corinth Pipeworks

- 8.3 DESFA

- 8.4 Denys

- 8.5 Enagas S.A.

- 8.6 Energinet

- 8.7 EUROPIPE

- 8.8 Fluxys

- 8.9 Gasunie

- 8.10 GAZ-SYSTEM

- 8.11 GRTgaz

- 8.12 ONTRAS Gastransport GmbH

- 8.13 REN

- 8.14 Siemens Energy

- 8.15 Spiecapag

- 8.16 Snam

- 8.17 Tekfen

- 8.18 Tenaris

- 8.19 Terega

- 8.20 The ROSEN Group