|

市场调查报告书

商品编码

1833654

远距医疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Telehealth Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

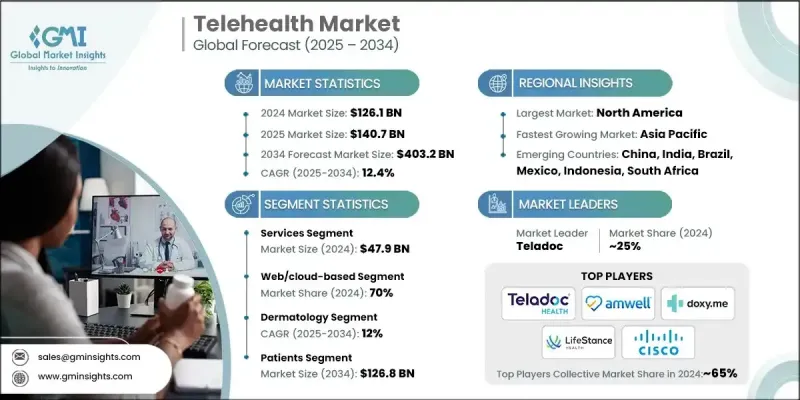

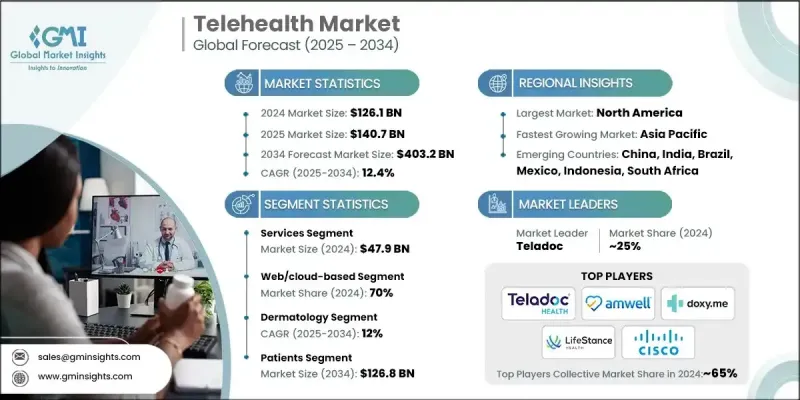

2024 年全球远距医疗市场价值为 1,261 亿美元,预计到 2034 年将以 12.4% 的复合年增长率成长,达到 4,032 亿美元。

远距医疗的快速扩张归因于人们对远距医疗日益增长的偏好,尤其是在城市和已开发地区,患者越来越依赖虚拟医疗来获得便利性和可近性。行动医疗应用和穿戴式技术的创新进一步促进了数位医疗解决方案的普及,这些技术可以实现持续监测并增强患者参与度。远距医疗是指透过先进的电信平台提供医疗服务,实现远距咨询、监测、诊断和病患支援。该市场涵盖硬体、软体和整合解决方案,建立了一个支援患者和医疗服务提供者的完整生态系统。影响成长的关键趋势包括人工智慧和机器学习的应用,它们可以提高诊断精度并增强个人化虚拟护理。透过分析血糖水平或呼吸活动等患者资料,机器学习演算法可作为医生重要的决策支援系统。这些因素共同改变了全球医疗保健的提供和取得方式。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1261亿美元 |

| 预测值 | 4032亿美元 |

| 复合年增长率 | 12.4% |

2024年,服务业收入达479亿美元。此类别包括远距患者监护、视讯或音讯咨询、即时互动、储存转发服务以及其他虚拟护理模式。对便利、经济高效且可扩展的远距医疗方案的需求日益增长,推动了该领域的成长,尤其是在医疗服务提供者将服务扩展到医疗资源匮乏的地区的情况下。远距医疗服务的便利性及其与日常医疗保健工作的融合,确保了该领域仍然是市场收入的支柱。

2024年,基于网路和云端的平台占据了70%的市场。它们的吸引力在于灵活性、较低的基础设施需求以及易于扩展。这些平台使医疗专业人员能够有效率地提供远距医疗服务,同时与电子健康记录集成,以改善协调并提升医疗效果。基于云端的系统还允许无缝更新和高级功能,而不会中断现有服务,这使得它们成为优于传统本地解决方案的首选模式。

2024年,北美远距医疗市场占48%的市场份额,巩固了其在全球远距医疗领域的领先地位。强大的医疗基础设施、广泛的网路普及率以及数位化医疗的高普及率等因素增强了北美的市场影响力。政府的支持性措施、医疗技术投资的不断增加以及领先远距医疗提供者的出现,进一步推动了该地区的成长。此外,慢性病盛行率的上升以及对持续远距监控需求的不断增长,也巩固了北美在全球远距医疗领域的主导地位。

全球远距医疗产业的主要活跃参与者包括 Teladoc Health、思科系统、Doximity、Athenahealth、美敦力、Amwell、西门子、McKesson Medical-Surgical、Omnia TeleHealth、AMD、Access TeleCare、Sesame、LifeStance Health、Health Catalyst、Telliheald、Dadioxy、HenryHealthn、Akan、MotSat)、ACapsaal、Batak、Dadia、Henry和 Eagle Telemedicine。在远距医疗市场竞争的公司正专注于增强可扩展性、可访问性以及与现有医疗系统整合的策略。许多提供者正在大力投资人工智慧和预测分析,以提高临床准确性、个人化护理并简化工作流程管理。提高与电子健康记录的互通性,并专注于网路安全增强以保护敏感的医疗资料。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 慢性病盛行率上升和老年人口增长推动远距医疗需求

- 数位健康技术日益进步

- 穿戴式装置和连网装置的普及率不断上升

- 政府措施和报销政策

- 产业陷阱与挑战

- 资料隐私和安全问题

- 发展中地区网路连线有限

- 市场机会

- 扩大新兴市场的数位医疗服务

- 混合医疗模式的渗透

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 投资和融资格局

- 远距医疗项目/计划

- 报销场景

- 技术格局

- 新兴技术

- 目前技术

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按组件,2021 - 2034

- 主要趋势

- 硬体

- 软体

- 服务

- 远端病人监控

- 即时互动

- 储存转发

- 视讯/音讯咨询

- 其他服务类型

第六章:市场估计与预测:依交付方式,2021 - 2034 年

- 主要趋势

- 网路为基础/云端

- 现场

第七章:市场估计与预测:按专业,2021 - 2034

- 主要趋势

- 皮肤科

- 心理健康

- 心臟病学

- 神经病学

- 骨科

- 妇科

- 其他专业

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医疗保健提供者

- 医院和诊所

- 长期照护中心

- 其他医疗保健提供者

- 付款人

- 患者

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Access TeleCare

- AMD

- American Well

- Apollo TeleHealth

- Athenahealth

- Capsa Healthcare

- Cisco Systems

- Doxy.me

- Doximity

- Eagle Telemedicine

- Health Catalyst

- Henry Schein

- Koninklijke Philips

- LifeStance Health

- McKesson Medical-Surgical

- Medtronic

- Omnia TeleHealth

- Sesame

- Siemens

- Teladoc Health

- Tellihealth

- Veradigm (Allscripts)

The Global Telehealth Market was valued at USD 126.1 billion in 2024 and is estimated to grow at a CAGR of 12.4% to reach USD 403.2 billion by 2034.

The rapid expansion is attributed to the growing preference for remote healthcare, particularly in urban and developed regions where patients increasingly rely on virtual care for convenience and accessibility. The adoption of digital health solutions is further enhanced by innovations in mobile health applications and wearable technologies, which allow continuous monitoring and stronger patient engagement. Telehealth involves the provision of healthcare services through advanced telecommunication platforms, enabling consultations, monitoring, diagnosis, and patient support remotely. The market encompasses hardware, software, and integrated solutions, creating a complete ecosystem that supports both patients and healthcare providers. Key trends shaping growth include the use of artificial intelligence and machine learning, which improve diagnostic precision and enhance personalized virtual care. By analyzing patient data such as glucose levels or respiratory activity, machine learning algorithms serve as vital decision-support systems for physicians. Together, these factors are transforming the way healthcare is delivered and accessed on a global scale.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $126.1 Billion |

| Forecast Value | $403.2 Billion |

| CAGR | 12.4% |

The services segment generated USD 47.9 billion in 2024. This category includes remote patient monitoring, video or audio consultations, real-time interactions, store-and-forward services, and other virtual care formats. Increasing demand for accessible, cost-efficient, and scalable remote healthcare options is fueling segment growth, particularly as providers expand services into underserved regions. The convenience of telehealth services and their integration into daily healthcare routines ensure this segment remains the backbone of market revenues.

The web and cloud-based platforms held a 70% share in 2024. Their appeal lies in flexibility, lower infrastructure needs, and ease of scaling. These platforms enable healthcare professionals to deliver telehealth services efficiently while integrating with electronic health records for improved coordination and outcomes. Cloud-based systems also allow seamless updates and advanced features without interrupting existing services, positioning them as the preferred model over traditional on-premises solutions.

North America Telehealth Market held a 48% share in 2024, cementing its position as a global leader in telehealth. Factors such as robust healthcare infrastructure, widespread internet penetration, and a high level of digital health adoption have strengthened its market presence. Supportive government measures, rising investments in healthcare technology, and the presence of leading telehealth providers further fuel growth in the region. Additionally, the increasing prevalence of chronic conditions and the rising demand for continuous remote monitoring reinforce North America's dominance in the global telehealth landscape.

Key players active in the Global Telehealth Industry include Teladoc Health, Cisco Systems, Doximity, Athenahealth, Medtronic, Amwell, Siemens, McKesson Medical-Surgical, Omnia TeleHealth, AMD, Access TeleCare, Sesame, LifeStance Health, Health Catalyst, Tellihealth, Doxy.me, Henry Schein, Apollo TeleHealth, Capsa Healthcare, Koninklijke Philips, Veradigm (Allscripts), and Eagle Telemedicine. Companies competing in the telehealth market are focusing on strategies that enhance scalability, accessibility, and integration with existing healthcare systems. Many providers are investing heavily in artificial intelligence and predictive analytics to improve clinical accuracy, personalize care, and streamline workflow management. Advancing interoperability with electronic health records and focusing on cybersecurity enhancements to safeguard sensitive medical data.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Component trends

- 2.2.3 Delivery mode trends

- 2.2.4 Specialty trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic disease and geriatric population drives demand for remote healthcare

- 3.2.1.2 Growing advancement in digital health technology

- 3.2.1.3 Rising adoption of wearable and connected devices

- 3.2.1.4 Government initiatives and reimbursement policies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data privacy and security concerns

- 3.2.2.2 Limited internet connectivity in developing areas

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding digital health access in emerging markets

- 3.2.3.2 Penetration of hybrid healthcare models

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Investment and funding landscape

- 3.6 Telehealth projects/ initiatives

- 3.7 Reimbursement scenario

- 3.8 Technological landscape

- 3.8.1 Emerging technology

- 3.8.2 Current technology

- 3.9 Future market trends

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

- 5.4.1 Remote patient monitoring

- 5.4.2 Real-time interactions

- 5.4.3 Store and forward

- 5.4.4 Video/ audio consultations

- 5.4.5 Other service types

Chapter 6 Market Estimates and Forecast, By Delivery Mode, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Web/ cloud-based

- 6.3 On premises

Chapter 7 Market Estimates and Forecast, By Specialty, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Dermatology

- 7.3 Mental health

- 7.4 Cardiology

- 7.5 Neurology

- 7.6 Orthopedics

- 7.7 Gynecology

- 7.8 Other specialties

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Healthcare providers

- 8.2.1 Hospitals and clinics

- 8.2.2 Long-term care centers

- 8.2.3 Other healthcare providers

- 8.3 Payers

- 8.4 Patients

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Access TeleCare

- 10.2 AMD

- 10.3 American Well

- 10.4 Apollo TeleHealth

- 10.5 Athenahealth

- 10.6 Capsa Healthcare

- 10.7 Cisco Systems

- 10.8 Doxy.me

- 10.9 Doximity

- 10.10 Eagle Telemedicine

- 10.11 Health Catalyst

- 10.12 Henry Schein

- 10.13 Koninklijke Philips

- 10.14 LifeStance Health

- 10.15 McKesson Medical-Surgical

- 10.16 Medtronic

- 10.17 Omnia TeleHealth

- 10.18 Sesame

- 10.19 Siemens

- 10.20 Teladoc Health

- 10.21 Tellihealth

- 10.22 Veradigm (Allscripts)