|

市场调查报告书

商品编码

1833655

静脉血栓栓塞症治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Venous Thromboembolism Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

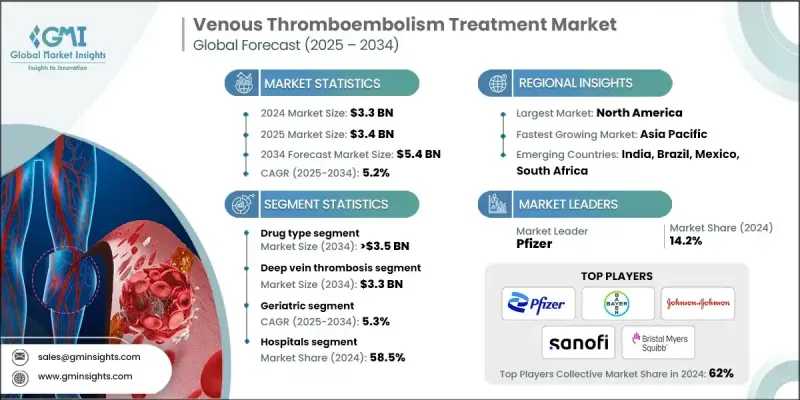

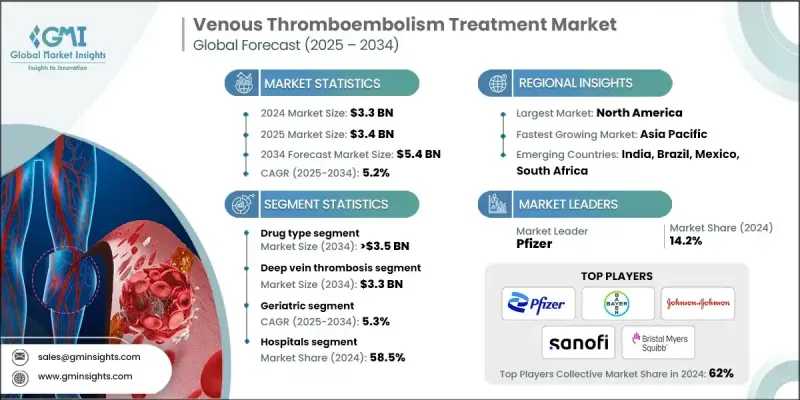

2024 年全球静脉血栓栓塞症治疗市场价值为 33 亿美元,预计到 2034 年将以 5.2% 的复合年增长率增长至 54 亿美元。

这一上升趋势的驱动力源自于全球静脉血栓栓塞症(VTE)发生率的不断上升,增加了对抗凝血药物、溶栓疗法和血管介入器材的需求。 VTE治疗包括一组专门设计用于溶解、预防或控制静脉系统内血栓的药物和器械。这些疗法根据患者自身的多种因素进行量身定制,包括年龄、免疫反应、整体健康状况和病情严重程度。公众和专业人士对未经治疗的VTE危险性认识的提高、临床环境中预防性护理方案的扩展以及远距医疗在远距抗凝血监测中的广泛应用,进一步推动了市场的成长。此外,医药电商平台的广泛普及提高了口服治疗和压力产品的可近性,促进了更早、更有效的介入。持续关注教育、诊断和数位化护理整合,正在支持更积极主动的疾病管理,从而改善患者预后,并提高医院和家庭环境中治疗方案的采用率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 33亿美元 |

| 预测值 | 54亿美元 |

| 复合年增长率 | 5.2% |

现代治疗方案正在改变医疗保健系统管理静脉血栓栓塞症(VTE)的方式,为患者提供更高的安全性、准确性和便利性。药物配方和血栓清除工具的技术进步有助于提高治疗精准度并减少併发症。长效口服抗凝血药物、AI引导血栓取出系统以及微创血管装置的研发,显着提高了患者对治疗计划的依从性,并最大限度地减少了不良反应。这些创新不仅提高了护理标准,也使医生能够提供高效的治疗,并获得更好的长期疗效。

2024年,药物类药物占了65.5%的市场份额,这得益于抗凝血剂和溶栓药物在临床和门诊的广泛使用。此类药物主要分为两大类:抗凝血剂和溶栓剂。抗凝血剂又细分为直接口服抗凝血剂、肝素产品和维生素K拮抗剂。这种优点源自于现代抗凝血剂具有可预测的疗效、更长的药效持续时间以及更少的监测需求。这些特性使其成为静脉血栓栓塞(VTE)初始治疗和持续治疗的理想选择,特别适用于各种患者环境。

深部静脉血栓形成 (DVT) 领域在 2024 年的市场规模为 20 亿美元,预计到 2034 年将达到 33 亿美元,成为整个静脉血栓栓塞 (VTE) 治疗市场的最大贡献者。 DVT 的特征是深部静脉栓塞,主要发生在下肢,如果未能及时发现和治疗,将构成严重的健康风险。 DVT 的盛行率受多种风险因素影响,例如久坐的生活方式、吸烟、高体重和慢性疾病。这种日益加重的负担促使医疗专业人员强调早期发现、指导抗凝血治疗,并在必要时进行机械干预,以提高康復率并减少危及生命的併发症。

北美静脉血栓栓塞症治疗市场占40.1%的市占率。该地区的主导地位源于其完善的医疗保健体系,包括先进的诊断资源、技术娴熟的医护人员以及高度的患者意识。以预防和早期症状识别为重点的公共卫生运动促进了静脉血栓栓塞症的及时治疗,同时,研发投入持续为市场带来新产品和新技术。总部位于北美的製药和医疗技术公司正在持续开发具有卓越疗效和安全性的创新解决方案,这支撑了该地区强劲的市场表现。

积极影响静脉血栓栓塞症治疗市场的知名公司包括强生、飞利浦医疗、勃林格殷格翰、第一三共、赛诺菲、诺华、AngioDynamics、拜耳、Argon Medical Products、波士顿科学、大成海洋、辉瑞、康德乐、库克医疗、葛兰素史克、百时美贵施贵敦和医疗医疗(美力宝敦)。静脉血栓栓塞症治疗市场的领导者正专注于创新、策略合作和地理扩张的结合,以巩固其市场地位。许多公司正在大力投资研发,以推出可提供更安全、更有效治疗选择的下一代疗法和设备。与学术和临床机构的策略合作有助于加速临床试验和技术开发。各公司也透过进入新兴市场和加强分销网络来扩大其全球影响力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 静脉血栓栓塞症盛行率不断上升

- 人口老化和流动性不足

- 抗凝血治疗的进展

- 人们对血栓后症候群的认识不断提高

- 产业陷阱与挑战

- 出血併发症的风险

- 发展中地区的认知有限

- 市场机会

- 双重作用疗法的开发

- 远距医疗平台的扩展

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 我们

- 加拿大

- 欧洲

- 亚太地区

- 北美洲

- 未来市场趋势

- 技术格局

- 现有技术

- 新兴技术

- 专利格局

- 管道分析

- 定价分析

- 疾病的流行病学

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按治疗类型,2021 - 2034

- 主要趋势

- 装置

- 压缩系统

- 血栓切除系统

- 下腔静脉过滤器

- 长袜

- 其他设备

- 药物类型

- 抗凝血剂

- 直接口服抗凝血药

- 肝素

- 维生素K拮抗剂

- 血栓溶解剂

- 抗凝血剂

第六章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 深层静脉栓塞

- 肺栓塞

第七章:市场估计与预测:按年龄组,2021 - 2034 年

- 主要趋势

- 成年人

- 老年

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 导管室

- 门诊手术中心(ASC)

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AngioDynamics

- Argon Medical Products

- Bayer

- Boehringer Ingelheim

- Boston Scientific

- Bristol Myers Squibb

- Cardinal Health

- Cook Medical

- Covidien (Medtronic)

- Daesung Maref

- Daiichi Sankyo

- GlaxoSmithKline

- Johnson & Johnson

- Novartis

- Pfizer

- Philips Healthcare

- Sanofi

目录

第 11 章:方法与范围

第 12 章:执行摘要

第 13 章:产业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 静脉血栓栓塞症盛行率不断上升

- 人口老化和流动性不足

- 抗凝血治疗的进展

- 人们对血栓后症候群的认识不断提高

- 产业陷阱与挑战

- 出血併发症的风险

- 发展中地区的认知有限

- 市场机会

- 双重作用疗法的开发

- 远距医疗平台的扩展

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 我们

- 加拿大

- 欧洲

- 亚太地区

- 北美洲

- 未来市场趋势

- 技术格局

- 现有技术

- 新兴技术

- 专利格局

- 管道分析

- 定价分析

- 疾病的流行病学

- 波特的分析

- PESTEL分析

第 14 章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第 15 章:市场估计与预测:按治疗类型,2021 - 2034 年

- 主要趋势

- 装置

- 压缩系统

- 血栓切除系统

- 下腔静脉过滤器

- 长袜

- 其他设备

- 药物类型

- 抗凝血剂

- 直接口服抗凝血药

- 肝素

- 维生素K拮抗剂

- 血栓溶解剂

- 抗凝血剂

第 16 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 深层静脉栓塞

- 肺栓塞

第 17 章:市场估计与预测:按年龄组,2021 年至 2034 年

- 主要趋势

- 成年人

- 老年

第 18 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 导管室

- 门诊手术中心(ASC)

- 其他最终用途

第 19 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 20 章:公司简介

- AngioDynamics

- Argon Medical Products

- Bayer

- Boehringer Ingelheim

- Boston Scientific

- Bristol Myers Squibb

- Cardinal Health

- Cook Medical

- Covidien (Medtronic)

- Daesung Maref

- Daiichi Sankyo

- GlaxoSmithKline

- Johnson & Johnson

- Novartis

- Pfizer

- Philips Healthcare

- Sanofi

The Global Venous Thromboembolism Treatment Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 5.4 billion by 2034.

The upward trend is driven by the growing incidence of VTE conditions globally, which has heightened demand for anticoagulant medications, thrombolytic therapies, and vascular intervention devices. VTE treatment includes a targeted group of drugs and devices that are specifically designed to dissolve, prevent, or manage blood clots within the venous system. These therapies are customized based on multiple patient-specific factors, including age, immune response, overall health, and the severity of the condition. The market growth is further fueled by increased public and professional awareness about the dangers of untreated VTE, the expansion of preventive care protocols in clinical settings, and the broader use of telemedicine for remote anticoagulant monitoring. Additionally, the widespread availability of pharmaceutical e-commerce platforms has improved access to both oral treatments and compression products, promoting earlier and more effective intervention. The continued focus on education, diagnostics, and digital care integration is supporting more proactive management of the condition, leading to improved patient outcomes and increased adoption of therapeutic solutions across both hospital and home settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $5.4 Billion |

| CAGR | 5.2% |

Modern treatment options are transforming how healthcare systems manage VTE, offering greater safety, accuracy, and convenience for patients. Technological progress in drug formulation and clot-removal tools is helping enhance therapeutic precision and limit complications. The development of longer-acting oral anticoagulants, AI-guided clot retrieval systems, and less invasive vascular devices is significantly improving patient adherence to treatment plans and minimizing adverse reactions. These innovations are not only improving the standard of care but also enabling physicians to deliver efficient treatment with better long-term outcomes.

In 2024, the drug-based segment held a 65.5% share, driven by the wide-scale use of anticoagulants and thrombolytic drugs across both clinical and outpatient environments. This segment is divided into two main categories: anticoagulants and thrombolytics. The anticoagulant category is further segmented into direct oral anticoagulants, heparin products, and vitamin K antagonists. This dominance is the result of modern anticoagulants offering predictable therapeutic effects, longer activity durations, and requiring less intensive monitoring. These features make them ideal for both initial and ongoing management of VTE, especially in varied patient settings.

The deep vein thrombosis (DVT) segment generated USD 2 billion in 2024 and will reach USD 3.3 billion by 2034, making it the largest contributor to the overall VTE treatment market. DVT is characterized by clot formation in deep veins, primarily in the lower limbs, and poses serious health risks if not identified and treated promptly. The prevalence of DVT is influenced by multiple risk factors such as sedentary lifestyles, smoking, high body weight, and chronic illnesses. This increasing burden has prompted medical professionals to emphasize early detection, guided use of anticoagulant therapy, and, where necessary, mechanical interventions to improve recovery rates and reduce life-threatening complications.

North America Venous Thromboembolism Treatment Market held a 40.1% share. The dominance of this region stems from its well-established healthcare framework, including advanced diagnostic resources, skilled healthcare personnel, and high patient awareness levels. Public health campaigns focused on prevention and early symptom recognition have contributed to the timely treatment of VTE, while research investments continue to bring new products and technologies to the market. Pharmaceutical and medical technology companies based in North America are consistently developing innovative solutions that offer superior efficacy and safety, which support the region's strong market performance.

Prominent companies actively shaping the venous thromboembolism treatment market include Johnson & Johnson, Philips Healthcare, Boehringer Ingelheim, Daiichi Sankyo, Sanofi, Novartis, AngioDynamics, Bayer, Argon Medical Products, Boston Scientific, Daesung Maref, Pfizer, Cardinal Health, Cook Medical, GlaxoSmithKline, Bristol Myers Squibb, and Covidien (Medtronic). Leading players in the venous thromboembolism treatment market are focusing on a blend of innovation, strategic partnerships, and geographic expansion to solidify their market standing. Many are investing heavily in R&D to launch next-generation therapies and devices that provide safer, more effective treatment options. Strategic collaborations with academic and clinical institutions are helping accelerate clinical trials and technology development. Companies are also expanding their global footprint by entering emerging markets and strengthening distribution networks to improve access.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Treatment type trends

- 2.2.3 Application trends

- 2.2.4 Age group trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence venous thromboembolism

- 3.2.1.2 Aging population and immobility

- 3.2.1.3 Advancements in anticoagulant therapy

- 3.2.1.4 Growing awareness of post-thrombotic syndrome

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of bleeding complications

- 3.2.2.2 Limited awareness in developing regions

- 3.2.3 Market opportunities

- 3.2.3.1 Development of dual-action therapies

- 3.2.3.2 Expansion of telehealth platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Future market trends

- 3.6 Technological landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Patent landscape

- 3.8 Pipeline analysis

- 3.9 Pricing analysis

- 3.10 Epidemiology of the disease

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Devices

- 5.2.1 Compression system

- 5.2.2 Thrombectomy systems

- 5.2.3 IVC filters

- 5.2.4 Stockings

- 5.2.5 Other devices

- 5.3 Drug type

- 5.3.1 Anticoagulants

- 5.3.1.1 Direct oral anticoagulants

- 5.3.1.2 Heparin

- 5.3.1.3 Vitamin K antagonists

- 5.3.2 Thrombolytics

- 5.3.1 Anticoagulants

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Deep vein thrombosis

- 6.3 Pulmonary embolism

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adults

- 7.3 Geriatric

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Catheterization laboratories

- 8.4 Ambulatory surgical centers (ASCs)

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AngioDynamics

- 10.2 Argon Medical Products

- 10.3 Bayer

- 10.4 Boehringer Ingelheim

- 10.5 Boston Scientific

- 10.6 Bristol Myers Squibb

- 10.7 Cardinal Health

- 10.8 Cook Medical

- 10.9 Covidien (Medtronic)

- 10.10 Daesung Maref

- 10.11 Daiichi Sankyo

- 10.12 GlaxoSmithKline

- 10.13 Johnson & Johnson

- 10.14 Novartis

- 10.15 Pfizer

- 10.16 Philips Healthcare

- 10.17 Sanofi

Table of Contents

Chapter 11 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 12 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Treatment type trends

- 2.2.3 Application trends

- 2.2.4 Age group trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 13 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence venous thromboembolism

- 3.2.1.2 Aging population and immobility

- 3.2.1.3 Advancements in anticoagulant therapy

- 3.2.1.4 Growing awareness of post-thrombotic syndrome

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of bleeding complications

- 3.2.2.2 Limited awareness in developing regions

- 3.2.3 Market opportunities

- 3.2.3.1 Development of dual-action therapies

- 3.2.3.2 Expansion of telehealth platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Future market trends

- 3.6 Technological landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Patent landscape

- 3.8 Pipeline analysis

- 3.9 Pricing analysis

- 3.10 Epidemiology of the disease

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 14 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 15 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Devices

- 5.2.1 Compression system

- 5.2.2 Thrombectomy systems

- 5.2.3 IVC filters

- 5.2.4 Stockings

- 5.2.5 Other devices

- 5.3 Drug type

- 5.3.1 Anticoagulants

- 5.3.1.1 Direct oral anticoagulants

- 5.3.1.2 Heparin

- 5.3.1.3 Vitamin K antagonists

- 5.3.2 Thrombolytics

- 5.3.1 Anticoagulants

Chapter 16 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Deep vein thrombosis

- 6.3 Pulmonary embolism

Chapter 17 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adults

- 7.3 Geriatric

Chapter 18 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Catheterization laboratories

- 8.4 Ambulatory surgical centers (ASCs)

- 8.5 Other end use

Chapter 19 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 20 Company Profiles

- 10.1 AngioDynamics

- 10.2 Argon Medical Products

- 10.3 Bayer

- 10.4 Boehringer Ingelheim

- 10.5 Boston Scientific

- 10.6 Bristol Myers Squibb

- 10.7 Cardinal Health

- 10.8 Cook Medical

- 10.9 Covidien (Medtronic)

- 10.10 Daesung Maref

- 10.11 Daiichi Sankyo

- 10.12 GlaxoSmithKline

- 10.13 Johnson & Johnson

- 10.14 Novartis

- 10.15 Pfizer

- 10.16 Philips Healthcare

- 10.17 Sanofi