|

市场调查报告书

商品编码

1846218

红外线检测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030)Infrared Detector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

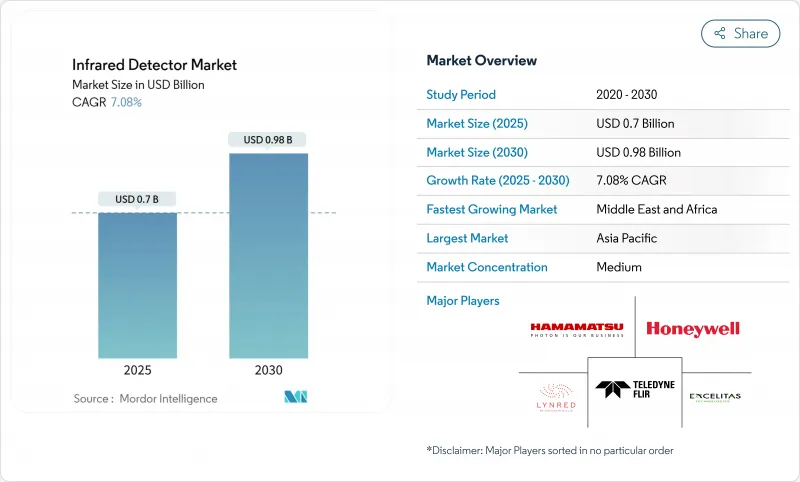

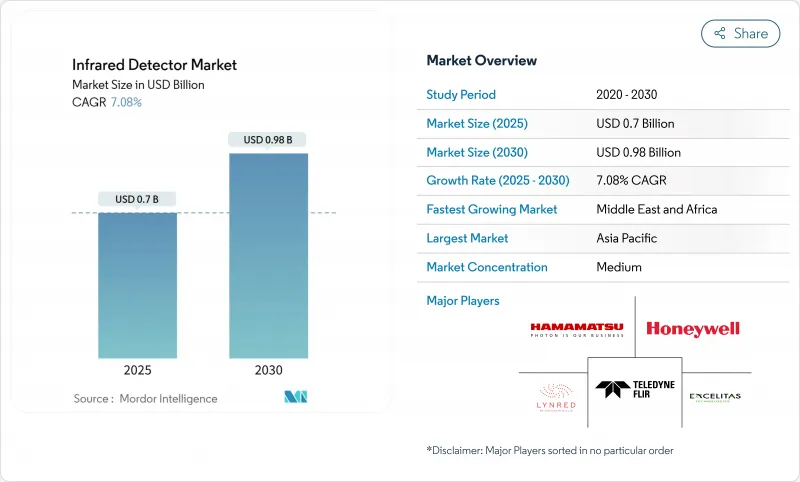

红外线检测器市场目前价值 7 亿美元,预计到 2030 年将达到 9.8 亿美元,复合年增长率为 7.08%。

微型非製冷微测辐射热计阵列、用于自动驾驶汽车的雷射雷达级近红外线感测器以及欧盟对预测性维护热成像的强制要求将支撑近期的成长势头。绿色氢能工厂广泛采用红外线气体洩漏检测系统、东亚地区对半导体检测的需求不断增长以及日本国防部对高灵敏度製冷阵列的主导,将进一步增强增长势头。为摆脱镓和锗的供应限製而进行的供应链重组正在加速检测器材料的替代,而以收购主导的整合正在塑造价值链各个环节的竞争策略。这些动态的相互作用预计将推动红外线检测器市场的持续扩张和技术多样化。

全球红外线检测器市场趋势与洞察

非製冷微测辐射热计阵列的小型化为亚洲的物联网运动感测器提供动力

阿尔託大学的锗基光电二极体在1.55微米波长下将响应度提高了35%,从而实现了经济高效的CMOS相容製造,解决了热漂移问题,同时保持了亚毫瓦级的功率范围。 MEMS与轻量级讯号处理逻辑的融合正在推动智慧楼宇端点的持续温度监控,而亚洲元件製造商正在捆绑无线连接,以在其家用电子电器产品组合中实现附加价值服务的收益。

预测性维护热成像技术成为欧盟製程工业的强制性要求

2024年欧盟机械法规将编纂风险评估通讯协定,使热成像技术成为合规检验的关键。基于状态的监控可以为能源密集型工厂每小时节省超过10万美元的停机时间,而人工智慧分析可以自动执行异常检测,从而缓解技能限制并增强投资案例。

高规格製冷检测器的出口管制限制

《国际武器贸易条例》和《瓦森纳条约》限制了60%的相机出口,包括原产于美国的子系统,迫使欧洲製造商采用双重产品线,增加了固定成本。欧洲製造商正在推动供应链本地化,但围绕镓和锗的地缘政治紧张局势加剧了时间线风险。

細項分析

到2024年,热检测器将占据红外线检测器市场的65%。然而,由于国防和科学应用领域对更高灵敏度的需求,光学或量子元件的复合年增长率高达8.5%。量子探测器红外线探测器市场规模预计将进一步扩大,因为有机半导体光电探测器已证明其比探测器高达5.55x1012琼斯(无需像素级图形化),这意味着製造成本的降低。

热检测器凭藉其非製冷运作和低初始成本,在民用和楼宇自动化应用中仍然占据主导地位。量子阵列中基于人工智慧的片上处理技术目前正在为军事装备提供即时威胁分类。韩国科学技术研究院 (KAIST) 的室温中红外线检测器打破了低温壁垒,为手持式和电池供电平台奠定了量子架构的基础。

由于设计人员优先考虑低功耗和易于集成,非製冷阵列将在2024年占据78%的收入。然而,由于与需要极高射程的国防项目相关,冷冻架构正以8.2%的复合年增长率发展。 Lynred的ATI320清楚地表明了提高非製冷灵敏度和模糊性能界限的动力。

军事领域占据了红外线检测器市场近60%的份额,其反舰和远距瞄准光学系统均采用製冷型。尺寸、重量和功率的最佳化使斯特林製冷型系统适用于无人机和可携式发射器。混合有效载荷(结合製冷和非製冷模组)正在兴起,使指挥官能够平衡成本和任务需求。

区域分析

随着中国电动车製造商扩大雷射雷达部署,以及台湾和韩国代工厂加大短波红外线侦测生产线的建设,亚太地区将在2024年占据全球支出的42%。本地光达公司在专利方面的领先地位凸显了该地区的创新深度,接近性终端用户丛集的优势则缩短了供应链。日本成熟的电子产业提供先进的封装服务,而印度在边防安全的投资将刺激对高灵敏度冷却的需求。

北美凭藉着雄厚的国防预算和专有感测器IP,支撑了持续的采购週期。 Teledyne公司报告称,2024年第四季其营收达15.023亿美元。 《国际武器贸易条例》(ITAR)条款保护了国内供应商,同时也增加了出口难度,鼓励国际买家实施地理多元化策略。加拿大和墨西哥为汽车和采矿业提供支持,而热感像仪则提升了这些行业的营运韧性。

在机械安全法规和环境指令将热成像纳入合规性审核的背景下,欧洲正经历稳定成长。 Lynred 斥资 8,500 万欧元(9,100 万美元)扩建设施,体现了其产能在地化,以降低供应链风险。北欧国家正在越来越多地采用智慧建筑,而中东和非洲地区预计将在绿色氢能大型企划和安全基础设施升级的推动下,以 8.9% 的复合年增长率成长。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查结果

- 调查前提

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 非製冷微测辐射热计阵列的小型化为亚洲的物联网运动感测器提供动力

- 预测性维护热成像技术成为欧盟製程工业的强制性要求

- 中国自动驾驶和电动车平台用光达级近红外线检测器的普及

- 中东绿色氢能工厂强制实施红外线气体洩漏检测

- 台湾和韩国半导体工厂检测对SWIR相机的需求

- 美国印边境监视现代化计划

- 市场限制

- 对高规格製冷检测器的出口管制(类似 ITAR)限制

- 被动PIR元件价格下滑

- 海上油气部署中的热漂移与校准问题

- 新兴市场的假检测器管道

- 价值/供应链分析

- 监理展望

- 技术展望

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测

- 按下检测器类型

- 热检测器

- 光(量子)检测器

- 按冷却技术

- 非冷冻红外线检测器

- 冷冻红外线探测器

- 按材质

- 微测辐射热计

- InGaAs(铟镓砷)

- MCT(碲镉汞)

- 热电电型

- 热电堆

- 按频谱范围

- 近红外线(NIR)

- 短波红外线(SWIR)

- 中波红外线(MWIR)

- 长波红外线(LWIR)

- 远红外线(FIR)

- 按用途

- 人员和运动检测

- 温度测量/热成像

- 工业程监控

- 光谱学和生物医学成像

- 火灾和气体侦测

- 汽车 ADAS 和 LiDAR

- 环境和农业监测

- 其他应用(楼宇和暖通空调自动化、智慧家庭、军事和国防等)

- 按最终用户产业

- 航太/国防

- 工业製造

- 车

- 石油、天然气和能源

- 医疗保健和生命科学

- 消费性电子产品

- 智慧基础设施

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 北欧的

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 台湾

- 澳洲

- 纽西兰

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- UAE

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Teledyne FLIR

- Lynred(ULIS+Sofradir)

- Hamamatsu Photonics

- Excelitas Technologies

- Honeywell International

- Murata Manufacturing

- Texas Instruments

- Omron Corporation

- Raytheon Technologies

- Leonardo DRS

- SCD-SemiConductor Devices

- BAE Systems plc

- L3Harris Technologies

- InfraTec GmbH

- iRay Technology

- Hikmicro(Hangzhou)

- Guide Sensmart(Wuhan Guide)

- DALI Technology

- InfraTec GmbH

第七章 市场机会与未来展望

The infrared detector market size is currently valued at USD 0.70 billion and is projected to reach USD 0.98 billion by 2030, advancing at a 7.08% CAGR.

Miniaturized uncooled microbolometer arrays, LiDAR-grade near-infrared sensors for autonomous vehicles, and mandatory predictive-maintenance thermography in the European Union underpin near-term momentum. Wider deployment of infrared gas-leak detection systems in green-hydrogen plants, expanding semiconductor inspection demand in East Asia, and defense-driven appetite for higher-sensitivity cooled arrays further reinforce the growth trajectory. Supply-chain realignment away from restricted gallium and germanium sources is accelerating substitutions in detector materials while acquisition-led consolidation is shaping competitive strategies across value-chain tiers. The interplay of these dynamics positions the infrared detector market for sustained expansion and technology diversification.

Global Infrared Detector Market Trends and Insights

Miniaturisation of Uncooled Micro-bolometer Arrays Empowering IoT Motion Sensors in Asia

Aalto University's germanium-based photodiodes raised responsivity by 35% at 1.55 μm, enabling cost-effective CMOS-compatible fabrication that tackles thermal drift while sustaining sub-milliwatt power envelopes.MEMS convergence with lightweight signal-processing logic is pushing continuous thermal monitoring into smart-building endpoints, and Asian component makers are bundling wireless connectivity to monetise value-added services across consumer electronics portfolios.

Mandatory Predictive-Maintenance Thermography in EU Process Industries

The 2024 EU machinery regulation codifies risk-assessment protocols that make thermal imaging integral to compliance validation. Condition-based monitoring reduces downtime that can exceed USD 100,000 per hour in energy-intensive plants, and AI-enabled analytics now automate anomaly detection, easing skills constraints and strengthening investment cases.

Export-Control Limits on High-Spec Cooled Detectors

ITAR and Wassenaar regimes constrain 60% of camera exports that contain US-origin subsystems, forcing dual product lines that elevate fixed costs. European manufacturers are localising supply chains, yet geopolitical tensions around gallium and germanium amplify timeline risks.

Other drivers and restraints analyzed in the detailed report include:

- Surge in LiDAR-grade Near-Infrared Detectors for Autonomous & EV Platforms in China

- IR Gas-Leak Detection Mandates for Green-Hydrogen Plants across Middle East

- Price Erosion in Passive PIR Components

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, thermal detectors captured 65% of the infrared detector market. Photo- or quantum-based devices are, however, expanding at an 8.5% CAGR as defense and scientific use cases favor higher sensitivity. The infrared detector market size for quantum detectors is forecast to widen as organic semiconductor photodetectors demonstrated specific detectivity of 5.55X1012 Jones without pixel-level patterning, signaling lower fabrication overheads.

Thermal detectors still dominate consumer and building-automation applications due to uncooled operation and lower upfront costs. AI-enabled on-chip processing inside quantum arrays is now providing real-time threat classification for military inventories, a shift likely to recalibrate procurement strategies. KAIST's room-temperature mid-infrared photodetector removes cryogenic barriers, positioning quantum architectures for handheld and battery-operated platforms.

Uncooled arrays delivered 78% of 2024 revenue as designers prized low power and simple integration. Yet cooled architectures are advancing at 8.2% CAGR tied to defense programs that demand extreme range. Lynred's ATI320 underscores the push to elevate uncooled sensitivity, blurring historical performance lines.

The military segment, nearly 60% of the total infrared detector market size, still specifies cooled formats for anti-ship and long-range targeting optics. Size, weight, and power optimisation is making Stirling-cooler packages suitable for drones and portable launchers. Hybrid payloads that combine cooled and uncooled modules are emerging, allowing unit commanders to balance cost and mission profiles.

The Infrared Detector Market is Segmented by Detector Type (Thermal Detector, Photo Detector), Cooling Technology (Uncooled, Cooled), Material (Microbolometer, Ingaas, and More), Spectral Range (NIR, SWIR, and More), Application (Motion Sensing, Thermography, Process Monitoring, and More), End-Use Industry (Aerospace and Defense, Industrial, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 42% of 2024 spending as Chinese EV makers scaled LiDAR rollouts and foundries in Taiwan and South Korea ramped SWIR inspection lines. Patent leadership by local LiDAR firms emphasises regional innovation depth, and proximity to end-use clusters shortens supply chains. Japan's mature electronics sector supplies advanced packaging services, and India's border-security investments boost high-sensitivity cooled demand.

North America leverages strong defense budgets and proprietary sensor IP, with Teledyne recording USD 1,502.3 million Q4 2024 sales that underline sustained procurement cycles. ITAR provisions shield domestic vendors yet complicate exports, prompting regional diversification strategies among international buyers. Canada and Mexico support the automotive and extractive verticals where thermal cameras enhance operational resilience.

Europe grows steadily under machinery-safety regulations and environmental directives that embed thermography into compliance audits. Lynred's EUR 85 million (USD 91 million) facility expansion evidences capacity localisation aimed at de-risking supply lines. Nordic nations champion smart-building deployments, while the Middle East and Africa forecast 8.9% CAGR on the back of green-hydrogen megaprojects and security infrastructure upgrades that specify long-range imagers.

- Teledyne FLIR

- Lynred (ULIS + Sofradir)

- Hamamatsu Photonics

- Excelitas Technologies

- Honeywell International

- Murata Manufacturing

- Texas Instruments

- Omron Corporation

- Raytheon Technologies

- Leonardo DRS

- SCD - SemiConductor Devices

- BAE Systems plc

- L3Harris Technologies

- InfraTec GmbH

- iRay Technology

- Hikmicro (Hangzhou)

- Guide Sensmart (Wuhan Guide)

- DALI Technology

- InfraTec GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Miniaturisation of Uncooled Micro-bolometer Arrays Empowering IoT Motion Sensors in Asia

- 4.2.2 Mandatory Predictive-Maintenance Thermography in EU Process Industries

- 4.2.3 Surge in LiDAR-grade Near-IR Detectors for Autonomous and EV Platforms in China

- 4.2.4 IR Gas-Leak Detection Mandates for Green-Hydrogen Plants across Middle East

- 4.2.5 Semiconductor Fab Inspection Demand for SWIR Cameras in Taiwan and South Korea

- 4.2.6 Border-Surveillance Modernisation Programs in US and India

- 4.3 Market Restraints

- 4.3.1 Export-control (ITAR-like) Limits on High-spec Cooled Detectors

- 4.3.2 Price Erosion in Passive PIR Components

- 4.3.3 Thermal Drift and Calibration Issues in Offshore Oil-and-Gas Deployment

- 4.3.4 Counterfeit Detector Channels in Emerging Markets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Detector Type

- 5.1.1 Thermal Detector

- 5.1.2 Photo (Quantum) Detector

- 5.2 By Cooling Technology

- 5.2.1 Uncooled Infrared Detector

- 5.2.2 Cooled Infrared Detector

- 5.3 By Material

- 5.3.1 Microbolometer

- 5.3.2 InGaAs (Indium Gallium Arsenide)

- 5.3.3 MCT (Mercury Cadmium Telluride)

- 5.3.4 Pyroelectric

- 5.3.5 Thermopile

- 5.4 By Spectral Range

- 5.4.1 Near-Wave Infrared (NIR)

- 5.4.2 Short-Wave Infrared (SWIR)

- 5.4.3 Mid-Wave Infrared (MWIR)

- 5.4.4 Long-Wave Infrared (LWIR)

- 5.4.5 Far-Infrared (FIR)

- 5.5 By Application

- 5.5.1 People and Motion Sensing

- 5.5.2 Temperature Measurement / Thermography

- 5.5.3 Industrial Process Monitoring

- 5.5.4 Spectroscopy and Biomedical Imaging

- 5.5.5 Fire and Gas Detection

- 5.5.6 Automotive ADAS and LiDAR

- 5.5.7 Environmental and Agriculture Monitoring

- 5.5.8 Other Applications (Building and HVAC Automation, Smart Homes, Military and Defense, and others)

- 5.6 By End-Use Industry

- 5.6.1 Aerospace and Defense

- 5.6.2 Industrial Manufacturing

- 5.6.3 Automotive

- 5.6.4 Oil, Gas and Energy

- 5.6.5 Healthcare and Life Sciences

- 5.6.6 Consumer Electronics

- 5.6.7 Smart Infrastructure

- 5.6.8 Others

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 France

- 5.7.3.3 United Kingdom

- 5.7.3.4 Italy

- 5.7.3.5 Nordics

- 5.7.3.6 Rest of Europe

- 5.7.4 Asia Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 Taiwan

- 5.7.4.6 Australia

- 5.7.4.7 New Zealand

- 5.7.4.8 Rest of Asia Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 UAE

- 5.7.5.1.3 Turkey

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Egypt

- 5.7.5.2.3 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Teledyne FLIR

- 6.4.2 Lynred (ULIS + Sofradir)

- 6.4.3 Hamamatsu Photonics

- 6.4.4 Excelitas Technologies

- 6.4.5 Honeywell International

- 6.4.6 Murata Manufacturing

- 6.4.7 Texas Instruments

- 6.4.8 Omron Corporation

- 6.4.9 Raytheon Technologies

- 6.4.10 Leonardo DRS

- 6.4.11 SCD - SemiConductor Devices

- 6.4.12 BAE Systems plc

- 6.4.13 L3Harris Technologies

- 6.4.14 InfraTec GmbH

- 6.4.15 iRay Technology

- 6.4.16 Hikmicro (Hangzhou)

- 6.4.17 Guide Sensmart (Wuhan Guide)

- 6.4.18 DALI Technology

- 6.4.19 InfraTec GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment