|

市场调查报告书

商品编码

1822555

自动餵鱼器市场机会、成长动力、产业趋势分析及2025-2034年预测Automatic Fish Feeders Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

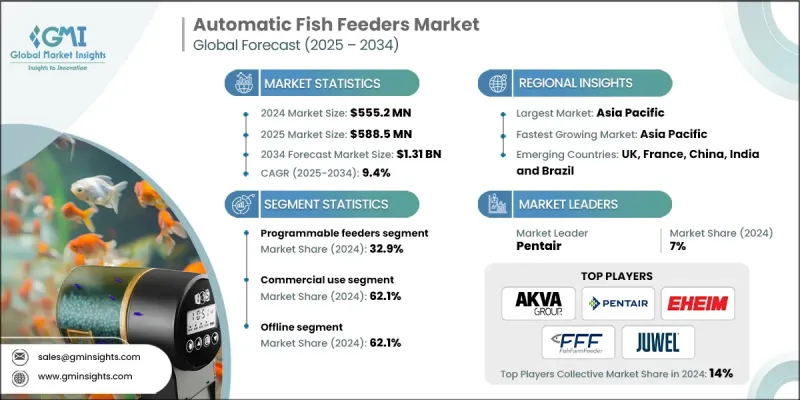

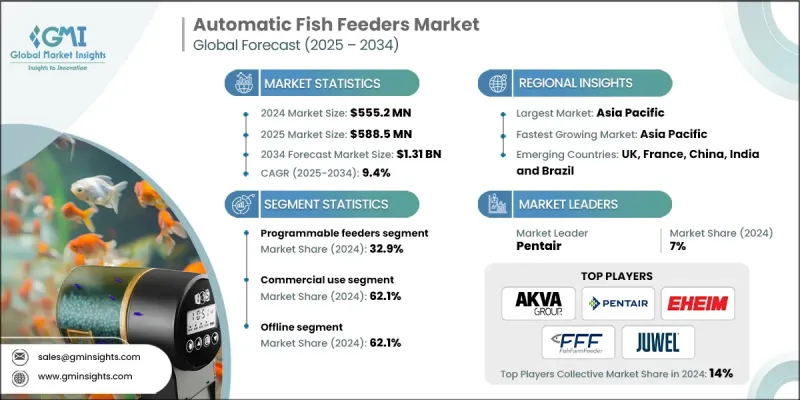

根据 Global Market Insights, Inc. 发布的最新报告,2024 年全球自动餵鱼器市场价值为 5.552 亿美元,预计将从 2025 年的 5.885 亿美元增长到 2034 年的 13.2 亿美元,复合年增长率为 9.4%。

市场持续成长,商业水产养殖场和观赏鱼养殖者对自动投餵系统解决方案的需求也日益增长。自动投餵系统可以提高投餵精度,减少对人工的依赖,并改善鱼类的健康和生长,从而提高运作效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5.552亿美元 |

| 预测值 | 13.2亿美元 |

| 复合年增长率 | 9.4% |

关键驱动因素:

- 水产养殖自动化需求不断增长:养鱼场正在使用自动餵食系统来减少饲料浪费,提高饲料转换率 (FCR),并更永续

- 业余养鱼的成长:城市消费者正在推动对家庭水族馆和鱼缸的需求,从而增加了小型可编程餵食器的销售。

- 商业水产养殖劳动力短缺:自动化减少了劳动力效率低下,并为大规模养殖提供了标准化的餵食计画。

- 可程式设备的进步:计时器、感测器和物联网功能的使用,帮助使用者远端操作送料器(例如线上)并即时追踪送料。

关键参与者:

- 前五大厂商分别是 AKVA Group、Pentair、EHEIM、Fish Farm Feeder 和 Juwel,共占 14% 的市场份额,反映市场集中度较高。

- 凭藉其尖端、可靠的餵食解决方案以及在水产养殖技术领域的强大全球影响力,滨特尔占据了 7% 的市场份额,成为市场领导者。

主要挑战:

- 农村电力依赖:专案馈线需要稳定的电力,这可能会成为一些发展中市场的限制因素。

- 大型餵料机初始投资高:商业餵料机虽然效率高,但往往需要大量的资本支出。

- 小型业者的产品意识程度低:缺乏自动化设备的训练和经验,减缓了传统水产养殖经营的转型。

浏览分布在 210 页的关键行业见解,其中包含 80 个市场资料表和图表,来自报告“自动餵鱼器市场规模 - 按类型、按安装类型、按机制、按功能、按容量、按饲料类型、按材料、按最终用途、按配销通路、增长预测,2025 - 2034”,详情以及目录:

1. 按类型 - 可程式供料器扩大市场

可程式自动餵食器凭藉其精准的餵食量、便利性以及在商业和观赏用途上的广泛应用,在2024年占据了最大的市场份额。可程式自动餵食器是一种深度整合的解决方案,用于控制餵食频率、时间和餵食量,因此在市场上取得了爆炸性增长,尤其受到所有消费群体的青睐。

2. 依最终用途划分-商业占大多数

2024 年,商业领域(例如养殖场和水产养殖厂)占据了最大的市场份额。可重复的鱼库使水产养殖系统能够提高餵食性能、减少饲料浪费并节省劳动力,这再次推动了大型公司大规模采用自动餵食器。

3. 按配销通路-线下通路占主导地位

2024年,线下通路占据市场主导地位。宠物店、水产养殖设备零售商和农场用品商店仍然是购买点的首选,尤其是在对新消费者来说最重视实际演示和售后服务的地区。

4. 按地区划分-亚太地区发挥领导作用

2024年,亚太地区凭藉其庞大的水产养殖网络、良好的环境以及政府支持鱼类养殖自动化的倡议,占据了市场主导地位。中国和东南亚地区经历了强劲的成长。

2024年,亚太地区凭藉其高水产养殖产量占据了最大的市场份额,尤其是在中国、印度和印尼。鱼类蛋白质需求的不断增长、政府对水产养殖项目的支持以及养鱼场自动化程度的提高,推动了可编程自动餵食器在该地区的应用。

自动餵鱼器产业的主要参与者有 AKVA Group、EHEIM、Fish Farm Feeder、Fish Mate、Hygger、Juwel、Kamber Tech、Lifegard Aquatics、Pentair、Pioneer Group、Resun、Sweeney Enterprise、Torlam、Yiyuan Technology 和 Zacro。

为了巩固市场地位,主要参与者正着力于产品开发、新兴市场渗透以及分销网络建设。 AKVA Group 和 Fish Farm Feeder 正在透过在投餵驳船上安装工业级投餵器来吸引商业水产养殖业者。 EHEIM、Zacro 和 Torlam 透过为水族爱好者和宠物主人提供可编程投餵器,在零售领域蓬勃发展。 Hygger 和 Lifegard Aquatics 正在为其产品设计添加智慧功能和备用电池,以追求便利性和可靠性。线下分销和店内演示仍然至关重要,尤其是在亚太地区的高成长地区。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 水产养殖日益普及

- 智慧餵料器的技术进步

- 商业养鱼场劳动成本的降低

- 产业陷阱与挑战

- 商业规模系统的初始投资较高

- 技术问题和维护需求

- 机会

- 与物联网和基于感测器的供料系统集成

- 针对特定物种的饮食和餵食模式进行客製化

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监理框架

- 标准和合规要求

- 区域监理框架

- 认证标准

- 贸易统计(HS编码:84798999)

- 主要进口国

- 主要出口国

- 波特五力分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依类型,2021-2034

- 主要趋势

- 可程式餵料器

- 旋转给料机

- 滚筒给料机

- 气动送料器

- 重力餵料机

- 其他(螺旋餵食器、振动餵食器、定量餵食器)

第六章:市场估计与预测:按安装类型,2021-2034

- 主要趋势

- 夹式送料器

- 浮动餵食器

- 内置储罐供料器

第七章:市场估计与预测:按机制,2021-2034

- 主要趋势

- 电动餵食器

- 太阳能餵食器

- 电池供电餵食器

第八章:市场估计与预测:依特征,2021-2034

- 主要趋势

- Wi-Fi 连接

- 智慧型手机控制

第九章:市场估计与预测:依产能,2021-2034

- 主要趋势

- 1公升以下

- 1至10公升

- 超过10公升

第 10 章:市场估计与预测:按饲料类型,2021-2034 年

- 主要趋势

- 颗粒

- 薄片

- 颗粒

- 冷冻干燥食品

- 直播

第 11 章:市场估计与预测:按材料,2021-2034 年

- 主要趋势

- 塑胶餵食器

- 金属进料器

- 复合材料进料器

第 12 章:市场估计与预测:按最终用途,2021-2034 年

- 主要趋势

- 住宅用途

- 商业用途

第 13 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 公司网站

- 线上零售商

- 离线

- 专卖店

- 宠物店

- 其他的

第 14 章:市场估计与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 15 章:公司简介

- AKVA Group

- EHEIM

- Fish Farm Feeder

- Fish Mate

- Hygger

- Juwel

- Kamber Tech

- Lifegard Aquatics

- Pentair

- Pioneer Group

- Resun

- Sweeney Enterprise

- Torlam

- Yiyuan Technology

- Zacro

The global automatic fish feeders market was valued at USD 555.2 million in 2024 and is projected to grow from USD 588.5 million in 2025 to USD 1.32 billion by 2034, at a CAGR of 9.4%, according to the latest report published by Global Market Insights, Inc.

The market is witnessing consistent growth and is seeing an increase in demand for automated feeding system solutions for commercial aquaculture farms and ornamental fishkeepers. Automatic fish feed systems improve feed accuracy, enable less reliance on manual labour, and also improve fish health and growth to improve operational efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $555.2 Million |

| Forecast Value | $1.32 Billion |

| CAGR | 9.4% |

Key Drivers:

- Increasing demand for aquaculture automation: fish farms are using automated feeding systems to reduce feed waste, improve FCR (feed conversion ratio) and be more sustainable

- Growth in hobby fishkeeping: urban consumers are driving the demand for home aquariums and fish tanks, which increases sales of smaller programmable feeders.

- Shortage of Commercial aquaculture labor: Automation reduces labor inefficiencies and provides standardization of feeding schedules in large-scale operations.

- Advancements in programmable devices: the use of timers, sensors, and IoT capability, are helping empower users to operate feeders remotely (e.g., online) and track-feed in real-time.

Key Players:

- Top 5 players are AKVA Group, Pentair, EHEIM, Fish Farm Feeder, and Juwel, together controlling 14% of the market, reflecting fragmented market concentration.

- Pentair is the market leader with 7% market share on account of its cutting-edge, reliable feeding solutions and robust worldwide presence in aquaculture technology.

Key Challenges:

- Rural power dependency: Stable electricity is required for program feeders, which could be a constraint in some developing markets.

- High initial investment for large feeders: Though efficient, commercial feeders tend to demand a lot of capital outlay.

- Low level of product awareness with small operators: Lack of training and experience with automation devices slows the transition in traditional aquaculture operations.

Browse key industry insights spread across 210 pages with 80 market data tables and figures from the report, "Automatic Fish Feeders Market Size - By Type, By Mounting Type, By Mechanism, By Features, By Capacity, By Feed Type, By Material, By End Use, By Distribution Channel, Growth Forecast, 2025 - 2034" in detail, along with the table of contents:

1. By Type - Programmable Feeders Expand Market

Programmable automatic feeders held the largest market share in 2024 due to precise feeding amounts, convenience, and availability for commercial and ornamental applications. Programmable automatic feeders are a deeply integrated solution for controlling frequency, times, and amounts of feeding, and therefore have exploded onto the market, particularly for all segments of the consumer.

2. By End Use - Commercial Makes Up the Majority

The commercial segment, such as fish farms and aquaculture plants, held the most significant market share in 2024. Repeatable depots of fish allows aquaculture systems to increase of feeding performance, less wasted feed, and save in labour, which again drives mass adoption of the automatic feeders among the largest firms.

3. By Distribution Channel - Offline Segment Dominates

Offline channels dominated the market in 2024. Pet stores, aquaculture equipment retailers, and farm supply stores are still the first choice for points of purchase, particularly in areas where hands-on demonstrations and post-sales services are most important for new consumers.

4. By Region - Asia Pacific Leverages Leadership

Asia Pacific dominated the market in 2024 thanks to its large aquaculture network, favorable environment, and government initiatives supporting fish farming automation. China and Southeast Asia experience robust growth.

The Asia Pacific region captured the largest market share in 2024 due to its high aquaculture production, especially in China, India, and Indonesia. Increasing fish protein demand, government support for aquaculture initiatives, and rising automation in fish farms drive programmable automatic feeders' adoption in this region.

Major players in the automatic fish feeders industry are AKVA Group, EHEIM, Fish Farm Feeder, Fish Mate, Hygger, Juwel, Kamber Tech, Lifegard Aquatics, Pentair, Pioneer Group, Resun, Sweeney Enterprise, Torlam, Yiyuan Technology, and Zacro.

To reinforce their market standing, major players are emphasizing product development, penetration into emerging markets, and distribution networks. AKVA Group and Fish Farm Feeder are pursuing commercial aquaculture operators with industrial-strength feeders built into feeding barges. EHEIM, Zacro, and Torlam are growing in retail by providing programmable feeders for the aquarist and pet owner. Hygger and Lifegard Aquatics are adding smart features and battery backup to their designs to pursue convenience and reliability. Offline distribution and in-store demonstrations remain critical, especially in Asia Pacific's high-growth regions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Mounting type

- 2.2.4 Mechanism

- 2.2.5 Features

- 2.2.6 Capacity

- 2.2.7 Feed type

- 2.2.8 Material

- 2.2.9 End use

- 2.2.10 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing popularity of aquaculture

- 3.2.1.2 Technological advancements in smart feeders

- 3.2.1.3 Labor cost reduction in commercial fish farms

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment for commercial-scale systems

- 3.2.2.2 Technical issues and maintenance needs

- 3.2.3 Opportunities

- 3.2.3.1 Integration with IoT and sensor-based feeding systems

- 3.2.3.2 Customization for species-specific diets and feeding patterns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory framework

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code: 84798999)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Programmable feeders

- 5.3 Rotary feeders

- 5.4 Drum feeders

- 5.5 Pneumatic feeders

- 5.6 Gravity feeders

- 5.7 Others (auger, vibrating, portion control fish feeders)

Chapter 6 Market Estimates & Forecast, By Mounting Type, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Clamp-on feeders

- 6.3 Floating feeders

- 6.4 Built-in tank feeders

Chapter 7 Market Estimates & Forecast, By Mechanism, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Electric feeders

- 7.3 Solar-powered feeders

- 7.4 Battery-operated feeders

Chapter 8 Market Estimates & Forecast, By Features, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Wi-Fi connectivity

- 8.3 Smartphone control

Chapter 9 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Under 1 liter

- 9.3 1 to 10 liters

- 9.4 More than 10 liters

Chapter 10 Market Estimates & Forecast, By Feed Type, 2021-2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Pellets

- 10.3 Flakes

- 10.4 Granules

- 10.5 Freeze-dried food

- 10.6 Live feed

Chapter 11 Market Estimates & Forecast, By Material, 2021-2034 (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 Plastic feeders

- 11.3 Metal feeders

- 11.4 Composite material feeders

Chapter 12 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Thousand Units)

- 12.1 Key trends

- 12.2 Residential use

- 12.3 Commercial use

Chapter 13 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Thousand Units)

- 13.1 Key trends

- 13.2 Online

- 13.2.1 Company websites

- 13.2.2 Online retailers

- 13.3 Offline

- 13.3.1 Specialty stores

- 13.3.2 Pet stores

- 13.3.3 Others

Chapter 14 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 14.1 Key trends

- 14.2 North America

- 14.2.1 U.S.

- 14.2.2 Canada

- 14.3 Europe

- 14.3.1 Germany

- 14.3.2 UK

- 14.3.3 France

- 14.3.4 Italy

- 14.3.5 Spain

- 14.4 Asia Pacific

- 14.4.1 China

- 14.4.2 India

- 14.4.3 Japan

- 14.4.4 South Korea

- 14.4.5 Australia

- 14.5 Latin America

- 14.5.1 Brazil

- 14.5.2 Mexico

- 14.5.3 Argentina

- 14.6 MEA

- 14.6.1 South Africa

- 14.6.2 Saudi Arabia

- 14.6.3 UAE

Chapter 15 Company Profiles

- 15.1 AKVA Group

- 15.2 EHEIM

- 15.3 Fish Farm Feeder

- 15.4 Fish Mate

- 15.5 Hygger

- 15.6 Juwel

- 15.7 Kamber Tech

- 15.8 Lifegard Aquatics

- 15.9 Pentair

- 15.10 Pioneer Group

- 15.11 Resun

- 15.12 Sweeney Enterprise

- 15.13 Torlam

- 15.14 Yiyuan Technology

- 15.15 Zacro