|

市场调查报告书

商品编码

1833676

铁矿球团市场机会、成长动力、产业趋势分析及2025-2034年预测Iron Ore Pellets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

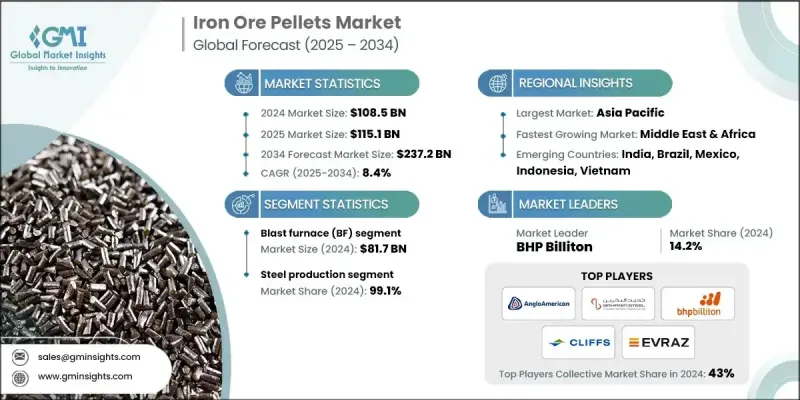

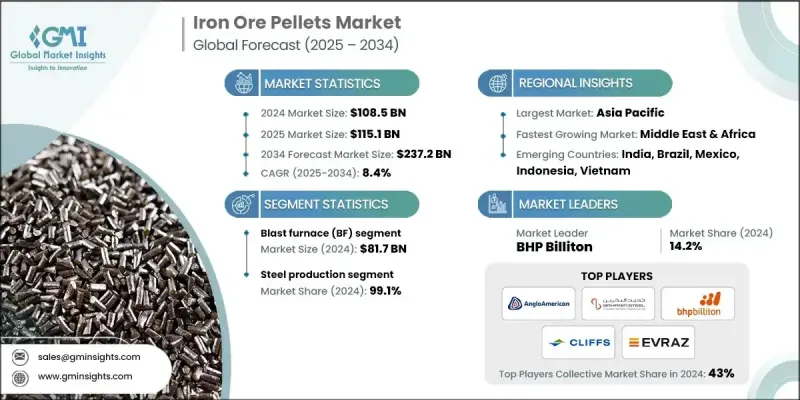

根据 Global Market Insights Inc. 发布的最新报告,2024 年全球铁矿球团市场规模估计为 1,085 亿美元,预计将从 2025 年的 1,151 亿美元增长到 2034 年的 2,372 亿美元,复合年增长率为 8.4%。

铁矿球团是炼钢的关键原料,尤其是在高炉炼钢和直接还原铁 (DRI) 製程。随着全球基础设施项目、汽车生产和建筑活动的持续扩张,对高品位铁矿石球团的需求也随之增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1085亿美元 |

| 预测值 | 2372亿美元 |

| 复合年增长率 | 8.4% |

高炉(BF)的采用率不断上升

高炉 (BF) 领域在 2024 年占据了显着份额,这得益于其在大规模炼钢作业中的关键作用。铁矿球团因其尺寸均匀、铁含量高且脉石含量低而成为高炉製程的首选,从而提高了炉效并降低了能耗。随着综合钢厂力求在满足更严格的排放标准的同时提高生产率,对高品质球团的需求持续成长。

钢铁产量不断成长

2024年,钢铁生产领域占据了相当大的份额,因为球团矿在冶金性能和炉效方面比块矿和烧结矿更胜一筹。球团矿稳定的品质确保了稳定的生产,并有助于减少整体碳足迹,因此对于传统高炉和新兴的直接还原铁 (DRI) 製程都至关重要。

亚太地区将成为利润丰厚的地区

受快速工业化、城市化发展以及中国、印度和东南亚地区大规模钢铁产能的推动,亚太地区铁矿石球团市场将在2034年前保持良好的复合年增长率。随着基础设施投资持续成长和环境法规日益严格,该地区正经历向高品位球团的强劲转变,以支持永续炼钢。印度等国家也正在扩大国内球团生产,以减少对进口烧结料的依赖。地区企业正在扩大产能,投资选矿和球团技术,并成立合资企业,以确保原材料供应并有效满足日益增长的需求。

铁矿石球团市场的主要参与者有 Cleveland-Cliffs、FERREXPO、METALLOINVEST、必和必拓、Jindal SAW、Evraz、LKAB Koncernkontor、英美资源集团、加拿大铁矿石公司和巴林钢铁公司。

为了巩固自身地位,铁矿石球团产业的企业正在采用垂直整合、技术创新和策略合作相结合的策略。许多企业正在投资选矿厂和低品位矿石加工,以提高球团品质并优化资源利用率。从采矿到球团生产的垂直整合确保了更好的成本控制和稳定的原料供应。此外,企业正专注于低碳球团生产流程,并参与永续发展计划,以符合ESG目标。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利格局

- 贸易统计资料(HS 编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场规模及预测:依等级,2021-2034

- 主要趋势

- 高炉(BF)

- 直接还原(DR)

第六章:市场规模与预测:Balling Technologies,2021-2034

- 主要趋势

- 球形磁碟

- 球鼓

第七章:市场规模与预测:按应用,2021-2034

- 主要趋势

- 钢铁生产

- 铁基化学品

第 8 章:市场规模与预测:按技术,2021-2034 年

- 主要趋势

- 电弧炉

- 电感应炉

- 氧基/高炉

第 9 章:市场规模与预测:按产品来源,2021-2034 年

- 主要趋势

- 赤铁矿

- 磁铁矿

- 其他的

第 10 章:市场规模与预测:依製粒工艺,2021-2034 年

- 主要趋势

- 移动炉篦(TG)

- 链篦窑(GK)

- 其他的

第 11 章:市场规模与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东和非洲其他地区

第十二章:公司简介

- Anglo American

- Bahrain Steel

- BHP Billiton

- Cleveland-Cliffs

- Evraz

- FERREXPO

- Iron Ore Company of Canada

- Jindal SAW

- LKAB Koncernkontor

- METALLOINVEST

The global iron ore pellets market was estimated at USD 108.5 billion in 2024 and is expected to grow from USD 115.1 billion in 2025 to USD 237.2 billion in 2034 at a CAGR of 8.4%, according to the latest report published by Global Market Insights Inc.

Iron ore pellets are a critical raw material in steelmaking, particularly in blast furnaces and direct reduced iron (DRI) processes. As global infrastructure projects, automotive production, and construction activities continue to expand, the demand for high-grade iron ore pellets rises in parallel.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $108.5 Billion |

| Forecast Value | $237.2 Billion |

| CAGR | 8.4% |

Rising Adoption of Blast Furnace (BF)

The blast furnace (BF) segment held a notable share in 2024, driven by its critical role in large-scale steelmaking operations. Iron ore pellets are preferred in BF processes due to their consistent size, high iron content, and lower gangue levels, which improve furnace efficiency and reduce energy consumption. As integrated steel plants aim to increase productivity while meeting stricter emission norms, the demand for high-quality pellets continues to rise.

Growing Steel Production

The steel production segment generated a significant share in 2024, as pellets offer superior performance over lump ore and sinter in terms of metallurgical properties and furnace efficiency. The consistent quality of pellets ensures stable production and helps reduce the overall carbon footprint, making them vital for both traditional blast furnaces and emerging direct reduced iron (DRI) processes.

Asia Pacific to Emerge as a Lucrative Region

Asia Pacific iron ore pellets market will grow at a decent CAGR through 2034, bolstered by rapid industrialization, urban development, and massive steel production capacity across China, India, and Southeast Asia. As infrastructure investments continue to surge and environmental regulations become more stringent, the region is witnessing a strong shift toward high-grade pellets to support sustainable steelmaking. Countries like India are also expanding their domestic pellet production to reduce dependence on imported sinter feed. Regional players are scaling up capacity, investing in beneficiation and pelletizing technologies, and forming joint ventures to secure raw material access and meet growing demand efficiently.

Major players involved in the iron ore pellets market are Cleveland-Cliffs, FERREXPO, METALLOINVEST, BHP Billiton, Jindal SAW, Evraz, LKAB Koncernkontor, Anglo American, Iron Ore Company of Canada, and Bahrain Steel.

To strengthen their position, companies in the iron ore pellets industry are adopting a blend of vertical integration, technological innovation, and strategic partnerships. Many are investing in beneficiation plants and low-grade ore processing to enhance pellet quality and optimize resource utilization. Vertical integration-from mining to pellet production-ensures better cost control and consistent feedstock supply. Additionally, firms are focusing on low-carbon pellet production processes and engaging in sustainability initiatives to align with ESG goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Grade

- 2.2.2 Balling Technologies

- 2.2.3 Application

- 2.2.4 Technology

- 2.2.5 Product Source

- 2.2.6 Pelletizing Process

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Grade, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Blast furnace (BF)

- 5.3 Direct reduction (DR)

Chapter 6 Market Size and Forecast, By Balling Technologies, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Balling disc

- 6.3 Balling drum

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Steel production

- 7.3 Iron based chemicals

Chapter 8 Market Size and Forecast, By Technology, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Electric arc furnace

- 8.3 Electric induction furnace

- 8.4 Oxygen based/blast furnace

Chapter 9 Market Size and Forecast, By Product Source, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Hematite

- 9.3 Magnetite

- 9.4 Others

Chapter 10 Market Size and Forecast, By Pelletizing Process, 2021-2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 Travelling grate (TG)

- 10.3 Grate kiln (GK)

- 10.4 Others

Chapter 11 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East & Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

- 11.6.4 Rest of Middle East & Africa

Chapter 12 Company Profiles

- 12.1 Anglo American

- 12.2 Bahrain Steel

- 12.3 BHP Billiton

- 12.4 Cleveland-Cliffs

- 12.5 Evraz

- 12.6 FERREXPO

- 12.7 Iron Ore Company of Canada

- 12.8 Jindal SAW

- 12.9 LKAB Koncernkontor

- 12.10 METALLOINVEST