|

市场调查报告书

商品编码

1833687

医疗旅游市场机会、成长动力、产业趋势分析及2025-2034年预测Medical Tourism Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

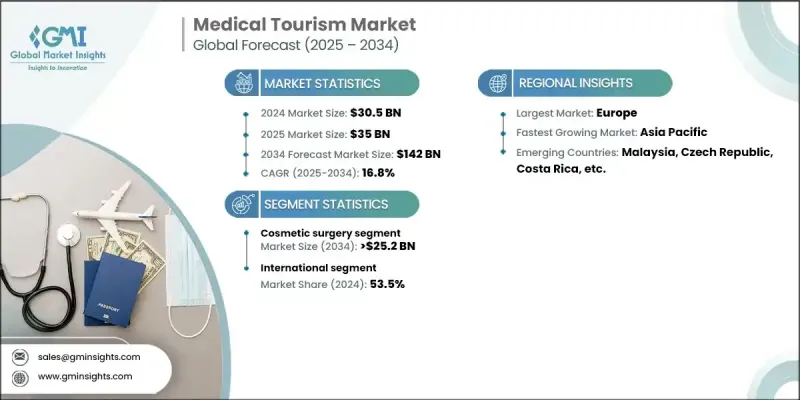

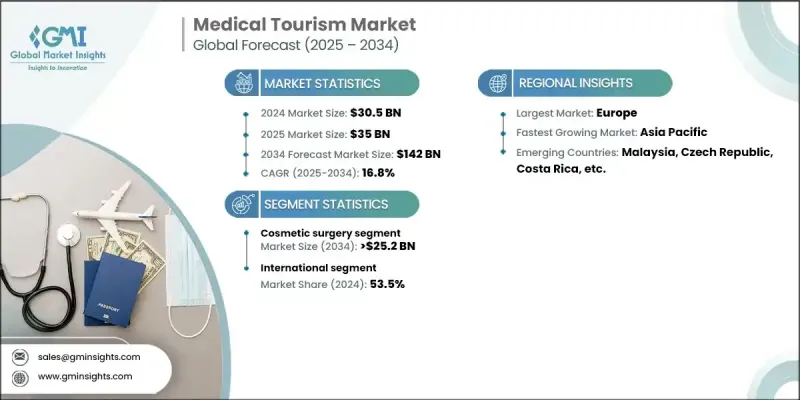

2024 年全球医疗旅游市场价值为 305 亿美元,预计到 2034 年将以 16.8% 的复合年增长率增长至 1,420 亿美元。

推动市场成长的因素包括政府简化跨境医疗旅游的措施、发展中地区可负担治疗方案的可用性以及慢性病患者数量的增加。采用国际公认的手术标准也增强了人们对海外医疗程序的信心。亚太地区各国已成为重要的医疗中心,以较低的成本提供先进的护理,同时为国际患者提供专门的资源。来自西方国家的游客经常选择这些目的地来获得优质的医疗服务,其中相当一部分人还将治疗与短期健康或康復之旅结合起来。医疗旅游的吸引力不仅在于价格实惠,还在于更短的等待时间、现代化的基础设施和专业的照护。人们的健康意识不断提高,加上对选择性手术和生活方式相关治疗的需求不断增长,继续推动医疗旅游的发展。这些因素共同作用,使医疗旅游成为全球患者的首选,市场也迅速调整以满足全球需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 305亿美元 |

| 预测值 | 1420亿美元 |

| 复合年增长率 | 16.8% |

2024年,美容整形手术市场占17%,这得益于旨在改善外观的手术日益普及,而创新技术也使治疗更加安全、精准和微创。更快的恢復期和更低的成本鼓励了更多患者追求美容。数位平台的影响力日益增强,也提高了人们的认知度,尤其是在年轻人群中,这进一步刺激了美容治疗的需求,并扩大了其在医疗旅游中的作用。

2024年,国际医疗份额占比53.5%,反映出寻求海外治疗的患者数量稳定成长。出国就医的吸引力在于能够获得先进的诊疗方案、降低费用,以及避开在本国冗长的候诊名单。这种转变增强了发展中国家在提供高品质医疗服务的同时保持成本竞争力的地位。来自不同地区的患者继续选择此类目的地作为满足多样化医疗需求的首选,这进一步强化了该行业的全球化特征。

2024年,欧洲医疗旅游市场占36.5%的市场份额,预计未来几年将大幅扩张。许多来自北美、中东及週边国家的患者更青睐欧洲目的地,因为欧洲拥有先进的医疗基础设施和相对较低的治疗成本。欧洲一些国家仍然是吸引多学科患者的主要中心,确保在全球市场扩张中发挥重要作用。

医疗旅游市场的主要参与者包括莱佛士医疗集团、纳拉亚纳健康集团、约翰霍普金斯医院、马克斯医疗保健、马卡蒂医疗中心、富通医疗有限公司、梅奥诊所、圣路加医疗中心、安纳多卢医疗中心、康民国际医院、KPJ 医疗保健有限公司、质子治疗中心、伊丽莎白医院、阿波罗医院集团、康民国际医院、KPJ 医疗保健有限公司、质子治疗中心、伊丽莎白医院、阿波罗医院集团、克利夫兰爱犬市阁、Skle KlinS Kliner

为了巩固市场地位,医疗旅游公司正推行多元化策略。领先的医院和医疗保健集团正在扩大与旅行社、保险公司和健康中心的合作,提供涵盖治疗、住宿和后续护理的综合套餐。他们正在大力投资先进的医疗技术和基础设施,以确保医疗服务达到国际认可的标准。许多机构也透过客製化的行销活动、多语言服务和专门的国际患者部门来瞄准海外患者。透过卫星设施和与地区医院的合作拓展新兴市场,有助于提高医疗服务的可近性并建立对病患的信任。包括远距医疗咨询和线上预约平台在内的数位转型进一步扩大了服务范围,同时提升了整体患者体验。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 开发中国家医疗费用低廉

- 日益符合外科手术的国际标准

- 政府推出多项政策,便利医疗旅游

- 慢性病盛行率不断上升

- 产业陷阱与挑战

- 某些医疗程序的等待时间较长

- 患者追踪及术后併发症问题

- 机会

- 健康经济特区发展

- 数位医疗和远距医疗

- 成长动力

- 成长潜力分析

- 监管格局

- 技术和创新格局

- 当前的技术趋势

- 人工智慧翻译工具

- 数位健康平台

- 电子病历(EMR)集成

- 新兴技术

- 基于区块链的健康资料安全

- AR/VR 医疗旅游

- 当前的技术趋势

- 医疗保险场景

- 消费者洞察

- 各地区医院数量

- 各国的发展与倡议

- 患者/游客的人口统计数据

- 投资前景

- 波特的分析

- PESTEL分析

- 差距分析

- 未来市场趋势

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 心血管外科

- 整容手术

- 隆乳

- 植髮

- 其他整容手术

- 骨科手术

- 肿瘤治疗

- 生育治疗

- 减重手术

- 其他应用

第六章:市场估计与预测:依旅游类型,2021 - 2034 年

- 主要趋势

- 国内的

- 国际的

第七章:市场估计与预测:按国家/地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 土耳其

- 捷克共和国

- 亚太地区

- 日本

- 印度

- 泰国

- 韩国

- 新加坡

- 马来西亚

- 拉丁美洲

- 巴西

- 墨西哥

- 哥伦比亚

- 哥斯大黎加

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 8 章:医疗保健提供者

- 关键球员

- 康民国际医院

- COMO 饭店及度假村

- 四季酒店

- 希尔顿全球控股公司

- IHH医疗保健

- 洲际集团

- KPJ医疗保健有限公司

- 仁爱医疗中心

- 马卡蒂医疗中心

- 万豪国际集团

- 国家心臟研究所(Institut Jantung Negara)

- 槟城安息日医院

- 丽笙酒店集团

- 莱佛士医疗集团

- 瑰丽酒店集团

- 新加坡保健集团

- 圣路加医疗中心

- 双威集团

- 新兴企业

- AEK乌隆国际医院

- Gojek

- Grab控股有限公司

- 卡玛拉雅

- 基马拉

- RAKxa

- 然禧国际医院

The Global Medical Tourism Market was valued at USD 30.5 billion in 2024 and is estimated to grow at a CAGR of 16.8% to reach USD 142 billion by 2034.

Market growth is driven by government initiatives that simplify cross-border medical travel, the availability of affordable treatment options in developing regions, and the increasing number of patients suffering from chronic illnesses. The adoption of internationally recognized surgical standards has also encouraged confidence in medical procedures abroad. Countries across the Asia Pacific have emerged as prominent hubs, offering advanced care at lower costs while dedicating specialized resources to international patients. Travelers from Western nations often seek these destinations for quality medical services, and a considerable portion also combine their treatment with short wellness or recovery-focused trips. The appeal lies not only in affordability but also in shorter waiting periods, modern infrastructure, and specialized care. Rising health awareness, coupled with growing demand for elective procedures and lifestyle-related treatments, continues to fuel momentum. Together, these factors are establishing medical tourism as a preferred option for patients worldwide, with markets adapting rapidly to meet global demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $30.5 Billion |

| Forecast Value | $142 Billion |

| CAGR | 16.8% |

The cosmetic surgery segment held a 17% share in 2024, driven by the increasing popularity of procedures aimed at improving physical appearance, supported by innovations that have made treatments safer, more precise, and minimally invasive. Faster recovery periods and reduced costs have encouraged more patients to pursue cosmetic enhancements. The growing influence of digital platforms has also heightened awareness, especially among younger demographics, further boosting demand for cosmetic treatments and expanding their role within medical tourism.

The international segment held a 53.5% share in 2024, reflecting the steady rise in patients seeking treatment abroad. The appeal of traveling for healthcare includes access to advanced procedures, reduced expenses, and the opportunity to bypass lengthy waiting lists in home countries. This shift has strengthened the position of developing nations that provide high-quality services while remaining cost-competitive. Patients from various regions continue to select such destinations as preferred choices for diverse medical needs, reinforcing the global nature of this industry.

Europe Medical Tourism Market held a 36.5% share in 2024 and is projected to expand significantly in the years ahead. Many patients from North America, the Middle East, and neighboring countries prefer European destinations due to the combination of advanced healthcare infrastructure and relatively lower treatment costs. Several countries within Europe remain leading centers for attracting patients across multiple specialties, ensuring a strong role in global market expansion.

Key players in the Medical Tourism Market include Raffles Medical Group, Narayana Health, Johns Hopkins Hospital, Max Healthcare, Makati Medical Center, Fortis Healthcare Limited, Mayo Clinic, St. Luke's Medical Center, Anadolu Medical Center, Bumrungrad International Hospital, KPJ Healthcare Berhad, Proton Therapy Center, Mount Elizabeth Hospitals, Apollo Hospitals Group, Mahkota Medical Centre, Gleneagles Hospital, Asklepios Kliniken GmbH & Co. KGaA, and Cleveland Clinic.

To reinforce their market position, companies in medical tourism are pursuing diverse strategies. Leading hospitals and healthcare groups are expanding partnerships with travel agencies, insurance providers, and wellness centers to offer comprehensive packages that include treatment, accommodation, and aftercare. Significant investments are being made in advanced medical technologies and infrastructure to ensure internationally accredited standards of care. Many organizations are also targeting overseas patients with tailored marketing campaigns, multilingual services, and dedicated international patient departments. Expansion into emerging markets through satellite facilities and affiliations with regional hospitals helps increase accessibility and build trust among patients. Digital transformation, including telemedicine consultations and online booking platforms, has further strengthened outreach while enhancing the overall patient experience.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Application trends

- 2.2.3 Travel type trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Low cost of medical treatment in developing countries

- 3.2.1.2 Growing compliance towards international standards for surgical procedures

- 3.2.1.3 Various government policies to ease medical travel

- 3.2.1.4 Increasing prevalence of chronic diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Long wait time for certain medical procedures

- 3.2.2.2 Issue with patient follow-up and post-surgery complications

- 3.2.3 Opportunities

- 3.2.3.1 Development of health special economic zones

- 3.2.3.2 Digital healthcare and telemedicine

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.1.1 AI-powered translation tools

- 3.5.1.2 Digital wellness platforms

- 3.5.1.3 Electronic medical records (EMR) integration

- 3.5.2 Emerging technologies

- 3.5.2.1 Blockchain-based health data security

- 3.5.2.2 AR/VR for medical tourism

- 3.5.1 Current technological trends

- 3.6 Medical coverage scenario

- 3.7 Consumer insights

- 3.8 Number of hospitals by region

- 3.9 Developments and initiatives by country

- 3.10 Demographics of patients/tourists

- 3.11 Investment landscape

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

- 3.14 Gap analysis

- 3.15 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Mergers and acquisitions

- 4.5.2 Partnerships and collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Cardiovascular surgery

- 5.3 Cosmetic surgery

- 5.3.1 Breast augmentation

- 5.3.2 Hair transplant

- 5.3.3 Other cosmetic surgeries

- 5.4 Orthopedic surgery

- 5.5 Oncology treatment

- 5.6 Fertility treatment

- 5.7 Bariatric surgery

- 5.8 Other applications

Chapter 6 Market Estimates and Forecast, By Travel Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Domestic

- 6.3 International

Chapter 7 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Turkey

- 7.3.7 Czech Republic

- 7.4 Asia Pacific

- 7.4.1 Japan

- 7.4.2 India

- 7.4.3 Thailand

- 7.4.4 South Korea

- 7.4.5 Singapore

- 7.4.6 Malaysia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Colombia

- 7.5.4 Costa Rica

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Healthcare Providers

- 8.1 Key players

- 8.1.1 Bumrungrad International Hospital

- 8.1.2 COMO Hotels and Resorts

- 8.1.3 Four Seasons Hotels

- 8.1.4 Hilton Worldwide Holdings Inc.

- 8.1.5 IHH Healthcare

- 8.1.6 InterContinental Group

- 8.1.7 KPJ Healthcare Berhad

- 8.1.8 Mahkota Medical Centre

- 8.1.9 Makati Medical Center

- 8.1.10 Marriott International

- 8.1.11 National Heart Institute (Institut Jantung Negara)

- 8.1.12 Penang Adventist Hospital

- 8.1.13 Radisson Hotel Group

- 8.1.14 Raffles Medical Group

- 8.1.15 Rosewood Hotel Group

- 8.1.16 SingHealth Group

- 8.1.17 St. Luke's Medical Center

- 8.1.18 Sunway Group

- 8.2 Emerging players

- 8.2.1 AEK Udon International Hospital

- 8.2.2 Gojek

- 8.2.3 Grab Holdings Ltd.

- 8.2.4 Kamalaya

- 8.2.5 Keemala

- 8.2.6 RAKxa

- 8.2.7 Yanhee International Hospital