|

市场调查报告书

商品编码

1844294

被动红外线感测器市场机会、成长动力、产业趋势分析及2025-2034年预测Passive Infrared Sensors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

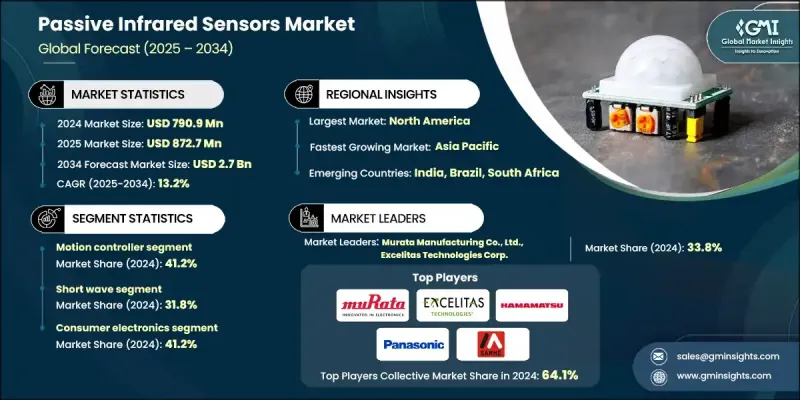

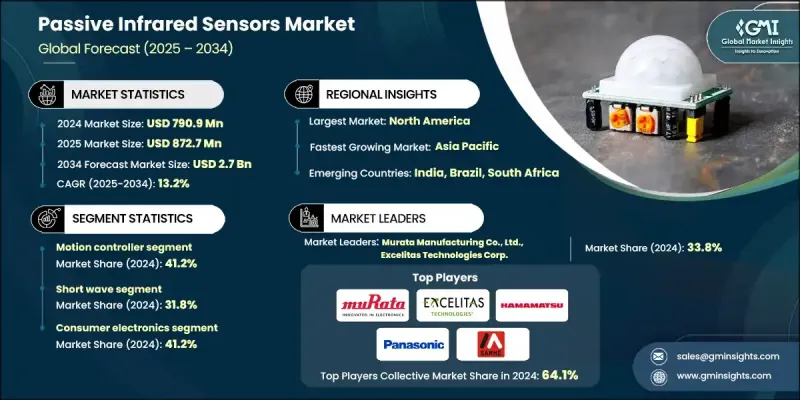

2024 年全球被动红外线感测器市场价值为 7.909 亿美元,预计到 2034 年将以 13.2% 的复合年增长率增长至 27 亿美元。

智慧家庭自动化的日益普及是推动这一成长的关键因素之一。随着消费者在连网装置上的投资不断增加,对 PIR 感测器的需求激增,因为这些感测器对于在智慧照明系统、安全警报和 HVAC(暖气、通风和空调)应用中实现运动侦测至关重要。 PIR 感测器以其低功耗和可靠的运动侦测功能而闻名,正成为提升便利性、安全性和能源效率不可或缺的一部分。语音助理和物联网设备的兴起进一步扩展了 PIR 感测器在提供无缝自动化的多功能设备中的应用。此外,全球对永续性和能源效率的重视促进了 PIR 感测器在节能建筑解决方案中的应用。这些感测器透过侦测人体存在并减少不必要的能源消耗,有助于优化照明、暖气和冷气系统的控制。随着各国政府实施更严格的能源效率法规以及企业采用绿建筑认证,这一趋势尤其重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.909亿美元 |

| 预测值 | 27亿美元 |

| 复合年增长率 | 13.2% |

运动控制器市场占41.2%的市场份额,2024年价值3.26亿美元。运动控制器因其在安防系统、照明控制和能源管理解决方案中的关键作用,继续主导PIR感测器市场。其价格实惠、功耗低且易于集成,使其成为住宅、商业和工业应用中的必备产品。

2024年,长波PIR感测器市场规模达3.823亿美元。长波PIR感测器在户外和大面积应用领域需求旺盛,例如周界安防、军事监视、交通监控和智慧城市基础设施。人们对先进安防系统、公共安全和国防现代化的日益关注,正在推动该领域的扩张。希望保持市场领先地位的公司应优先开发具有增强连接性、降低误报率和提高性能的远端感测器,以满足大型基础设施和国防专案的需求。

2024年,美国被动红外线感测器市场规模达2.458亿美元,复合年增长率达14%,这得益于家庭自动化的蓬勃发展、先进安防系统需求的不断增长以及智慧基础设施项目的兴起。智慧家庭的普及、能源效率的日益提升以及政府推动永续建筑实践的激励措施,都在加速PIR感测器在各个领域的应用。此外,美国国防和航太工业的蓬勃发展,也推动了用于监控和监测应用的高性能PIR感测器需求的不断增长。

全球被动红外线感测器市场的主要参与者包括通用动力公司、博世安防系统有限责任公司、霍尼韦尔国际公司、赛普拉斯半导体公司、Elmos 半导体公司、安讯士公司、意法半导体公司、松下控股公司、Excelitas Technologies Corp.、爱特梅尔公司、村田製作所、滨松光子学株式会、日本航空仪社和日本航空公司(Eyocom 商社、滨松光子学株式会和日本航空公司和日本航空公司。被动红外线感测器市场的公司正在采用几种关键策略来巩固其市场地位。这些策略包括投资于创新感测器技术的开发、专注于提高感测器性能和提高能源效率。公司也在扩大其产品组合,以满足对先进 PIR 感测器日益增长的需求,特别是在智慧家庭、安全和能源管理等应用领域。另一个重要策略是建立策略伙伴关係和合作关係,以进入新市场并分享技术专长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 智慧家庭自动化的普及率不断提高

- 对节能建筑解决方案的需求不断增长

- 物联网和连接设备的扩展

- 安全和监控要求不断提高

- 汽车驾驶辅助系统的成长

- 产业陷阱与挑战

- 恶劣环境下的感测器精度问题

- 来自替代感测技术的竞争日益激烈

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 历史价格分析(2021-2024)

- 价格趋势驱动因素

- 区域价格差异

- 价格预测(2025-2034)

- 定价策略

- 新兴商业模式

- 合规性要求

- 永续性措施

- 永续材料评估

- 碳足迹分析

- 循环经济实施

- 永续性认证和标准

- 永续性投资报酬率分析

- 全球消费者情绪分析

- 专利分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 市场集中度分析

- 按地区

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各地区市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:按设备,2021 - 2034 年

- 主要趋势

- 烟雾侦测器

- 热探测器

- 运动控制器

- 其他设备

第六章:市场估计与预测:按范围,2021 - 2034

- 主要趋势

- 短波被动红外线感测器

- 中波被动红外线感测器

- 长波被动红外线感测器

第七章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 消费性电子产品

- 智慧型手机和智慧型行动装置

- 相机

- 其他电子

- 卫生保健

- 病人监护系统

- 发热筛检设备

- 睡眠追踪系统

- 红外线温度计

- 其他的

- 工业的

- 汽车

- 国防和航太

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Atmel Corporation

- Axis Communications AB

- Bosch Security Systems, LLC

- Current Corporation

- Cypress Semiconductor

- Elmos Semiconductor

- Epson Toyocom Corporation

- Excelitas Technologies Corp.

- General Dynamics Corporation

- Hamamatsu Photonics KK

- Honeywell International Inc.

- Murata Manufacturing Co., Ltd.

- Ningbo Sanhe Sensor Co., Ltd.

- Nippon Avionics Co., Ltd

- Panasonic Holdings Corporation

- STMicroelectronics NV

The Global Passive Infrared Sensors Market was valued at USD 790.9 million in 2024 and is estimated to grow at a CAGR of 13.2% to reach USD 2.7 billion by 2034.

The increasing popularity of smart home automation is one of the key factors driving this growth. As consumers invest more in connected devices, the demand for PIR sensors has surged, as these sensors are essential for enabling motion detection in smart lighting systems, security alarms, and HVAC (heating, ventilation, and air conditioning) applications. PIR sensors, known for their low power consumption and reliable motion-detection capabilities, are becoming integral to enhance convenience, security, and energy efficiency. The rise of voice assistants and IoT devices further expands the use of PIR sensors in multifunctional devices that offer seamless automation. Additionally, the global emphasis on sustainability and energy efficiency has promoted the adoption of PIR sensors in energy-saving building solutions. These sensors help optimize the control of lighting, heating, and cooling systems by detecting human presence and reducing unnecessary energy use. This trend is particularly important as governments implement stricter energy efficiency regulations and companies adopt green building certifications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $790.9 Million |

| Forecast Value | $2.7 Billion |

| CAGR | 13.2% |

The motion controller segment held a 41.2% share and was valued at USD 326 million in 2024. Motion controllers continue to dominate the PIR sensor market due to their crucial role in security systems, lighting control, and energy management solutions. Their affordability, low power usage, and easy integration make them essential in residential, commercial, and industrial applications.

The long-wave PIR sensor segment generated USD 382.3 million in 2024. Long-wave PIR sensors are in high demand for outdoor and large-area applications, such as perimeter security, military surveillance, traffic monitoring, and smart city infrastructure. The growing focus on advanced security systems, public safety, and defense modernization is driving this segment's expansion. Companies looking to maintain leadership in the market should prioritize the development of long-range sensors with enhanced connectivity, reduced false alarms, and higher performance to cater to large-scale infrastructure and defense projects.

United States Passive Infrared Sensors Market generated USD 245.8 million in 2024, with a CAGR of 14% fueled by a surge in home automation, the increasing demand for advanced security systems, and a rise in smart infrastructure projects. The adoption of smart homes, a heightened focus on energy efficiency, and government incentives promoting sustainable building practices are all accelerating the use of PIR sensors in various sectors. Additionally, the strong U.S. defense and aerospace industries contribute to the growing demand for high-performance PIR sensors used in surveillance and monitoring applications.

Key players operating in the Global Passive Infrared Sensors Market include General Dynamics Corporation, Bosch Security Systems, LLC, Honeywell International Inc., Cypress Semiconductor, Elmos Semiconductor, Axis Communications AB, STMicroelectronics N.V., Panasonic Holdings Corporation, Excelitas Technologies Corp., Atmel Corporation, Murata Manufacturing Co., Ltd., Hamamatsu Photonics K.K., Ningbo Sanhe Sensor Co., Ltd., Espon Toyocom Corporation, and Nippon Avionics Co., Ltd. Companies in the Passive Infrared Sensors Market are employing several key strategies to solidify their market position. These strategies include investing in the development of innovative sensor technologies, focusing on improving sensor performance, and enhancing energy efficiency. Firms are also expanding their product portfolios to meet the growing demand for advanced PIR sensors, especially in applications such as smart homes, security, and energy management. Another important strategy is forming strategic partnerships and collaborations to access new markets and share technological expertise.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Packaging type trends

- 2.2.2 Material trends

- 2.2.3 Application trends

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing adoption of smart home automation

- 3.2.1.2 Rising need for energy-efficient building solutions

- 3.2.1.3 Expansion of IoT and connected devices

- 3.2.1.4 Increasing security and surveillance requirements

- 3.2.1.5 Growth in automotive driver assistance systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Sensor accuracy issues in harsh environments

- 3.2.2.2 Rising competition from alternative sensing technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 Historical price analysis (2021-2024)

- 3.8.2 Price trend drivers

- 3.8.3 Regional price variations

- 3.8.4 Price forecast (2025-2034)

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.12.1 Sustainable materials assessment

- 3.12.2 Carbon footprint analysis

- 3.12.3 Circular economy implementation

- 3.12.4 Sustainability certifications and standards

- 3.12.5 Sustainability ROI analysis

- 3.13 Global consumer sentiment analysis

- 3.14 Patent analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Device, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Smoke detector

- 5.3 Heat detector

- 5.4 Motion controller

- 5.5 Other devices

Chapter 6 Market Estimates and Forecast, By Range, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Short wave passive infrared sensor

- 6.3 Mid wave passive infrared sensor

- 6.4 Long wave passive infrared sensor

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Consumer electronics

- 7.2.1 Smartphones and smart mobile devices

- 7.2.2 Cameras

- 7.2.3 Other electronic

- 7.3 Healthcare

- 7.3.1 Patient monitoring systems

- 7.3.2 Fever screening devices

- 7.3.3 Sleep tracking systems

- 7.3.4 Infrared thermometers

- 7.3.5 Others

- 7.4 Industrial

- 7.5 Automotive

- 7.6 Defense and aerospace

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Atmel Corporation

- 9.2 Axis Communications AB

- 9.3 Bosch Security Systems, LLC

- 9.4 Current Corporation

- 9.5 Cypress Semiconductor

- 9.6 Elmos Semiconductor

- 9.7 Epson Toyocom Corporation

- 9.8 Excelitas Technologies Corp.

- 9.9 General Dynamics Corporation

- 9.10 Hamamatsu Photonics K.K.

- 9.11 Honeywell International Inc.

- 9.12 Murata Manufacturing Co., Ltd.

- 9.13 Ningbo Sanhe Sensor Co., Ltd.

- 9.14 Nippon Avionics Co., Ltd

- 9.15 Panasonic Holdings Corporation

- 9.16 STMicroelectronics N.V