|

市场调查报告书

商品编码

1833632

医疗保健咨询服务市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Healthcare Consulting Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

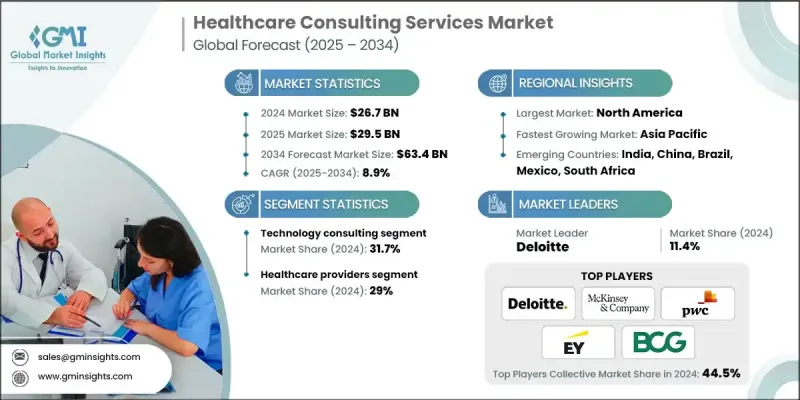

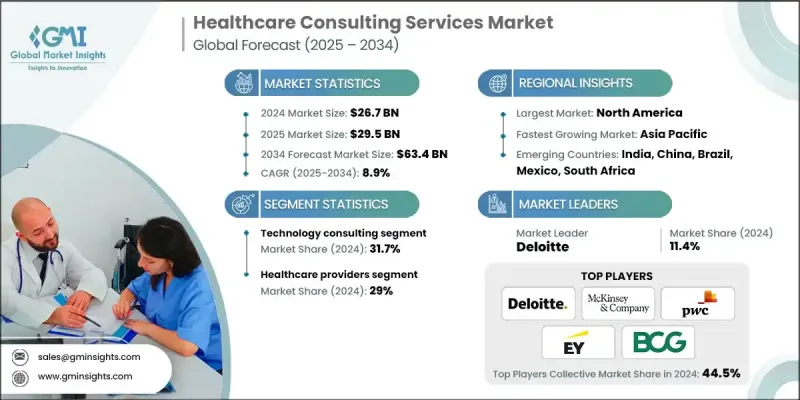

根据 Global Market Insights Inc. 发布的最新报告,全球医疗咨询服务市场规模在 2024 年估计为 267 亿美元,预计将从 2025 年的 295 亿美元增长到 2034 年的 634 亿美元,复合年增长率为 8.9%。

电子健康记录 (EHR)、远距医疗平台和人工智慧诊断等数位转型的推动,催生了对专家指导的强烈需求。医疗保健顾问能够帮助医疗服务提供者和付款人选择、部署和优化符合临床和业务目标的数位化工具。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 267亿美元 |

| 预测值 | 634亿美元 |

| 复合年增长率 | 8.9% |

技术咨询将获得发展动力

随着医疗服务提供者和付款方加速数位转型,技术咨询领域在2024年占据了显着的份额。从实施电子健康记录 (EHR) 和远距医疗平台,到部署人工智慧驱动的分析和网路安全解决方案,技术顾问是帮助医疗机构适应更以资料为中心、互联互通的生态系统的重要合作伙伴。随着数位医疗的普及,对策略性、可扩展且合规的技术路线图的需求仍然是咨询公司的主要成长动力。

医疗保健提供者的采用率不断上升

医疗保健提供者细分市场在2024年创造了可观的收入,这得益于优化营运、改善病患治疗效果和降低管理成本的需求。顾问与提供者组织紧密合作,重新设计医疗服务模式,与基于价值的医疗框架保持一致,并管理临床和财务绩效。无论是在劳动力规划、数位整合或供应链优化方面,提供者越来越多地寻求专家顾问的帮助,以适应快速变化的医疗保健格局。

北美将成为推动力地区

2024年,北美医疗咨询服务市场维持了可持续的份额,这得益于先进的医疗基础设施、高水准的技术应用以及对法规合规性的高度重视。美国在需求方面处于领先地位,这得益于其持续向基于价值的报销模式转变、人口健康计划以及大型医院网络和保险公司的数位转型。顾问公司正在透过投资专业人才、本地交付能力和跨职能服务来扩大其影响力,以满足城乡市场客户的多样化需求。

医疗保健咨询服务市场的主要参与者有 IQVIA、Guidehouse、LEK Consulting、Vizient、凯捷、安永、波士顿咨询集团、Cognizant、贝恩公司、德勤、奥纬咨询、埃森哲、Chartis、普华永道 (PwC)、ClearView Healthcare Partners、科尔尼、NTT DATA、HURON、麦肯道 (PwC)、ClearView Healthcare Partners、科尔尼、NTT DATA、HURON、麦肯锡公司和毕马威锡。

为了巩固自身地位,医疗咨询服务市场的领先公司正在采取注重专业化、可扩展性和以客户为中心的创新的策略。许多公司正在组建垂直领域的专业团队,这些团队在付款人策略、人口健康或法规遵循等领域拥有深厚的专业知识。这些公司还透过收购或与医疗科技新创公司合作来扩展其数位化能力,从而能够提供端到端的转型服务。此外,资料安全和互通性也受到高度重视,一些公司正在开发符合《健康保险流通与责任法》(HIPAA) 和其他隐私法规的框架。透过将策略咨询与实际实施和长期变革管理相结合,咨询服务提供者正在将自己定位为医疗转型中不可或缺的合作伙伴。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 医疗保健领域的技术进步

- 併购活动增加

- 全球研发支出不断增加

- 产业陷阱与挑战

- 隐性成本和营运动态

- 市场机会

- 数位医疗转型的需求日益增长

- 对人工智慧和资料分析整合的需求

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 当前的技术趋势

- 新兴技术

- 差距分析

- 波特的分析

- PESTEL分析

- 未来市场趋势

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 伙伴关係与合作

- 推出新服务类型

- 扩张计划

第五章:市场估计与预测:按服务类型,2021 - 2034 年

- 主要趋势

- 技术咨询

- 策略咨询

- 营运咨询

- 财务咨询

- 其他服务类型

第六章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医疗保健提供者

- 医疗保健付款人

- 生命科学和製药公司

- 医疗科技和数位健康公司

- 政府和监管机构

第七章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Accenture

- Bain & Company

- Boston Consulting Group

- Capgemini

- Chartis

- ClearView Healthcare Partners

- Cognizant

- Deloitte

- Ernst & Young

- Guidehouse

- HURON

- IQVIA

- Kearney

- KPMG

- LEK Consulting

- McKinsey & Company

- NTT DATA

- Oliver Wyman

- PricewaterhouseCoopers (PwC)

- Vizient

The global healthcare consulting services market was estimated at USD 26.7 billion in 2024 and is expected to grow from USD 29.5 billion in 2025 to USD 63.4 billion in 2034, at a CAGR of 8.9%, according to the latest report published by Global Market Insights Inc.

The push toward digitization, such as implementing electronic health records (EHR), telemedicine platforms, and AI-powered diagnostics, is creating a strong need for expert guidance. Healthcare consultants support providers and payers in choosing, deploying, and optimizing digital tools that align with clinical and business objectives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $26.7 Billion |

| Forecast Value | $63.4 Billion |

| CAGR | 8.9% |

Technology Consulting to Gain Traction

The technology consulting segment held a notable share in 2024, as providers and payers accelerate digital initiatives to modernize their operations. From implementing electronic health records (EHRs) and telehealth platforms to deploying AI-driven analytics and cybersecurity solutions, technology consultants are essential partners in helping healthcare organizations adapt to a more data-centric, connected ecosystem. As digital health adoption grows, the demand for strategic, scalable, and compliant technology roadmaps remains a major growth driver for consulting firms.

Rising Adoption of Healthcare Providers

The healthcare providers segment generated significant revenues in 2024, driven by the need to optimize operations, improve patient outcomes, and reduce administrative overhead. Consultants work closely with provider organizations to redesign care delivery models, align with value-based care frameworks, and manage clinical and financial performance. Whether it's workforce planning, digital integration, or supply chain optimization, providers are increasingly turning to expert advisors to help them adapt to a fast-changing healthcare landscape.

North America to Emerge as a Propelling Region

North America healthcare consulting services market held a sustainable share in 2024, driven by advanced healthcare infrastructure, high levels of technology adoption, and a strong focus on regulatory compliance. The United States leads in demand, fueled by ongoing shifts toward value-based reimbursement models, population health initiatives, and digital transformation across large hospital networks and insurance providers. Consulting firms are expanding their presence by investing in specialized talent, local delivery capabilities, and cross-functional service offerings to meet the diverse needs of clients in both urban and rural markets.

Major players in the healthcare consulting services market are IQVIA, Guidehouse, L.E.K. Consulting, Vizient, Capgemini, Ernst & Young, Boston Consulting Group, Cognizant, Bain & Company, Deloitte, Oliver Wyman, Accenture, Chartis, PricewaterhouseCoopers (PwC), ClearView Healthcare Partners, Kearney, NTT DATA, HURON, McKinsey & Company, and KPMG.

To strengthen their position, leading firms in the healthcare consulting services market are adopting strategies that focus on specialization, scalability, and client-centric innovation. Many are building vertical-specific teams with deep domain expertise in areas like payer strategy, population health, or regulatory compliance. Firms are also expanding their digital capabilities through acquisitions or partnerships with health tech startups, allowing them to offer end-to-end transformation services. Additionally, a strong emphasis is being placed on data security and interoperability, with companies developing frameworks that align with HIPAA and other privacy mandates. By combining strategic advisory with hands-on implementation and long-term change management, consulting providers are positioning themselves as indispensable partners in healthcare transformation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Service type trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements in the healthcare sector

- 3.2.1.2 Increased merger and acquisitions activity

- 3.2.1.3 Rising global spending on research and development

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Hidden costs and operational dynamics

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for digital health transformation

- 3.2.3.2 Demand for AI and data analytics integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Service Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Technology consulting

- 5.3 Strategy consulting

- 5.4 Operations consulting

- 5.5 Financial consulting

- 5.6 Other service types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Healthcare providers

- 6.3 Healthcare payers

- 6.4 Life science and pharma companies

- 6.5 Healthcare technology and digital health companies

- 6.6 Government and regulatory agencies

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Accenture

- 8.2 Bain & Company

- 8.3 Boston Consulting Group

- 8.4 Capgemini

- 8.5 Chartis

- 8.6 ClearView Healthcare Partners

- 8.7 Cognizant

- 8.8 Deloitte

- 8.9 Ernst & Young

- 8.10 Guidehouse

- 8.11 HURON

- 8.12 IQVIA

- 8.13 Kearney

- 8.14 KPMG

- 8.15 L.E.K Consulting

- 8.16 McKinsey & Company

- 8.17 NTT DATA

- 8.18 Oliver Wyman

- 8.19 PricewaterhouseCoopers (PwC)

- 8.20 Vizient