|

市场调查报告书

商品编码

1844342

慢性静脉闭塞治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Chronic Venous Occlusions Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

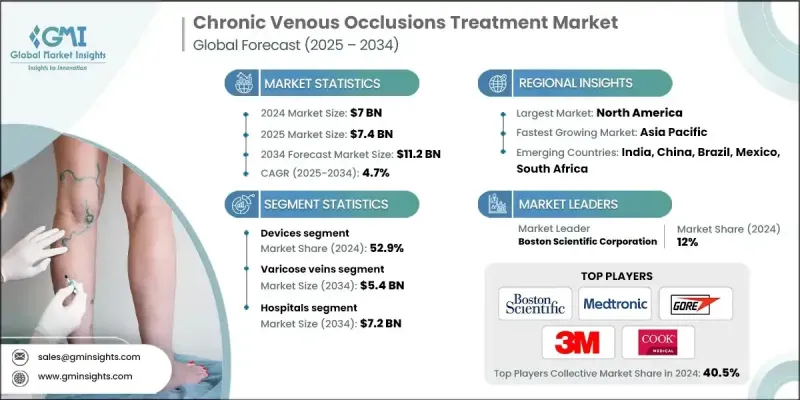

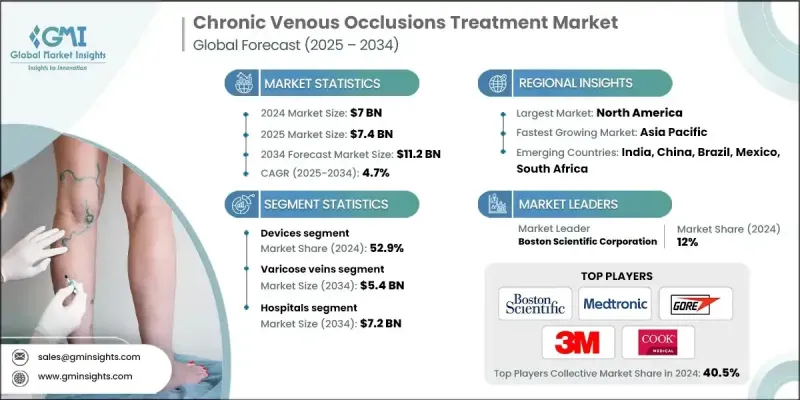

2024 年全球慢性静脉闭塞治疗市场价值为 70 亿美元,预计到 2034 年将以 4.7% 的复合年增长率增长至 112 亿美元。

静脉疾病发病率的上升、老龄人口的增长以及治疗方法的持续技术进步推动了这一行业的稳步增长。随着医疗保健系统日益注重改善患者预后,微创疗法和个人化治疗策略的应用已获得显着发展。随着患者和临床医生意识的增强,早期诊断和主动治疗计划正变得越来越普遍。医疗保健宣传活动、病患教育计画以及报销支持范围的扩大正在推动产业发展。数位医疗技术与传统护理模式的融合也正在改变治疗后管理。价值链上的企业,包括设备製造商、药品开发商和医疗保健提供者,正在建立策略合作伙伴关係,以推出创新解决方案并提高医疗服务的可及性。此外,成熟经济体不断增长的医疗支出和政策支持为整个行业的未来成长奠定了坚实的基础。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 70亿美元 |

| 预测值 | 112亿美元 |

| 复合年增长率 | 4.7% |

慢性静脉阻塞的治疗着重于透过一系列方法(例如压迫疗法、药物治疗、静脉腔内手术和数位监测工具)来管理长期静脉阻塞。这些治疗方法旨在恢復静脉血流,预防併发症,减轻症状,并改善患者的整体生活品质。其潜在病因通常包括血管瘢痕形成、血栓形成和先天性畸形,这些因素会导致需要长期治疗的慢性症状。

2024年,医疗器材市场占了52.9%的市场份额,这归因于人们对微创治疗的日益青睐,以及先进静脉内器械和压迫系统的广泛应用。人们逐渐放弃侵入性手术,这使得恢復更快、风险更低的治疗方案越来越受欢迎。消融疗法、硬化疗法和现代压迫服等技术的日益普及反映了这一趋势。患者和医护人员越来越青睐那些能够高效治疗且对日常生活影响最小的解决方案,这推动了对尖端治疗设备的需求。

静脉曲张领域占据48.7%的市场份额,预计2034年将达到54亿美元。这种主导地位主要归因于静脉功能不全的高发生率,尤其是在老年人、久坐不动或肥胖人群中。向静脉内雷射和射频消融等微创解决方案的转变正在推动市场扩张。生活方式相关因素和公众意识的提高正在扩大寻求治疗的患者群体,尤其是在40岁及以上的人群中。

2024年,北美慢性静脉闭塞治疗市场占据40.1%的市场。该地区完善的医疗基础设施、较高的认知度以及对新疗法的早期采用,使其占据领先地位。老年人口的不断增长,更容易患上慢性功能不全和血栓等静脉併发症,这推动了持续的需求。诊断和报销制度的创新也推动了该地区先进疗法的强劲应用。

全球慢性静脉闭塞治疗市场的关键参与者包括:辉瑞、波士顿科学公司、泰尔茂、美敦力、Tactile Medical、康乐保、戈尔、拜耳、赛诺菲、Viatris、AngioDynamics、康维特、Sciton、Leucadia Pharmaceuticals (Hikma)、3M、库克医疗和康维特。慢性静脉闭塞治疗市场的领先公司正优先进行研发,以开发安全性和有效性更高的微创设备和新型药物。透过策略併购扩大产品组合,使公司能够整合互补技术并拓宽市场准入。许多公司正在利用与医院、研究机构和数位健康平台的合作伙伴关係来改善病患监测和长期疾病管理。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 静脉曲张盛行率不断上升,同时人们对其治疗的认识也不断提高

- 微创手术日益受到青睐

- 骨科手术数量增加

- 与慢性静脉功能不全治疗疗法相关的技术进步

- 产业陷阱与挑战

- 不同治疗模式的副作用和风险

- 严格的监管准则

- 市场机会

- 门诊和行动照护环境的需求不断增长

- 数位健康与人工智慧的融合

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 当前的技术趋势

- 微创支架和导管介入措施的采用率不断上升

- 整合先进的影像技术,实现精确的诊断和治疗计划

- 慢性静脉功能不全的压力疗法创新发展

- 新兴技术

- 开发生物可吸收支架以维持长期血管健康

- 人工智慧驱动的静脉闭塞治疗成像和决策支持

- 非侵入性超音波疗法

- 当前的技术趋势

- 差距分析

- 波特的分析

- PESTEL分析

- 未来市场趋势

- 向门诊手术中心护理的强劲转变

- 随着医疗保健服务水准的提高,新兴市场的渗透率不断提高

- 策略合作推动创新和全球扩张

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 伙伴关係与合作

- 推出新服务类型

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 装置

- 压缩装置

- 硬化疗法

- 静脉内消融术

- 雷射烧蚀

- 射频消融

- 静脉剥离器

- 其他设备

- 药物

- 止痛药

- 抗生素

- 抗凝血剂

- 其他药物

第六章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 静脉曲张

- 浮肿

- 深层静脉栓塞

- 静脉淤滞性溃疡

- 其他应用

第七章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- 3M

- AngioDynamics

- Bayer AG

- Boston Scientific Corporation

- Coloplast

- ConvaTec

- Cook Medical

- Gore

- Leucadia Pharmaceuticals (Hikma)

- Medtronic

- Pfizer

- Sanofi

- Sciton

- Tactile Medical

- Terumo

- Viatris

The Global Chronic Venous Occlusions Treatment Market was valued at USD 7 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 11.2 billion by 2034.

The steady growth is driven by a rising number of venous disorders, growing elderly populations, and continuous technological advancements across treatment approaches. With healthcare systems increasingly focused on improving patient outcomes, the adoption of minimally invasive therapies and personalized treatment strategies has gained significant traction. As awareness grows among both patients and clinicians, early diagnosis and proactive treatment planning are becoming more common. Healthcare campaigns, patient education programs, and expanded reimbursement support are helping propel industry development. The convergence of digital health technologies and traditional care models is also transforming post-treatment management. Companies across the value chain including device makers, pharmaceutical developers, and healthcare providers are forging strategic partnerships to introduce innovative solutions and enhance care accessibility. Additionally, increasing medical expenditure and policy support in mature economies have created a strong foundation for future growth across the sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7 Billion |

| Forecast Value | $11.2 Billion |

| CAGR | 4.7% |

Chronic venous occlusions treatment focuses on managing long-term venous blockages through a range of approaches like compression therapy, pharmaceuticals, endovenous procedures, and digital monitoring tools. These treatments work to restore venous blood flow, prevent complications, reduce symptoms, and improve overall quality of life for affected patients. The underlying causes often include vascular scarring, thrombosis, and congenital abnormalities, which contribute to chronic symptoms requiring long-term management.

The devices segment held 52.9% share in 2024, attributed to the rising preference for less invasive treatments and broader use of advanced endovenous tools and compression systems. The shift away from invasive surgical options has led to the popularity of procedures with faster recovery and fewer risks. The growing use of techniques such as ablation therapy, sclerotherapy, and modern compression wear reflects this trend. Both patients and healthcare professionals increasingly favor solutions offering efficient outcomes with minimal disruption to daily life, driving demand for cutting-edge treatment devices.

The varicose veins segment held 48.7% share and is expected to reach USD 5.4 billion by 2034. This dominance is largely due to the high incidence of venous insufficiency, especially among older adults and those with sedentary lifestyles or obesity. The shift toward minimally invasive solutions like endovenous laser and radiofrequency ablation is reinforcing market expansion. Lifestyle-related factors and increasing public awareness are expanding the treatment-seeking patient base, particularly among individuals aged 40 and above.

North America Chronic Venous Occlusions Treatment Market held 40.1% share in 2024. The region's well-established healthcare infrastructure, high awareness levels, and early adoption of novel therapies contribute to its leadership position. A growing elderly population, more vulnerable to venous complications such as chronic insufficiency and thrombosis, is fueling continuous demand. Innovations in diagnostics and reimbursement systems have also supported strong uptake of advanced treatments throughout the region.

Key Players involved in the Global Chronic Venous Occlusions Treatment Market: Pfizer, Boston Scientific Corporation, Terumo, Medtronic, Tactile Medical, Coloplast, Gore, Bayer AG, Sanofi, Viatris, AngioDynamics, ConvaTec, Sciton, Leucadia Pharmaceuticals (Hikma), 3M, Cook Medical, and ConvaTec. Leading companies in the chronic venous occlusions treatment market are prioritizing R&D to develop minimally invasive devices and novel pharmaceuticals with enhanced safety and efficacy. Expanding product portfolios through strategic mergers and acquisitions allows firms to integrate complementary technologies and broaden market access. Many are leveraging partnerships with hospitals, research institutions, and digital health platforms to improve patient monitoring and long-term disease management.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of varicose veins coupled with rising awareness regarding its treatment

- 3.2.1.2 Growing preference for minimally invasive procedures

- 3.2.1.3 Rise in number of orthopedic procedures

- 3.2.1.4 Technological advancements pertaining to chronic venous insufficiency treatment therapies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects and risks associated with different treatment modes

- 3.2.2.2 Strict regulatory guidelines

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for outpatient and ambulatory care settings

- 3.2.3.2 Integration of digital health and AI

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Rising adoption of minimally invasive stent and catheter-based interventions

- 3.5.1.2 Integration of advanced imaging for precise diagnosis and treatment planning

- 3.5.1.3 Growth in compression therapy innovations for chronic venous insufficiency

- 3.5.2 Emerging technologies

- 3.5.2.1 Development of bioresorbable stents for long-term vascular health

- 3.5.2.2 AI-driven imaging and decision support for venous occlusion treatment

- 3.5.2.3 Non-invasive ultrasound-based therapies

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.9.1 Strong shift toward ambulatory surgical center-based care

- 3.9.2 Growing penetration in emerging markets with improved healthcare access

- 3.9.3 Strategic collaborations driving innovation and global expansion

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Devices

- 5.2.1 Compression devices

- 5.2.2 Sclerotherapy

- 5.2.3 Endovenous ablation

- 5.2.3.1 Laser ablation

- 5.2.3.2 Radiofrequency ablation

- 5.2.4 Vein stripper

- 5.2.5 Other devices

- 5.3 Drugs

- 5.3.1 Analgesics

- 5.3.2 Antibiotics

- 5.3.3 Anticoagulants

- 5.3.4 Other drugs

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Varicose veins

- 6.3 Edema

- 6.4 Deep vein thrombosis

- 6.5 Venous stasis ulcers

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M

- 9.2 AngioDynamics

- 9.3 Bayer AG

- 9.4 Boston Scientific Corporation

- 9.5 Coloplast

- 9.6 ConvaTec

- 9.7 Cook Medical

- 9.8 Gore

- 9.9 Leucadia Pharmaceuticals (Hikma)

- 9.10 Medtronic

- 9.11 Pfizer

- 9.12 Sanofi

- 9.13 Sciton

- 9.14 Tactile Medical

- 9.15 Terumo

- 9.16 Viatris