|

市场调查报告书

商品编码

1833668

电动建筑设备市场机会、成长动力、产业趋势分析及2025-2034年预测Electric Construction Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

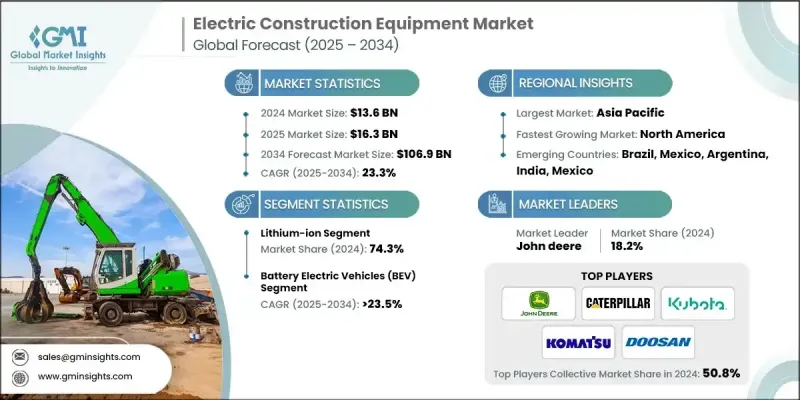

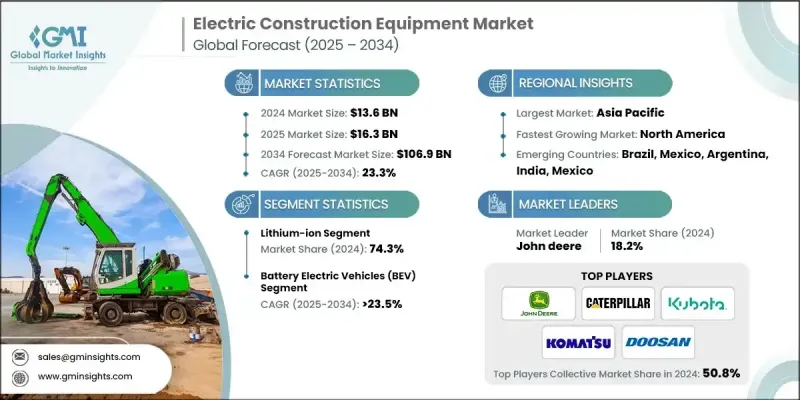

根据 Global Market Insights Inc. 发布的最新报告,2024 年全球电动建筑设备市场规模估计为 136 亿美元,预计将从 2025 年的 163 亿美元增长到 2034 年的 1,069 亿美元,复合年增长率为 23.3%。

欧洲、北美和亚洲部分地区的政府正在日益严格非道路移动机械(包括建筑设备)的排放标准。这些法规旨在控制氮氧化物 (NOx)、粒状物 (PM) 和二氧化碳 (CO2) 等有害污染物的排放,这些污染物是造成空气污染和气候变迁的主要因素。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 136亿美元 |

| 预测值 | 1069亿美元 |

| 复合年增长率 | 23.3% |

锂离子电池的普及率不断上升

锂离子电池凭藉其高能量密度、更长的使用寿命和快速充电能力,在2024年占据了相当大的份额。企业之所以重视锂离子技术,是因为它能够提供高要求施工任务所需的可靠电力,同时减轻设备整体重量。随着技术创新和规模经济的推动,电池成本持续下降,锂离子电池正成为製造商和最终用户的首选。

电动车需求不断成长

受全球推动零排放解决方案的推动,纯电动车 (BEV) 将在 2025 年至 2034 年间实现显着成长。这些车辆兼具减少噪音污染和消除废气排放的双重优势,使其成为城市和室内建筑工地的理想选择。开发 BEV 的公司优先考虑电池技术的进步,以延长营运时间并减少充电停机时间。

亚太地区将崛起为利润丰厚的地区

2024年,亚太地区电动建筑设备市场占据了相当大的份额,这得益于快速的城市化、基础设施建设以及政府推行的清洁能源应用支援政策。中国、日本和韩国等国家正引领这一趋势,在电动车队的研发和部署方面投入大量资金。该地区建筑业的蓬勃发展,加上环保意识的不断增强,正在加速对兼具性能和可持续性标准的电动机械的需求。

电动建筑设备产业的主要参与者有利勃海尔、久保田、斗山工程机械、Mecalac、约翰迪尔、柳工机械、卡特彼勒、小松、曼尼通和日立建筑。

为了在不断发展的电动建筑设备市场中站稳脚跟,各公司正在采取多方面的策略。产品创新仍然是核心重点,公司投入大量资金用于开发续航时间更长的电池、改进的能源管理系统以及涵盖各种设备类别的多功能电动型号。与电池製造商和科技公司建立策略合作和合资企业有助于公司加速创新并缩短产品上市时间。此外,扩大售后服务网络并投资客户教育计画对于建立信任并简化从柴油机械到电动机械的过渡至关重要。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 原物料供应商

- 零件製造商

- 设备製造商

- 分销商和经销商

- 售后市场供应商

- 产业衝击力

- 成长动力

- 严格的排放法规

- 都市化和智慧城市项目

- 节省成本和提高效率

- OEM和租赁采用

- 产业陷阱与挑战

- 前期成本高

- 充电基础设施缺口

- 市场机会

- 政府激励和补贴

- 电池技术的进步

- 智慧工地集成

- 绿色基础设施项目

- 成长动力

- 成长潜力分析

- 专利分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术整合和标准化挑战

- 充电基础设施相容性和标准

- 连接器标准和互通性问题

- 通讯协定和资料交换

- 跨製造商相容性挑战

- 遗留系统整合与迁移成本

- 车队管理系统集成

- 多品牌车队管理的复杂性

- 数据整合和分析平台

- 远端资讯处理和远端监控系统

- 维护计划和优化

- 数位转型和物联网集成

- 连接标准和协议

- 3资料安全和隐私要求

- 边缘运算和即时分析

- 数位孪生技术与仿真

- 多供应商整合的复杂性

- 跨品牌充电连接器相容性问题

- 车队管理系统整合挑战(15+个平台)

- 资料格式标准化和互通性差距

- 服务诊断工具需求和培训

- 充电基础设施相容性和标准

- 3 能源管理与电网整合

- 智慧充电和负载管理系统

- 动态负载平衡和削峰

- 使用时间优化和成本降低

- 电网稳定性和需求响应集成

- 人工智慧和机器学习应用

- 再生能源整合

- 太阳能和风能整合的优势

- 储能和电池系统

- 微电网发展与孤岛能力

- 减少碳足迹和永续发展

- 车辆到电网 (V2G) 和双向充电

- 电网服务和收入机会

- 技术要求和标准

- 商业模式开发与实施

- 规范架构和市场壁垒

- 智慧充电和负载管理系统

- 服务网络准备评估

- 地理服务涵盖分析

- 服务覆盖差距识别(40% 的市场服务不足)

- 区域服务密度和反应时间分析

- 农村与城市服务可用性差异

- 紧急服务反应能力

- 技术人员认证和培训基础设施

- 高压认证计划的可用性

- 培训能力与瓶颈分析

- 技能发展时间表和要求

- 认证成本及投资分析

- 诊断设备和工具要求

- 专业诊断工具投资

- 软体平台整合和更新

- 多品牌相容性和标准化

- 技术升级和淘汰管理

- 地理服务涵盖分析

- 零件供应和供应链支持

- 电子元件供应链成熟度

- 电池更换和服务基础设施

- 紧急零件供应和交货时间

- 区域供应链发展与本地化

- 服务模式创新与数位融合

- 远端诊断和预测性维护

- 扩增实境和数位服务工具

- 服务即服务模式与订阅

- 客户自助服务和数位平台

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

- 用例

- 最佳情况

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按设备,2021 - 2034 年

- 主要趋势

- 挖土机

- 装载机

- 推土机

- 起重机

- 自卸卡车

- 滚筒

- 其他的

第六章:市场估计与预测:依电池容量,2021 - 2034 年

- 主要趋势

- 少于50度

- 50度电至200度

- 超过200度

第七章:市场估计与预测:按电池技术,2021 - 2034 年

- 主要趋势

- 铅酸电池

- 锂离子

- 镍氢电池

第八章:市场估计与预测:依电源分类,2021 - 2034 年

- 主要趋势

- 纯电动车(BEV)

- 插电式混合动力电动车(PHEV)

第九章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 建造

- 矿业

- 物料搬运

- 农业

- 其他的

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 全球参与者

- Caterpillar

- CNH Industrial

- Hitachi Construction Machinery

- JCB

- John Deere

- Komatsu

- Komatsu

- Liebherr

- 区域参与者

- Develon

- Doosan Infracore

- Hyundai Construction Equipment

- LiuGong Machinery

- Manitou

- Mecalac

- SDLG

- 新兴玩家

- Avant Tecno

- Elematic

- Kramer-Werke

- Sunward Intelligent Equipment

- Zoomlion Heavy Industry Science & Technology

The global electric construction equipment market was estimated at USD 13.6 billion in 2024 and is expected to grow from USD 16.3 billion in 2025 to USD 106.9 billion by 2034 at a CAGR of 23.3%, according to the latest report published by Global Market Insights Inc.

Governments across Europe, North America, and parts of Asia are increasingly tightening emission standards for non-road mobile machinery, including construction equipment. These regulations aim to curb harmful pollutants such as nitrogen oxides (NOx), particulate matter (PM), and carbon dioxide (CO2), which are major contributors to air pollution and climate change.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.6 Billion |

| Forecast Value | $106.9 billion |

| CAGR | 23.3% |

Rising Adoption of Lithium-Ion

The lithium-ion battery segment held a significant share in 2024, owing to its high energy density, longer lifecycle, and rapid charging capabilities. Companies emphasize lithium-ion technology because it provides the reliable power needed for demanding construction tasks while reducing overall equipment weight. As battery costs continue to decline, driven by technological innovation and economies of scale, lithium-ion batteries are becoming the preferred choice for both manufacturers and end-users.

Increasing Demand for Battery Electric Vehicles

The battery electric vehicles (BEVs) are witnessing significant growth from 2025 to 2034, fueled by a global push toward zero-emission solutions. These vehicles offer the dual benefits of minimizing noise pollution and eliminating tailpipe emissions, making them ideal for urban and indoor construction sites. Companies developing BEVs are prioritizing advancements in battery technology to extend operational hours and reduce charging downtime.

Asia Pacific to Emerge as a Lucrative Region

Asia Pacific electric construction equipment market held a sizeable share in 2024, driven by rapid urbanization, infrastructure development, and supportive government policies promoting clean energy adoption. Countries such as China, Japan, and South Korea are leading the charge with substantial investments in research and development and the deployment of electric fleets. The region's expanding construction industry, coupled with rising environmental awareness, is accelerating demand for electric machinery that meets both performance and sustainability criteria.

Major players operating in the electric construction equipment industry are Liebherr, Kubota, Doosan Infracore, Mecalac, John Deere, LiuGong Machinery, Caterpillar, Komatsu, Manitou, and Hitachi Construction.

To secure and strengthen their foothold in the evolving electric construction equipment market, companies are adopting multifaceted strategies. Product innovation remains a core focus, with investments funneled into developing longer-lasting batteries, improved energy management systems, and versatile electric models that cover various equipment categories. Strategic collaborations and joint ventures with battery manufacturers and technology firms help companies accelerate innovation and reduce time-to-market. Furthermore, expanding after-sales service networks and investing in customer education initiatives are critical to building trust and easing the transition from diesel to electric machinery.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment

- 2.2.3 Battery Capacity

- 2.2.4 Battery Technology

- 2.2.5 Power Source

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Component manufacturers

- 3.1.3 Equipment manufacturers

- 3.1.4 Distributors and dealers

- 3.1.5 Aftermarket suppliers

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent emission regulations

- 3.2.1.2 Urbanization & smart city projects

- 3.2.1.3 Cost savings & efficiency

- 3.2.1.4 OEM and rental adoption

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High upfront costs

- 3.2.2.2 Charging infrastructure gaps

- 3.2.3 Market opportunities

- 3.2.3.1 Government incentives & subsidies

- 3.2.3.2 Advancements in battery tech

- 3.2.3.3 Smart jobsite integration

- 3.2.3.4 Green infrastructure projects

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology Integration and Standardization Challenges

- 3.8.1 Charging Infrastructure Compatibility and Standards

- 3.8.1.1 Connector Standards and Interoperability Issues

- 3.8.1.2 Communication Protocols and Data Exchange

- 3.8.1.3 Cross-Manufacturer Compatibility Challenges

- 3.8.1.4 Legacy System Integration and Migration Costs

- 3.8.2 Fleet Management System Integration

- 3.8.2.1 Multi-Brand Fleet Management Complexity

- 3.8.2.2 Data Integration and Analytics Platforms

- 3.8.2.3 Telematics and Remote Monitoring Systems

- 3.8.2.4 Maintenance Scheduling and Optimization

- 3.8.3 Digital Transformation and IoT Integration

- 3.8.3.1 Connectivity Standards and Protocols

- 3.8.3.2 3Data Security and Privacy Requirements

- 3.8.3.3 Edge Computing and Real-Time Analytics

- 3.8.3.4 Digital Twin Technology and Simulation

- 3.8.4 Multi-Vendor Integration Complexity

- 3.8.4.1 Charging Connector Compatibility Issues Across Brands

- 3.8.4.2 Fleet Management System Integration Challenges (15+ Platforms)

- 3.8.4.3 Data Format Standardization and Interoperability Gaps

- 3.8.4.4 Service Diagnostic Tool Requirements and Training

- 3.8.1 Charging Infrastructure Compatibility and Standards

- 3.9 3 Energy Management and Grid Integration

- 3.9.1 Smart Charging and Load Management Systems

- 3.9.1.1 Dynamic Load Balancing and Peak Shaving

- 3.9.1.2 Time-of-Use Optimization and Cost Reduction

- 3.9.1.3 Grid Stability and Demand Response Integration

- 3.9.1.4 AI and Machine Learning Applications

- 3.9.2 Renewable Energy Integration

- 3.9.2.1 Solar and Wind Power Integration Benefits

- 3.9.2.2 Energy Storage and Battery Systems

- 3.9.2.3 Microgrid Development and Islanding Capabilities

- 3.9.2.4 Carbon Footprint Reduction and Sustainability

- 3.9.3 Vehicle-to-Grid (V2G) and Bidirectional Charging

- 3.9.3.1 Grid Services and Revenue Opportunities

- 3.9.3.2 Technology Requirements and Standards

- 3.9.3.3 Business Model Development and Implementation

- 3.9.3.4 Regulatory Framework and Market Barriers

- 3.9.1 Smart Charging and Load Management Systems

- 3.10 Service Network Readiness Assessment

- 3.10.1 Geographic Service Coverage Analysis

- 3.10.1.1 Service Coverage Gap Identification (40% Markets Underserved)

- 3.10.1.2 Regional Service Density and Response Time Analysis

- 3.10.1.3 Rural vs Urban Service Availability Disparities

- 3.10.1.4 Emergency Service Response Capabilities

- 3.10.2 Technician Certification and Training Infrastructure

- 3.10.2.1 High-Voltage Certification Program Availability

- 3.10.2.2 Training Capacity and Bottleneck Analysis

- 3.10.2.3 Skill Development Timeline and Requirements

- 3.10.2.4 Certification Cost and Investment Analysis

- 3.10.3 Diagnostic Equipment and Tool Requirements

- 3.10.3.1 Specialized Diagnostic Tool Investment

- 3.10.3.2 Software Platform Integration and Updates

- 3.10.3.3 Multi-Brand Compatibility and Standardization

- 3.10.3.4 Technology Upgrade and Obsolescence Management

- 3.10.1 Geographic Service Coverage Analysis

- 3.11 Parts Availability and Supply Chain Support

- 3.11.1 Electric Component Supply Chain Maturity

- 3.11.2 Battery Replacement and Service Infrastructure

- 3.11.3 Emergency Parts Availability and Lead Times

- 3.11.4 Regional Supply Chain Development and Localization

- 3.12 Service Model Innovation and Digital Integration

- 3.12.1 Remote Diagnostics and Predictive Maintenance

- 3.12.2 Augmented Reality and Digital Service Tools

- 3.12.3 Service-as-a-Service Models and Subscriptions

- 3.12.4 Customer Self-Service and Digital Platforms

- 3.13 Patent analysis

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly Initiatives

- 3.14.5 Carbon footprint considerations

- 3.15 Use cases

- 3.16 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Equipment, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Excavators

- 5.3 Loaders

- 5.4 Bulldozers

- 5.5 Cranes

- 5.6 Dump Trucks

- 5.7 Roller

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Battery Capacity, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Less than 50 kWh

- 6.3 50 kWh to 200 kWh

- 6.4 More than 200 kWh

Chapter 7 Market Estimates & Forecast, By Battery Technology, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Lead-acid

- 7.3 Lithium-ion

- 7.4 Nickel-metal hydride

Chapter 8 Market Estimates & Forecast, By Power Source, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Battery Electric Vehicles (BEV)

- 8.3 Plug-in Hybrid Electric Vehicles (PHEV)

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Construction

- 9.3 Mining

- 9.4 Material Handling

- 9.5 Agriculture

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Caterpillar

- 11.1.2 CNH Industrial

- 11.1.3 Hitachi Construction Machinery

- 11.1.4 JCB

- 11.1.5 John Deere

- 11.1.6 Komatsu

- 11.1.7 Komatsu

- 11.1.8 Liebherr

- 11.2 Regional Players

- 11.2.1 Develon

- 11.2.2 Doosan Infracore

- 11.2.3 Hyundai Construction Equipment

- 11.2.4 LiuGong Machinery

- 11.2.5 Manitou

- 11.2.6 Mecalac

- 11.2.7 SDLG

- 11.3 Emerging Players

- 11.3.1 Avant Tecno

- 11.3.2 Elematic

- 11.3.3 Kramer-Werke

- 11.3.4 Sunward Intelligent Equipment

- 11.3.5 Zoomlion Heavy Industry Science & Technology