|

市场调查报告书

商品编码

1833661

睡眠科技设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Sleep Tech Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

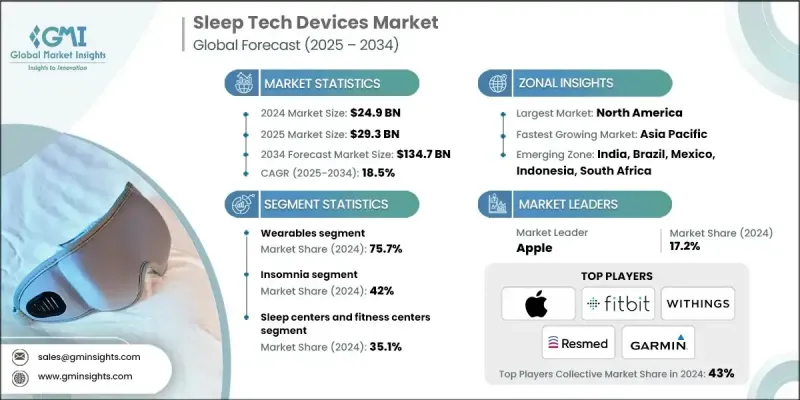

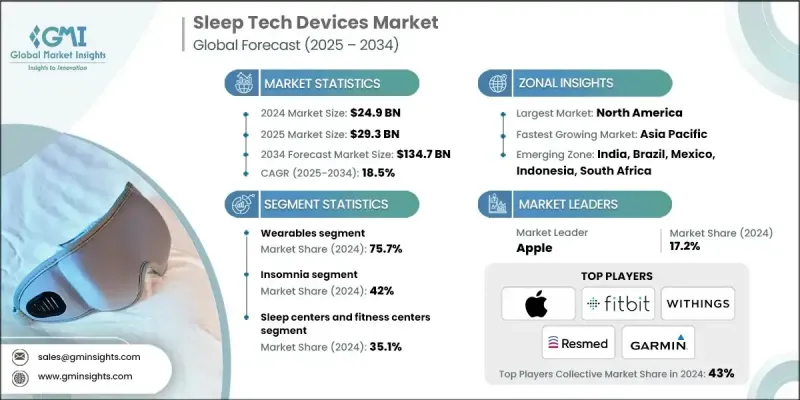

根据 Global Market Insights Inc. 发布的最新报告,全球睡眠技术设备市场规模预计在 2024 年为 249 亿美元,预计将从 2025 年的 293 亿美元增长到 2034 年的 1,347 亿美元,复合年增长率为 18.5%。

根据多项健康研究,目前相当一部分成年人有睡眠品质不佳或睡眠时间不足的问题,但往往没有正式诊断。这种诊断不足的情况进一步推动了消费者对非侵入式设备的需求,这些设备可以帮助人们自我监控并及早采取行动。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 249亿美元 |

| 预测值 | 1347亿美元 |

| 复合年增长率 | 18.5% |

穿戴式装置的普及率不断提高

2024年,穿戴式装置市场占据了显着份额。消费者越来越多地选择智慧手錶、健身手环和其他配备感测器的可穿戴设备,以监测睡眠模式、心率变异性和夜间血氧饱和度。这种需求很大程度源自于人们对持续、非侵入式健康追踪的需求,而这种追踪方式可以无缝融入日常生活。随着感测器精度和人工智慧分析技术的提升,穿戴式装置正从基本的睡眠追踪器发展成为全方位的健康伴侣。

失眠症盛行率不断上升

到2034年,失眠领域将保持良好的复合年增长率,因为数百万人正饱受慢性睡眠入睡和维持问题的困扰。针对此市场量身订製的睡眠科技设备,例如智慧枕头、基于认知行为疗法 (CBT) 的应用程式以及噪音掩蔽设备,正受到消费者和临床医生的青睐。这些设备的重点是提供非药物的个人化解决方案,以提升睡眠质量,且无不良副作用。主要参与者正在投资实证医学和数位疗法,以解决失眠的根本原因,同时提供实际的见解,促进更好的睡眠卫生和长期行为改变。

睡眠中心和健身中心将获得关注

2024年,睡眠中心和健身中心占据了相当大的份额。睡眠实验室越来越多地采用先进的监测系统、人工智慧诊断和连网设备,以简化睡眠研究并改善临床结果。同时,健身中心正在将睡眠追踪服务整合到更广泛的健康计划中,并认识到睡眠品质、身体表现和恢復之间的直接联繫。这些合作关係正在为製造商开闢新的B2B收入来源,并创建一个混合生态系统,让睡眠技术的医疗和生活方式应用能够共存并蓬勃发展。

北美将成为推动力地区

预计到2034年,北美睡眠科技设备市场将创造可观的收入,这得益于消费者认知度的提升、先进的医疗基础设施以及对个人化健康解决方案的强劲需求。尤其值得一提的是,美国占据了该地区收入的最大份额,睡眠障碍和慢性疾病的发生率不断上升,对消费级和临床级设备的需求持续增长。在优惠的医疗器材报销政策、穿戴式科技创新以及数位健康平台扩张的推动下,北美市场预计将继续稳定成长。

睡眠科技设备市场的主要参与者有 Smart Nora、Fitbit、BedJet、Withings、ResMed、Emfit、Oura Health、SleepScore Labs、Somnofy、Balluga、ChiliSleep、Apple、ReST、Itamar Medical、华为、Somnox、Pulsetto、飞利浦、Garmin、Eightin、小米 Medicalmin、Fisher Healthcare。

为了巩固在睡眠科技设备市场的领先地位,领先公司正在采取策略合作、产品创新和定向收购等多种策略。许多公司专注于整合人工智慧和机器学习,以提供更深入的洞察和预测分析,从而提升用户参与度和临床相关性。其他公司则透过与健康应用程式和智慧家庭平台的互通性来扩展其生态系统。品牌差异化也透过直接面向消费者的模式、网红行销和订阅式服务模式来实现。此外,与医疗保健提供者和睡眠诊所的合作有助于公司验证其产品,同时开拓新的患者群体和报销管道。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 睡眠科技设备的技术进步

- 提高对睡眠技术设备可用性的认识

- 老年人口不断增加

- 对便携式、高效、优质的睡眠技术设备的需求激增

- 主要市场参与者的产品创新和不同策略的采用

- 产业陷阱与挑战

- 睡眠技术设备成本高昂

- 严格的监管框架

- 市场机会

- 与远距医疗和远距病人监控的整合

- 拓展心理健康与保健领域

- 成长动力

- 成长潜力分析

- 监管格局

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 供应链分析

- 消费者行为趋势

- 市场进入策略分析

- 波特的分析

- 品牌分析

- 顶尖公司的商业模式

- 苹果

- 瑞思迈

- PESTEL分析

- 未来市场趋势

- 差距分析

- 2024年定价分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 穿戴式装置

- 智慧手錶和手环

- 其他穿戴式装置

- 非穿戴式装置

- 睡眠监测器

- 智慧床

第六章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 阻塞性睡眠呼吸中止症

- 失眠

- 嗜睡症

- 其他应用

第七章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 睡眠中心及健身中心

- 大型超市和超市

- 电子商务

- 药局和零售店

- 其他分销管道

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Apple

- Balluga

- BedJet

- ChiliSleep

- Eight Sleep

- Emfit

- Fisher & Paykel Healthcare

- Fitbit

- Garmin

- Huawei

- Itamar Medical

- Oura Health

- Philips

- Pulsetto

- ResMed

- ReST

- SleepScore Labs

- Smart Nora

- Somnofy

- Somnox

- Withings

- Xiaomi

The global sleep tech devices market was estimated at USD 24.9 billion in 2024 and is expected to grow from USD 29.3 billion in 2025 to USD 134.7 billion in 2034, at a CAGR of 18.5%, according to the latest report published by Global Market Insights Inc.

According to various health studies, a significant portion of the adult population now experiences poor sleep quality or insufficient sleep duration, often without being formally diagnosed. This underdiagnosis further drives demand for consumer-facing, non-invasive devices that allow individuals to self-monitor and take early action.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.9 Billion |

| Forecast Value | $134.7 Billion |

| CAGR | 18.5% |

Increasing Adoption of Wearables

The wearables segment held a notable share in 2024. Consumers are increasingly turning to smartwatches, fitness bands, and other sensor-equipped wearables to monitor sleep patterns, heart rate variability, and oxygen saturation throughout the night. The demand is largely driven by the desire for continuous, non-invasive health tracking that fits seamlessly into daily life. With improvements in sensor accuracy and AI-powered analytics, wearables are evolving from basic sleep trackers to holistic wellness companions.

Increasing Prevalence of Insomnia

The insomnia segment will grow at a decent CAGR through 2034, as millions of individuals struggle with chronic sleep initiation and maintenance problems. Sleep tech devices tailored for this market-such as smart pillows, cognitive behavioral therapy (CBT)-based apps, and noise-masking devices-are gaining traction among both consumers and clinicians. The focus is on providing drug-free, personalized solutions that enhance sleep quality without adverse side effects. Key players are investing in evidence-based features and digital therapeutics to address the root causes of insomnia while delivering actionable insights that promote better sleep hygiene and long-term behavioral changes.

Sleep Centers and Fitness Centers to Gain Traction

The sleep centers and fitness centers held a sizeable share in 2024. Sleep labs are increasingly adopting advanced monitoring systems, AI-powered diagnostics, and connected devices to streamline sleep studies and improve clinical outcomes. At the same time, fitness centers are integrating sleep tracking services as part of broader wellness programs, recognizing the direct link between sleep quality, physical performance, and recovery. These partnerships are opening new B2B revenue streams for manufacturers and creating a hybrid ecosystem where medical and lifestyle applications of sleep technology can coexist and thrive.

North America to Emerge as a Propelling Region

North America sleep tech devices market is expected to generate significant revenues by 2034, fueled by high consumer awareness, advanced healthcare infrastructure, and strong demand for personalized wellness solutions. The United States, in particular, accounts for the lion's share of the region's revenue, with rising rates of sleep disorders and chronic health conditions creating ongoing demand for both consumer-grade and clinical-grade devices. The market in North America is expected to continue growing steadily, supported by favorable reimbursement policies for medical devices, innovation in wearable technologies, and the expansion of digital health platforms.

Major players in the sleep tech devices market are Smart Nora, Fitbit, BedJet, Withings, ResMed, Emfit, Oura Health, SleepScore Labs, Somnofy, Balluga, ChiliSleep, Apple, ReST, Itamar Medical, Huawei, Somnox, Pulsetto, Philips, Garmin, Eight Sleep, Xiaomi, Fisher & Paykel Healthcare.

To strengthen their foothold in the sleep tech devices market, leading companies are employing a mix of strategic partnerships, product innovation, and targeted acquisitions. Many are focusing on integrating AI and machine learning to deliver deeper insights and predictive analytics, enhancing user engagement and clinical relevance. Others are expanding their ecosystems through interoperability with health apps and smart home platforms. Brand differentiation is also being achieved through direct-to-consumer models, influencer marketing, and subscription-based service models. Additionally, collaborations with healthcare providers and sleep clinics help companies validate their offerings while tapping into new patient segments and reimbursement channels.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements in sleep tech devices

- 3.2.1.2 Increasing awareness regarding availability of sleep tech devices

- 3.2.1.3 Rising geriatric population

- 3.2.1.4 Surging demand for portable, efficient and superior sleep tech devices

- 3.2.1.5 Product innovation and adoption of different strategies by key market participants

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of sleep tech devices

- 3.2.2.2 Stringent regulatory framework

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with telehealth and remote patient monitoring

- 3.2.3.2 Expansion into mental health and wellness segments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Consumer behaviour trend

- 3.8 Go-to-market strategy analysis

- 3.9 Porter's analysis

- 3.10 Brand analysis

- 3.11 Business model of top companies

- 3.11.1 Apple

- 3.11.2 ResMed

- 3.12 PESTEL analysis

- 3.13 Future market trends

- 3.14 Gap analysis

- 3.15 Pricing analysis, 2024

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 Middle East and Africa

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wearables

- 5.2.1 Smart watches and bands

- 5.2.2 Other wearables

- 5.3 Non-wearables

- 5.3.1 Sleep monitors

- 5.3.2 Smart beds

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Obstructive sleep apnea

- 6.3 Insomnia

- 6.4 Narcolepsy

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Sleep centers and fitness centers

- 7.3 Hypermarkets and supermarkets

- 7.4 E-commerce

- 7.5 Pharmacy and retail stores

- 7.6 Other distribution channels

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Apple

- 9.2 Balluga

- 9.3 BedJet

- 9.4 ChiliSleep

- 9.5 Eight Sleep

- 9.6 Emfit

- 9.7 Fisher & Paykel Healthcare

- 9.8 Fitbit

- 9.9 Garmin

- 9.10 Huawei

- 9.11 Itamar Medical

- 9.12 Oura Health

- 9.13 Philips

- 9.14 Pulsetto

- 9.15 ResMed

- 9.16 ReST

- 9.17 SleepScore Labs

- 9.18 Smart Nora

- 9.19 Somnofy

- 9.20 Somnox

- 9.21 Withings

- 9.22 Xiaomi