|

市场调查报告书

商品编码

1833667

联合疫苗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Combination Vaccines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

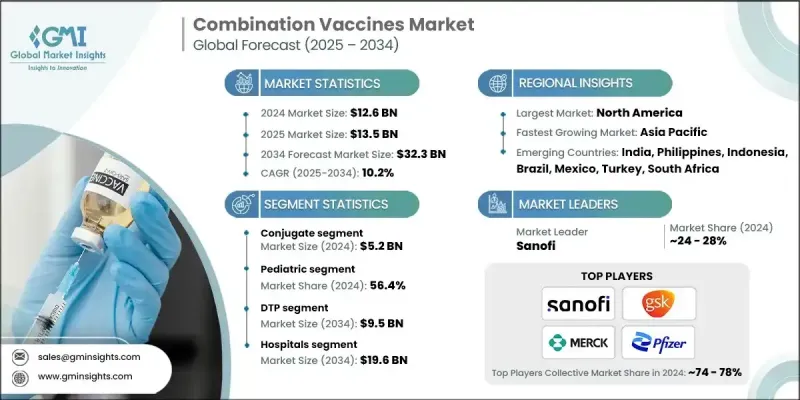

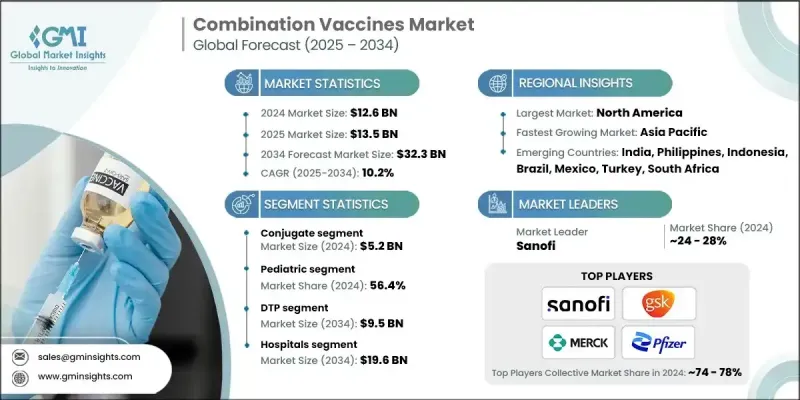

2024 年全球联合疫苗市场价值为 126 亿美元,预计将以 10.2% 的复合年增长率成长,到 2034 年达到 323 亿美元。

这一激增的动力源于人们日益重视透过积极主动的医疗保健来预防疾病。联合疫苗正获得强劲发展势头,因为它们透过将针对多种疾病的保护合併为一剂,简化了免疫接种流程。这不仅最大限度地减少了所需的注射次数,还提高了依从性,简化了物流,并提高了疫苗接种覆盖率,尤其是在医疗资源匮乏的地区。随着医疗保健系统寻求更有效率的解决方案,这些疫苗在支持高通量免疫接种工作、减少就诊次数和减轻营运负担方面发挥着至关重要的作用。其可扩展性使其在国家和全球疫苗接种策略中都至关重要,进一步凸显了其在公共卫生领域日益增长的重要性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 126亿美元 |

| 预测值 | 323亿美元 |

| 复合年增长率 | 10.2% |

结合疫苗市场在2024年创造了52亿美元的收入,这得益于其强大的安全性和可靠的性能,尤其是在婴幼儿群体中。这类疫苗利用蛋白质连接抗原来激发更强的免疫反应,被广泛应用于针对多醣包衣病原体引起的疾病的免疫接种计划。结合疫苗被纳入采购管道,显着增强了其在已开发经济体和新兴经济体的影响力。

2024年,控股部门的市占率为56.4%;儿科部门仍是联合疫苗消费的主要驱动力。高出生率和多价免疫接种方案的广泛采用确保了儿科疫苗需求保持强劲。在政策授权和国际支持的支持下,这些疫苗通常在生命早期阶段接种,有助于减轻疾病负担和减少就诊次数,同时优化全民免疫工作。

2024年,北美联合疫苗市场占据40.2%的市占率。该地区受益于先进的医疗基础设施、积极的公共卫生倡议以及强大的疫苗研发实力。对联合疫苗创新的投资,加上日益提升的认知度和普及度,继续巩固了其在该地区的优势地位。国家免疫指南和儿童联合疫苗的定期接种进一步提升了美国和加拿大市场的渗透率。

领先的联合疫苗市场参与者包括默克、辉瑞、科兴、葛兰素史克、印度血清研究所、赛诺菲、武田、CSL、第一三共、巴拉特生物技术、阿斯利康、帕那西生物技术、明治、MTPC、北京民海生物技术、田边三菱、Emergent BioSolutions和沃森生物技术製药。在联合疫苗市场竞争的公司正大力投资,透过先进的研发来扩大其产品组合,推出针对新发和再发疾病的新型多价製剂。与政府机构、卫生组织和采购机构建立策略合作伙伴关係有助于获得大规模合约并改善全球分销。监管协调和快速审批也是获得市场吸引力的关键。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 日益重视预防性医疗保健

- 对便利性和合规性的需求不断增长

- 政府措施和支持措施

- 扩大儿童免疫接种计划

- 增强临床意识和免疫指南

- 产业陷阱与挑战

- 严格的监管审批流程

- 开发和生产成本高

- 冷炼和储存挑战

- 市场机会

- 加强疫苗分发的公私伙伴关係

- 扩大成人疫苗接种计划

- 成长动力

- 成长潜力分析

- 监管格局

- 管道分析

- 技术格局

- 投资和融资格局

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 公司矩阵分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按技术分类,2021 - 2034 年

- 主要趋势

- 共轭

- 减毒活疫苗

- 灭活

- 重组

- 类毒素

- 其他技术

第六章:市场估计与预测:按年龄组,2021 - 2034 年

- 主要趋势

- 儿科

- 成人

第七章:市场估计与预测:按疾病,2021 - 2034

- 主要趋势

- 白喉、破伤风和百日咳 (DTP)

- 小儿麻痹

- 肝炎

- 流感

- 人类乳突病毒(HPV)

- 水痘

- 麻疹、腮腺炎和德国麻疹 (MMR)

- 其他疾病

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 民众

- 私人的

- 专科诊所

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AstraZeneca

- Beijing Minhai Biological Technology

- Bharat Biotech

- CSL

- Daiichi Sankyo

- Emergent BioSolutions

- GlaxoSmithKline (GSK)

- Meiji

- Merck

- Mitsubishi Tanabe Pharma (MTPC)

- Panacea Biotec

- Pfizer

- Sanofi

- Serum Institute of India

- Sinovac

- Takeda

- Walvax Biotechnology

The Global Combination Vaccines Market was valued at USD 12.6 billion in 2024 and is estimated to grow at a CAGR of 10.2% to reach USD 32.3 billion by 2034.

This surge is fueled by increasing emphasis on disease prevention through proactive healthcare. Combination vaccines are gaining strong momentum as they streamline immunization by merging protection against multiple diseases into one dose. This not only minimizes the number of injections required but also enhances compliance, simplifies logistics, and improves vaccination coverage-particularly in underserved regions. As healthcare systems seek more efficient solutions, these vaccines are proving vital in supporting high-throughput immunization efforts with fewer clinic visits and reduced operational burden. Their scalable nature makes them crucial in both national and global vaccination strategies, reinforcing their growing relevance in public health.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.6 Billion |

| Forecast Value | $32.3 Billion |

| CAGR | 10.2% |

The conjugate vaccine segment generated USD 5.2 billion in 2024, backed by its strong safety profile and reliable performance, especially among infants and young children. These vaccines, which use a protein-linked antigen to provoke stronger immune responses, are widely incorporated into immunization programs targeting diseases caused by polysaccharide-coated pathogens. Their inclusion in procurement pipelines has significantly strengthened their presence in both developed and emerging economies.

The holding segment held a 56.4% share in 2024; the pediatric segment remains the primary driver of combination vaccine consumption. High birth rates and widespread adoption of multivalent immunization schedules have ensured that pediatric demand remains resilient. Backed by policy mandates and international support, these vaccines are routinely administered in early life stages, helping reduce disease burden and medical visits while optimizing immunization efforts across populations.

North America Combination Vaccines Market held 40.2% share in 2024. The region benefits from advanced healthcare infrastructure, proactive public health initiatives, and robust vaccine R&D. Investment in combination vaccine innovation, coupled with heightened awareness and uptake, continues to support regional dominance. National immunization guidelines and regular administration of combined vaccines for children further boost market penetration across the United States and Canada.

Leading Combination Vaccines Market participants include Merck, Pfizer, Sinovac, GSK, Serum Institute of India, Sanofi, Takeda, CSL, Daiichi Sankyo, Bharat Biotech, AstraZeneca, Panacea Biotec, Meiji, MTPC, Beijing Minhai Biological Technology, Mitsubishi Tanabe Pharma, Emergent BioSolutions, and Walvax Biotechnology. Companies competing in the combination vaccines market are investing heavily in expanding their product portfolios through advanced R&D to introduce new multivalent formulations that target emerging and re-emerging diseases. Strategic partnerships with government agencies, health organizations, and procurement bodies are helping secure large-scale contracts and improve global distribution. Regulatory alignment and fast-track approvals are also central to gaining market traction.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Technology trends

- 2.2.3 Age group trends

- 2.2.4 Disease trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising emphasis on preventive healthcare

- 3.2.1.2 Growing demand for convenience & compliance

- 3.2.1.3 Government initiatives and supportive measures

- 3.2.1.4 Expanding pediatric immunization programs

- 3.2.1.5 Enhanced clinical awareness and immunization guidelines

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory approval processes

- 3.2.2.2 High development and production costs

- 3.2.2.3 Cold chain & storage challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Growing public-private partnerships for vaccine distribution

- 3.2.3.2 Expanding adult vaccination programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Pipeline analysis

- 3.6 Technology landscape

- 3.7 Investment and funding landscape

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Company matrix analysis

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Conjugate

- 5.3 Live attenuated

- 5.4 Inactivated

- 5.5 Recombinant

- 5.6 Toxoid

- 5.7 Other technologies

Chapter 6 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pediatric

- 6.3 Adult

Chapter 7 Market Estimates and Forecast, By Disease, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Diphtheria, Tetanus, and Pertussis (DTP)

- 7.3 Polio

- 7.4 Hepatitis

- 7.5 Influenza

- 7.6 Human Papillomavirus (HPV)

- 7.7 Varicella

- 7.8 Measles, Mumps, and Rubella (MMR)

- 7.9 Other diseases

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.2.1 Public

- 8.2.2 Private

- 8.3 Specialty clinics

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AstraZeneca

- 10.2 Beijing Minhai Biological Technology

- 10.3 Bharat Biotech

- 10.4 CSL

- 10.5 Daiichi Sankyo

- 10.6 Emergent BioSolutions

- 10.7 GlaxoSmithKline (GSK)

- 10.8 Meiji

- 10.9 Merck

- 10.10 Mitsubishi Tanabe Pharma (MTPC)

- 10.11 Panacea Biotec

- 10.12 Pfizer

- 10.13 Sanofi

- 10.14 Serum Institute of India

- 10.15 Sinovac

- 10.16 Takeda

- 10.17 Walvax Biotechnology