|

市场调查报告书

商品编码

1844320

宠物配件市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Pet Accessories Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

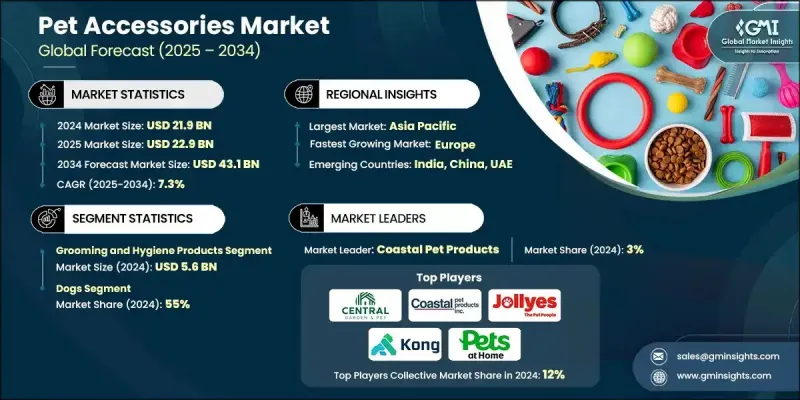

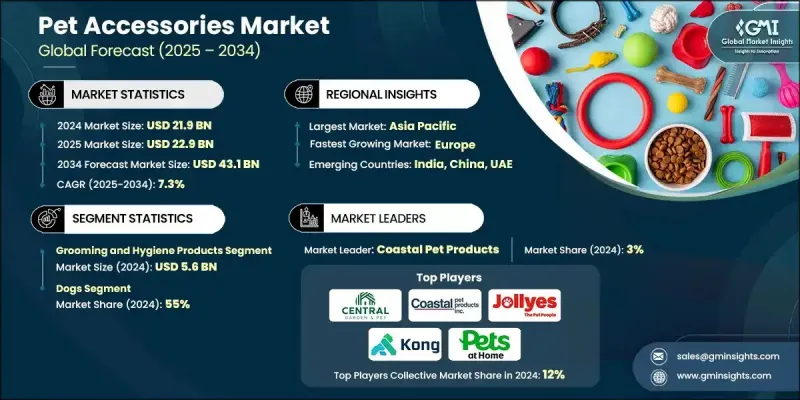

2024 年全球宠物配件市场价值为 219 亿美元,预计将以 7.3% 的复合年增长率成长,到 2034 年达到 431 亿美元。

城市、乡村和郊区宠物拥有率的不断上升,持续塑造市场的未来。随着越来越多的家庭收养宠物,对必需品和小众配件的需求都在激增。这为品牌创新和满足宠物主人不断变化的需求打开了大门。消费者对宠物健康、舒适度和参与度的意识日益增强,促使製造商探索新的产品类别,并改进设计,以反映当前的生活方式和价值观,例如环保意识和个人化。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 219亿美元 |

| 预测值 | 431亿美元 |

| 复合年增长率 | 7.3% |

一些国家推出了鼓励宠物收养的政策,加上可支配收入的提高,进一步推动了宠物拥有量的增加。这一趋势也激发了人们对高端多功能产品的兴趣,例如智慧项圈、人体工学玩具和人工智慧餵食器。分销网路的增强,尤其是透过线上平台,正在扩大产品的可及性。从健身监测器到自动餵食系统,科技与配件的整合正成为主流,而新兴经济体则在推动产品价格的降低与创新。随着各行各业拥抱数位商务和数据驱动的客製化,全球市场正在不断涌现新的成长途径。

2024年,宠物美容和卫生相关配件的市场规模达到56亿美元,预计到2034年将以8%的复合年增长率成长。越来越多的宠物主人选择互动玩具和卫生用品,以促进精神刺激和身体活动。这些玩具现在采用可生物降解和可回收的材料製成,以符合环保价值。永续发展的趋势也影响宠物护理领域的设计决策和购买模式,使绿色替代品成为产品开发的驱动力。

宠物狗市场占了55%的份额,预计2025年至2034年的复合年增长率将达到7.5%。宠物主人现在正在投资增强健康的配件,例如矫形床上用品、数位健康追踪器和营养补充包。个人化配件,包括订製服装和刻字标籤,在狗主人中越来越常见,他们现在不仅重视宠物的舒适度和个性,也同样重视自己的舒适度和个性。随着宠物与人类关係的加深,专用配件的支出持续成长。

美国宠物配件市场占76%的市场份额,2024年市场规模达59亿美元。将宠物视为家庭成员的文化转变持续影响消费者的消费行为。美国消费者越来越多地选择智慧宠物配件,包括摄影机、GPS追踪器和自动化系统。环保包装和永续生产方式也越来越受到美国消费者的重视,这进一步增强了消费者对负责任的宠物产品的需求。

影响全球宠物配件市场的关键公司包括 KONG Company、Red Dingo、Outward Hound、Pets at Home Group、Jollyes Pet Superstores、ZippyPaws、Coastal Pet Products、Central Garden & Pet、Ferplast、Merrick Pet Care、Rogz Pet Gear、Hartz Mountain、Nestle Purina PetCare、MidWest for ProductsCare、MidWest for Productss 和 Pettz。宠物配件市场的领导者正在优先考虑产品创新、高端化和永续性,以保持竞争力。许多品牌正在推出由 GPS、健康监测和自动化等互联技术支援的智慧宠物产品,以满足现代生活方式。客製化产品(例如订製项圈或量身定制的服装)正在推出,以吸引寻求个人化的宠物主人。公司也正在投资永续材料和可回收包装,以顺应日益增长的环保意识。与零售连锁店的策略合作以及透过电子商务平台扩大其数位影响力使公司能够接触到更广泛的受众。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 宠物主人数量不断增加

- 宠物人性化趋势日益明显

- 消费者在宠物照护方面的支出增加

- 产业陷阱与挑战

- 宠物服装和配件的季节性

- 供应链中断

- 市场竞争激烈

- 机会

- 环保且永续

- 智慧/科技配件

- 多功能且节省空间的设计

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034

- 主要趋势

- 餵料和饮水系统

- 自动餵食器和智慧分配器

- 传统碗和喷泉

- 旅行和便携式餵食解决方案

- 专门的饮食支援配件

- 美容和卫生用品

- 刷子、梳子和美容工具

- 洗髮精和清洁产品

- 指甲护理和牙齿卫生

- 专业美容设备

- 住房和运输工具

- 室内饲养解决方案(笼子、狗舍)

- 运输箱和旅行箱

- 寝具和舒适配件

- 户外庇护所和天气保护

- 玩具和益智产品

- 互动与益智玩具

- 咀嚼玩具和牙齿保健产品

- 运动和活动器材

- 物种特异性富集解决方案

- 项圈、皮带和挽具

- 传统项圈和身分标籤

- 智慧项圈和 GPS 追踪设备

- 牵引绳和伸缩系统

- 安全带和安全设备

- 其他(健康与安全产品等)

第六章:市场估计与预测:依宠物类型,2021 - 2034

- 主要趋势

- 狗

- 猫

- 鸟类

- 鱼类和水生宠物

- 爬虫类

- 其他(哺乳动物、兔子、仓鼠等)

第七章:市场估计与预测:依价格区间,2021 - 2034

- 主要趋势

- 低的

- 中等的

- 高的

第 8 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 超市和大卖场

- 宠物专卖店

- 其他零售店(宠物医院等)

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Central Garden & Pet Company

- Coastal Pet Products

- Ferplast

- Furhaven Pet Products

- Hartz Mountain

- Jollyes Pet Superstores

- KONG Company

- Merrick Pet Care

- MidWest Homes for Pets

- Nestle Purina PetCare

- Outward Hound

- Pets at Home Group

- Red Dingo

- Rogz Pet Gear

- ZippyPaws

The Global Pet Accessories Market was valued at USD 21.9 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 43.1 billion by 2034.

The rising rate of pet ownership across urban, rural, and suburban regions continues to shape the future of the market. With more households adopting pets, demand for both essential and niche accessories is surging. This has opened doors for brands to innovate and meet the evolving needs of pet owners. Growing consumer awareness around pet wellness, comfort, and engagement is encouraging manufacturers to explore fresh product categories and improve designs that reflect current lifestyles and values, such as eco-consciousness and personalization.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.9 Billion |

| Forecast Value | $43.1 Billion |

| CAGR | 7.3% |

Policy support in several countries encouraging pet adoption, alongside rising disposable income, is further increasing pet ownership. This rising trend has amplified interest in high-end, multifunctional products like smart collars, ergonomic toys, and AI-powered feeders. Enhanced distribution networks, especially through online platforms, are expanding product accessibility. The integration of technology in accessories, from fitness monitors to automated feeding systems, is becoming mainstream, while emerging economies are driving both affordability and innovation. As industry embraces digital commerce and data-driven customization, new growth avenues are constantly unfolding across global markets.

In 2024, the grooming and hygiene-related accessories generated USD 5.6 billion and are projected to grow at a CAGR of 8% through 2034. Pet owners are increasingly opting for interactive toys and hygiene essentials that cater to mental stimulation and physical activity. These toys are now made from biodegradable and recyclable materials to align with environmentally responsible values. The shift toward sustainability is also influencing design decisions and purchase patterns across the pet care space, making green alternatives a driving force in product development.

The dogs segment held a 55% share and is expected to grow at a CAGR of 7.5% from 2025 to 2034. Pet owners are now investing in health-enhancing accessories such as orthopedic bedding, digital health trackers, and supplement packs. Personalized accessories, including custom outfits and engraved tags, are becoming common among dog parents who now prioritize their pet's comfort and individuality as much as their own. As the pet-human bond deepens, spending on specialized accessories continues to rise.

U.S. Pet Accessories Market held a 76% share and generated USD 5.9 billion in 2024. The cultural shift toward treating pets as part of the family continues to influence spending behavior. Consumers in the U.S. are increasingly opting for smart pet accessories, including cameras, GPS trackers, and automated systems. Eco-friendly packaging and sustainable production practices are also gaining importance among American shoppers, reinforcing the demand for responsibly crafted pet products.

Key companies shaping the Global Pet Accessories Market include KONG Company, Red Dingo, Outward Hound, Pets at Home Group, Jollyes Pet Superstores, ZippyPaws, Coastal Pet Products, Central Garden & Pet, Ferplast, Merrick Pet Care, Rogz Pet Gear, Hartz Mountain, Nestle Purina PetCare, MidWest Homes for Pets, and Furhaven Pet Products. Leading players in the Pet Accessories Market are prioritizing product innovation, premiumization, and sustainability to stay competitive. Many brands are introducing smart pet products powered by connected technologies like GPS, health monitoring, and automation to cater to modern lifestyles. Customized offerings such as bespoke collars or tailored apparel are being introduced to appeal to pet owners seeking personalization. Companies are also investing in sustainable materials and recyclable packaging to align with growing environmental awareness. Strategic collaborations with retail chains and expanding their digital presence through e-commerce platforms allow firms to reach wider audiences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of pet owners

- 3.2.1.2 Growing trend of pet humanization

- 3.2.1.3 Higher consumer spending on pet care

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Seasonality in pet clothing & accessories

- 3.2.2.2 Supply chain disruptions

- 3.2.2.3 Intense market competition

- 3.2.3 Opportunities

- 3.2.3.1 Eco-conscious & sustainable

- 3.2.3.2 Smart/tech-enabled accessories

- 3.2.3.3 Multi-functional and space-saving designs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade Statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Feeding & watering systems

- 5.2.1 Automated feeders & smart dispensers

- 5.2.2 Traditional bowls & water fountains

- 5.2.3 Travel & portable feeding solutions

- 5.2.4 Specialized dietary support accessories

- 5.3 Grooming & hygiene products

- 5.3.1 Brushes, combs & grooming tools

- 5.3.2 Shampoos & cleaning products

- 5.3.3 Nail care & dental hygiene

- 5.3.4 Professional grooming equipment

- 5.4 Housing & carriers

- 5.4.1 Indoor housing solutions (cages, kennels)

- 5.4.2 Transport carriers & travel crates

- 5.4.3 Bedding & comfort accessories

- 5.4.4 Outdoor shelters & weather protection

- 5.5 Toys & enrichment products

- 5.5.1 Interactive & puzzle toys

- 5.5.2 Chew toys & dental health products

- 5.5.3 Exercise & activity equipment

- 5.5.4 Species-specific enrichment solutions

- 5.6 Collars, leashes & harnesses

- 5.6.1 Traditional collars & identification tags

- 5.6.2 Smart collars & GPS tracking devices

- 5.6.3 Leashes & retractable systems

- 5.6.4 Harnesses & safety equipment

- 5.7 Others (health & safety products, etc.)

Chapter 6 Market Estimates & Forecast, By Pet Type, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Birds

- 6.5 Fish & aquatic pets

- 6.6 Reptiles

- 6.7 Others (mammals, rabbits, hamsters, etc.)

Chapter 7 Market Estimates & Forecast, By Price range, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce

- 8.2.2 Company website

- 8.3 Offline

- 8.3.1 Supermarkets and hypermarkets

- 8.3.2 Pet specialty stores

- 8.3.3 Other retail stores (pet hospitals, etc.)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Central Garden & Pet Company

- 10.2 Coastal Pet Products

- 10.3 Ferplast

- 10.4 Furhaven Pet Products

- 10.5 Hartz Mountain

- 10.6 Jollyes Pet Superstores

- 10.7 KONG Company

- 10.8 Merrick Pet Care

- 10.9 MidWest Homes for Pets

- 10.10 Nestle Purina PetCare

- 10.11 Outward Hound

- 10.12 Pets at Home Group

- 10.13 Red Dingo

- 10.14 Rogz Pet Gear

- 10.15 ZippyPaws